Published on August 21, 2025 by Suvendu Patra

In 2025, the global defence industry is entering a transformative era of strategic competition, where military strength, technological edge and geopolitical influence are more interconnected than ever. Amid escalating geopolitical tensions and rising trade barriers, global uncertainty continues to mount. While this has had a depressing effect on most business sectors in general, defence budgets worldwide have been expanding significantly.

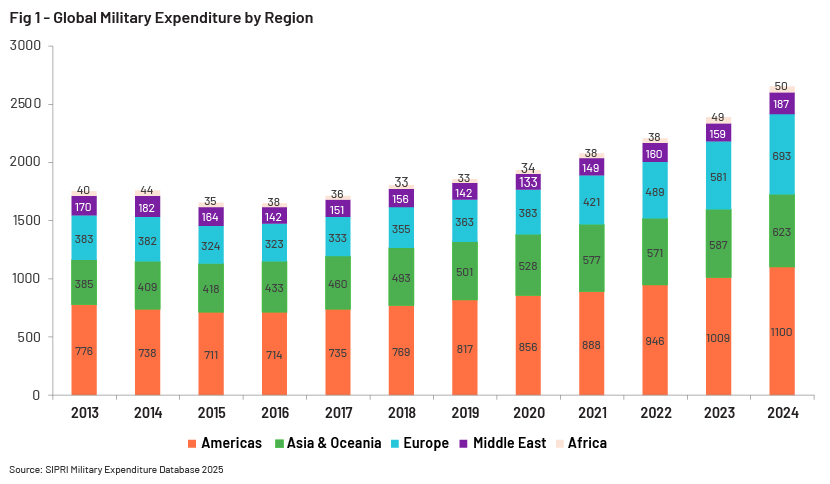

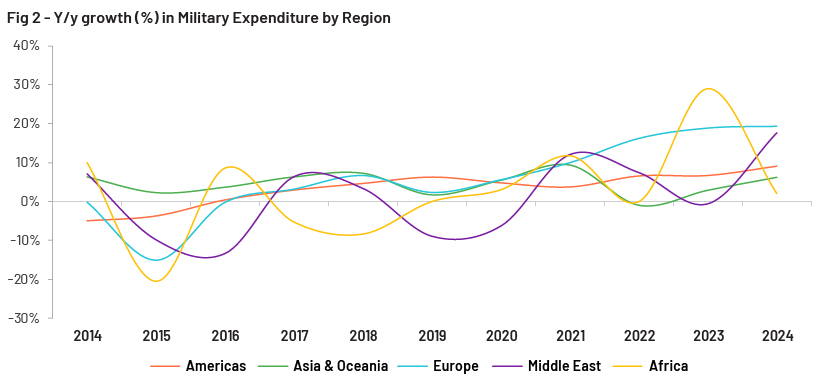

Military expenditure surpassed USD2.6trn in 2024 from USD1.75trn in 2014. Military expenditure in the Americas, led by the US, rose to USD1.1trn from USD738bn during the period, followed by Asia & Oceania, where spending grew to USD623bn from USD409bn. Europe saw the sharpest climb during the period – to USD693bn from USD382bn, reflecting heightened security concerns. The Middle East and Africa have also seen an upswing recently, though from a relatively low base, indicative of intensified defence investments amid evolving geopolitical dynamics (Fig 1 and 2).

This surge in defence spending reflects not just scale but also a deliberate shift in strategic priorities. Nations are racing to modernise; tech firms are redefining warfare and defence contractors are navigating record backlogs. The countries and companies that can innovate, export and adapt will shape the future of global security. For investors, policymakers and strategists alike, the message is clear: defence budgets are poised to rise, with a sharp focus on autonomous tech, cyber warfare and space assets, amid global instability.

Source: SIPRI Military Expenditure Database 2025

Geopolitics is driving the surge, and stakes are higher than ever

The Russia-Ukraine conflict, now in its third year, has fundamentally reshaped Europe’s defence posture. North Atlantic Treaty Organization (NATO) members have responded with urgency, increasing collective defence spending by 12% y/y in 2024. Moreover, NATO allies have pledged to raise their spending to 5% of gross domestic product (GDP) by 2035 compared with the long-standing 2% benchmark. Defence spending has evolved beyond traditional assets such as armoured assets and personnel (3.5% of GDP), and an increasing share is directed towards the development of digitally fortified, artificial intelligence (AI) driven and cyber-resilient military infrastructure (1.5% of GDP).

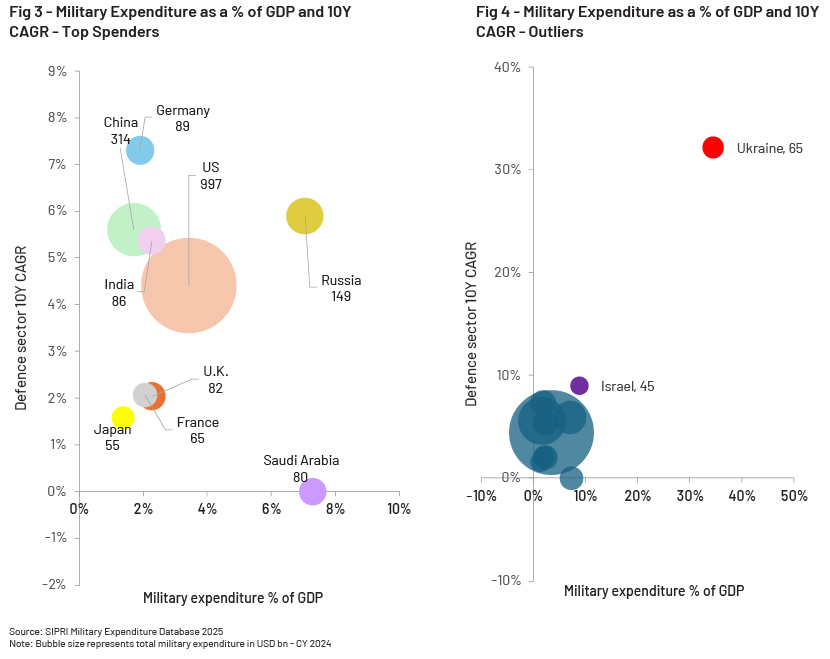

In the Middle East, the October 2023 Hamas-Israel conflict reignited long-standing tensions. Israel’s defence budget surged by 65%, now accounting for nearly 9% of its GDP (Fig 4), while the Gulf States are aggressively acquiring advanced missile systems and air defence platforms (Fig 2).

Moreover, the Indo-Pacific region is emerging as the epicentre of another strategic rivalry. With tensions escalating over Taiwan and the South China Sea, countries such as China and India have also significantly ramped up their military spending.

These incremental investments in defence reflect not only territorial disputes but also a broader contest for influence, innovation and regional supremacy.

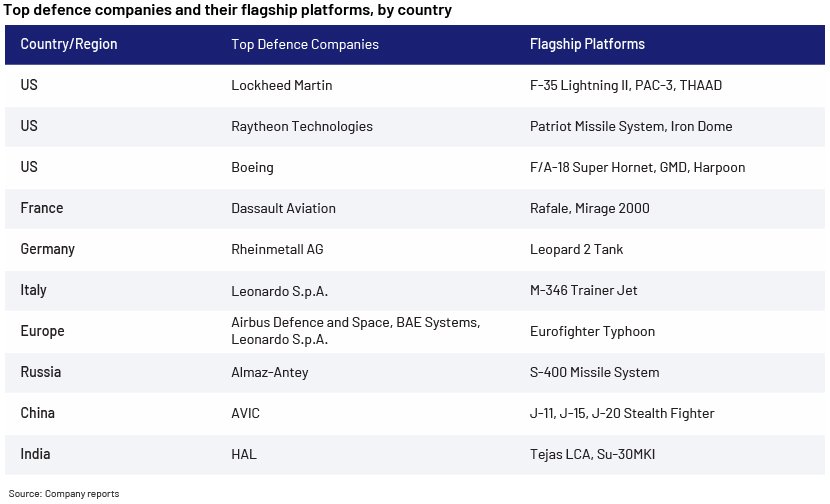

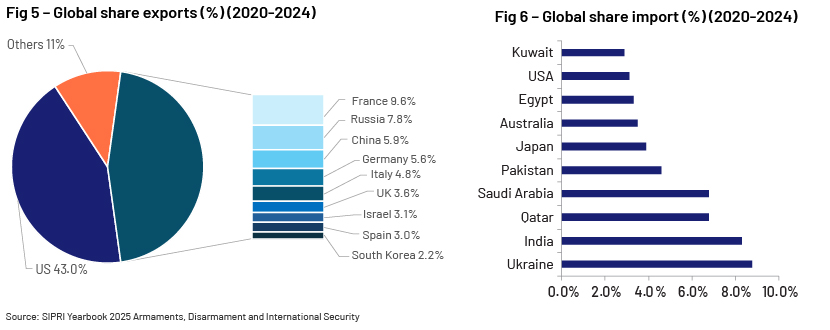

US supremacy in defence exports continue, other players are emerging

According to SIPRI’s 2025 report, the US remains the world’s largest arms exporter, commanding 43% of global arms exports (Fig 5). As global demand for advanced defence systems accelerates, the US continues to benefit from its technological edge, robust industrial base and longstanding partnerships.

Europe has also been gaining ground. Germany, France, Italy and Spain together account for 23% of global arms exports. France has overtaken Russia to become the second-largest arms exporter with a 9.6% share, while Russia’s share has declined to 7.8%, largely due to sanctions and supply chain disruptions. European nations are ramping up production and exports to meet rising demand from NATO and allied countries. (Fig 5)

On the import side, Ukraine has emerged as the world’s largest arms importer, accounting for 8.8% of global imports, followed by India, which remains a major buyer, despite a decline in imports over the past five years. Other top importers include Pakistan, Japan and Australia, reflecting heightened security concerns in the Indo-Pacific region (Fig 6).

Declining import trends in China and India signal a strategic pivot toward self-reliance and indigenous capability development. For the first time in decades, China has dropped out of the top 10 arms importers, driven by the expansion of its domestic defence industry. Meanwhile, India is emerging as a credible exporter, with defence exports reaching a record USD2.83bn (INR236.22bn) in FY 2024-25, supported by a growing portfolio of indigenous platforms.

Technology is the new battlefield

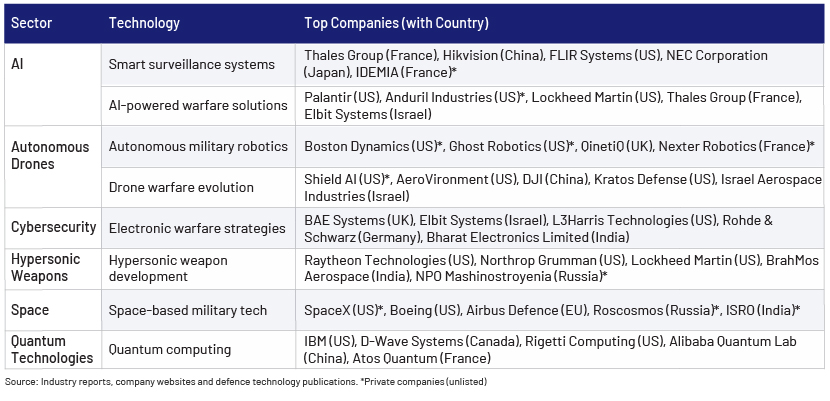

In 2025, global defence strategies are being redefined by rapid advancements in emerging technologies. Nations are investing heavily in AI, autonomous drones, cybersecurity, hypersonic weapons and space and quantum technologies to gain a strategic edge.

-

AI in defence is projected to reach 4bn globally, powering everything from autonomous systems to predictive coordination.

-

The defence cybersecurity market size stood at USD26bn in 2025 and is projected to reach USD46.51bn by 2030, reflecting a CAGR of 11.87%.

-

The military global quantum technologies market is projected to grow at a 2% CAGR from 2023 to 2033, capturing a significant share of total quantum tech spending by 2033.

-

Space is now a contested domain, critical for communications, surveillance and missile tracking. Dual-use technologies from SpaceX, Airbus and Indian Space Research Organization (ISRO)are shaping the future of orbital defence.

As these technologies mature, they are not just enhancing capabilities; they are reshaping the very nature of warfare. This defence resurgence is fuelling growth far beyond the battlefield – elevating aerospace, semiconductors and cybersecurity into critical pillars of modern defence. These shifts are also drawing sharp attention from forward-looking investors seeking exposure to companies involved in next-generation security technologies.

As these technologies mature, they are not just enhancing capabilities; they are reshaping the very nature of warfare. This defence resurgence is fuelling growth far beyond the battlefield – elevating aerospace, semiconductors and cybersecurity into critical pillars of modern defence. These shifts are also drawing sharp attention from forward-looking investors seeking exposure to companies involved in next-generation security technologies.

How Acuity Knowledge Partners Can Help

We are a leading provider of bespoke research and analytics services, helping clients build proprietary research products across equity and credit. We provide support in areas such as equity research services, fixed income and credit research and research publishing services. We are also involved in research operations, financial modelling and CRM analytics.

References

-

Ai In The Defence Industry Statistics Statistics: Market Data Report 2025

-

U.S. prepares F-35 Lot 20 production line for foreign allies

-

Top 100 | Defense News, News about defense programs, business, and technology

-

Defense Tech Boom: Autonomous Drones, Lasers, And Hypersonic Missiles

-

Global Quantum Technologies in Military Market Size, Growth Forecasts To 2033

-

Defense Cyber Security Market Size, Industry Growth, Trends & Share Report 2030

-

NATO - News: Defence Expenditure of NATO Countries (2014-2024), 17-Jun.-2024

-

How is quantum technology used in the military? - Army Technology

-

Defense Tech Boom: Autonomous Drones, Lasers, And Hypersonic Missiles

-

Thales speeds up its development of AI for defence | Thales Group

-

FLIR FC-Series AI Thermal AI Analytics Camera | Teledyne FLIR

Tags:

What's your view?

About the Author

Suvendu Patra recently joined Acuity Knowledge Partners and brings over five years of experience in investment research and business valuations from his time at S&P Global Market Intelligence. At Acuity, he is part of the Sell-side Research & Operations (SRO) department, where he supports clients with research assignments such as economic updates, data analysis, and earnings reviews. He holds a master’s degree in management studies with a specialization in Finance and a bachelor’s degree in engineering, specializing in electronics and telecommunication.

Like the way we think?

Next time we post something new, we'll send it to your inbox