Published on October 1, 2025 by Shubhangi Shukla

Global warming is a focus area of governments, institutions and individuals alike globally. Among its many ill effects is the constant rise in temperatures, leading to a multifold increase in the cooling load requirements. Electrical systems in several countries are strained due to this ever-increasing demand of space cooling. Since the beginning of the century, energy utilisation for establishment cooling has doubled. According to some studies, almost 20% of total electricity consumption in a building is attributed to electric fans and air conditioners, globally. The district cooling (DC) system becomes important here: to meet the cooling requirements of the population while also caring for the planet.

The DC system is one of the most promising sustainable cooling technologies, offering high efficiency coupled with good cooling capacity. Here, chilled water is produced in a centralised location and distributed through insulated pipes to various establishments, which could be industrial, commercial or even residential. On reaching the establishment, this chilled water is either circulated through refrigeration coils or enters the air conditioning system by using absorption technology.

Thus, not only does DC lessen greenhouse gas emissions, the centralised system enables it to utilise economies of scale, offering various benefits to the users as well, including cost savings, reduced maintenance, scalability and reliability. All of these factors, along with many others, have enabled district cooling to gain the image of “the leading alternative source of cooling”.

This system has a more vivid impact in hot and arid regions such as the Middle East, where year-round high temperatures make cooling a necessity in all sorts of establishments. Keeping the Sustainable Development Goals in mind, the region needs to address its vast cooling needs in a sustainable manner. By 2030, a properly employed DC system could provide c.30% of the Gulf Cooperation Council’s forecast cooling requirements. This negates the need to build 20GW in new power generation capacity as well as saves 200,000 barrels of oil equivalent per day in fuel.

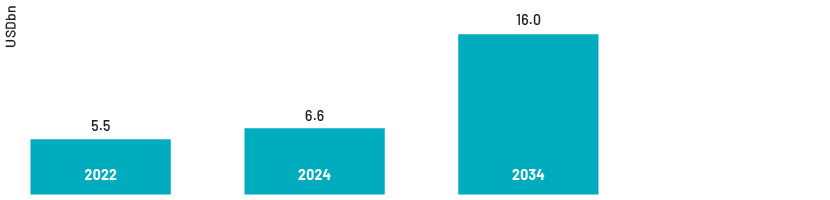

Having said this, the DC industry in the Middle East is quite well developed already, being valued at USD6.6bn in 2024, and is estimated to grow at a CAGR of 9.3% from 2025 to 2034, according to Global Market Insights (GMI). The UAE’s market is expected to cross USD4bn by 2034 according to GMI, while Saudi Arabia’s is expected to record a CAGR of 9.3% from 2024 (c.USD1.5bn) to 2030 (c.USD2.5bn), according to Prescient and Strategic Intelligence. In contrast, Fortune Business Insights estimates the global DC market at USD26.8bn in 2024 and expects it to post a CAGR of 7.6% from 2024 to 2032 (c.USD48.2bn) while reaching c.USD10bn in the US by 2032.

Apart from climate conditions, several other factors have bolstered the growth of DC in the region, including the following:

-

Investments in infrastructure, including commercial and residential, resulting from the growing tourist and expatriate population

-

The role played by regional governments, including favourable schemes, incentives and rebate programmes to stir up the adaptability of sustainable solutions

-

Enforcement of green building codes and standards

-

Technological advancements in thermal/heat storage and the unification of renewable energy

-

Byproducts or parallel benefits that can be obtained from the DC process, which include heating water or generating electricity from the excess heat generated, as DC plants can use innovative methods for waste heat recovery

Residential establishments constitute c.52.7% of DC usage and is estimated to witness a growth rate of over 8.5% through 2034.

If we look at the different technologies involved in the process, electric chiller is the leading one, with value estimated to reach USD9bn by 2034. Other technologies include free cooling and absorption cooling.

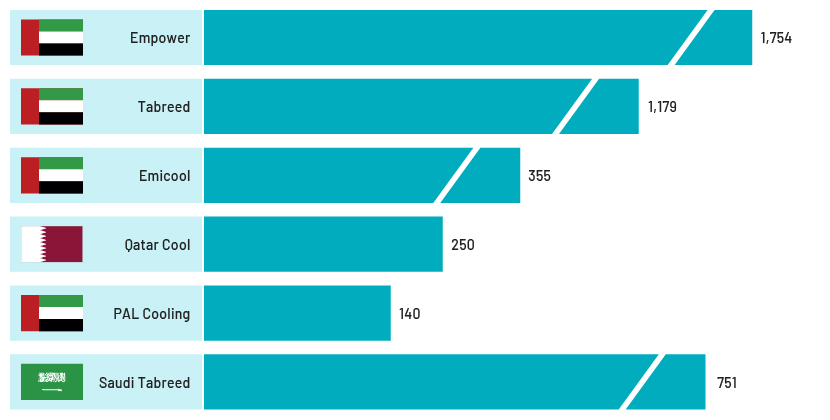

The Middle East district cooling industry is becoming increasingly competitive, with both established players and new entrants contending for market share in the region's swiftly transforming energy landscape. Some leading companies of the region are Tabreed, Empower, Qatar Cool, Marafeq Qatar, Emicool and Pal Cooling.

The industry has been bustling with market activity, with several mergers and acquisitions (M&As), initial public offerings (IPOs) and fund raising in the region. The most recent one is the c.USD1bn sale of PAL Cooling Holding, in which names such as KKR, I Squared, CVC, TAQA and Ivestcorp are interested in, reportedly. The IPO of the world’s largest DC services provider Empower, which raised USD724m in November 2022 was one of the largest in the region. Tabreed is also reportedly planning a potential IPO of its subsidiary, Saudi Tabreed, in Riyadh. Other than this, Tabreed also raised USD700m through an inaugural, five-year green Sukuk, which will list and trade on the London Stock Exchange’s International Securities Market.

Empower’s Business Bay DC project in Dubai achieved the Guinness World Record for the highest capacity DC plant [241,272 refrigeration tons (RT)] in October 2024. Including 9 DC plants, the project is has an unrivalled capacity of 451,540 RT.

In 2020, the company launched a pilot for the first-ever remote-controlled cooling plant (capacity: 49,000 RT) in Jumeirah Village Circle, using an advanced supervisory control and data acquisition system and artificial intelligence. Not only did it highlight Empower but also put the UAE on the forefront of the industry in the region. The second plant was announced in August 2024, with a capacity of 37,000 RT.

Saudi Arabia has also set a target of achieving 3m RT in DC capacity by 2030-2033.

According to Qatar General Electricity and Water Corporation, the regulator of DC system in the country, DC plants are expected to share 24.0% of the total cooling capacity in Qatar by 2030. Currently, the DC capacity of the country has reached 1.2m RT, accounting for 19% of the total cooling capacity of the country. In July 2024, Siemens installed its cooling system at Hamad International Airport in Doha, Qatar.

Bahrain and Kuwait are also witnessing a surge in district cooling projects, further highlighting the ever-increasing popularity and acknowledgement of this efficient cooling solution across the region.

DC is a budding source of long-term, energy friendly cooling for the increasing air conditioning demand in the Middle East while also meeting the region’s progressing cooling requirements due to the soaring temperatures. Lesser energy usage, environmental friendliness and low costs are major benefits of DC networks. Due to the many benefits of DC, the regional governments are capturing the opportunity with favourable policies. This, in addition to other factors like the increase in population and advancement in technologies, will fuel the growth of the industry in the future.

How Acuity Knowledge Partners Can Help

We enable our clients to take first-mover advantage of the market opportunities available, owing to our expertise in critical capital markets and transaction advisory-related tasks across deal origination, pitching and execution. With myriad teams covering various sub-sectors in energy, we have a plethora of experience in clean energy, infrastructure and other related domains. We support clients as an extension of their teams, offering timely and accurate insights, valuations and due diligence. Our high-level screening and analysis help locate ‘below-the-radar’ investment targets with attractive growth or value dynamics. We dive deep into areas of interest and conduct preliminary operational and commercial due diligence analysis to enable clients to better evaluate the investment/acquisition under consideration.

Sources:

-

https://www.tomorrow.city/dubais-innovative-district-cooling-how-block-airconditioning-works/

-

https://www.psmarketresearch.com/market-analysis/saudi-arabia-district-cooling-market

-

https://www.fortunebusinessinsights.com/industry-reports/district-cooling-market-100090.

-

https://www.sciencedirect.com/science/article/abs/pii/S2352710223017023

-

https://www.gminsights.com/industry-analysis/middle-east-district-cooling-market#

-

https://www.araner.com/blog/advantages-district-cooling-comparison-conventional-cooling

Tags:

What's your view?

About the Author

Shubhangi Shukla has over five years of experience in the investment banking domain. She has exposure to various banking work products, including company research, industry research and valuation. In the M&A team, she provides valuable insights through multiple industries. Shubhangi holds an MBA with a major in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox