Published on May 6, 2024 by Sandeep Dhingra

Time of low interest rates and easy money

Investment community/market has seen a long duration in the period from end of 2008 to end of 2021 when Federal Reserve Bank of U.S. (Fed) kept Fed Fund Rate (FFR) to zero or low levels to revive economy from effect of global financial crisis and Pandemic. It was a time of easy money with its broad effects like reduced cost of capital, low unemployment, accelerated economic growth, higher values of assets, wealth effect, higher use of leverage and easily & cheaply available financing. All this together fueled longest bull run in US equity market, new records in M&A volumes, private market fundraise, overall optimism and low risk aversion.

High inflation and change in interest rates regime

Lower interest rates, pandemic related supply chain issues and imbalance in labor market fueled prices and inflation which forced Fed to start rate hike campaign in March 2022 by raising its short-term rates to the range of 0.25% to 0.5% and it raised that successively 11 times to bring it to 22 years high of 5.25% to 5.50% in July 2023 to bring inflation to target of 2% which reached 9.1% in June 2022, highest in four decades. Fed paused rate hikes after July 2023 and kept rates steady since then but changed its tone dovish in December 2023 meeting after having some encouraging data on inflation measures but still very far from its goal.

Fed meeting in March 2024 and expectation of higher for longer federal fund rates

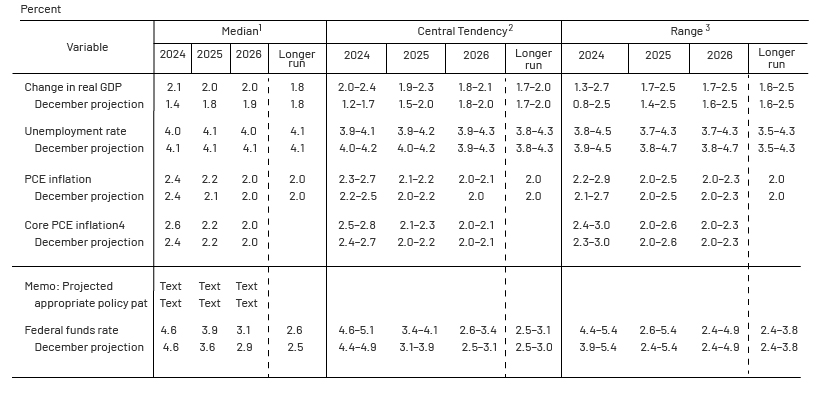

Two years after the launch of its record rate hike cycle, Fed’s meeting in March 2024 ended mostly as per market expectations of status quo of steady rates in range of 5.25% - 5.5% and likely rate cuts for three times in 2024. While reaffirming the expectation of three rate cuts this year by keeping 2024 rate target to 4.6%, Fed officials have revised up projections for growth and inflation with different projected path for FFR. Their stance for higher rates for longer seems to be implied from upward revision in FFR for 2025, 2026 and long run rate to 3.9%, 3.1% and 2.6% respectively. There is uptick in long run rate and 25 basis point increase in rate for 2025 and 2026 compared to last meeting projections.These changes reflect some confidence for higher rate in short to long term. This really reflects majority view of FOMC participants towards the structural change for higher rate in economy which might not return to pre-covid level even after victory over inflation to bring it back to long term target of 2%, Chairman Powell also found to be with same view as he said in press conference that his “instinct is that rates will not go back to low pre-pandemic levels.” This is really a view as per March meeting and Fed will be watching data in upcoming months and then decide meeting on meeting basis.

Table 2: Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, March 2024

Source: Federal Reserve Bank

Updates post March 2024 meeting

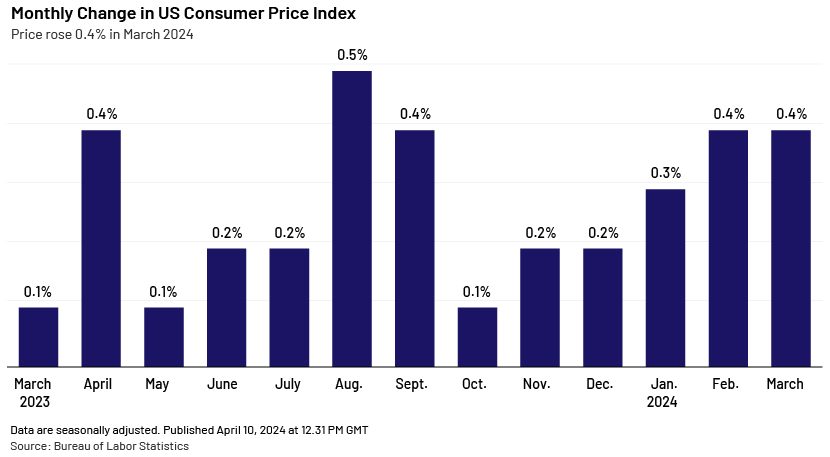

U.S. consumer prices came higher than expected in March. This is third straight month of strong consumer price readings reported by Labor Department after dovish stance taken by Fed. Labor market data also came hotter than expected for March 2024 with accelerated Job growth and lower unemployment. There is an increase in number of Fed Officials who are of opinion that there is no rush to cut down post inflation and job data for March month. Combination of recent months inflation and labor market data has further casted a shadow over expectations of policy easing in U.S.

Chart 1:

Some Experts’ views on interest rates remaining higher for longer and pushback to rate cuts:

Fed board Governor Christopher Waller emphasized in his speech on 27th March 2024 that “there is no rush” to cut the interest rates. He attributed this stance to data for inflation, employment, labor market that is not as per expectations and has dented the optimism reflected in data in second half of 2023.

Apollo Global management’s chief economist Torsten Sløk recently commented “Fed will not cut rates in 2024” because US economy is simply not slowing down and Fed pivot in December meeting acted as strong catalyst for growth since then. He also highlighted:

-

Wage inflation as measured by New York Fed is hovering around 5% and which is not consistent with Fed’s long term target of 2% inflation, this may force Fed to keep rates higher

-

US households experienced a wealth gain of USD 13.5 trillion from equity and bond market since Fed’s dovish tone in December 2023 meeting and this may fuel private consumption in coming quarters

Oaktree’s capital management Co-chairman Howard Marks, respected for his memos among investment community presented a view in his recent memo easy money in 2024 that base interest rates over the next several years is more likely to average 2-4% than 0-2% with many reasons. Few of them are:

-

Fading globalization & its disinflationary impact which leads to rising bargaining power of labor, due to these reasons inflation would be higher in near future than we have seen pre-2021.

-

Fed has tasted high inflation after a long time and it might want to keep FFR high enough to avoid risk of reversal. To do that rate needs to be positive in real terms and if inflation comes out to be 2% then rates needs to be above this to be positive in real terms

Howard Marks also cited that an ultra-low interest rates create a tendency of easy money in market which could lead to the following in addition to what is mentioned above:

(a) Induced risk taking and “malinvestment”; (b) Encourage increased use of leverage; (c) Induce asset bubbles.

Higher Rates and Restructurings & M&A

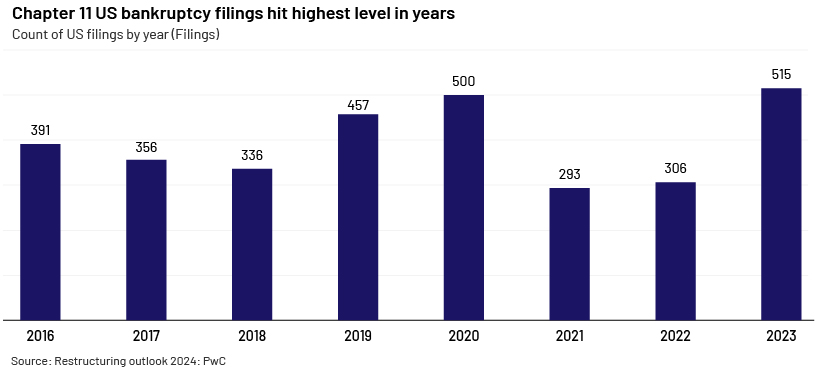

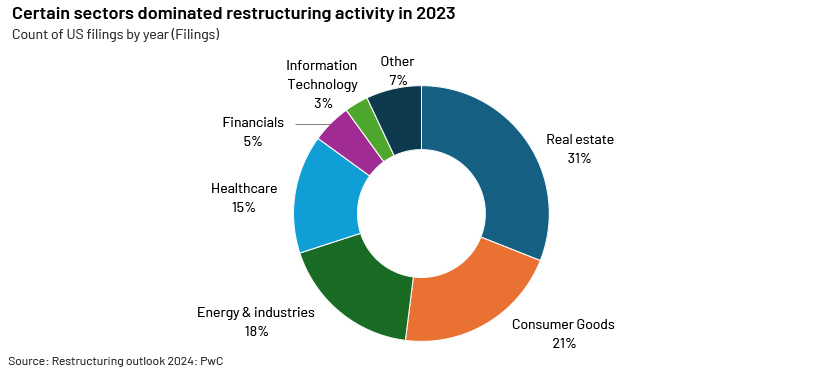

Amidst current economic uncertainties, geopolitical tensions a relief from higher interest rate is unlikely in the near horizon. The higher level of the interest rates would lead to organizations looking for measures like restructuring, refinancing that would help them stay afloat or avoid bankruptcy. Certain sectors like commercial real estate, healthcare providers, and consumer goods etc. that are still reeling under the impact of pandemic have shown a greater restructuring activities in 2023. This trend may continue as in 2024 as higher interest rates are expected to continue given the current economic and geopolitical scenarios. With both the sectors under extreme distress organizations in these sectors would closely look for signals that would help them avoid or postpone restructuring. But given the current economic trends and other factors like geopolitical tensions it is very likely that many of these firms would ultimately turn to restructuring or measures like liability management transactions and amend and extend measures. Another possibility that exists is to look for new opportunities that might put the existing commercial real estate infrastructure to residential or other uses like wellness. Though these might be capital intensive but could provide an option to avoid bankruptcies. A possibility also exists that an upward trend could be witnessed in M&A activities later this year. This could act as a beacon of hope for many organizations staring at bankruptcy could find a potential acquirer. This trend could lead to many successful M&A deals where the firm could find many potential acquirers to help them overcome their distressed situation. Also private equity firms could find this as a golden opportunity to reap in windfall gains provided they choose the potential target carefully in order to get the maximum benefits by taking over and restructuring them mindfully.

Chart 2:

Chart 3:

How Acuity can help?

At acuity we aim to provide solution to all your Investment Banking and capital market related needs. Our dedicated team of in-house specialists are qualified to handle the complex mandates from M&A, restructuring origination to executions. Looking at the current uncertain environment on rate cut decision, geopolitical issues and its consequences to corporate balance sheet, capital market. Our team can help by providing customized solutions after conducting a detailed research and evaluating the sectoral and geographical threats and opportunities helping the clients make a well informed decision.

Sources:

-

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

-

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240320.pdf

-

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240320.pdf

-

https://www.federalreserve.gov/newsevents/speech/waller20240327a.htm

-

https://www.apolloacademy.com/the-fed-will-not-cut-rates-in-2024/

-

https://libertystreeteconomics.newyorkfed.org/2024/03/will-the-moderation-in-wage-growth-continue/

-

https://www.apolloacademy.com/sp-500-market-cap-is-up-10-9-trillion-since-the-fed-pivot/

- https://www.oaktreecapital.com/insights/memo/easy-money

- Detroit Press Article - 20 March 2024

What's your view?

About the Author

CFA Charterholder with over 13 years of work experience with Acuity in information services support. He brings rich experience across M&A, sector coverage and capital markets to enhance the information service offering across multiple sectors with strength and flair for client relationship building and management

Extensive exposure of working on complex information requirements and PIBs, newsletters, news run, corporate document extraction, financial projections from market data sources, target and peer identification, deal information, credit and broker report search, share price data, financials from market data sources etc

Like the way we think?

Next time we post something new, we'll send it to your inbox