Published on July 10, 2023 by Hengrui Zhang

Introduction

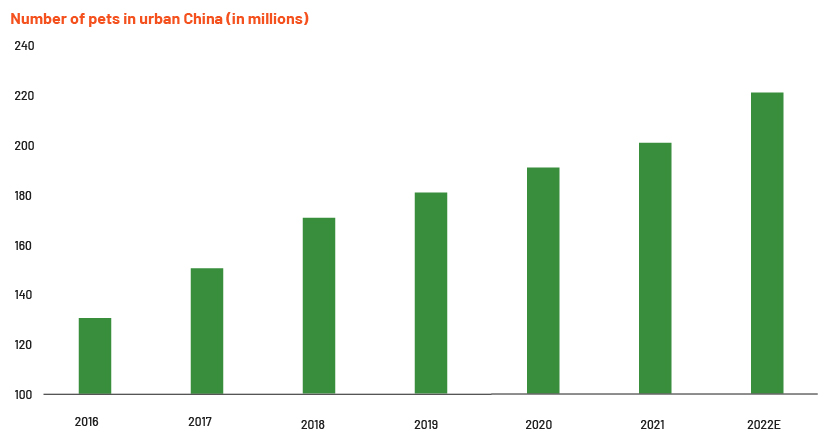

There are as many as 51m pet dogs and 65m pet cats in urban China. If distributed evenly across China’s urban population, this means about one in eight Chinese people owns either a dog or a cat.

Source: China: Pet population 2022 | Statista

The number of pets in China has exploded over the past decade, primarily due to rising living standards and a fundamental shift in how people view pets. Previously, pets were owned for economic reasons –dogs to enhance security and cats to keep away rodents. Today, most pet owners under the age of 40 own pets to satisfy emotional needs, such as the need for companionship.

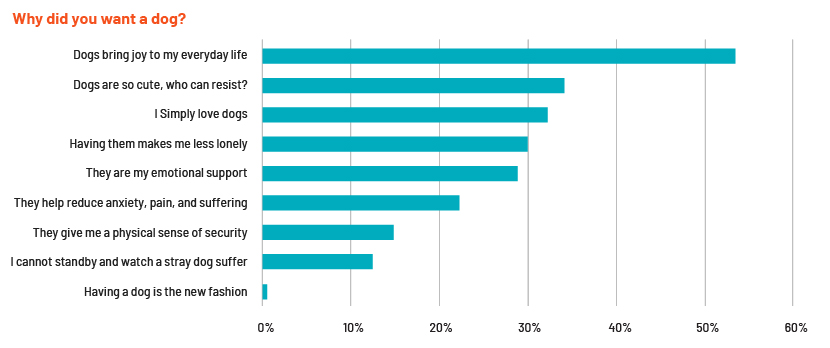

Over 53% of the 3,650 participants in a survey on dog ownership experiences conducted by Ifeng.com (a leading Chinese online media platform) said their primary motive for getting a dog was to enjoy a special kind of joy in their mundane lives. Over 33% said they simply could not resist how cute the dog looked, and more than 29% cited the need for companionship as the main reason. A mere 14% said it was to increase physical security.

Source: https://culture.ifeng.com/c/84q50RICO5C

The rapid increase in pet spending is fuelled by a new generation of Chinese pet owners who demand higher-quality products and diversified services

With rising living standards and the ever-deepening bond between pets and their owners, it is unsurprising that pet-related spending has grown considerably over the past decade. The average dog owner spends RMB4,000-6,000 annually in a normal year where there are no major medical expenses (the cost would, of course, differ significantly for the different breeds). With a health incident that requires major surgery or therapy, the annual expense could easily exceed RMB10,000. With cats, annual expenses are slightly lower, RMB2,500-5,000 (again, excluding non-recurring large medical expenses). Compare these figures to what they would have been 10 years ago: an average dog cost its owner about RMB2,600 annually and an average cat about RMB1,800, indicating a nominal CAGR in spending of 6-8% (and a real CAGR of 3-5%).

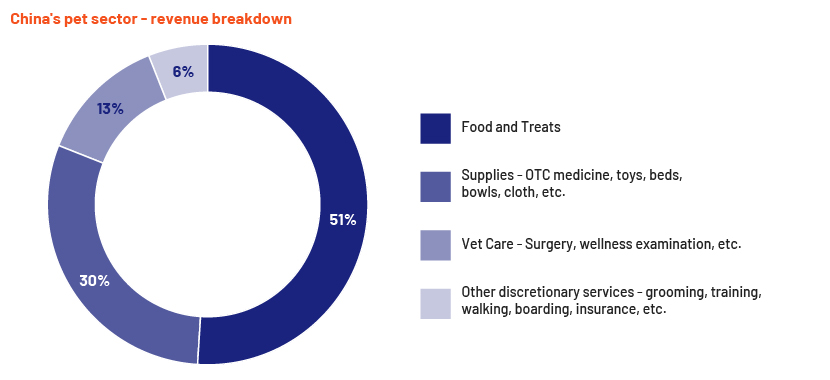

Whether one owns a dog or a cat, and excluding the one-time cost of ownership transfer, spending generally falls under four big categories:

Source: https://baijiahao.baidu.com/s?id=1746176516202149508&wfr=spider&for=pc

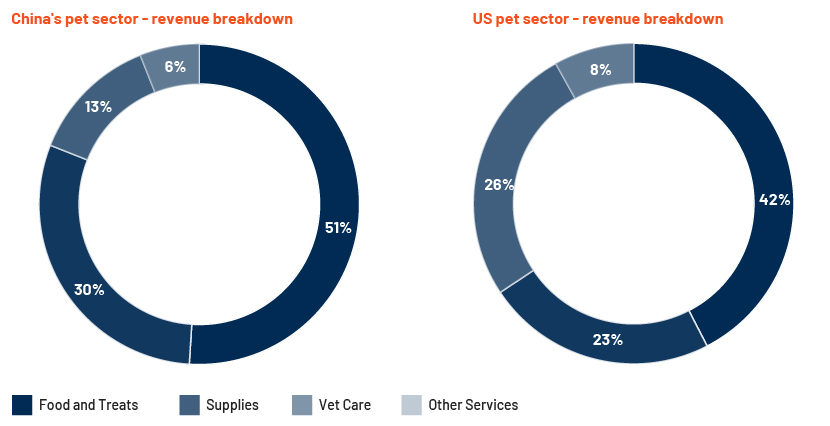

Chinese pet owners spend less on vet care and discretionary expenses than American pet owners but more on foods and supplies:

Source: https://baijiahao.baidu.com/s?id=1746176516202149508&wfr=spider&for=pc

China’s pet sector emerged around the 1990s, 40 years after the US’s. In line with the evolution of the US pet sector, an increasing portion of China’s pet sector revenue is likely to be derived from vet care and discretionary services in the next decade or so.

China’s pet sector has a consumer staple element

According to the American Pet Products Association (APPA), 67% of households in the US own some kind of pet and 20% once owned a pet but no longer do. Only 13% of households never owned a pet. In the US, pets are not only very popular, but also very sticky. Most American pet-owning households had owned more than one lifecycle of pets as of 2022. First-time pet owners make up only a small fraction of total pet owners – pet ownership by household has been above 50% since the 1990s; it peaked at 68% in 2013 and has hovered around that level since. Anecdotal evidence suggests that after grieving for a pet for a relatively short period of time, most would welcome a new pet.

A highly stable and saturated pet market likely leads to high and recurring demand for pet food and supplies and vet care services, making these downstream subsectors relatively recession-proof, as people would still have to feed their dogs or cats and bring them to hospital amid economic hardship.

In contrast to the US market, many Chinese pet-owning households are first-time pet owners. We can reasonably expect the first big wave of pet death to occur in 5-10 years’ time. If we use US pet-ownership behaviour as a benchmark, it suggests that after this first wave of pet death, around 75% of current Chinese pet owners may get new pets (i.e., a projected pet-ownership retention rate of 75%). Adding to this a younger generation with higher pet acceptance rates, China’s pet sector has a bright and stable future.

Empirically, long-term pet sector growth is tied to growth in disposable income

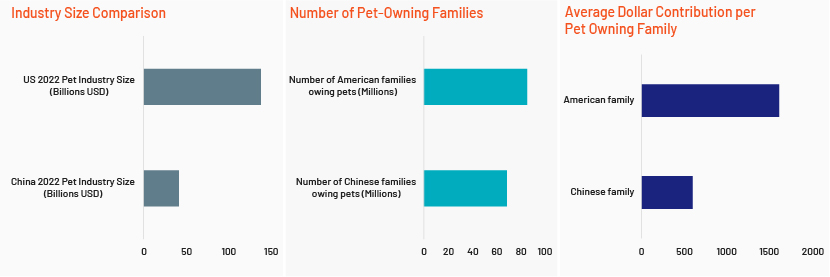

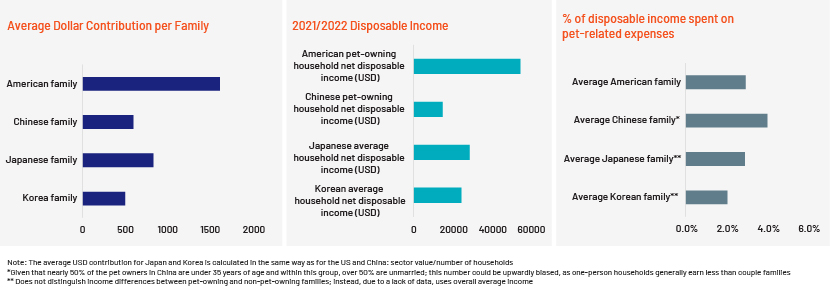

China’s pet sector was worth c.USD41bn as of 2022. Divided among the c.68m urban pet-owning families, this means each family contributed an average of USD599. The average US household contributed nearly 2.5x that amount in 2022 – a staggering USD1,611

Source: Pet Industry Market Size, Trends & Ownership Statistics (americanpetproducts.org); China: urban pet market size 2022 | Statista, Pet Ownership Statistics [2022]: U.S Pet Population (spots.com); China: number of dog and cat owners in urban households | Statista

The average USD contribution per family cannot be compared objectively due to differences in levels of disposable income. Adjusting for this difference, we find that the average American household spends about 3% of its total annual disposable on pet-related expenses and the average Chinese household spends about 4%.

Interestingly, pet owners around the globe seem to uniformly spend 2-5% of their disposable income on pet-related expenses. This is observed not only in the US and China, but in other Asian countries such as Japan and Korea as well.

Source: South Korea: pet industry market size 2017-2027 | Statista; 2023 Pet Ownership Statistics: 70 Fur Facts – Lemonade, South Korea: households owning a pet by pet type 2022 | Statista, Pet Ownership Statistics – Veterinarians.org, https://www.thepaper.cn/newsDetail_forward_13692308, OECD Better Life Index

As growth in new-pet ownership stabilises, growth in pet spending may be more directly related to growth in net disposable income.

Older pets may create a new set of opportunities for the pet sector, especially in the pet healthcare subsector

Healthcare services

The average age of a pet dog in China is 2.7 years and that of a pet cat is 2.2 years, according to a survey conducted by IResearch in 2021. These average ages are towards the lower end of the age spectrum due to the spike in the new-pet population in the past five years. The average lifespan of a dog is 10-13 years and of a cat 13-17 years. As with humans, ageing impairs a dog’s or cat’s general state of health, making them vulnerable to a variety of diseases. Demand for pet healthcare services tends to increase in the later stages of a pet’s life. Treatment for problems such as arthritis and diabetes is more frequently required. The chance of getting a cancer increases. The tipping point for a dog is at around 6 years of age and for a cat at around 8. China’s first large dog and cat population is expected to reach these ages in 2026-30, leading to a surge in demand for healthcare services.

Pet hospitals

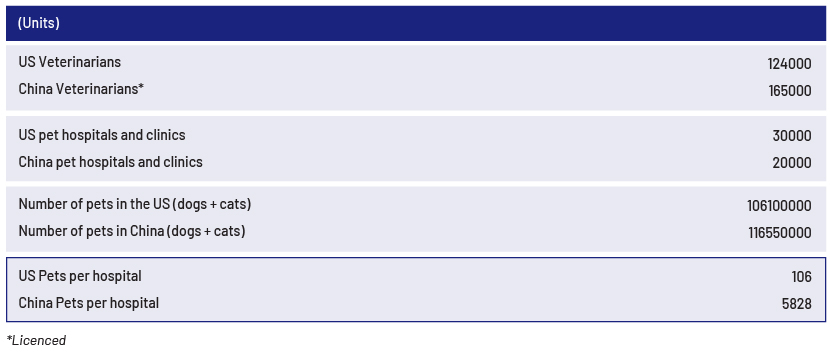

The number of pet hospitals in China was significantly lower than in the US as of 2022. Given China also has a slightly larger pet population, the pets/hospitals ratio in China is about 60% higher than in the US. This gap is likely to narrow as the number of pet hospitals in China continues to grow rapidly.

Source: U.S. veterinarians | American Veterinary Medical Association (avma.org), 29 Eye-Opening Veterinarian Stats (2023 UPDATE) | Petpedia, https://mp.weixin.qq.com/s, https://www.sohu.com/a/643933584_121615910

Veterinarians

A major challenge in China’s pet healthcare subsector is the scarcity of specialised veterinarians. Currently, the vast majority of veterinarians operating in China are pet generalists. Most perform a wide spectrum of tasks on many different pet types and breeds. In the US, about 10-15% of veterinarians specialise in one of the 41 American Veterinary Medical. Association (AMVA)-recognised speciality branches. An increase in demand for veterinary specialists may drive development of China’s specialised veterinary education sector.

China’s cat economy may outperform its dog economy for a number of reasons

Both the dog and cat economies are expected to outperform other sectors of the Chinese economy, but the cat economy may surpass the dog economy, as the Chinese prefer cats to dogs for the following reasons:

-

Cats need less investment in terms of time and energy. Cats are also more independent and less needy than dogs. Perhaps the biggest time investment with dogs is the mandated walking duty. Statistics show that over 65% of dog owners spend at least 30 minutes every day walking their dog. In today’s fast-paced world, fewer young people are able and willing to spend that much time.

-

Dogs need space to roam while cats do not. Space is limited in China’s larger cities. Larger dogs tend to need even more space than smaller dogs, and it is recommended that they be kept outdoors. Unlike in the US, the vast majority of urban Chinese live in apartments and do not have backyards.

-

Some major cities restrict the ownership of certain dog breeds over concern for public safety. Beijing, for example, prohibits as many as 40 different breeds of dogs.

Studies have shown the following:

-

Pet ownership can increase the mental wellbeing of older people by providing companionship and reducing loneliness(1)

-

Owning pets slows impairment of cognitive and physical abilities as we age(2)

-

Having a pet can provide critical emotional support during difficult times(3)

-

Pets can help alleviate post-traumatic stress disorder (PTSD)(4)

A growing number of industry counsellors and specialists in China advocate the benefits of pet ownership. This has had a positive impact on society’s view of owning pets, especially among older people.

-

In a longitudinal study of a group of people over the age of 50 (N = 378), researchers found that pet ownership was positively correlated with stronger mental functions including better verbal learning capabilities and better memory function. Dog ownership was also positively correlated with better physical conditions.

-

In a study of a group of participants who were either dog owners or prospective dog owners (N = 1,535), researchers found that during the pandemic, dog owners reported having significantly more social support relative to prospective dog owners. Dog owners also scored lower on the depression scale.

-

In a study of a group of primary-care patients over the age of 60 (N = 830), researchers found that pet owners were far less likely to report loneliness than all-else-equal non-pet owners.

-

In a study of a group affected by the 2011 Great East Japan Earthquake (N = 216), researchers found that pet owners scored lower on PTSD scores than non-pet owners.

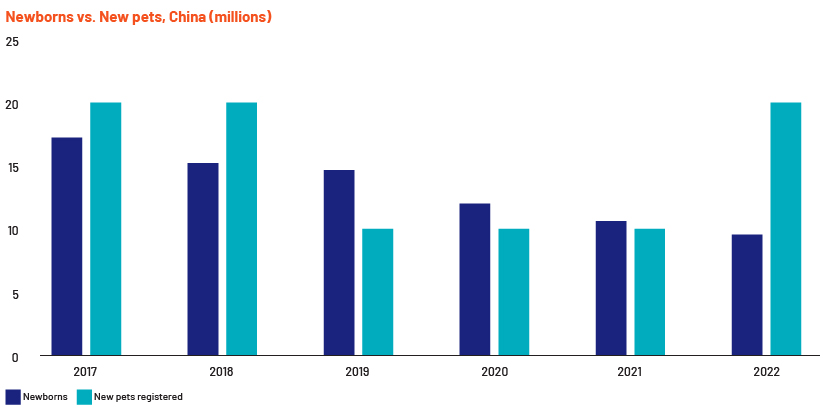

There are now twice as many new pets as newborns in China, and the increasing number of pets may be contributing directly to the decline in population growth rates

China currently faces a large population crisis. Marriage and fertility rates have been plummeting in recent years. 2022 saw rates hit an all-time low. Factors that explain this phenomenon are high housing prices, individualism, women opting for higher education and working full-time, and a worsening economy. One often-ignored factor is that attachment to pets may be reducing the desire to have children, especially among the middle class.

In a two-part cross-sectional study involving a total of 155 and 255 Chinese participants, respectively, researchers found that attachment to pets and fertility intention were negatively correlated for individuals with high subjective socioeconomic status (i.e., for those that earn more and are well educated, greater attachment to pets means they are less willing to have children). The study offered two key insights:

-

Attachment to pets and attachment to children are similar on a psychological level, making them imperfect substitutes. This phenomenon is universal and unaffected by subjective socioeconomic perception.

-

Individuals with higher subjective socioeconomic perception (i.e., those perceived to have higher income and education levels relative to society’s benchmark) tend to also emphasise greater self-focus and are better at resisting contextual constraints such as family and social expectations. Thus, they have more decision-making power to choose not to raise a child and instead own a pet. In contrast, individuals with lower subjective socioeconomic perception tend to lack this decision-making power and are more likely to conform to the social norm of parenthood.

Note: One caveat of the study is that fertility intention may not fully represent actual fertility behaviour; the study should be viewed only through the lens of how external forces shape an individual’s state of desire, making them prone to behave in a certain way, but not how observed factors may lead to a reliable deterministic outcome.

Supporting these findings, the younger generations in China are, on average, better educated and more independent. Empirically, many of them indeed view pets as surrogate children.

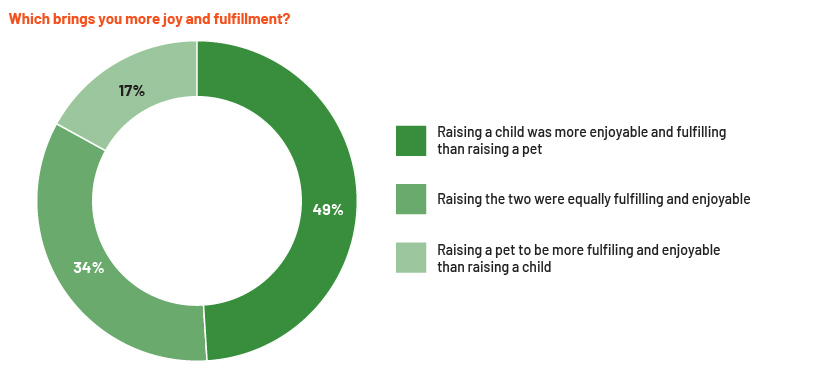

As a separate piece of evidence, in a 2006 survey conducted by China Youth Times, 18.5k participants (consisting mostly of young pet-lovers residing in urban areas) were asked about their thoughts on pets vs children. Three groups were identified:

-

Those who thought raising a child was more enjoyable and fulfilling than raising a pet

-

Those who thought both endeavours were equally fulfilling and enjoyable

-

Those who thought raising a pet was more fulfilling and enjoyable than raising a child

17% picked the third option, and 34% picked the second.

Source: http://news.sohu.com/20060819/n244884685.shtml

Regardless of subsequent behaviour (whether or not intentions matched actual decisions), the survey reveals a collective perception that saw the overall importance and necessity of having children diminish due to the existence of pets. To a certain degree, raising a pet is much like raising a child and sometimes more enjoyable. Pet owners reap the benefits of intimacy, connection and a sense of achievement, while avoiding some important costs of raising children such as higher investment and emotional stress. That is not to say that pets do not come with their own costs, such as a relative lack of intelligence and a much shorter lifespan.

More interestingly, the survey took a closer look at the third group and discovered that these were mostly young people working in white-collar professions where work was more stressful and demanded longer hours than was the case for the groups that answered otherwise. This may have important implications in today’s society, as work is becoming increasingly stressful and demanding for just about every Chinese person.

Are the young today even more likely to delay having children (perhaps indefinitely) and instead devote time and resources to raising a pet? No official poll has been conducted in recent years, but data shows that in 2022, the number of newborns was less than half the number of new pets.

Source: China: number of births 2022 | Statista; China: pet population 2022 | Statista

Conclusion:

Pet humanisation is an ongoing trend in China. The fundamental change in how Chinese society views pets is leading to a booming pet sector, currently worth more than USD40bn. This sector is still in its rapid growth phase, and certain pockets such as pet healthcare are especially lucrative and under-supplied. The pet sector is defined by its stability, recurring streams of income and recession-proof characteristics. By subsector, the cat economy is likely to outperform the dog economy because cats are easier to manage and more Chinese in general prefer cats to dogs. Counsellors and specialists recommend owning pets, as research shows a myriad of mental wellness benefits related to pet ownership. The younger generations favour raising pets over raising children; this may be one reason for China’s population growth rate continuing to decline.

How Acuity Knowledge Partners can help

We set up dedicated teams of analysts and associates to support comprehensive coverage of a wide spectrum of booming industries presenting opportunities across sectors and geographies. Our research teams provide critical value-adding services to help clients discover areas of investment opportunity and post-investment management strategies, including industry profiling, financial analysis, thematic research and database construction.

Sources:

-

正式发布!2022年中国宠物行业系列白皮书发布会在京圆满举行 - 活动专题 - 中国畜牧业协会宠物产业分会 (caaa.cn)

-

FEATURE: Pet ownership in Japan on the rise amid COVID-19 pandemic (kyodonews.net)

-

农业农村部国家首席兽医师李金祥:我国官方兽医13.6万人,执业兽医16.5万人,乡村兽医17.7万人,执业兽医缺口30万人 (qq.com)

-

https://www.lemonade.com/pet/explained/pet-ownership-statistics/

-

Pet Ownership Statistics [2022]: US Pet Population (spots.com)

-

Rakuten Insight – Trusted Research Partner for Asia, US & Beyond

-

Japanese Pet Survey Finds Owners Spend Twice as Much on Dogs as Cats | Nippon.com

-

https://wenku.baidu.com/view/b5d770e1ef3a87c24028915f804d2b160a4e866f.html?

-

Pet Ownership Statistics By State: How Many People Own Pets? (spendmenot.com)

-

https://www.statista.com/statistics/961152/south-korea-pet-industry-market-size/

-

How Many Dogs Are There? (US & Worldwide Statistics 2023) | Pet Keen

-

https://www.bing.com/ck/a?!&&p=7e85e5a82ff1dd96JmltdHM9MTY4MjI5NDQwMCZpZ

-

U.S. veterinarians | American Veterinary Medical Association (avma.org)

-

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0258034

- 养宠物到底要花多少钱 - 豆丁网 (docin.com)

-

Pet Industry Market Size, Trends & Ownership Statistics (americanpetproducts.org)

-

China: Number of dog and cat owners in urban households | Statista

-

South Korea: Households owning a pet by pet type 2022 | Statista

What's your view?

About the Author

Hengrui Zhang has 3 years of experience in public equity investment research & analysis with a focus on US and Asian markets. In his current role at Acuity Knowledge Partners, Hengrui supports investment management for a large Asia private equity fund, covering a wide spectrum of industries including but unlimited to healthcare, education, consumers, and real estate. Hengrui holds a bachelor’s degree in economics from the University of Toronto.

Like the way we think?

Next time we post something new, we'll send it to your inbox