Published on July 2, 2018 by Nuha Hameed

Among the many disruptive forces changing the way banks operate, the EU’s Revised Payment Services Directive, PSD2, takes the lead. The directive – effective January 13, 2018 – threatens banks’ position in the payments industry like never before.

Its primary disruptive factor is Access to Accounts (A2A) and, thereby, the facilitating of open banking.

Open banking:

This is a collaborative model in which banking data is shared through use of application programming interfaces (APIs) between unaffiliated parties or third-party payment service providers (TPPs), including fintechs and technology companies that currently provide consumers with an alternative way of making payments.

In facilitating open banking under PSD2, banks grant TPPs access to a customer’s accounts and data in a regulated and secure way through the use of APIs, provided the account holder has granted their consent.

PSD2 thus creates two entirely new regulated services to be offered:

Payment Initiation Service Providers (PISPs) – Third parties initiate the online payment transaction directly from the payer’s bank account to the recipient beneficiary via an online portal.

Account Information Service Providers (AISPs) – Third parties extract data from a customer’s bank accounts, including transaction history, allowing the AISP to consolidate data from different banks and provide a customer with a holistic picture of their finances in one portal.

To leverage PSD2 to their benefit, incumbent banks need to think fast to chart a strategy that would exploit opportunities amid the disruption and threats.

Threats to banks from PSD2

Increased competition from A2A

PSD2 enables TPP organizations to compete in parallel with incumbent banks as PISPs, threatening banks’ positions in the market through the provision of low-cost, more innovative and differentiated offerings tailored to consumer needs.

Loss of fees from card-based transactions

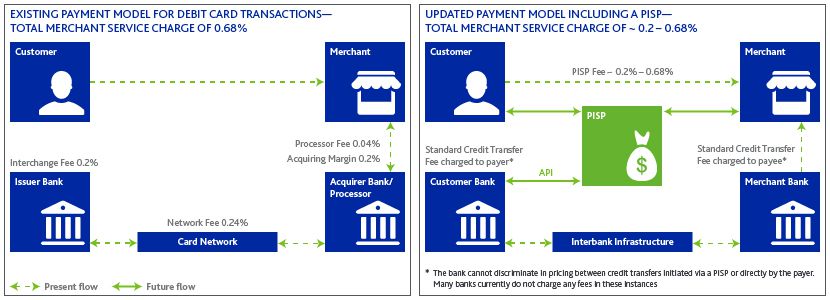

As the following model of UK card payments indicates, the inclusion of PISPs reduces banks’ role in the process.

The acquirer bank’s role is completely dissolved under the PISP inclusion, resulting in a loss of significant fees from card transactions to banks. The impact, however, is entirely dependent on the uptake of PISPs by merchants.

Nevertheless, since a PISP simplifies the payments value chain to include only itself as the intermediary, it is possible that services may be offered at a significant discount to existing rates (0.20-0.68% in the UK), increasing the likelihood of its wide uptake by merchants.

Loss of customer insight

Under PSD2, TPPs can leverage the existing technology and digital infrastructure and provide an aggregated service as both PISPs and AISPs through an extended API integration. Customers can use a single platform to access multiple standalone financial products – ranging from payments to advisory – integrated with their existing accounts and transaction data taken directly from banks.

This would significantly reduce a bank’s interaction with its account holders, thereby restricting its ability to cross-sell products and limiting access to customer insights and data – a key advantage banks hold over other financial institutions.

Solution: Go digital to remain competitive

Banks could embrace complete digitalization to address threats posed head on and harness PSD2 as the catalyst for the transformation of its organization into a digital one.

It could build mutual partnerships with TPPs, integrating core bank offerings with TPP capabilities to build a single digital platform that is central to a customer’s everyday use.

The provision of this platform would manifest itself via:

Service consolidation – Third-party owned products/services are offered on the bank’s online platform

Data consolidation – Customer data stored on third-party systems are presented on the bank’s online system

Banks can create an ecosystem among itself, partners, merchants, and consumers by consolidating data and services and by using open APIs. Data stored through this ecosystem can be used to benefit each party with the bank utilizing the valuable insights gained and holistically meet the needs of consumers and merchants via tailored products and services.

Conclusion

Despite the threat it poses, PSD2 forces banks in Europe to take a proactive step in establishing themselves in a digitizing industry to meet the needs of technology-driven, dynamic customers.

Acuity Knowledge Partners enables banks to innovate and transform to remain competitive in today’s dynamic market. View our solutions for commercial banks and how our credit analysts and our proprietary automation platform BEAT (Business Excellence and Automation Tools) enable global banks such as yours to centralize, standardize, and optimize banking processes.

Sources:

PSD2: Taking advantage of open-banking disruption by McKinsey & Co

Catalyst or Threat? The strategic implications of PSD2 for Europe's banks by PWC

What's your view?

About the Author

Nuha Hameed is an Associate in the Commercial Lending business at Acuity Knowledge Partners. She is experienced in earning updates, monitoring covenants, and performing risk raters. Nuha is a Passed Finalist from the Chartered Institute of Management (UK) and is a CFA (USA) Level 1 Candidate.

Like the way we think?

Next time we post something new, we'll send it to your inbox