Published on May 16, 2025 by Rohit Kumar Jaitly and Lalit Chauhan

Overview

The private equity (PE) investment process/deal lifecycle starts from sourcing potential targets, then conducting due diligence on the target company, deciding on valuation, investing in the business, supporting portfolio companies in creating value and eventually exiting the business. Each stage in the deal lifecycle – including the due diligence process in private equity – is essential to the PE investment process.

Due diligence is a process undertaken by a potential buyer to investigate and evaluate the target business. This helps identify and mitigate associated risks and provides insights on opportunities and synergies that can impact the investment decision. The private equity due diligence process involves analysing the business, reviewing its financials, benchmarking them against competitors’ and deciding on an appropriate purchase price.

The following are key takeaways relating to PE due diligence, according to a recent survey conducted by Accenture:

-

75% of the PE leaders surveyed agree that PE investments have grown more complex, a 1.5x increase from the 2023 study

-

83% of the respondents believe their current approach to due diligence has scope for improvement

-

PE firms expect to spend USD80bn on due diligence in the next five years

-

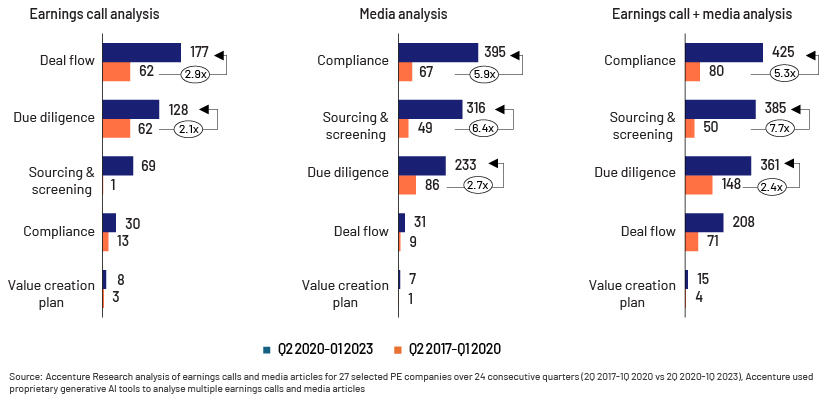

The following charts show increased focus on the pre-deal phase, with a 2.4x increase in reference to due diligence in PE firms’ earnings calls and media articles:

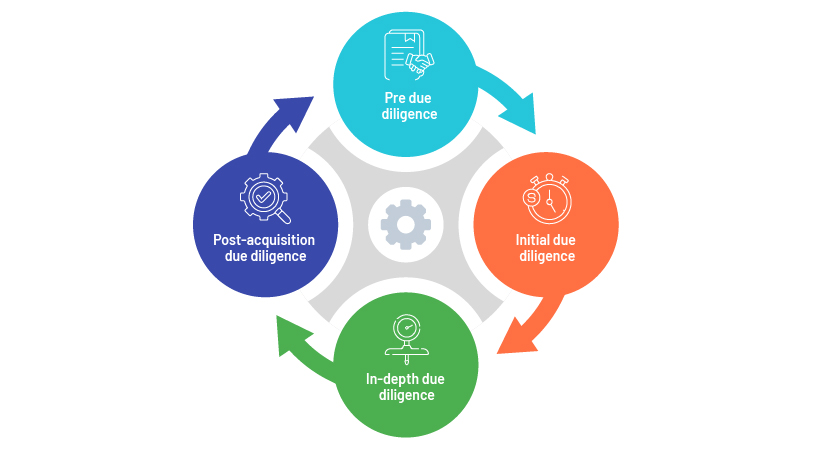

Stages of the due diligence process

Pre due diligence

This stage involves reviewing the legal risks associated with the transaction. At this stage, company-specific queries are added to a set of general questions, and the PE firm presents a list of documents required from the target companies. During this stage, the private equity due diligence checklist is used while the team conducts internal discussions on issues likely to arise.

Initial due diligence

The PE firm invites the target company’s management to a virtual data room – a secure online repository for document storage and distribution – where progress can be monitored, and communication is more streamlined.

In-depth due diligence

This stage includes in-depth analysis of the target company and the information provided by its management. It can include interviews with management, staff and suppliers. The company’s cashflow and contracts can also be analysed at this stage.

Post-acquisition due diligence

This stage is also known as the first phase of post-merger integration (PMI). It involves working with the acquired company’s management to ensure that any remaining issues at the target company are solved to ensure optimum value creation from the deal. It comprises ongoing monitoring and control execution to detect and prevent financial crime.

The due diligence process covers several areas, such as financials, legal matters, operations and market analysis, focusing on verifying data and assessing risks before a transaction or investment:

Industry Research

Favourable industry trends and a positive outlook drive investment decisions, requiring in-depth industry analysis Typically covers a target company’s market analysis, competitive landscape, growth prospects and precedent transactions and their multiples

Financial due diligence

Focuses on analysing financial statements, projections, cashflow, accounting policies, etc.

Focuses mainly on understanding quality of earnings and identifying potential mis-statements

Operational due diligence

Focuses on areas to improve the operational capabilities of the target company to generate more value Covers analysing business operations, supply chain, investments, geographical locations, etc.

Technology and IT due diligence

Focuses on auditing the target company’s IT infrastructure, strategy, information security, associated risks, etc. Also looks at potential bottlenecks at onshore and offshore data centres

Legal due diligence

Involves identifying the target company’s liabilities and analysing laws and regulations that apply to the target company and impact the investment

Commercial due diligence

Focuses on in-depth analysis of the target business in terms of market positioning, growth opportunities, business model analysis, tracking and analysing operational KPIs, etc.

The traditional due diligence process often faces significant challenges, as highlighted below:

Data overload

As part of due diligence, companies prepare a confidential information memorandum (CIM) providing in-depth details and a summary of their business overview, operations, financials, market position, strategy and outlook. However, due diligence requires a thorough reading between the lines, beyond the scope of a CIM, to ensure a complete assessment of the company. This involves collecting and analysing large amounts of data. Excess data could sometimes lead to inefficient due diligence because of overemphasis on not-so-important data and overlooking important areas.

Inconsistent data quality

This refers to non-availability or inconsistency in a private firm’s data, especially data that is unique to the firm. Examining a range of companies with different fundamental characteristics often results in PE firms obtaining data that differs in depth, format and accuracy. Standardising relevant data is a tedious and long-drawn-out task. Inconsistency in data quality complicates the due diligence process and could hinder accurate and reliable valuation.

Time constraints

PE companies operate within short timelines, as they are required to close deals quickly; this creates pressure. However, gaining a comprehensive understanding of a company's overall health requires careful analysis, which is time-consuming. Hence, PE firms face the challenge of balancing an efficient due diligence process with ensuring high-quality analysis. Failing to achieve this balance can be detrimental, as inaccurately identifying asset-quality issues has been the main reason for unsuccessful post-deal integration.

Human bias

Due diligence is a manual process and is, thus, susceptible to human bias in the evaluation process. Analysts often bring their own preconceived notions and biases to decision-making, which could impact investment decisions. Some analysts may also fall victim to confirmation bias, favouring information that supports their preconceived notions and biases, while ignoring evidence that contradicts them.

Inadequate resources

Due diligence is a resource-intensive process and requires a large and dedicated team of analysts to thoroughly evaluate a target company. It also requires external consultants with expertise in specific areas of the due diligence process. Working with so many individuals requires extensive coordination between a number of teams, making the traditional due diligence process time-consuming and expensive.

Conclusion

In general, while companies have high levels of dry powder at their disposal, exit levels have been weak; the average holding period for PE firms was 6.1 years in 2024 (6.4 years in 2023), higher than the average holding period recorded from 2018 to 2022. This includes businesses not generating enough value to meet exit multiples investors expect. This means that while there is more scope for investment, conducting due diligence would ensure the investments have significant value that could be realised within a reasonable time. There is a positive correlation between PE risk and returns; hence, conducting thorough due diligence is critical for evaluating the viability and suitability of these opportunities.

How Acuity Knowledge Partners can help

We are a leading provider of research, analytics and technology solutions to over 650 financial institutions across the world, including asset managers, corporate and investment banks, and PE and venture capital (VC) firms. Our services and solutions are supported by a global network of more than 6,000 analysts and industry experts. We assist PE and VC clients across their investment value chain, from industry research, deal screening and due diligence to deal acquisition and portfolio monitoring, enabling them to fast-track their investment decisions.

Sources:

-

Optimizing AI for Private Equity: A Guide to Prompt Engineering

-

The Significance of Corporate Due Diligence in AML Compliance

Tags:

What's your view?

About the Authors

He has ~12 years of experience in financial research domain supporting investment bank, Debt Capital Markets teams, credit research and private equity clients. Holds MBA in Finance and has cleared CFA Level 2 from CFA Institute

He has ~12 years of experience in secondary research across Investment Bank and Private Markets space, working with Private equity clients from across the world on various products like industry research, target screening, deal sourcing, etc. Postgraduate in Finance from ITM Business School, Warangal

Like the way we think?

Next time we post something new, we'll send it to your inbox