Published on July 19, 2021 by Nishanth Neeli

What comes first to your mind when you hear the term alternative assets? Rich investors, high returns, risky business, less liquidity? It does involve all these aspects. Alternatives encompass anything that is not a traditional form of asset class, including private equity, hedge funds, venture capital, infrastructure and natural resources. New additions to this list are wine funds, fine art funds and film funds.

As per Chartered Alternative Investment Analyst (CAIA) Association, between 2013 and 2018, investments in global assets doubled and those in alternative assets tripled, which means 12% of global assets are invested in alternatives. This percentage is expected to surge upto 18-24% by 2023.

Alternatives, like baccarat (a popular game played in casinos), have earned the reputation of being an asset class for high-rollers. With online casinos gaining popularity, players with modest budgets are also able to play the game. Likewise, with growing financial literacy, retail investors understand the risks and lock-up periods involved and yet are actively looking to invest in them. But in reality, alternatives are mostly barricaded for accredited investors only, which acts as a barrier to entry for retail investors. Tokenisation is one such product innovation, which would lower this barricade.

Tokenisation is a process of creating a digital representation of a non-digital asset, meaning the digitalisation of an asset. The underlying assets could include stocks, bonds, private equity, hedge funds, infrastructure and natural resources. The use of blockchain technology as a distributed ledger opens up many opportunities to create, record and transfer of assets. Broadly tokens can be classified into three categories:

-

Security tokens – symbolise ownership or interest in an underlying asset

-

Utility tokens – provide access to specific rights and privileges to token holders

-

Exchange tokens – can be used as a mode of payment

Additionally tokens are also classified as fungible tokens and non-fungible tokens (NFTs). Fungible tokens can be switched, traded or substituted like exchange tokens. NFTs are not interchangeable and each one is valued uniquely, which represent a fractional ownership in single piece of art, paintings, sculptures, photographs or collectible items. We will be concentrating on fungible tokens in this blog.

Tokenisation of alternative investments

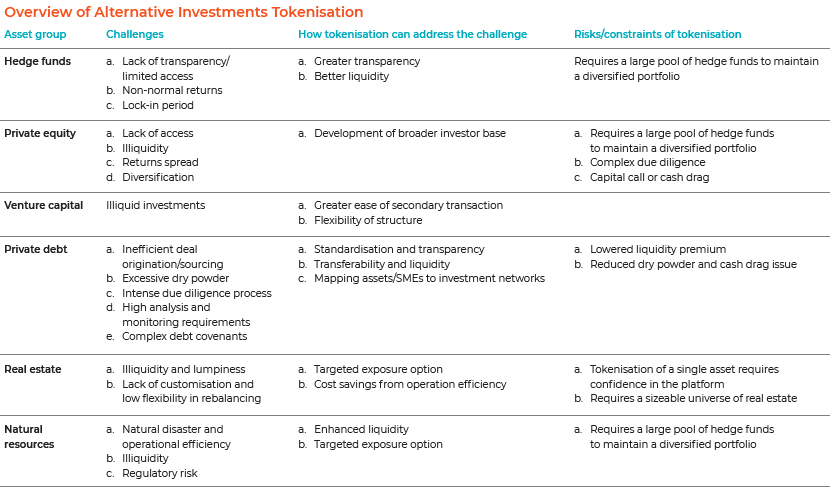

Tokenisation is the ability to democratise an alternative asset, i.e. make it more accessible to a wide range of investors, addressing the challenges like barriers of entry by providing greater transparency, more inclusive access, faster/cheaper transactions and better liquidity. REIT is a good example of what tokenisation can do to the world of alternatives. With REITs, investors own a fractional ownership in commercial real estate. In the real world, they could buy and sell these tokens whenever they wish to increase or decrease their exposure to a particular property or asset. Having said that, it has its own set of risks associated with it. The chart below lists down risks/constraints associated with individual assets within alternatives.

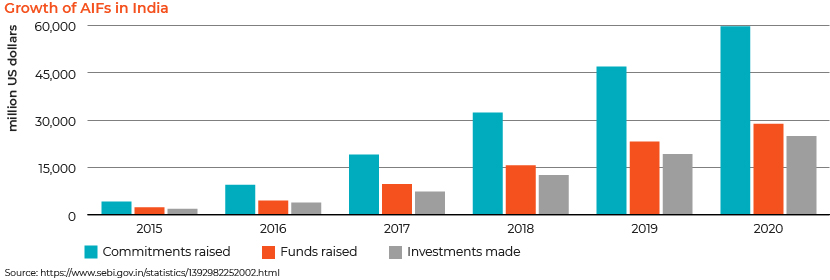

Preqin (a leading financial-data provider on the alternative asset market) estimates alternative assets’ AuM to grow at a rate of 9.8% through 2025. The growth is expected to be higher in Asia-Pacific. In India, where SEBI’s concept paper on AIFs was approved in May 2012, the total commitment raised as on 31 March 2021 was almost USD 59.7 billion. It took the mutual fund business nearly 20 years to raise this capital, which alternatives raised in less than 10 years. According to BCG (Boston Consulting Group), the total revenue from alternative investments accounts for almost half the total generated by the global asset management industry, while the percentage of alternatives as compared to traditional asset classes is only 16%. Hence, asset managers are keen to expand their product mix and capabilities, paving the way for increased technological development and adoption of digitalisation including blockchain. Given the increasing disposable income and risk appetite, and bond interest rate at an all-time low, alternatives could be exactly what retail investors are looking for.

Process of tokenisation

1.Tokenisation

a. Deal structuring – This is the most important part, where decision makers have to consider key aspects such as business objectives, share class, valuation and pricing, fee structure, capital commitment, regulations and taxes.

b. Digitalisation – Upon the completion of deal structuring, the underlying asset can be tokenised. The asset can be fractionalised into as many tokens as possible. Blockchain technology is used as a distributed ledger, and tokens are then sold or issued to investors.

2. Primary distribution – As with any investment, KYC and suitability checks are mandatory before accepting investors. Blockchain holds all the relevant information of investors on a digital record of members (ROM) and via distributing smart contracts.

3. Post-token management – Smart contracts could save a significant amount of time by managing real-time alerts including the distribution of dividends/interest, communication, and initiation / completion of voting activities

4. Secondary market trading – With an evolving global regulatory framework, asset tokenisation is expected to be received well in secondary markets.

Benefits of tokenisation

-

Open access via fractionalisation – An asset can be divided into any number of smaller portions, lowering the bar for retail investors

-

Shorter settlement time – Enables 24/7 trading facility and real-time settlement unlike T+2 or T+3 settlements

-

Flexibility – An asset can be twisted and turned into infinite share classes

-

Data transparency – Data can be stored on blockchain

-

Creation of transformational value via operational efficiency – Drag-along actions, such as corporate actions, can be automated

-

Increased liquidity – Tokens could be easily traded in the secondary market, improving the overall liquidity

In addition, there are no geographical barriers, no middlemen and rapid hassle-free transactions.

Recent updates

While this might appear futuristic and will require time to implement, there are few ice barkers who have issued tokens, raised capital, and granted fractional ownership. Below are few of the latest happenings,

-

2 June 2021: Singapore DBS bank announced its first security token offering using blockchain. This offering of approximately USD15m of digital bonds are expected to be traded on the DBS Digital Exchange (DDEx), which uses blockchain technology.

-

USPX is a token, valued at one-tenth of a share, represents an interest in SpaceX. Token holders can trade this on the secondary market (i.e., exchange platforms) such as order book or Codex.one.

-

December 2020: ICHAM Unicorn Opportunity Fund raised USD20m through an initial offering of its digitised securities on iSTOX, a capital market platform. iSTOX is backed by the Singapore Exchange (SGX) and Heliconia Capital Management, a subsidiary of Temasek Holding.

-

RealT (a real estate company in Florida) provides fractional real estate investing. The real asset is distributed across a finite number of tokens. Based on token share, owners collect their revenue share from the total income generated by the asset. The minimum investment in this tokenised asset is USD50.71.

Conclusion

Tokenisation has immense potential for illiquid assets with high barriers to entry via fractional ownership. This is achieved by gaining access to the previously illiquid assets such as private equity, real estate, private debt and luxury collectibles. As an industry, tokenisation has evolved as one of the most eminent product innovation that brings change to the investor dynamics to the wealth and asset management world. It will likely continue to revamp the structure of alternatives through the digitalisation of real assets.

From an investor’s standpoint, tokenisation has opened up a lot of investment opportunities at lower costs, making their portfolios more diversified and risk-adjusted. However, it is not without challenges. Participants in this ecosystem will have their own set of questions, which need to be addressed. The overall acceptance and development of this financial innovation, along with governments’ formulation of relevant regulations around it will take time, but tokenisation will likely flourish.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a pioneer in investment services offering spanning across the globe. We understand our clients’ products and corresponding regulations associated with them. Our investment services include equity research, index analysis and Investment Operations and Risk Services. We also specialise in areas such as pre-trade and post-trade surveillance, interpretation and coding of client IMAs and reporting of regulatory restrictions, along with support functions including trade capturing and processing for private equity and hedge funds.

Sources

https://www.sebi.gov.in/statistics/1392982252002.html

https://beincrypto.com/learn/nfts-explainer/

Tags:

What's your view?

About the Author

Nishanth Neeli has over 7 years of experience in investment compliance with a prior working experience at Goldman Sachs. At Acuity Knowledge Partners he is responsible for process supervisory, coding and post trade management support of Investment Compliance Services. Nishanth has done his Masters in Actuarial Science from Bharatidasan University.

Like the way we think?

Next time we post something new, we'll send it to your inbox