Published on June 5, 2025 by Naina Kamra

Overview: Growth of EV Charging Infrastructure in India

Who would have thought that one day, India would have an entire fleet of electric vehicles (EVs)? A vision of the Indian government led by Narendra Modi, the country now has more than 12,000 public EV-charging stations operational. This clearly shows how much effort it has put in to meet rising demand for EVs. Increasing consumer awareness has shifted preference for buying EVs such as scooters, cars and buses for daily transport. India, therefore, needs a robust backbone of EV charging infrastructure, considering its traffic and population density.

The government acknowledges the need to boost EV charging infrastructure in India, not just to meet increasing demand but also to meet its targets for emission-free EVs. that benefit the environment and reduce operating costs compared with those related to traditional combustion-engine vehicles. The government recognises it needs at least 1.3m electric vehicle charging stations in India by the end of 2030; to reach this, it would need to install approximately 400,000 stations a year. India is estimated to have c.50m EVs on the road by 2030, with the EV market and EV charging infrastructure in India projected to reach USD48.6bn and create c.50m direct and indirect jobs. This is a significant opportunity for the country, one of the world’s fastest-growing economies, set to continue to adapt to the changing needs of its people and environment.

India’s EV market penetration and market share, 2024

The Ministry of Road Transport and Highways (MoRTH) notes the following:

-

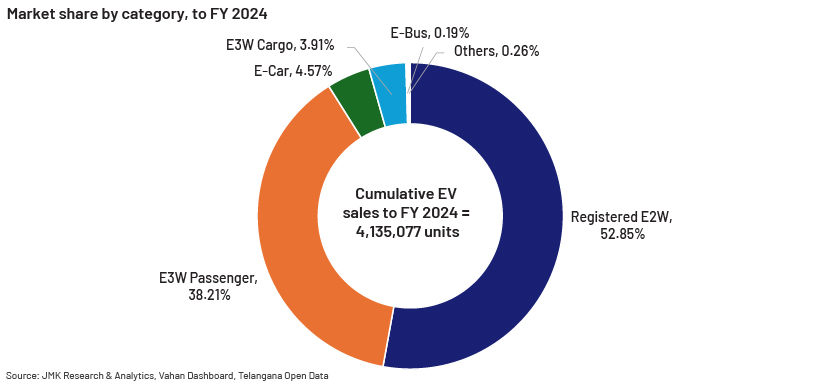

India has sold 4,135,077 EVs – two-wheelers, three-wheelers, cars, buses and other cargo vehicles to date

-

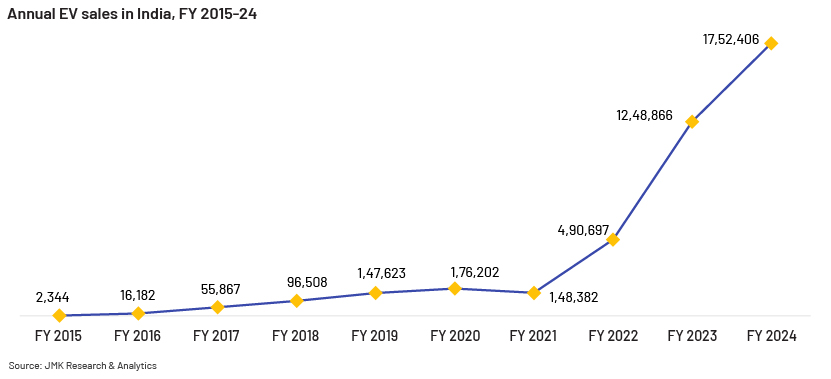

EV sales of 1.75m units were registered in FY24, with strong YoY growth of 40.31%

-

Electric vehicle adoption in India is still in its nascent stages, accounting for c.0.80% of total vehicle sales as of mid-2023.

-

-

The highest EV sales have been in the state of Uttar Pradesh, with the number of units sold across vehicle segments totalling 3,05,269, followed by Maharashtra with 2,11,691 units and Karnataka with 1,69,282 units

-

Electric two-wheelers lead the electric vehicle market in India, accounting for 53% of total EVs sold (by volume). This category is expected to have exceeded the 1m-unit mark by 2024, driven by rising demand and enhanced manufacturing capabilities

-

Maharashtra leads in two-wheeler sales, due to increased income levels and supportive government regulations

-

The state aims for EVs to account for 10% of all new vehicle registrations by end-2025

-

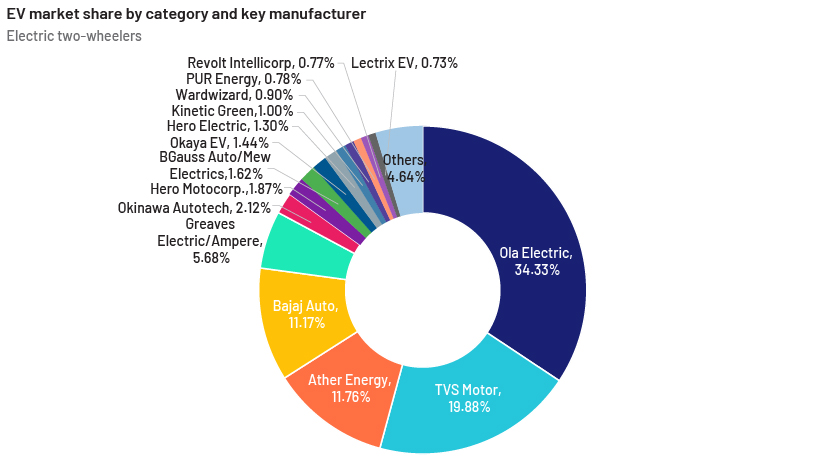

Ola Electric holds the largest market share, followed by TVS Motor and Ather Energy

-

Ola Electric raised c.USD700m in an IPO in August 2024 and plans to use the proceeds for expanding its manufacturing capabilities, research and development, and strengthening its charging infrastructure

-

-

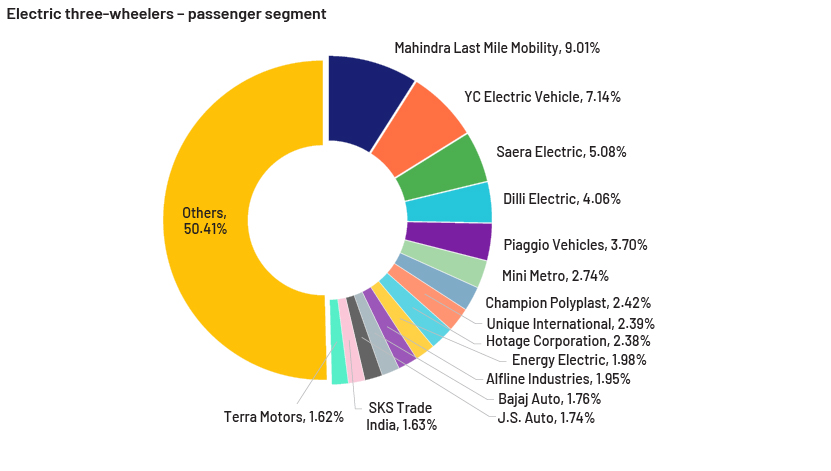

The electric three-wheeler market (excluding e-rickshaws) has grown phenomenally, largely for last-mile delivery in the goods sector

-

Operating costs have reduced by 55% compared with those relating to conventional three-wheelers, driven by e-commerce expansion and seamless transition

-

-

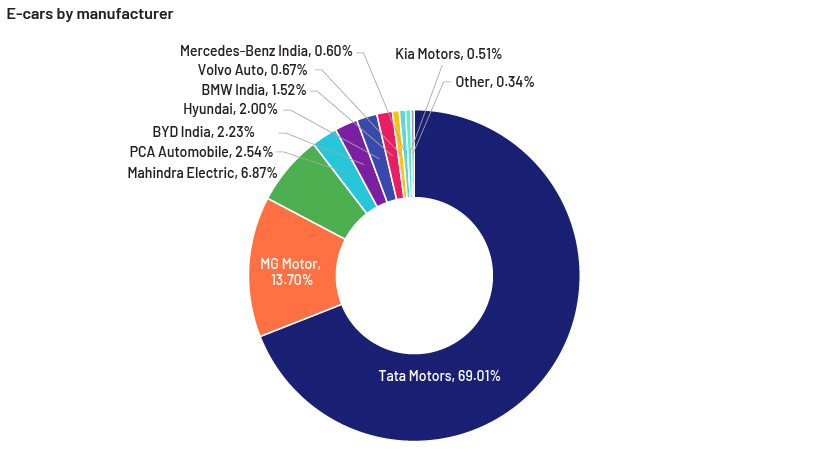

In Mumbai, the number of electric cars exceeded 10,000 as of June 2024, accounting for 33% of all electric cars in Maharashtra

-

Karnataka aims to electrify 100% of three- and four-wheeler cargo vehicles by December 2030

-

India’s EV market has noted new entrants such as Okinawa, Greaves Electric Mobility, Ather Energy, Atul Auto, Jitendra New EV Tech, Altigreen and Euler, in addition to auto-manufacturing behemoths such as Hero MotoCorp, Mahindra & Mahindra and Tata Motors

-

Original equipment manufacturers (OEMs) are widening their reach to rural regions

Annual EV sales in India have increased significantly – from just 2,344 units in 2015 to 1.7m units in 2024, totalling 41.3m units from 2015 to date.

India’s EV market penetration and market share, 2024

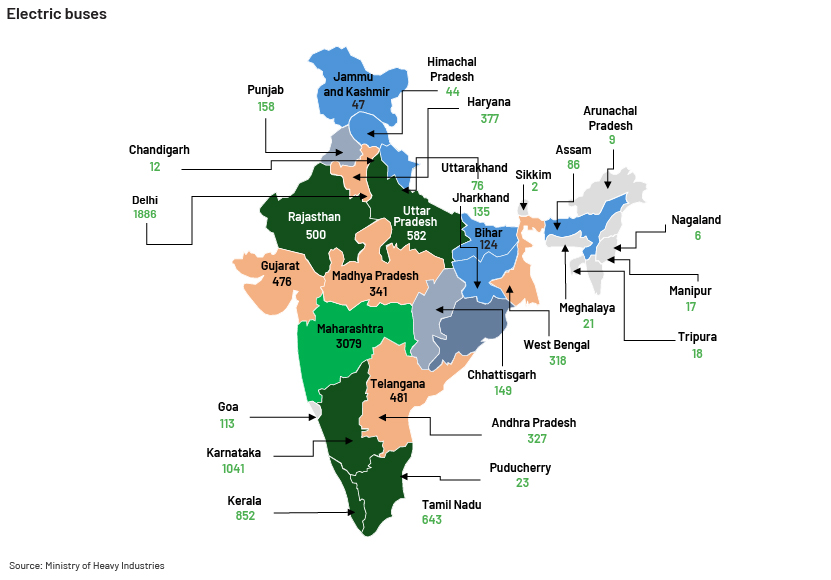

The following map depicts the number of public charging stations (PCS) currently operational in India:

India had more than 12,000 EV charging infrastructure in India and 40+ charge point operators (CPOs), offering different specifications and power capacities, as of February 2024. CPOs build, operate and maintain EV- charging infrastructure. Charging stations are operated by both private- and public-sector establishments. Maharashtra accounts for the largest market share in terms of the number of EV-charging stations, followed by Delhi, Karnataka and Kerala.Dominant industry players have recognised the need to enhance the EV charging infrastructure in India. Hyundai Motor India has announced expanding its ultra-fast EV-charging network with 11 new stations in cities including Mumbai, Pune, Ahmedabad, Hyderabad, Gurugram and Bangalore and along major highways. Additionally, oil-marketing companies, such as IOCL, HPCL and BPCL, had planned to install c.22,000 public EV-charging stations in prominent cities and on national highways by December 2024.

This is bolstered by government support and incentives, increasing environmental challenges and technological advancements. India aims to significantly increase adoption of EVs, transforming the transport sector to ensure sustainability and innovation.

EV Charging Infrastructure Ecosystem in India

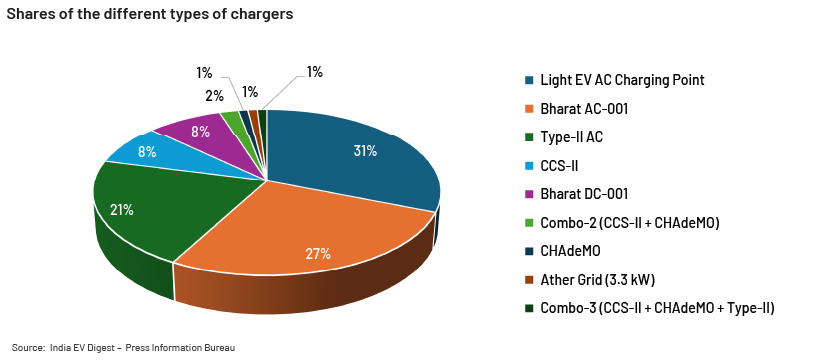

Charging infrastructure includes charger manufacturers, CPOs and battery-swapping companies. The main operational EV chargers are of the plug-in conductive type, and battery swapping is gaining traction to meet demand from the two-wheeler and three-wheeler segments. CPOs are installing different types of chargers across the country. The following chart shows the market shares of the different types of chargers in India:

A larger number of EV chargers were installed in 2022, according to the Bureau of Energy Efficiency. India’s EV-charger market is estimated to grow by 200%. Deployment of EV chargers has grown at an average of 120% in the past five years. Specifically, LEV AC chargers have grown by 370% and Type-II AC chargers by 360% since 2017.

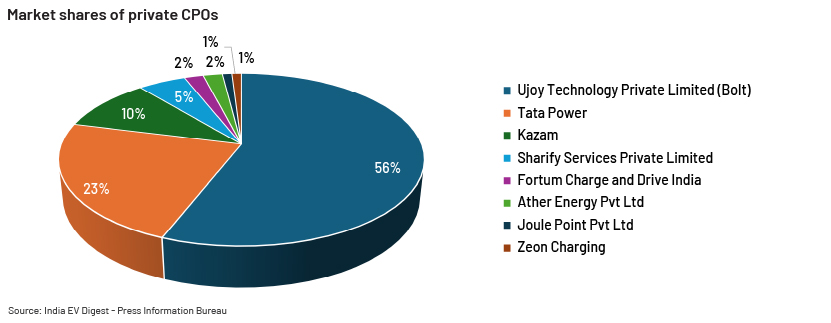

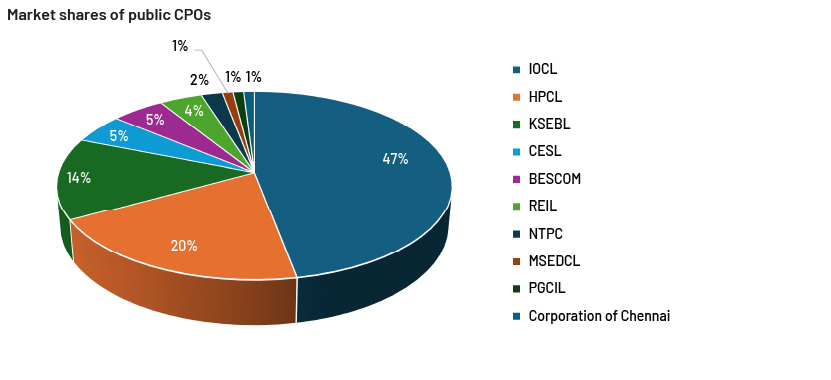

The following chart shows the market shares of public and private CPOs:

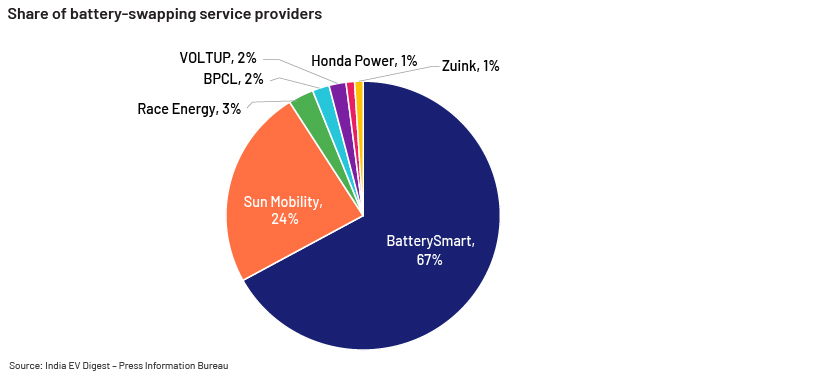

Battery swapping refers to a technology that enables owners of EVs to replace their depleted batteries with fully charged ones – a convenient solution for traditional charging, which is generally time-consuming. This approach has gained attention as a possible solution to address time- and range-related issues in vehicles such as electric two-wheelers and electric three-wheelers. Battery-swapping operators offer a distinct charging solution for EVs. They set up networks of exchange stations strategically positioned to offer prompt and convenient battery swapping for EV owners. There are more than 1,000 battery-swapping stations currently operational across India. The market for exchanging EV batteries in India was worth USD10.2m in 2022 and is estimated to reach a whopping USD61.57m by FY 2030, growing at a CAGR of 25.20%. The only challenge facing the development of a battery-swapping ecosystem is the standardisation of swappable batteries. The model aims to resolve the issues of long charging periods and an inadequate network of charging stations.

| S.No | Company name | In the battery-swapping business since… | Vehicles for which swapping is offerred |

|---|---|---|---|

| 1 |  |

2017 | 2W and 3W |

| 2 |  |

2020 | 2W and 3W |

| 3 |  |

2023 | 2W, mopeds |

| 4 |  |

2016 | 2W and 3W |

| 5 |  |

2019 | 2W and 3W |

| 6 |  |

2018 | 2W and 3W |

| 7 |  |

2019 | 3W |

| 8 |  |

2019 | 2W and 3W |

| 9 |  |

2018 | 3W |

There are over 20 battery-swapping operators in India, with 1,000-1,100 swapping stations and more than 0.01m batteries, according to the India Energy Storage Alliance (IESA).

Considering the phenomenal expansion of the public EV-charging network, the country deploys both slow and fast EV chargers – 85% of them are considered to be slow chargers (installed in homes and offices) and 15% fast chargers (at public charging stations), according to the Bureau of Energy Efficiency.

Recent developments

Government initiatives

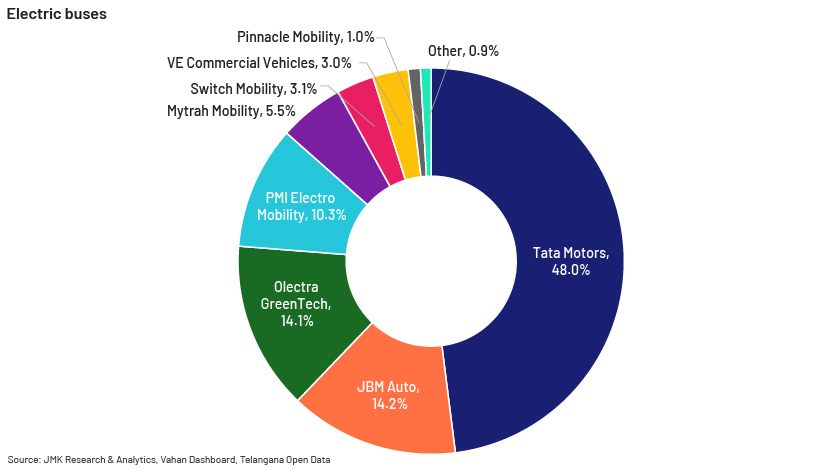

As the government increases EV adoption, it needs to have a large EV-charging infrastructure in place. It aims to increase EV sales of two- and three-wheelers by about 80%, private cars by 30%, commercial cars by 70% and buses by 40% by 2030.

It launched the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME India) scheme in 2015 to promote charging infrastructure and resource-efficient growth:

-

Phase II of the scheme commenced in April 2019 and was implemented with an outlay of USD1.2bn for a five-year period, including the following:

-

7,432 public EV-charging stations sanctioned to oil-marketing companies (IOCL, BPCL and HPCL) for deployment at retail outlets

-

Delhi planned to install c.18,000 public and semi-public EV-charging points by 2024

-

The Kerala State Electricity Board plans to install 3,000 destination chargers in public and private buildings

-

Chandigarh plans to install 100 public EV-charging stations within the city

-

-

It launched the Electric Mobility Promotion Scheme, worth USD60m, for electric two- and three-wheelers, aimed at enhancing green mobility and boosting EV manufacturing

-

The Bihar government aims for EVS to account for 15% of vehicle registrations by 2028

-

The state cabinet also approved a proposal to purchase 400 electric buses as part of the "PM-e Bus Sewa" programme for six districts

-

-

The Ministry of Power is supporting seven states including nine mega cities (with a population of more than 4m) in establishing EV accelerator cells to facilitate the accelerated deployment of public EV-charging infrastructure

-

Additionally, Union Finance Minister Smt. Nirmala Sitharaman, in the Interim Budget 2024-25, revealed a strategic plan to boost the EV ecosystem:

-

Extended the customs duty exemption on the import of capital goods and machinery needed for the manufacture of lithium-ion cells in batteries used in EVs

-

Reduced GST on EVs from 12% to 5%; reduced GST on chargers/charging stations for EVs from 18% to 5%

-

Granted green licence plates to both commercial and private battery-operated vehicles and exempted them from permit requirements

-

Provided a waiver for EVs on road tax, to reduce the initial cost of EVs

-

Private initiatives:

-

Ather Energy, an EV manufacturer, plans to install 2,500+ charging stations by end-2023

-

Statiq, a charging solution provider, plans to install 20,000 EV-charging stations across the country

-

Tata plans to install 25,000 EV-charging points over the next five years

-

By taking such measures, the government aims to have EVs accounting for at least 30% of new-vehicle sales by 2030. It is, therefore, essential that all stakeholders in India’s EV ecosystem continue to collaborate.

Conclusion: The Future of EV Charging Infrastructure in India

EV adoption has spiked recently, mainly due to progressive government policies and regulations. Growing public awareness of the benefits of switching to EVs has made EVs the preferred choice, encouraging the major automobile manufacturers to start producing them on a large scale. Taking advantage of the favourable ecosystem of buoyant demand for EVs and the policy paradigm, several international automakers have also started setting up EV-manufacturing plants in India. Increased demand for EVs has driven demand for charging infrastructure, supported by investment by the government and the private sector. At the state level, 26 states have EV policies, boosting demand for and supply of an EV ecosystem. To drive awareness of the benefits offered by the central and state governments, the Bureau of Energy Efficiency has developed the "EV Yatra" web portal and mobile application to provide one-stop access to e-mobility-related programmes across the country. All these initiatives would foster a positive environment for large-scale EV adoption and ensure India’s e-mobility market is sustainable.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners offer high-value research, analytics and business intelligence services to all sectors, and are the frontrunner in the global investment banking domain. Our range of services help clients identify the most suitable high-yielding M&A targets and investment opportunities. We also offer investment research, lending, private equity consulting and financial marketing services.

Sources:

-

India's electric vehicle boom stalls over charging challenges – Nikkei Asia

-

Electric Vehicle Industry in India: Market Growth & Innovations | IBEF

-

Charging Ahead: Evolution of Electric Vehicle Infrastructure in India | IBEF

-

At 10,893, Mumbai has 33% of state's electric cars | Mumbai News – Times of India (indiatimes.com)

-

Charging Infrastructure in India evolution market trends (jmkresearch.com)

-

EV CHARGING INFRASTRUCTURE SCENARIO IN INDIA – JMK Research & Analytics

-

Charging Stations – Requirement of more than 20 lakh on the anvil – JMK Research & Analytics

-

Insights into OLA Electric IPO: What investors should know – BusinessToday

Tags:

What's your view?

About the Author

Naina is a seasoned investment banking research professional with over 13 years of experience in supporting global investment banks.

She has a proven track record of delivering high-impact industry analysis, macro-economic analysis, company analysis and valuation analysis and is attached to the Industrials and Power, Utilities & Infrastructure (PUI) sector teams for a leading bank based in the USA. Naina holds an MBA from IILM Graduate School of Management and B.Com Lakshmibai College, University of Delhi

Like the way we think?

Next time we post something new, we'll send it to your inbox