Published on May 7, 2025 by Anshul Sehgal

Key takeaways

-

Strong balance sheets, normalising rates and increased global competition have increasingly put M&A on the table for European banks.

-

The appetite of EU banks to increase scale via acquisitions remains strong. However, banking M&A remains plagued by competition concerns, labour issues and political hurdles.

-

The Danish Compromise – the regulation much-loved by European banks that incentivises banking groups to acquire fee-generating businesses by reducing the capital impact – has been one of the key drivers of M&A.

-

However, the ECB has expressed an adverse opinion on two prominent Danish Compromise cases recently, eliminating the capital benefit. Regardless, M&A activity will likely continue as the need for scale and diversification remains.

European Banking M&A in Spotlight – Push for Scale and Diversification

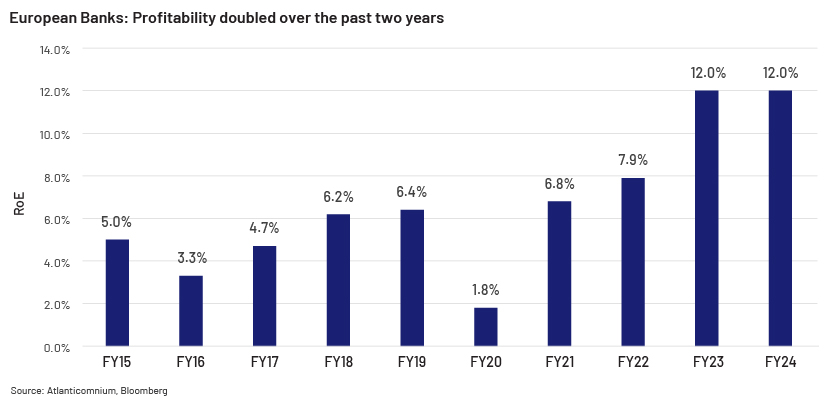

European banks have enjoyed robust profitability over the last two years (2023-2024 RoE of 12% vs 6.6% average over 2015-2024), benefiting significantly from elevated interest rates. With rates now set on a normalising path, EU banks are increasingly looking to maintain their strong profits either by increasing scale or by focusing on escalating the share of capital-light fee-generating businesses (e.g., insurance, asset and wealth management).

EU banks are currently aflush with capital (excess capital above EUR500bn) and have stronger and cleaner balance sheets (average NPL ratio of 1.9%), which makes conditions ripe for stronger banks to consider opportunistic acquisitions.

Most market commentators expect a significant uptick in European banking M&A trends, with stronger institutions exploring consolidation opportunities to boost profitability and expand fee-generating capabilities. As per EY, European banking deals (transactions announced or completed where the target was from the banking, insurance, or asset management sector) rose to 213 in 2024 from 195 in 2023.

Over the past 12 months, we have witnessed renewed appetite for large-scale European bank M&A trends, with several prominent players initiating bold moves to consolidate market share. Spain’s BBVA has bid to acquire domestic rival Banco Sabadell, and Italy’s UniCredit has made an ambitious attempt for Commerzbank in Germany and followed it up with a takeover offer for Banco BPM in Italy. Surprisingly, Monte Paschi, long considered a takeover target, has also announced its intention to acquire Mediobanca, while BPER Banca is targeting Banco Popolare di Sondrio in Italy.

While these hostile bids indicate EU banks’ appetite to pursue large domestic and even cross-border deals, they remain plagued by outright rejection by target banks’ management, labour union issues, competition concerns, and pushback from politicians. As such, these deals will likely remain challenging (from approval to integration) and capital-intensive and pose significant integration risks. The lack of a European banking union and common deposit insurance scheme remain major impediments to cross-border banking deals.

Danish Compromise Regulation and Its Role in EU Bank Consolidation

Given the challenges surrounding cross-border and domestic banking deals, the acquisition of insurance and asset management firms is likely to be a relatively easy route for European banks to maintain profits by augmenting fee income generation. Surprisingly, the Danish Compromise – an EU regulation – comes in handy in such deals.

The Danish Compromise (named so as the supposedly temporary exception was approved in 2012 under Denmark’s EU presidency) incentivises EU banks, which are recognised as financial conglomerates (sizeable banking, insurance and investment operations) by the ECB, to acquire insurance units (and potentially asset managers) at advantageous capital terms. Under these rules, banks need to hold capital for their insurance holdings on a risk-weighted basis instead of deducting them from capital.

In addition, the regulation potentially allows the goodwill generated from asset manager acquisitions made from their insurance units to be risk weighted. Financial conglomerates are leaning on this aspect, known as Danish Compromised Squared (DC2), in a number of M&A deals.

With the application of CRR3 from January 2025, the Danish Compromise has become a permanent element of EU banking capital regulation. The reduction in risk weightage of insurance holdings to 250% (for most cases) from 370% further sweetens the pot.

Recent examples

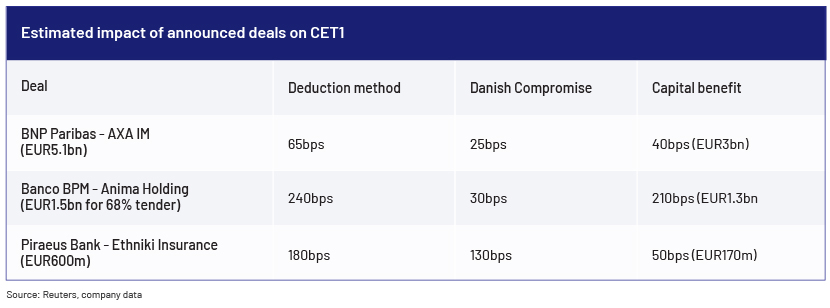

The application of the Danish Compromise was a key tenet in BNP Paribas’ acquisition of AXA Investment Managers and Banco BPM’s tender offer for the full takeover of Anima Holding. Both the deals were announced through their insurance units BNP Paribas Cardif and Banco BPM Vita, respectively. Piraeus Bank in Greece also aims to leverage the Danish Compromise in its 90% acquisition of Ethniki Insurance.

UniCredit has announced its plan to internalise life insurance operations by buying the stakes of Allianz and CNP Assurance in its JVs with them. Furthermore, BBVA and Santander are negotiating with the ECB so that they can use the favourable Danish Compromise capital treatment.

Limited but important pushbacks

The advantageous regulation is construed as unfair by the insurance sector, as it does not enjoy similar preferential capital benefits. Several banking executives have advised caution to avoid the overuse of the arbitrage. Furthermore, banks without an insurance unit see limited benefits, due to the complexity involved. Finally, certain strict conditions (covering risk management, governance and controls, among others) need to be met in order to be considered as a financial conglomerate.

ECB’s Evolving Stance on EU Banking Consolidation

The ECB has iterated that it will decide on the favourable capital treatment application on a case-by-case basis. More recently, the central bank gave an adverse opinion on the application of the Danish Compromise benefit to the Banco-BPM-Anima deal and followed it up with a similar negative view on the BNP Paribas-AXA IM deal.

The ECB’s negative opinion, especially on the BNP Paribas-AXA IM deal, could dampen European banking M&A, as market consensus assigned it a higher approval probability.

The ECB’s stance reeks of an effort to ensure equal treatment across the industry. As per the ECB Supervisory Board Chair’s comments, the ECB’s interpretation is to apply the favourable treatment to the insurance sector and not to asset management undertakings.

Although both Banco BPM and BNP Paribas are still going ahead with the respective deals, the acquisitions will likely have a significantly higher capital impact (see above table).

However, all is not lost, as BNP Paribas’ expected capital hit of c.35bps is much lower than the c.65bps impact that was anticipated under the full deduction method. As such, we believe, the ECB has taken a middle-path.

Road ahead

The ECB is expected to publish guidelines to provide clarity on the regulation in the near term. Although its recent decisions could have a negative impact on the financial sector’s consolidation, we expect mid-size and large European banking groups to increasingly focus their attention on acquiring fee-generating businesses.

Although the Danish Compromise sweetens the capital accounting, the need for diversification remains fundamental to sustain strong profitability and gain a competitive edge. The continuation of BPM and BNP’s deals, despite the higher capital hit, provides a testimony. Strong balance sheets offer sufficient capacity to integrate such deals and augment fee income for EU banking groups.

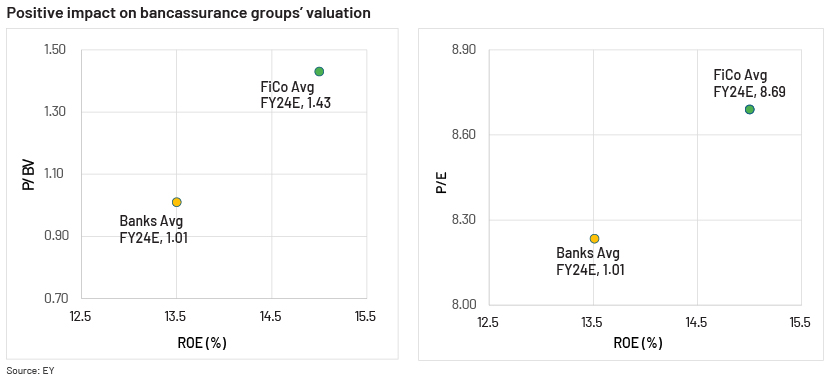

The ongoing challenges (US competition and profitability pressure) in Europe’s asset management sector warrant consolidation. Banking groups with insurance arms can be viable suitors, leading to a win-win situation for both the sectors. Markets reward financial conglomerates with higher valuations compared to traditional banks. As such, we expect continued vertical integration of financial activities by EU banking groups in the near to medium term provided regulators play ball.

How Acuity Knowledge Partners can help

We have been supporting asset managers, wealth managers and hedge funds invested in the global financial space through rigorous bottoms-up credit research, along with opportunity screening and reviews. Acuity’s in-house subject matter experts and credit analysts combine not only qualitative and quantitative fundamental credit research best practices but also leverage technological solutions. This not only improves our speed to market but also provide actionable insights to our buy-side clients.

Sources

-

The Banker - Europe’s banks gear up for a wave of consolidation in 2025

-

How a weapons-grade loophole helps European financial consolidation

-

European banks set for more asset manager takeovers thanks to Danish compromise

- Explainer: What is the Danish Compromise that Banco BPM was counting on?

-

BNP Paribas’ Capital Treatment in Axa IM Deal Opposed by ECB

-

European Banks 2024 Q4 Earnings - Cashing in after a strong year

Tags:

What's your view?

About the Author

Anshul Sehgal has around nine years of experience in credit research, with a primary focus on the European banking sector. Currently, he works as the financial sector credit analyst for a UK-based credit hedge fund, providing trade recommendations across the capital stack for global banks through a mix of bottoms-up fundamental research and relative valuation. Prior to this, he was the desk analyst of a global investment bank’s top-ranked European banks team covering regulations, issuance, ratings and bank debt trade opportunities. Anshul holds an MBA from IIM Raipur and a Bachelor of Technology (Computer Science and Engineering) from Maharaja Surajmal Institute of Technology, New Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox