Published on February 15, 2022 by Tong ZHOU

In recent years, the Chinese long-video market has demonstrated strong potential. However, the sector faces few challenges, which are possible to overcome.

-

Chinese long-video market

Long video refers to high-quality 30-minute (or longer) online entertainment shows, TV series or documentaries with a long production cycle. Long-video platforms usually have two revenue streams: advertising sponsorship fee and membership fee. Advertisers pay a sponsorship fee to advertise their products, and users pay a membership fee to the platforms to watch longer high-quality content without advertisement.

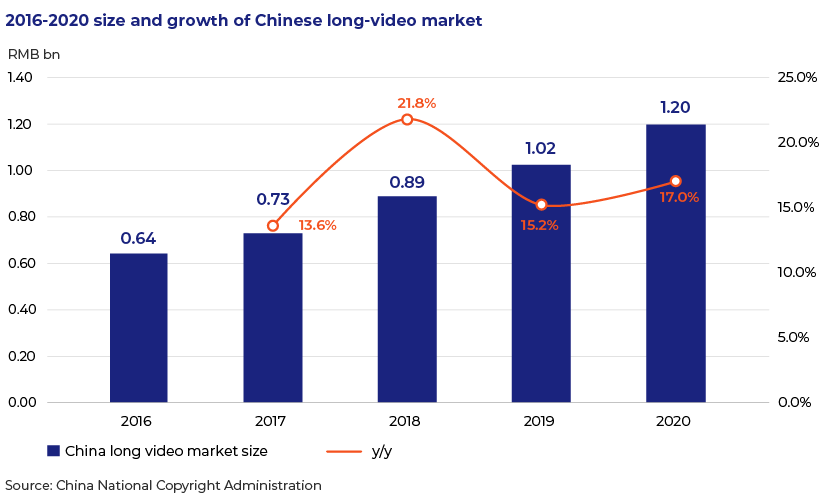

One of the downstream subsets of the digital entertainment industry, the Chinese online long-video market has been growing continually since 2016. In 2020, the market size was RMB119.72bn, growing 17% y/y. The 2016-2020 CAGR was 17%, underlining stable expansion despite the impact of short videos.

-

Prominent players

The Chinese long-video market boasts four key players: iQiyi, Tencent Video, Youku and Mango TV. iQiyi and Tencent Video rank in the first tier, while other two names rank in the second tier. Competition in the market is relatively stable.

-

Challenges confronting long-video players

-

Chinese users are not willing to pay membership fee as high as US users, translating into lower average revenue per user (ARPU) for iQiyi than Netflix’s.

-

Netflix has a higher proportion of self-made content, and the US market has a better production environment.

-

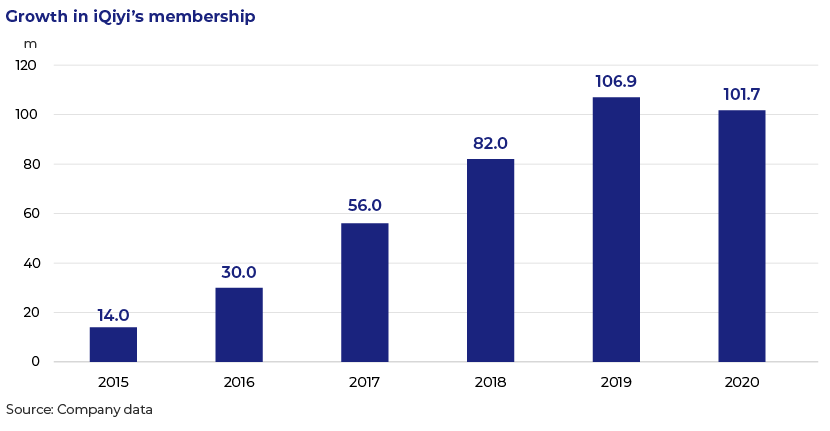

Long-video platforms suffer from the lack of stickiness among Chinese users, who often pay a short-term membership fee. In 1Q21, owing to the popularity of ‘My Heroic Husband’, iQiyi’s membership fee revenue increased 12.4% QoQ. However in 2Q, given the lack of popular programmes, revenue decreased 7.2% QoQ.

-

iQiyi, Youku and Tencent rely heavily on the financial support of their shareholders Baidu, Alibaba and Tencent Holdings, respectively, which infuse significant capital for content production capex every year in order to remain competitive. As a result, all the companies invested much more capital than they should, which led to excessive competition in the whole market.

High production cost of self-made content

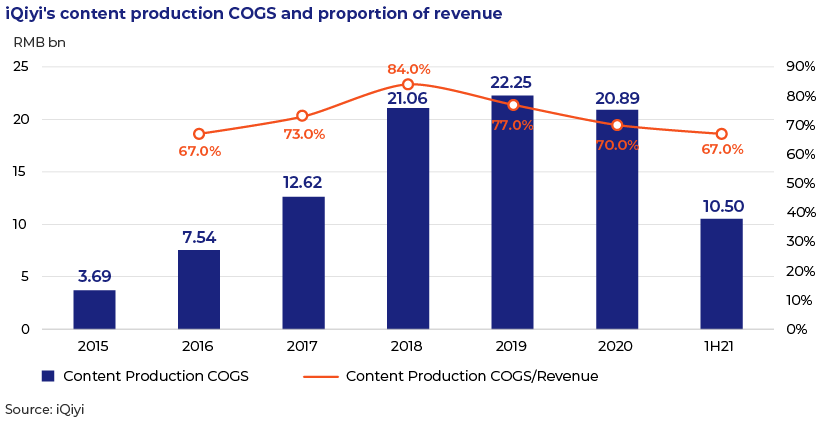

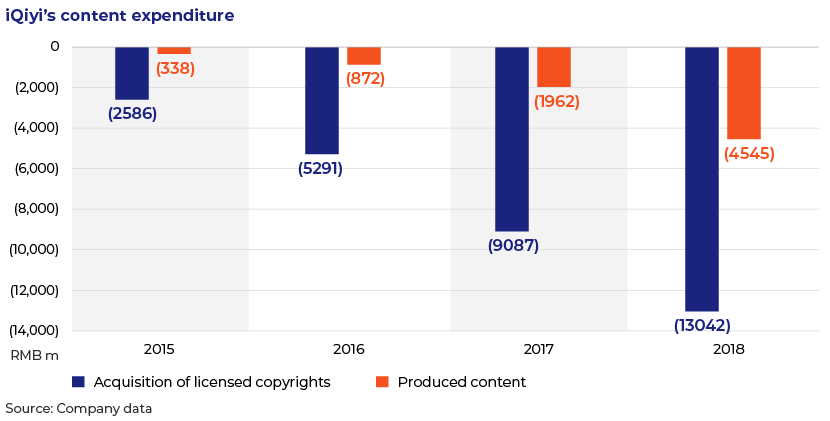

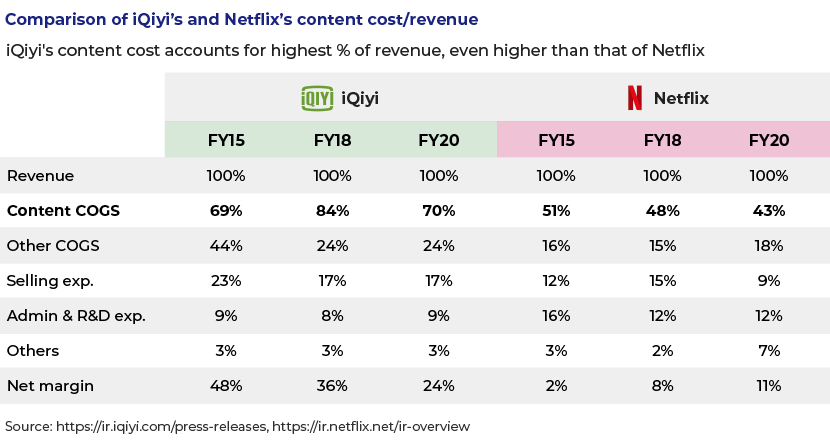

For iQiyi, Youku and Tencent, the road towards becoming the next ‘Chinese Netflix’ is filled with speed breakers given the high production cost of self-made content. Between 2010 and 2019, Netflix raised its financing from $50m to $4.5bn in order to produce high-quality content, resulting in an average debt/asset ratio of more than 70% and negative free cash flow until 2020. In China, iQiyi’s net profit between 2015 and 2020 was -RMB4.92bn, -RMB7.95bn, RMB0.97bn, -RMB9.41bn, -RMB10.33bn and -RMB7.05bn, respectively. The board remarked the continually expanding cost of goods sold (COGS), especially content production cost, had hurt the company’s earnings.

Netflix’s content cost accounts for a lower proportion of revenue than iQiyi’s, as:

Besides high production costs, two other factors add to the woes of Chinese long-video players:

-

-

Competition from short-video players

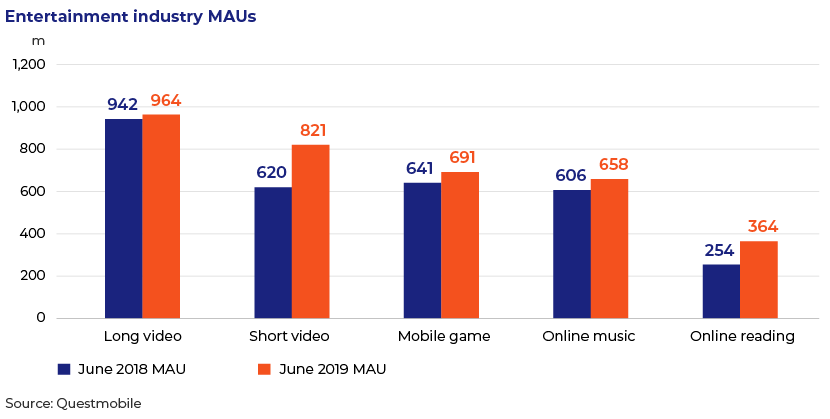

The real competitors of long-video platforms are short-video platforms such as TikTok. Since 2019, long video (11% share) has been overtaken by short video (15%) in terms of daily average online time. In June 2019, short-video monthly active users (MAUs) went up 32.4% y/y to 821m. The explosive growth of short video has eroded long-video MAUs.

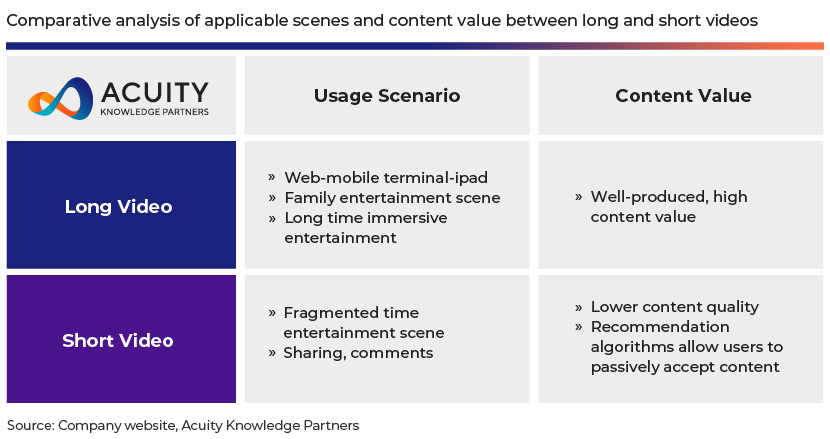

In fact, there are essential divergences between the business models of long- and short-video players. Long-video players earn through membership fee so they continually enhance membership scale to raise ARPU. Short-video players spend relatively less on attracting mainstream media, livestream providers and key opinion leaders (KOLs) in the early stage. Later, cash flows through audiences’ rewards, among others.

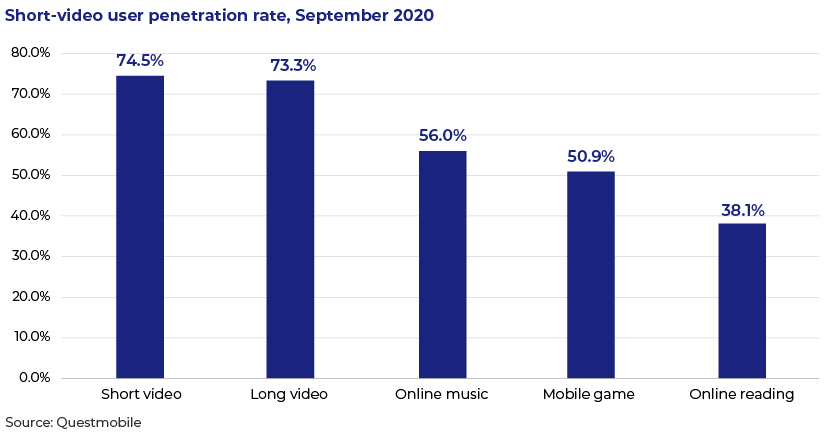

In September 2020, the penetration rate of the short-video industry was 74.5%. The number of paid users (PUs) and MAU of short videos are forecast to continue to grow in the future, but this is less likely to squeeze the margins of long-video names, as these two types of players may prove to be complementary to each other.

Steps taken by players to overcome challenges

iQiyi, Youku and Tencent have been improving their free cash flow by paring COGS and increasing revenue by:

-

Obtaining advance from customers for enabling early access to programmes. In August 2019, Tencent launched ‘The Untamed’ – a 24-hour-early-access function. More than 2.5m people paid for this facility, bringing RMB75m in advances.

-

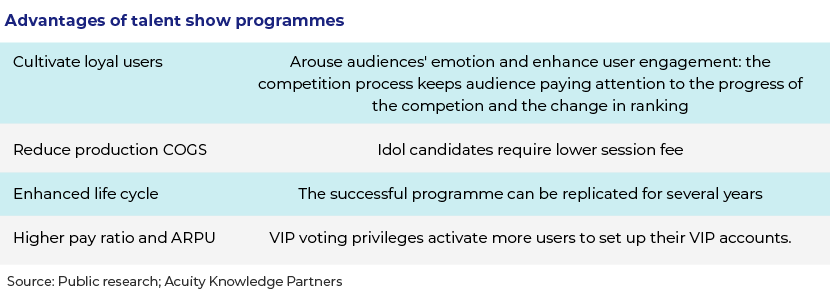

Producing talent shows. The table below provides four reasons long-video players enjoy producing talent shows.

-

Introducing a salary cap for actors. Top stars’ salary accounted for most of the content production cost before the launch of the salary cap policy at end-2018, which stipulated that all actors’ salary should be less than 40% of production cost and leading actors’ salary should be less than 70% of all actors’ cumulative salaries.

Strategies adopted to succeed in long-video market

-

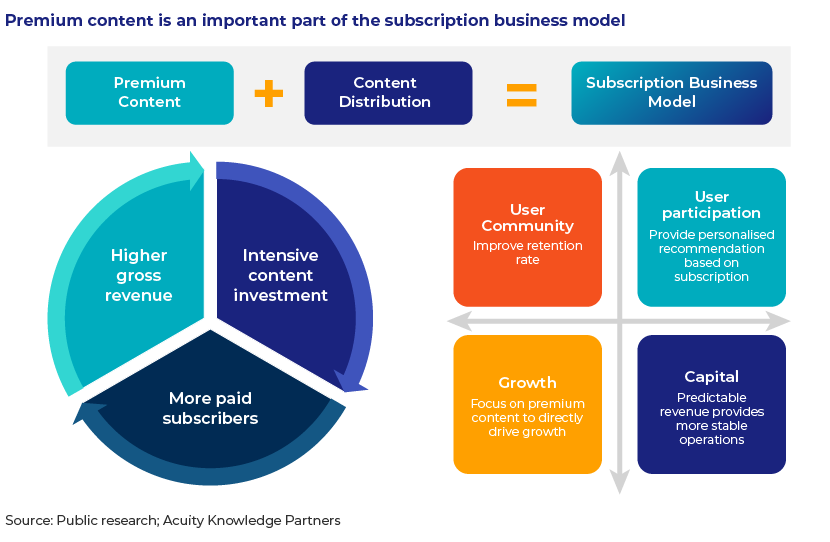

Premium content production

Long-video players should make content themselves.

Although the purchase of external copyright content is paramount, long-video players should give topmost priority to the quality of their own content. Producing premium and exclusive content is the best way to increase PUs, while the continued growth of PUs will likely directly drive revenue growth.

-

Content distribution

is the recommendation of different content to users who may like it. In 2006, Netflix offered $1m to global experts to develop personalised recommendation algorithm for its website. iQiyi, Youku and Tencent have currently adopted a myopic distribution model, directing all its traffic to their best programmes, which may weaken user experience. They should take a cue from Netflix and TikTok and recommend content to more users based on their preference. -

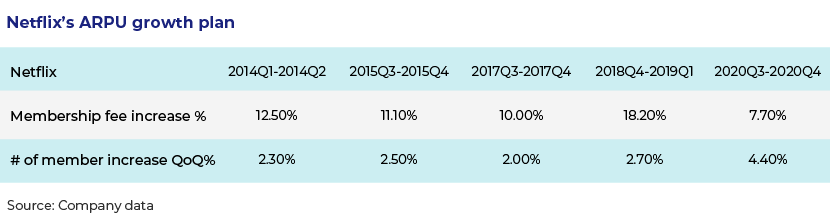

Timely and appropriate increase in membership fee to improve ARPU

The continued launch of premium content by platforms is key to raising membership fee. Referring to Netflix’s ARPU growth plan, it has been found that following each price increase, the membership base grew larger given the guarantee of excellent product quality.

-

Strategic reliance on overseas market .

According to Yahoo Finance, Netflix generally pays c.130% of the production cost to content studios to buy out the copyright of a programme. The cash flow is one-off, and Neflix does not share subsequent benefits, if any. However, Chinese TV stations usually pay content producers 60-70% of the production cost in advance and share the revenue if a programme becomes popular. In contrast to TV stations, the downside of the Neflix model is that the user base must be large enough. Following Netflix, if Chinese players cannot improve the quality of their content in the short term, they will have to continue to increase the number of overseas users.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has expertise in the Chinese digital entertainment sector. We provide end-to-end support to funds on investments in China’s TMT market, including performing in-depth TMT industry research, evaluating pre-investment opportunities and formulating post-investment value-added strategies.

Sources

National copyright Administration

What's your view?

About the Author

Tong ZHOU has 2 years of experience in private equity investment analysis with a focus on China market. In his current role at Acuity Knowledge Partners, Tong supports both pre-investment research and post-investment management for a large Asia private equity fund, covering a wide spectrum of industries such as TMT. Tong holds a master degree in Economics, Accounting and Finance from University of Bristol.

Like the way we think?

Next time we post something new, we'll send it to your inbox