Published on February 18, 2019 by Supratik Shankar

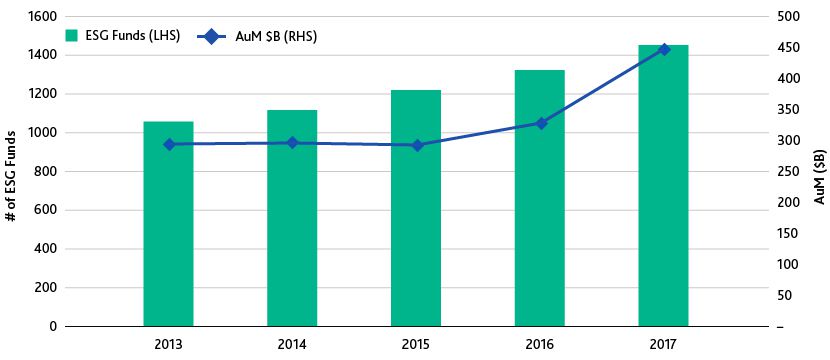

We see a growing prominence of environmental, social, and governance (ESG) in investment management. For instance, asset growth in 2017 increased to 37% YoY to $445bn, outperforming the MSCI World Index (+23% returns), based on data compiled by Bloomberg. Furthermore, the number of funds created in 2017 nearly doubled when compared to 2014 thanks to the rising number of ETFs.

ESG Funds and Assets under Management (AuM)

We see a similar trend based on the 2018 RBC Global Asset Management Responsible Investing Survey, which drew responses from more than 540 participants around the world. Based on the survey, nearly 72% of the respondents either somewhat or significantly use ESG principles as part of their investment decision making. This was up from the previous year’s 66%. Interestingly, 90% of the respondents consider ESG-integrated portfolios to be better than or at par with non-ESG-integrated portfolios. Despite the euphoria, we believe ESG-based products are still underowned by the investor community. For example, only 24% of the respondents globally used ESG significantly, while the adoption rate in the US (18%), Canada (21%), and Asia lagged substantially. This indicates room for further growth.

Millennials will lead the ESG path

Today, the term “ESG” is more popular with the millennials, more importantly because the industry is drifting from defined benefit plans towards more active defined contribution plans. Most millennials are now party to the change, and they seem to be taking charge of their own investments. They lay a strong focus on ESG parameters and are actively involved in creating long-term sustainable alpha. We believe the millennial clout is set to increase as more than US$20 trillion is expected to be under their control by 2020, according to UBS. This implies that asset managers ready with ESG-based investment options will be in a strong position to take advantage of this trend, attracting new assets and retaining beneficiary millennial clients.

Key challenges ahead

Corporate disclosures on ESG issues have been improving steadily since the launch of the Global Reporting Initiative (GRI) back in 2000. This has partly helped overcome the problems faced by the lack of complete and sector-focused usable information. Based on a PWC survey, only 29% of the investors are confident in using the quality of information they receive from corporates. To bridge this gap, the US-based Sustainability Accounting Standard Board (SASB) and the International Integrated Reporting Initiative (IIRC) have worked on a framework that encourages industry sector-specific reporting by corporates to make it more relevant to investors. However, it will take some time before the information on ESG disclosed by corporates will be used directly in making investment decisions.

Another key challenge with regard to ESG integration is the lack of data in emerging and frontier markets. For example, the overall ESG reporting is rising in China, but it fails to give a complete picture. On the other hand, the poor adoption of GRI’s framework makes it difficult for an analyst to compare the data on a global scale. Also, third-party audits are not mandatory for sustainability reports, such as financial reports, which could result in reporting errors or even window dressing. Now that the China Securities Regulatory Commission (CSRC) has mandated all listed companies to disclose ESG risks by 2020, we expect the quality and amount of data to increase with time. However, given that the majority of the listed companies’ reports are in local language, it becomes necessary for ESG analysts to use language experts while extracting the data.

Acuity Knowledge Partners ESG expertise

Acuity Knowledge Partners extensively supports asset management firms, hedge funds, and sell-side investment banks. We specialize in providing detailed sector specific ESG analysis, periodic updates, scoring and related services. Our team of ESG domain experts, together with local language experts in frontier markets, can provide strategic insights by making use of the fragmented data to make better investment decisions.

Sources:

http://www.rbcgam.com/corporate-governance-and-responsible-investment/pdf/esg-executive-summary.PDF

Tags:

What's your view?

About the Author

Supratik Shankar is a CFA charterholder with over nine years of experience in equity research, covering the industrials sector. He currently works in the Investment Research division of Acuity Knowledge Partners and supports buy-side clients with research assignments. He is experienced in performing investment thesis validation, spotting secular plays, conducting ESG research, writing thematic reports, and creating financial models.

Supratik holds a Postgraduate Diploma in Finance from SDM Institute for Management Development, India, and a Bachelor of Technology (Electrical) from West Bengal University of Technology, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox