Published on September 11, 2020 by Anish Chopra

Energy transition plays a vital role in addressing rising concerns about global warming and environmental degradation. As part of the Paris Agreement 2015, over 180 nations have agreed to a common goal of limiting the increase in global average temperature to well below 1.5°C by 2050. A significant increase in renewable power generation is required to achieve this. Ninety percent of carbon-reduction targets will be achieved through renewable energy and energy-efficiency measures, according to the International Renewable Energy Agency’s (IRENA’s) Global Energy Transition: A Roadmap to 2050 report (dated April 2020). In the “Transforming Energy Scenario”, renewables would account for 57% of world power generation by 2030 and 86% by 2050, up from 26% in 2018-19. Promoting renewable energy is essential to realising the United Nations’ Sustainable Development Goal of providing affordable and clean energy by 2030. Countries with power deficits are focusing on developing renewable facilities to provide cost-effective energy and expand off-grid electricity access in remote areas.

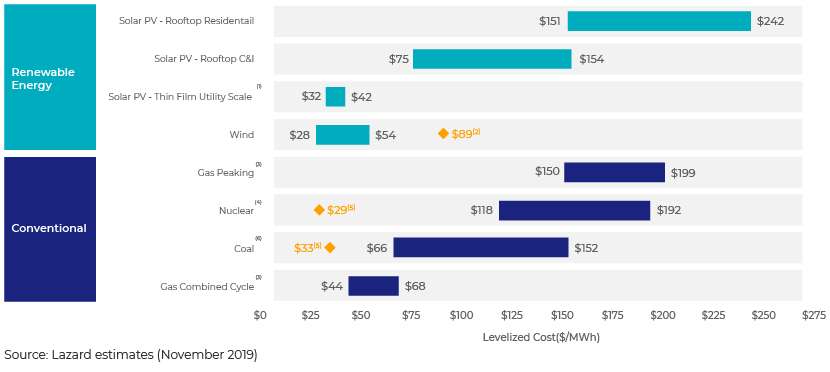

Renewable energy capacity has increased steadily in recent years. Around 1,200GW of new capacity was added to the system with an investment of USD2.7tn over the last decade (2010-19), supported by a reduction in cost disparity between fossil fuels and renewable sources. The cost of clean energy is competing with the cost of fossil fuel thanks to declining material costs, increasing capacity utilisation and improving manufacturing efficiencies. Favourable policies such as tax credits, preferential feed-in tariffs and renewable portfolio standards (RPS) have also contributed to the cost decline. Renewables are the cheapest source of energy in two-thirds of the world, according to Bloomberg New Energy Finance (BNEF). The cost of most new renewable capacity additions is less than the most cost-effective fossil fuel power generation option. Over 50% of the renewable capacity added in 2019 costs less than new coal power. IRENA estimates that solar power saw the sharpest cost decline of 82% over 2010-19, while onshore and offshore wind saw cost declines of 40% and 29%, respectively. Lazard’s Levelized Cost of Energy (LCOE) Analysis shows that the cost of renewable sources (such as solar PV and wind) will remain competitive with the marginal cost of conventional technologies.

With costs continuing to fall, replacing a traditional power plant with a renewable source is likely to generate significant cost savings. Replacing the costliest 500GW of coal capacity with solar and wind would cut system costs by up to USD23bn annually and yield stimulus worth USD940bn, as per IRENA. By 2021, operating expenses of 1,200GW of existing coal-fired capacity will be higher than the cost of installing a new utility-scale solar PV facility.

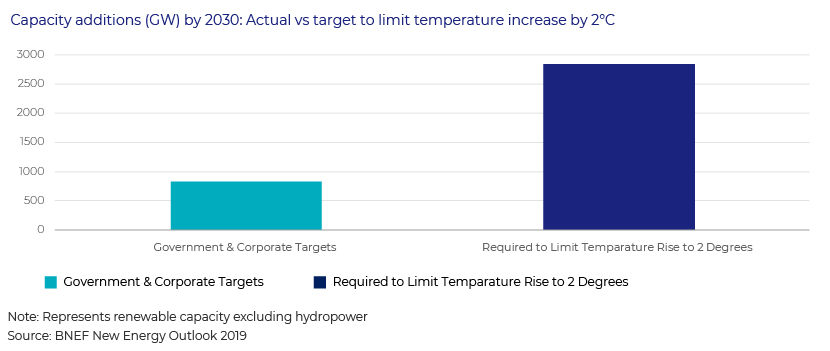

The substantial gap between actual figures and targets for renewable energy presents potential investment opportunities

Although remarkable progress has been made towards a green ecosystem, the targets met are still far short of the official targets for addressing climate change. Global governments and corporations have made clean-energy commitments of around 826GW by 2030, according to BNEF’s New Energy Outlook 2019, with an estimated cost of around USD1tn, or an average of USD100bn a year. However, these commitments are not sufficient to limit the increase in global average temperature to less than 2°C. They are also way behind the last decade’s achievements. BNEF estimates that around 2,836GW of new renewable capacity addition is required by 2030 even to limit the increase to 2°C and that this could require an investment of around USD3.1tn.

Investment would need to be scaled up significantly to transform the world’s energy system. Goldman Sachs (in a research report dated June 2020) projected that the cleantech industry could draw close to USD1-2tn per annum of green infrastructure investments, with an overall investment opportunity of up to USD16tn by 2030, to meet the Paris Agreement objectives. Renewable energy (including bioenergy) would account for about 25% of all energy spending in 2021, exceeding investment in oil and gas.

COVID-19: A game changer, accelerating the transition to clean energy

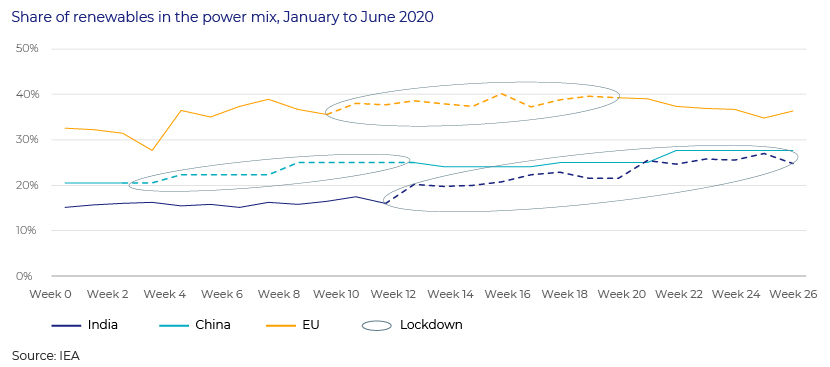

The COVID-19 crisis has accelerated energy-transition momentum. The global lockdowns led to a significant drop in energy demand. The International Energy Agency (IEA) projects that overall energy demand will contract by 6% while demand for coal will drop by 8% in 2020. The share of renewables in the overall energy mix is increasing due to reduced demand for fossil fuels, the high cost of carbon permits, low operating costs and regulations providing priority access to the grid. Many countries/regions saw sharp increases in renewable energy consumption during the lockdowns. Demand for coal fell by 20% in 1Q 2020, and the share of renewables reached an all-time high in the European Union (EU). In the UK, renewable power generation surged by over 24% in 1H 2020 versus 1H 2019. In India and China, the share of renewables increased after their first lockdowns. We expect this trend to continue in 2H 2020 as utilities face revenue challenges and focus on solar and wind facilities more than on costlier fossil fuel plants

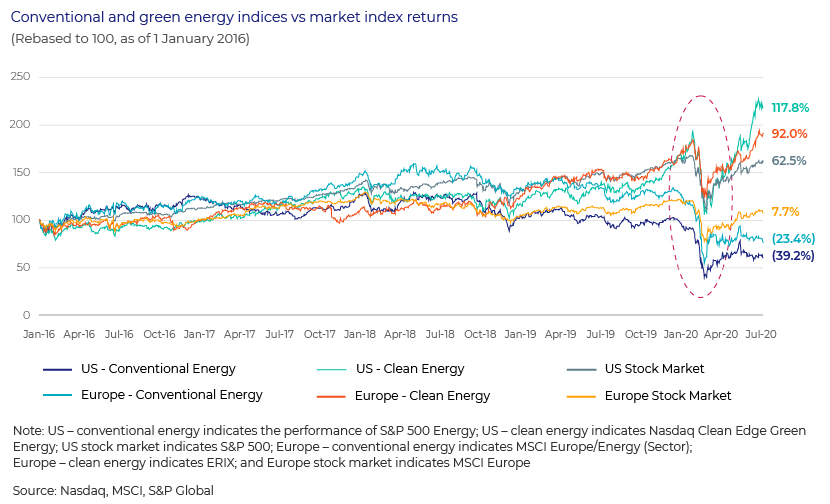

The fall in demand for fossil fuels and the collapse in oil prices amid the crisis also affected investor confidence. Brent crude prices fell to an 18-year low of USD19 per barrel (bbl) and the West Texas Intermediate (WTI) forward contract price turned negative for the first time in history, reaching a negative USD37/bbl on 20 April 2020. Oil majors (including Shell, BP, Total, Eni, Equinor, Galp and Repsol) lost an average of 35.6% of their total market value in 1H 2020. Against such a backdrop, renewables are emerging as a safer and more reliable investment avenue. Declining costs and favourable policies have made renewables a more lucrative investment. Renewable energy stocks have outperformed their conventional counterparts and the market amid the crisis.

Considering the growing financial risks of carbon-intensive investments, some of the world’s largest financial institutions continue to rapidly divest their fossil investments and seek investment opportunities within the cleantech space, especially renewables:

-

Goldman Sachs targets to finance and invest USD150bn in clean technology and renewable energy companies by 2025

-

JP Morgan aims to facilitate and underwrite USD200bn in capital for renewable energy projects and green bond offerings by 2025

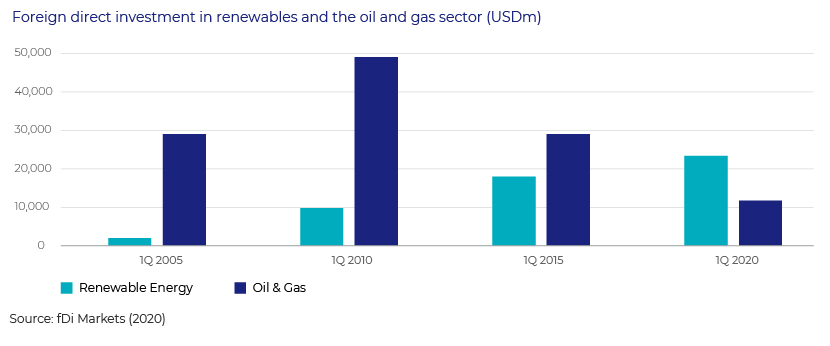

Renewables continue to attract investment amid the crisis because of their risk profile and resilience. Foreign direct investment in renewables reached an all-time high in 1Q 2020, while investment in fossil fuels dropped. fDi Markets (2020) data shows that USD23.3bn was invested across 159 projects in 1Q 2020, making it the strongest first quarter in a decade.

Oil majors to stay committed to their energy-transition targets despite liquidity crunch

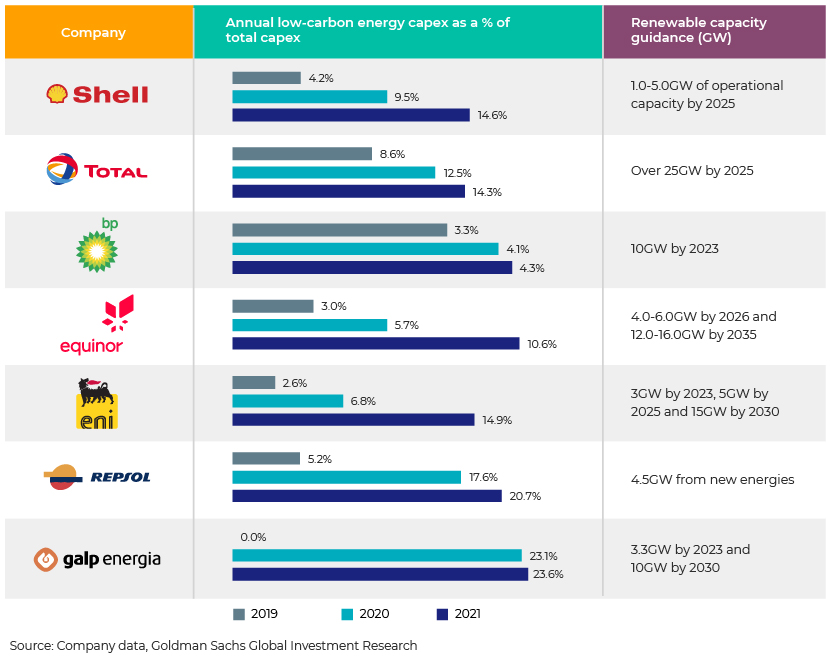

Another potential opportunity to scale the expansion of renewables arises with oil majors becoming a part of the energy transition. Global oil giants are focusing on decarbonising their operations and are investing in clean energy. Under the Paris Agreement, oil majors such as BP, Shell, Total and Eni have made commitments to meet their carbon-reduction targets, including investments in renewable energy. Although oil companies are facing a liquidity crisis due to the oil price crash and are focusing on severe cost-cutting measures, with some (such as Shell and Equinor) reducing dividends, none of them have cut their clean-energy budgets and remain committed to meeting their net-zero carbon goals. Moreover, high volatility in oil prices has increased the attractiveness of renewable energy projects for fossil-fuel companies. Oil majors have allocated an average of 15% of their 2021 budgets to low-carbon energy sources vs c.4% in 2019.

Oil companies have defined their strategies and goals relating to diversifying their investments, focusing on clean energy:

-

In March 2020, Total CEO Patrick Pouyanné announced that the company is cutting its overhead and capital spending by 20% but is not reducing its USD2bn (c.13% of total capex) of investments in new energy sources in 2020

-

In April 2020, Shell planned to decarbonise its energy products up to 65% by 2025, with more investments in renewable and hydrogen businesses. It targets investing USD1-2bn annually by 2021 and up to USD2-3bn every year thereafter

-

BP’s net-zero target for 2050 remains unchanged, with capex of USD500m in 2020 on low-carbon investments

Stimulus packages focused on clean-energy transition can help beat economic slump

Investments in renewables can stimulate job creation and economic development while reducing emissions. Clean-energy investments are estimated to yield 3-8x higher economic returns. IRENA’s Global Renewables Outlook 2020 assesses the socioeconomic impact of several scenarios. In the “Deeper DeCarbonization Perspective”, attaining a net-zero-emissions world by 2050-60 would cost USD35-45tn, but yield USD62-169tn in cumulative savings, considering healthcare and social costs saved due to reduced pollution. Progress in energy transition could also generate around 100m jobs in the energy sector globally by 2050, of which renewable energy would account for c.42m jobs, compared to just 11m in 2018. These gains would far outweigh the loss of c.6m jobs in the fossil fuel and nuclear sectors over the same period. This is an opportunity for governments to recover from the crisis by focusing on clean energy in their stimulus packages.

Policymakers and regulators have a critical role to play

Supportive policies can attract investors to the renewable energy sector and accelerate energy transition. The IEA estimates that around 70% of the world’s energy investments are directly and indirectly supported by governments. The availability of finance has contracted amid the crisis, reducing investors’ risk appetite and affecting future investments and installation of renewable energy systems. In such a scenario, stimulus and recovery packages focusing on clean-energy deployment would help keep a low-carbon transition on the right path. Some governments, however, are focusing on safeguarding the interests of carbon-intensive industries, for instance, the USD123bn bailout to airlines with no conditions on carbon reductions attached. The fossil fuel sector receives over USD400bn of subsidies annually, and governments could use the decline in oil prices to reduce these subsidies. We believe they should capitalise on the drop in the cost of renewable energy and include clean energy as a key component of the post-COVID-19 economic recovery.

European countries have maintained their focus on climate-related goals. In 2019, the EU presented the European Green Deal (EGD), a roadmap that outlines targets such as a 50-55% carbon emission reduction by 2030, a ‘climate law’ to achieve net-zero emissions by 2050, a EUR100bn transition fund and other policies to accelerate climate transition. Around EUR260bn of additional annual investment is required to achieve these objectives. The EU suggests new plans to revive the investment. In 2020, the EU Commission proposed a two-fold COVID-19 recovery plan, including a EUR1,100bn Long-term Budget for 2021-27 and Next-Generation EU, a EUR750bn short-term tool with financing raised through the issuance of bonds for 2021-24, providing EUR1.85tn of financial stimulus to the EU budget. The green and digital transitions are key components of this plan. Within the framework, the Commission proposed a EUR40bn Just Transition Fund to achieve its climate objectives. These funding initiatives would boost private-sector investment towards green transition. Governments are also taking steps to improve the region’s financing environment. In July 2020, the European Bank for Reconstruction and Development (EBRD) announced its new Green Economy Transition plan to allocate 50% of its annual investments towards a green economy by 2025. The UK government plans to launch a new green investment bank to invest in green infrastructure projects.

The COVID-19 pandemic has disrupted the global economy, and the energy sector has not been spared. The renewable energy market has been impacted mostly in the form of delayed construction due to supply-chain disruptions and closure of construction sites. Many countries have introduced policy changes to address these concerns. Despite short-term headwinds, the renewable energy sector has performed better than the overall energy sector. Industry experts believe that the sector has a positive outlook in the long term because it builds on economies of scale achieved in recent years. The IEA forecasts that global use of renewable energy will increase by 1% in 2020.

Although the renewable energy sector has been relatively resilient amid the pandemic, government support is critical to provide the urgent and necessary boost it needs. Significant investment is required to meet global climate goals, presenting an opportunity for capital providers to enter into or expand their presence in the clean-energy sector. Promoting renewable energies within the framework of recovery packages could guarantee long-term public funding, boosting investor confidence and attracting private capital.

Acuity Knowledge Partners has a large pool of experts with diverse experience in the power, utilities and infrastructure sectors. We are able to assist with a range of investment banking, consulting and business research projects including idea generation, deep dives, strategic research, competitive landscaping and financial modelling. We have dedicated renewable and clean energy-focused teams that keep abreast of market trends to help clients capitalise on investment and M&A opportunities across the globe. To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought-leadership content and action-oriented guides and best practices

References:

The International Energy Agency (IEA)

New Energy Finance (BNEF)

The International Renewable Energy Agency (IRENA)

https://www.fs-unep-centre.org/wp-content/uploads/2020/06/GTR_2020.pdf

https://www.wri.org/blog/2020/05/coronavirus-renewable-energy-stimulus-packages

https://www.unido.org/stories/cleantech-innovators-take-covid-19

https://cleantechnica.com/2020/06/17/india-x-cleantech-june-2020/

http://cleantechiq.com/2020/02/fundraising-update-kkr-generate-each-top-1b-for-cleantech-funds/

What's your view?

About the Author

Anish Chopra has over 14 years of experience in investment banking with Acuity Knowledge Partners. He has significant experience in working on power, infrastructure, consumer, healthcare and TMT sectors. In his current role, he is leading a dedicated team supporting Power, Infrastructure and Utilities Group of a global investment bank. He is responsible for managing the team and delivering diverse analysis required during the entire cycle of a transaction including structuring and preparing compete pitch books. He is actively engaged in client interaction, as well as guiding and training juniors. Previously, he supported a European bulge bracket investment bank. Anish holds a Master’s degree in Business Administration in..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox