Published on January 17, 2024 by Pratiti Choudhury

The ESG reporting landscape is changing rapidly. Recent regulations have brought a variety of businesses under the compliance reporting umbrella. The EU Corporate Sustainability Reporting Directive (CSRD) itself has brought about 50,000 companies under the ambit of mandatory ESG reporting from 2024. This suggests that the first CSRD reports are due in 2025, but a lack of data to adequately report on dozens of metrics will likely be a challenge.

The US was lagging behind other developed countries in terms of ESG reporting regulations, but there has been considerable progress in recent years. The Sustainability Accounting Standards Board (SASB) was established in 2011 to integrate sustainability into accounting practices and business operations. In 2022, it partnered with the International Financial Reporting Standards (IFRS) Board to form the International Sustainability Standards Board. In March 2022, the Securities and Exchange Commission (SEC) published its proposed Sustainability Disclosure Requirements, analogous to the European Union's Sustainable Finance Disclosure Regulation (SFDR). The proposed rules include risk-management procedures for climate-based risks.

Let us first look at what environmental, social and governance (ESG) data is and the types of data.

Investors, analysts, businesses, lawmakers and other stakeholders use ESG data to comprehend and make well-informed decisions on risk, sustainability and business effectiveness. Such data helps achieve a company’s ESG-related objectives.

ESG data does not refer to a specific type of data. For instance, financial data complements the use of ESG data. It is typically used to compute intensity ratios and other ESG KPIs to assess a company’s financial performance and stability.

Why is ESG data important?

ESG data offers insight on the ESG facets of a business’s operations. It enables evaluation by stakeholders, investors and ESG rating organisations of a company’s performance in terms of sustainability, ethical business conduct and long-term value generation.

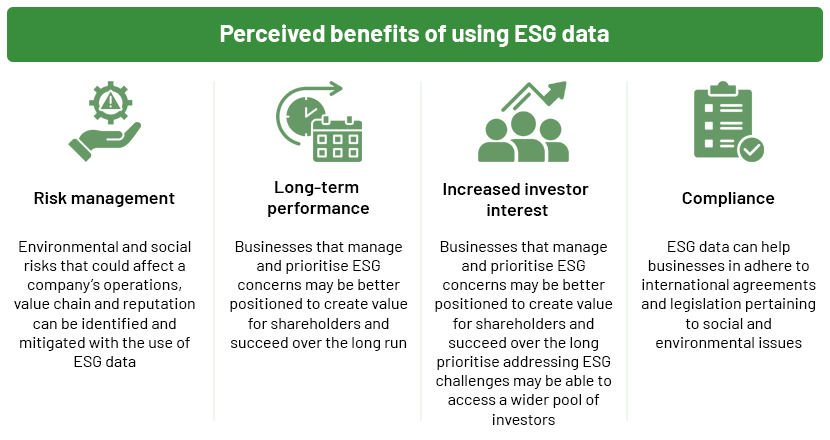

The main benefits of ESG data are as follows:

How can ESG data be managed and tracked?

Businesses leading the way in ESG have adopted comprehensive strategies that consider the requirements, concerns and interconnectedness of all stakeholders. To foster confidence in all stakeholder groups, they transparently integrate ESG into strategy, operations and reporting.

This involves setting specific goals and KPIs, followed by preparing a roadmap outlining how the goals will be attained and progress will be reported.

Company data can be used to track and evaluate ESG performance. A number of ESG measuring frameworks and reporting standards are beginning to converge to guarantee trustworthy ESG disclosure. This would result in a uniform reporting environment for future regulation and third-party attestation.

Regulations popular in Europe

According to the private markets survey, The SFDR is a popular framework in Europe, as is the EU Taxonomy, for analysing alignment with SDGs and to establish an ESG data infrastructure.

Use of ESG data for reporting purposes – to proxy or not?

ESG is an evolving domain in the business world, particularly in the private equity (PE) and venture capital (VC) markets. A considerable proportion of investments made by PE and VC firms is in small and mid-size businesses. There are no systems to collect and track ESG data at such small businesses and for even at mid-size businesses. Where they are available, the ESG data is not up to standard and is of poor quality in terms of meeting disclosure requirements. In situations where ESG data is unavailable, proxy numbers are considered to be helpful.

Data on corporate governance, social issues and the environment are disclosed through ESG reporting. Like all disclosure, this aims to increase investor transparency, highlight a company’s ESG initiatives and encourage other businesses to follow suit.

Investors may screen investments, align investments to their values and steer clear from businesses that run the risk of causing environmental harm or corruption. They are able to do this as ESG reports provide an overview of the qualitative and quantitative benefits of a company’s ESG efforts.

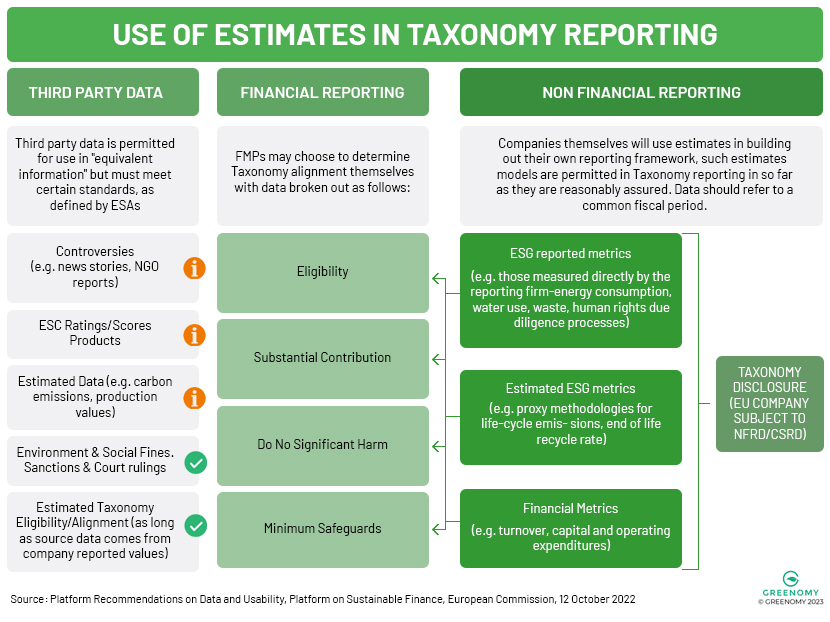

When there is insufficient or no direct ESG data available, ESG proxy data is used to assess ESG performance. By using proxy data, gaps in ESG reporting can be addressed and an improved understanding of a company’s ESG performance or risk exposure can be gathered. However, there are specific challenges associated with using proxy data, and it must adhere to certain regulatory requirements, especially when it comes to EU Taxonomy reporting.

The Commission allows financial market participants (FMPs) to report proxy data on underlying investment companies, which fall outside the NFRD’s mandate and are not subject to EU Taxonomy reporting. The Platform on Sustainable Finance (PSF) uses the term “equivalent” information to refer to a Taxonomy-permitted estimate date.

Substantial contribution: FMPs require data from the company to approximate its substantial contribution to an environmental objective; hence, metrics should come from the company's own disclosure and cannot be approximated. However, if a cautious approach is used, entity-level disclosure can be used to estimate the significant contribution at the activity or business-unit level, using a top-down methodology.

Do No Significant Harm (DNSH) test:

Use of environmental controversies: A company is considered to "pass" the DNSH test if it does not violate any common, international environmental standard.

Compliance with official standards or local environmental legislation: A business can "pass" the DNSH test if it adheres to the official standards and local environmental legislation that are relevant to its operations.

Applying environmental criteria to ESG scores: To proxy to DNSH, a company needs to self-define a tolerance level on an ESG score or rating (generated internally or purchased externally).

Assessing an organisation’s adherence to the DNSH tests in the Taxonomy and/or carrying out due diligence: Determining whether an organisation shows, through its corporate sustainability reporting procedures, that it satisfies some of the DNSH requirements to receive a percentage of compliance.

Minimum safeguards (MS):

The PSF discourages the use of controversy-only methods; instead, it suggests use of company-reported social and governance policies, management systems, KPIs and remediation processes to approximate a company's MS compliance.

In conclusion, different types of proxy and estimated data are acceptable under regulations in different situations based on their stated purpose (substantial contribution, DNSH test and MS).

Investors should, thus, carefully consider whether (a) they can use proxies (estimated data is permitted only for companies exempt from mandatory disclosure laws) or (b) whether their estimated data has been extensively examined to guarantee that it accurately represents the company being evaluated.

Proxy data, also called dummy data or estimated data, is generated through various arithmetic calculations involved with real ESG data of peer companies. A carefully selected set of comparable peer companies is used to derive estimated ESG data for the target company.

There are many third-party service providers that help generate proxy ESG data used for reporting; many obligated entities keep the process in-house.

How Acuity Knowledge Partners can help

We help clients interested in reporting on SFDR with estimated GHG emissions data across Scope 1, 2 and 3. We use tools developed in-house to generate proxy data used for regulatory reporting.

Tags:

What's your view?

About the Author

I am working in Acuity Knowledge Partners within PEC as an associate for 1.5 years. I am supporting in sustainability reporting and engagement, ESG assessment on private equities and other ad-hoc ESG related tasks.

Like the way we think?

Next time we post something new, we'll send it to your inbox