Published on October 9, 2023 by Prashant Gupta

On 23 August 2023, the US Securities and Exchange Commission (SEC) approved a major overhaul of regulations for the private funds industry that manages c.USD20trn in assets. The regulator’s five-member panel voted 3-2 to adopt new and amended rules under the Investment Advisers Act of 1940, which is expected to significantly impact all private fund advisers across the industry, including those that are not required to be registered with the SEC.

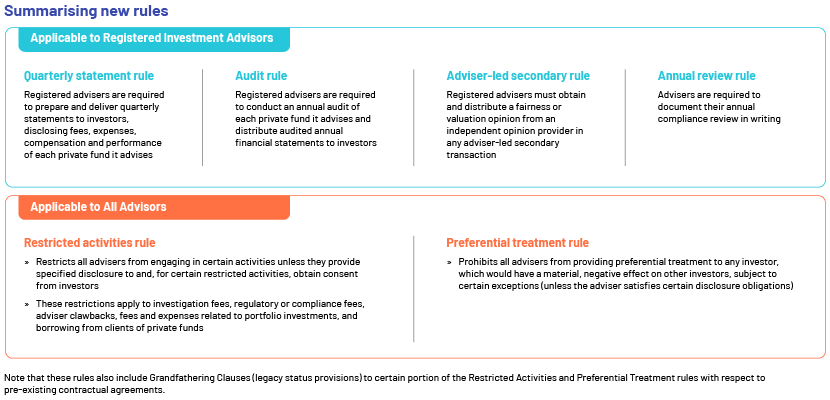

The purpose: The Private Fund rules are intended to enhance the regulation and update the existing compliance rule. The chief objective of the SEC to adopt these reforms is to protect private fund investors by addressing three principal risks that are believed to be common in an adviser-investor relationship.

The problems: While these rules have been approved, that was not without disagreement from members of the private fund industry, Congress and even certain SEC members. Many private fund industry participants have echoed their concerns, highlighting the unwarranted impact on long-standing industry-wide business practices of the private funds industry and the scope for a drastic increase in regulatory compliance burden on private fund managers. Some industry groups have also filed a case challenging these rules.

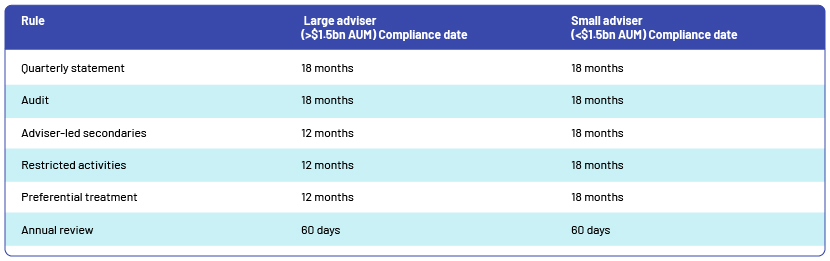

The transition: Barring any potential litigation outcomes, these rules are scheduled to come into effect 60 days after it is published in the Federal Register, with staggered compliance transition periods of either 12 or 18 months, depending on the type of rule and the level of an adviser's private fund assets under management (AUM).

Concern for advisors: If you are a private fund adviser (registered or unregistered), the new rules described above will be applicable to you. Even though the compliance dates are relatively far off, advisers are recommended to begin understanding how these rules will affect their fundraising and operations once effective, including how the rules with legacy status will apply to such advisers.

Furthermore, though these rules do not apply to non-US investment advisers with respect to their non-US private funds, given the major overhauling in the regulatory landscape of the private funds industry, a non-US advisor is recommended to review their current policies and practices to determine whether changes need to be implemented, either as an industry best practice or as a direct requirement of the private fund adviser rules.

How Acuity Knowledge Partners can add value

It is very likely that existing and newly planned funds will need to prepare disclosures to comply with the new rule. We have more than two decades of experience in offering support to global clients working in the private market space. We work as pure extensions of their onshore teams, providing end-to-end support across the investment cycle. We aim to support our clients in developing a structure to implement these rules and ensure processes and policies are updated accordingly to account for these rule changes.

References:

-

SEC.gov | SEC Enhances the Regulation of Private Fund Advisers

-

SEC.gov | Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews

Tags:

What's your view?

About the Author

Prashant is a seasoned professional within the Private Market team and has been with the company for over 12 years. His extensive career spans more than 18 years, during which he has garnered a wealth of experience through a diverse range of research and analysis assignments. His clientele is impressive and varied, including top-tier asset managers, private equity firms, and bulge bracket investment banks.

His expertise is broad and deep, with a particular focus on comprehensive end-to-end credit analysis.Prashant’s skill set encompasses capital structure analysis, intricate corporate structure assessments—including guarantees and structural subordination cases—and covenant compliance analysis. Additionally, he is adept at financial modeling and valuation, asset recovery analysis,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox