Published on July 3, 2025 by Dushyant Rolyana

Carbon financing and carbon markets

Carbon has become a financial commodity and is now traded globally like any other financial asset. This journey started when global leaders started to dwell on the long- term harmful effects of industrialisation on the climate. This gave way to the Kyoto Protocol in 1997 that introduced the Clean Development Mechanism, enabling developed countries to gain carbon credits in return for investment in emission- reduction projects within these nations. This form of financing is termed carbon financing – the use of financial instruments to fund projects that reduce or remove greenhouse gas emissions.

What is carbon financing?

Each carbon credit represents one ton of CO₂ reduced from the environment. These credits are then available for trading and investment in carbon markets, where companies can offset their emissions to achieve their sustainability goals and meet the regulatory standards of their respective countries.

The markets can be broadly classified as follows:

Compliance markets: These are regulated by national or regional authorities [EU Emission Trading System (ETS) and China ETS]

Voluntary carbon markets (VCMs): These are operated by companies and standards such as Verra, the Gold Standard and the Core Carbon Principles (CCP)

To enable cross-border cooperation, a global framework for carbon trading was established by the Paris Agreement’s Article 6 in 2015. The EU launched the first international ETS (EU ETS) in 2005, followed by China, which opened the world’s largest ETS in 2021, covering over 4bn tons of CO₂ annually.

Market size and expected growth

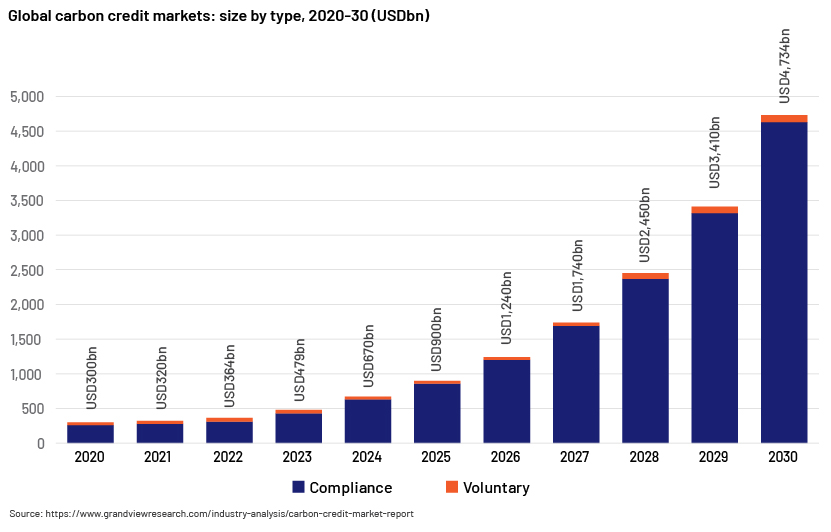

The value of the global carbon market is expected to increase to USD 4,734.35bn by 2030, growing at a whopping CAGR of 39.4% from USD 479.41bn in 2023, according to Grand View Research.

Stakeholder countries and their plans of action

The major economies have recently been increasing their focus on reforming carbon markets to meet climate goals.

-

The EU leads with its expanded EU ETS, which now also covers the maritime and real estate sectors, and is implementing the Carbon Border Adjustment Mechanism (CBAM) to tax imports that are carbon-intensive

-

China, operating the world’s largest ETS by volume, recently added the cement and steel sectors on the exchange

-

The US supports not a formal carbon market but state-level governance of emissions, using systems such as the California Cap-and-Trade Program and the Regional Greenhouse Gas Initiative (RGGI)

-

India launched its Carbon Credit Trading Scheme (CCTS) in 2023, with full rollout expected by 2026, and focuses on projects aligned with energy efficiency and green hydrogen projects

-

Brazil, in December 2024, approved its ETS based on a forest-based credits system and REDD+ projects [a voluntary climate mitigation framework developed by the United Nations Framework Convention on Climate Change (UNFCCC)]

While each country has a different approach to tackling the problem, the indication of the global trend is clear: carbon is a financial commodity that is tradable and properly regulated through a framework.

Ultimate effect on businesses and economies

The situation generated by carbon markets is a win-win for both companies and countries. Companies benefit as follows:

-

Cost-effective compliance with emission targets

-

Reputation building and ESG alignment

Economies benefit as follows:

-

Revenue generation via carbon projects

-

Receipt of innovation funding for carbon-removal technologies

The carbon markets believe “you cannot change what you cannot measure” and have derived the “carbon credit” as a fundamental currency to change the effects of pollution. By assigning a price to a carbon credit, it acts as a commodity where the carbon markets can do the following:

-

Reward efforts to reduce emissions. When a company sells the extra “carbon space”, it can generate revenue

-

Promote investment in cleaner technologies, pushing for long-term savings on credits

-

Exchange carbon credits to offset footprint, potentially saving companies from legal sanctions and fines

-

Enable companies to score better on ESG metrics, increasing investor trust and consumer confidence

How carbon financing affects business plans

Carbon finance is also changing how businesses grow. When a company is just starting out, it must think about carbon-related matters early – such as how much pollution results from its products or suppliers. If it wants to sell its products in Europe, for example, it would need to deal with the CBAM, which charges extra for carbon-heavy imports.

When the company grows, it would face pressure to show it is sustainable. This would require it to track emissions, buy credits and invest in being cleaner.

This system of quantifying pollution and turning it into a measurable liability results in a market-driven mechanism for achieving climate goals while enabling green investment.

How Acuity Knowledge Partners can help

We offer comprehensive thought leadership and specialised research solutions – end- to-end research, analytics and advisory support – enabling our clients to navigate challenges presented by the carbon markets. From evaluating carbon credit quality and pricing trends to integrating emissions data into ESG and financial models, we help our clients make informed decisions, driving growth and sustainability.

Sources:

-

https://climatetrust.org/news/carbon-market-trends-for-2025/

-

https://corporatefinanceinstitute.com/resources/esg/carbon-markets/

-

https://www.belfercenter.org/research-analysis/cbam-climate-finance

-

https://www.worldbank.org/en/publication/state-and-trends-of-carbon-pricing

-

https://www.i4ce.org/en/publication/global-carbon-accounts-2025-climate/

-

https://www.grandviewresearch.com/industry-analysis/carbon-credit-market-report

What's your view?

About the Author

Dushyant has 4+ years of experience in handling buy-side clientele. He has worked extensively with clients in the restructuring, investment banking, corporate development, alternate investments and strategy consulting domain across the US, Europe and Israel. He holds Bachelors Degree in Computer Science from Delhi University, Atma Ram Sanatan Dharma College and is also pursuing CFA.

Like the way we think?

Next time we post something new, we'll send it to your inbox