Published on May 27, 2025 by Amila Perera

Cashflow-based lending

Banks extend finance to borrowers under secured or unsecured terms. Secured lending branches into asset-based lending (ABL) and cashflow-based lending (CBL). These various forms of financing have been developed to cater to the varied needs of borrowers. In cashflow based lending, a bank will scrutinise the past and future cashflow of a borrower and make arrangements to secure future cashflow and extend finance based on this future cashflow.

CBL is ideal for borrowers with a steady revenue stream but a limited asset base. Furthermore, it is preferred over ABL, as collateral appraisal is time-consuming and complex. Secure revenue streams, asset-light balance sheets and project-based incomes characterise the sectors that favour CBL, such as technology and software, professional service firms and renewable-energy projects.

Companies operating in the technology and software space usually have highly skilled manpower and project-based revenue streams, making them ideal contenders for CBL. In the professional services space too, companies such as audit firms, law firms and consultancy firms are heavy with human capital, and revenue streams are secured by long-term contracts, enabling them to use CBL based on secure future cashflow. In the renewable-energy space, the special-purpose vehicles (SPVs) that undertake the project secure their cashflow with the state-owned utility, making them ideal candidates for CBL as well.

Key challenges faced by banks when on-lending based on CBL

From a micro perspective, banks face the challenge of accurate revenue forecasting. Lenders must analyse past financial statements and scrutinise projected cashflow to ensure the borrower can meet repayment obligations, and structure the repayments mirroring cash inflow. Another challenge faced by lenders is ensuring the promised cashflow is directed to the bank for loan servicing. Although a steady stream of cashflow may be available, if the borrower does not direct it to the lender for loan servicing, there could be a risk of default.

From a macro perspective, lenders face the challenge of a volatile global economy characterised by increased geopolitical tensions, potentially leading to supply-chain disruptions, regulatory changes inclined towards protectionist policies and economic uncertainty in terms of interest rates, inflation and employment.

Solutions to these challenges

Revenue seasonality and other challenges can be mitigated by implementing tools such as escrow accounts and cashflow waterfalls and introducing financial covenants. Escrow accounts help lenders manage cash inflow and guarantee loan repayments by distributing funds according to a pre-defined structure. Cashflow waterfalls help build a hierarchy and, thus, prioritise payments. Cashflow waterfalls also ensure that loan repayments, operating expenses and other critical expenses are given due priority and managed flawlessly. In terms of covenants, lenders may present several financial covenants including turnover covenants and debt service coverage ratios (DSCRs) to flag potential threats to future cashflow.

Operating an escrow account

Legal considerations:

A well-defined escrow structure is important to mitigate risk by ensuring financial discipline and adherence to the loan agreement. A clear and sound escrow agreement will define the responsibility of every party involved in the transaction (i.e. the borrower, lender, escrow agent). A precursor to the escrow agreement is securing the revenue streams from the borrower’s various projected income lines. This would be in the form of the borrower executing legal documentation to allocate the projected revenue to a pre-determined account nominated by the lender. The underlying project documents, such as contracts with customers and agreements with state utilities, will be the base documents for the escrow agreement. Thereafter, the escrow agreement will incorporate the terms of the facility agreement such as loan terms, repayment plan, covenants and waterfall instructions. The agreement will also expressively mention the individuals who can instruct fund movements and implementation of reserve build-up for an unforeseen situation and, finally, under which conditions funds can be disbursed to the borrower (project sponsors and equity holders).

Operational considerations:

On signing the escrow agreement, the underlying agreements will be forwarded to the loan operations team that will place the necessary holds on the escrow account, ensuring full control to the escrow agent. Thereafter, the operations team will define and incorporate the cashflow waterfall into the loan management system.

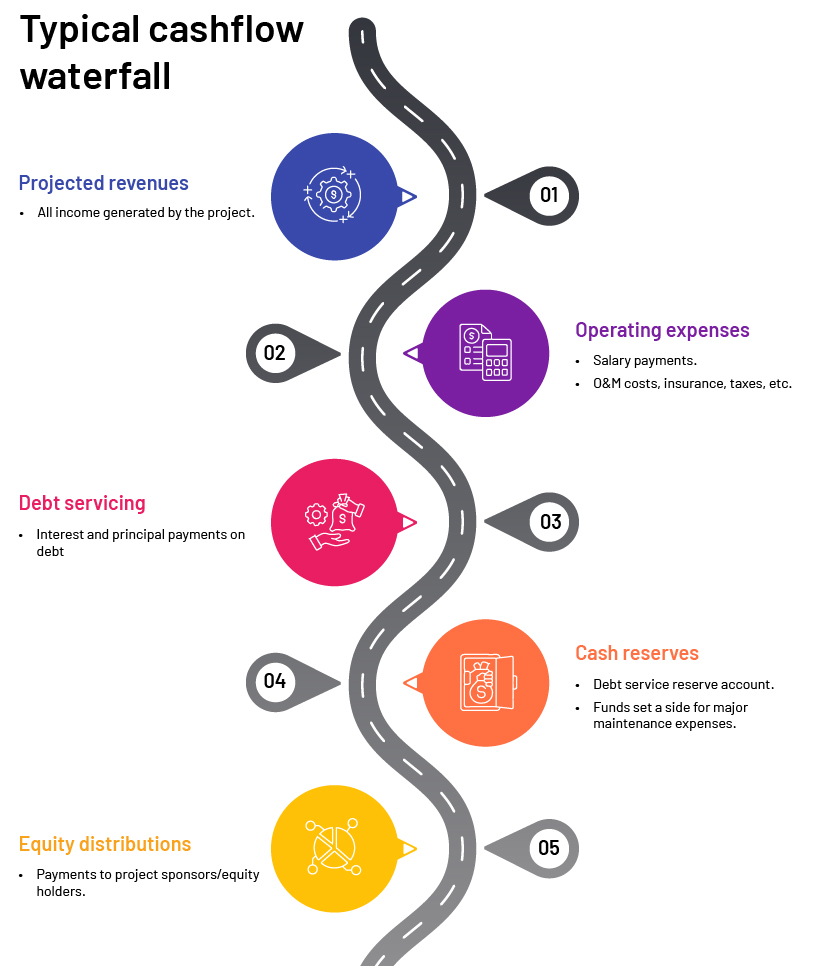

Setting up the cashflow waterfall may be deemed to be the crucial part of escrow operations. It indicates the priority of payments from the account. A typical cashflow waterfall could include the following levels:

Ongoing administration of an escrow account by the loan operations team includes monthly monitoring of projected revenue to the account, liaising with the escrow agent on receipt of funds and making payments as defined in the waterfall. A key step in this process includes liaising with the other syndicate lenders on their monthly requirement for loan settlements and onward communication with the escrow agent. The monthly operation and maintenance (O&M) payment is most often revised annually, and instructions regarding this need to be communicated to the escrow agent. Thereafter, the balance available will be transferred for escrow reserve build-up. Once the reserve is built up to the desired level as defined in the escrow agreement, the operations team will liaise with the escrow agent to disburse excess funds to the borrowers (project sponsors and equity holders).

In terms of supporting the covenant-monitoring process, details of the transactions mentioned above must be communicated to the transaction management team, who will perform calculations for the financial covenants and ensure projected cashflows of the CBL are received. Information shared with the transaction management team includes the following:

- Projected revenue to the escrow account along with actual inflow

- Monthly disbursements for O&M expenses

- Allocation to syndicate lenders for monthly capital and interest payments

- Transfers to build up escrow reserve

The loan operations team, therefore, plays a critical role in identifying potential risks to future cashflows.

Conclusion

Escrow operations are a critical pillar in cashflow based lending. They empower lenders to safeguard repayments, monitor covenants and manage the credit facility effectively. Lenders could also reduce credit risk by introducing a clear waterfall process and monitoring in a timely manner. This significantly enhances a portfolio’s health. In today’s fast-paced world, lenders often shift towards smarter credit models. Financial institutions that invest in improving these operations through specialised teams or trusted partners would be better positioned to gain a competitive advantage and navigate the complexities of modern credit ecosystems.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners help financial institutions manage their CBL portfolios through loan servicing solutions. Our team guarantees seamless escrow account administration by adhering to waterfall instructions, effective loan monitoring, following regulatory guidelines and communicating with escrow agents. By leveraging our expertise, lenders can enhance risk management, improve loan servicing efficiency and maintain financial stability in CFL.

Sources:

-

Cashflow Collection and the Role of Escrow in Cashflow Management

-

Features Of A Cash Flow Waterfall In Project Finance | Mazars Financial Modelling

-

Cash Flow vs. Asset-Based Business Lending: What’s the Difference?

-

Traders betting Fed will cut rates at least 4 times this year to bail out economy

What's your view?

About the Author

Amila Perera is a credit risk professional with over 11 years of experience in the Banking & Financial Services industry. He currently serves as a Delivery Manager - Commercial Lending at Acuity Knowledge Partners where he led the Corporate Sector Lending (CSL) team for the Central and Eastern European portfolio of a major European Bank. His responsibilities included analytical credit reviews, internal risk ratings, financial spreading and covenant monitoring.

Prior to joining Acuity, he worked at a leading non-banking financial institution in Sri Lanka. Amila holds an MSc in Financial Mathematics from the University of Colombo and a BSc in Business Management from London South Bank University.

Like the way we think?

Next time we post something new, we'll send it to your inbox