Published on July 30, 2020 by Archana Kanojia

In the middle of difficulty lies opportunity – Albert Einstein

Overview of distressed private equity

The word “distressed” has a very negative connotation, implying something troubled or stressful. When we talk of distressed private equity (PE), however, the negative implication somehow diminishes, for a distressed PE firm invests in companies facing challenges (struggling operationally or financially bankrupt). The distressed PE firm works through the company, refurbishes its operations and exits the investment once its operations or financial position is restored. Although there is volatility around “fixed or stable returns”, distressed PE firms help “distressed” companies “de-stress” by restoring balance.

Growth of the market

The concept of distressed PE arose during the 1980s, when funds investing in companies in financial distress contributed to the PE marketplace. The distressed PE market has grown over the years to now play a vital part in the PE space.

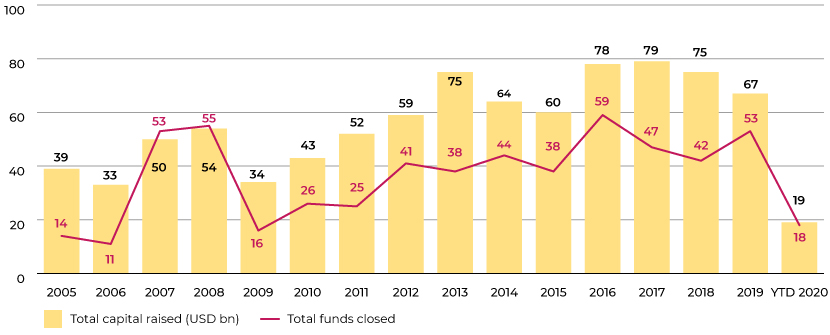

The following chart depicts growth of the distressed private capital market over the past 15 years:

Source: www.preqin.com

Distressed private capital increased to USD67bn in 2019 from USD39bn in 2005. As depicted in the chart above, the financial crisis in 2007 saw distressed private capital register a 52% increase in capital raised, to USD50bn in 2007 from USD33bn in 2006, while total funds raised increased by 382% to over 50 funds in 2007 from 11 in 2006. The private distressed market has, therefore, seen an increase in investor confidence since the financial crisis of 2007-08 (as the chart shows), with capital raised increasing consistently.

Risk propensity among limited partners

Distressed PE firms’ mantra of “buy low, sell high” attracts the interest of limited partners (LPs), as it offers good investment opportunities along with risk-adjusted returns. However, as distressed PE firms invest in troubled companies, returns have a risk factor attached, calling for healthy risk appetite on the part of investors (usually institutional investors such as banks and pension funds).

The confidence of LPs (mostly institutional investors) in the distressed PE market has increased since the financial crisis of 2007-08. PE firms have raised USD44.7bn as the markets have presented investment opportunities to distressed PE firms. According to experts, there has been increased interest from high-net-worth individuals (HNWIs) and institutional investors in distressed PE firms amid the current crisis as well. In March 2020, institutional investors were found reaching out to Probitas Partners (a US-based placement agent that raises capital for PE firms), looking for distressed/opportunistic funds, rather than the other way around, as reported by Probitas Partners.

Why now?

Unlike PE firms, distressed PE firms are inversely correlated to the market. PE blooms when markets are in a bull phase; likewise, distressed PE blooms when markets are in a bear phase. This countercyclical nature of distressed PE made it attractive during the global recession of 2008. Similarly, the COVID-19 crisis that has adversely impacted global economies calls for action by distressed PE firms to de-stress the market in these challenging times. The crisis has also impacted the PE space (as discussed in our blog https://acuitykp.com/blog/understanding-the-impact-of-covid-19-on-private-equity-activities/). We believe distressed PE firms can help companies navigate the choppy waters.

Deal flow has been affected by the current market conditions:

-

A recent survey indicated that 25% of the respondents (PE firms) have suspended making new investments until the market stabilises, as they have been adversely affected by the crisis.

With companies struggling amid the pandemic, discounted purchase opportunities will likely be available for distressed PE firms.

-

In a recent earnings call, Apollo Global Management announced switching the strategy of its USD24.7bn fund from traditional PE to distressed strategy.

A snapshot of the findings of a survey conducted by Intertrust:

-

92% of the respondents expect an increase in distressed fund transactions over the next 12 months

-

83% feel distressed funds will witness increased fundraising activity over the next 12 months

-

Another 41% feel PE managers will allocate available capital to distressed funding

As mentioned earlier, distressed PE works in inverse tandem with the market, as opposed to PE that is directly correlated to the market. During the financial crisis of 2008, distressed PE funds reported a median net IRR of 16.2%, compared to growth (9.1%), buyout (6.6%) and venture (1.9%) funds. These figures reiterate the fact that when market conditions are uncertain and volatile, distressed PE performs.

The distressed private capital market holds dry powder of USD131bn (as of June 2020), according to data released by Preqin. Many PE firms believe the COVID-19 pandemic will call for increased investment by distressed PE firms, as a number of industries and sectors have been affected adversely.

How Acuity Knowledge Partners can help

Our service offering to PE clients (and to PE firms managing distressed strategies) includes collateral management support, presentation updates, secondary research, newsletters, ad hoc work (as per client requirements) and RFP writing support. Our teams work as an extension of our client teams.

To help our clients navigate both the people and business impact of the crisis, we have created dedicated hub of topics, including our latest insights, thought-leadership content and action-oriented guides and best practices.

Sources

https://www.mondaq.com/Article/950312

Tags:

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox