Published on May 30, 2025 by Ankur Arora

Decoding global economies through bankruptcies

The increase in Chapter 11 filings indicates that many businesses, particularly in the retail sector, are facing severe financial challenges. High interest rates and the exhaustion of COVID-19 relief measures have made it difficult for businesses to refinance their debt and maintain operations.

Economic trends shaped by bankruptcy data

The increase in global bankruptcies suggests a number of underlying economic and financial challenges:

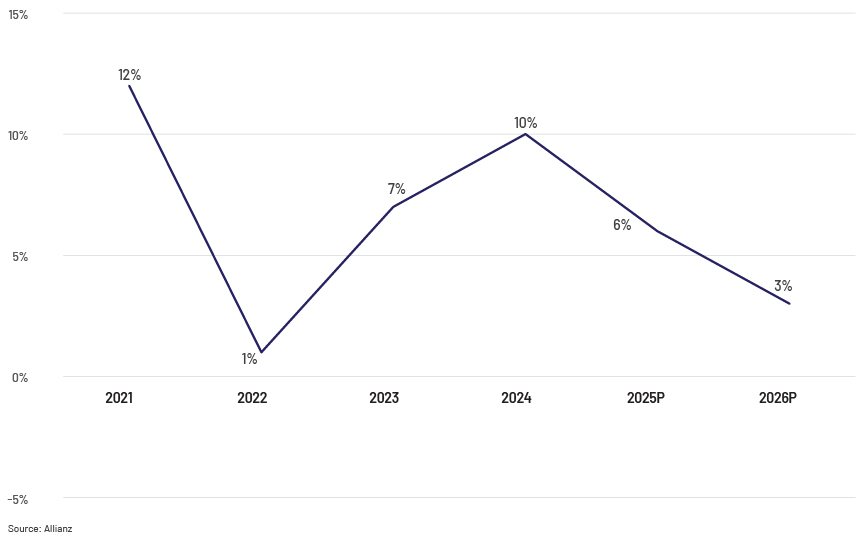

Economic instability: Increased bankruptcies often reflect broader economic instability, such as recessions, high inflation or slow growth. Example: If global economic growth increases by 1.5% lower than what is expected, it is estimated that insolvencies could increase by 7.5%, as some sectors or companies already suffering losses may not cope with marginal or compressed growth.

High interest rates: Rising borrowing costs can strain businesses, especially those with high debt levels. Similarly, lower borrowing costs reduce the interest burden on highly leveraged companies, and these companies can use the surplus cash to improve their income or add financial flexibility. If interest rates stay high for longer, less credit availability may cause more insolvencies. Credit helps firms manage debt and avoid bankruptcy, especially in a downturn. Although rates may drop in Europe and the US, inflation risks could slow cuts. Higher borrowing costs may limit credit growth, tighten financial conditions and raise default risks for highly leveraged firms.

Geopolitical uncertainty: Ongoing geopolitical tensions can disrupt supply chains and markets, leading to financial distress for businesses. These issues include the Russia-Ukraine conflict, the China-Taiwan issue and increased uncertainties around European politics, all contributing to supply-chain issues and making labour and materials expensive. President Trump’s moves to control immigration by means of deportation could also impact the cheap labour the US has been using. New tariff rules would also impact the companies importing material and goods from China and Vietnam.

Consumer spending: Reduced consumer spending can impact businesses, particularly in sectors such as retail and hospitality. A small increase in consumer spending can boost businesses and improve earnings, and an increase in investment can make borrowing more affordable. By sector, the real estate and construction sectors depend on increases in consumer spending.

Structural changes: As an increasing number of shoppers prefer online retail, conventional businesses are witnessing a drop in physical visits. This trend could result in lower sales and income, posing difficulties for these traditional enterprises in maintaining their profitability.

-

Lay-offs: Increased bankruptcies are leading to higher unemployment because of downsizing or rightsizing of an organisation's structure. The number of layoffs in Europe and North America is expected to have surpassed 1.6m in 2024 and to keep rising in 2025.

A combination of these factors could create a challenging environment for businesses, leading to increased bankruptcies.

How corporates can manage the macroeconomic challenges to overcome pressures on liquidity and profitability

Cost curtailment: This is the most common path available, achievable through the following:

Suspending dividends can result in saving critical cashflow available to a firm

Mass layoffs

Replanning capital expenditure by prioritising expenses

-

Shutting down lower-margin business verticals/stores

Opting for revenue diversification: Concentrating on revenue from one line of business could make a company vulnerable amid challenges. Diversification can be achieved through the following:

M&A of new business lines that may have similar platforms. Example: Zomato acquiring BlinkIT and District

Launch of new products and services, although the margin may be less initially and R&D costs could be higher

-

Setting up joint ventures or strategic alliances with the help of leading players in the verticals as co-partners; this would add expertise and resources

Availability of alternative financing options or sources of liquidity: Primary sources of capital could be limited. Hence, other options should be checked regularly, such as exploring loans from

Credit unions

Asset sales

Sale and leaseback transactions

-

Securitisation of receivables

Working capital management: This refers to streamlining the cashflow lifecycle, which could be achieved by

Negotiating with suppliers to reduce costs

Destocking/restocking inventory

Identifying cost-effective raw material providers

-

Acquisition of/partnership with key material providers

Conclusion

The restructuring landscape in 2025 is affected by high interest rates and a tough economic situation. Average mortgage rates are around 6.7% for 30-year fixed loans and 6.1% for 15-year fixed loans, increasing borrowing costs and Chapter 11 bankruptcy filings. US GDP growth slowed to 2.3% in 4Q 2024, affecting sectors such as retail and restaurants, which faced over 30 bankruptcies due to high food costs and less discretionary income. Healthcare and real estate are also struggling with debt and regulations. Distressed M&A and private equity are key strategies for overcoming financial distress, while challenges such as protectionism could disrupt supply chains and raise costs for businesses and consumers. These challenges highlight the potential for increased economic instability and the need for strategic planning to mitigate their impacts.

How Acuity Knowledge Partners can help

We present comprehensive functional offerings in all aspects of restructuring advisory, making us an ideal partner for consulting firms engaged in restructuring and turnaround, expanding their capabilities to meet rising demand. We have extensive experience in supporting global companies' corporate development teams with making strategic decisions for business growth and restructuring.

Our significant expertise in strategic analysis and deep sector knowledge support a wide range of restructuring and turnaround activities. We also provide end-to-end support in the credit domain, focusing on capital preservation, return maximisation and niche opportunity assessments.

Our subject-matter experts offer customised solutions in niche domains, delivering projects swiftly with improved output. Our flexible working models enhance margins, employee satisfaction and revenue, catering to global consulting firms, Fortune 500 companies and large enterprises.

Sources:

Tags:

What's your view?

About the Author

Ankur has 12 years of experience in managing and executing projects across, consulting, PE, Investment Banking, and served multiple sectors, Ankur completed his PGDM from Kirloskar Group near Bangalore

Like the way we think?

Next time we post something new, we'll send it to your inbox