Published on May 12, 2020 by Ankita Jhawar, CFA

The backdrop

COVID-19 has now spread to almost every country. As nations try to contain the virus, the only news gripping markets everywhere is how the pandemic is devastating lives and livelihoods globally. As Chang Yong Rhee, director of the IMF’s Asia and Pacific Department, rightly said, “This is a crisis like no other”.

The global spread of COVID-19 has resulted in unprecedented market volatilities, partial shutdown of many countries and unforeseen supply chain disruptions. This, coupled with the crude oil supply war between Saudi Arabia and Russia, rattled the financial markets, over the first quarter of 2020.

The MSCI ACWI returned -21.3%, for the year, as of March-end, erasing almost all of last year’s gains, as the pandemic hit economic activity across countries. The US markets experienced a sharp fall, with the S&P 500 returning -19.6% over the first quarter of the year. UK equities, too, declined significantly, with the FTSE 100 plunging 25.1%, its worst fall in last three decades, and the Eurozone tumbled, with the MSCI Europe ex-UK, detracting 20.9%.

Factor performance and its impact on returns

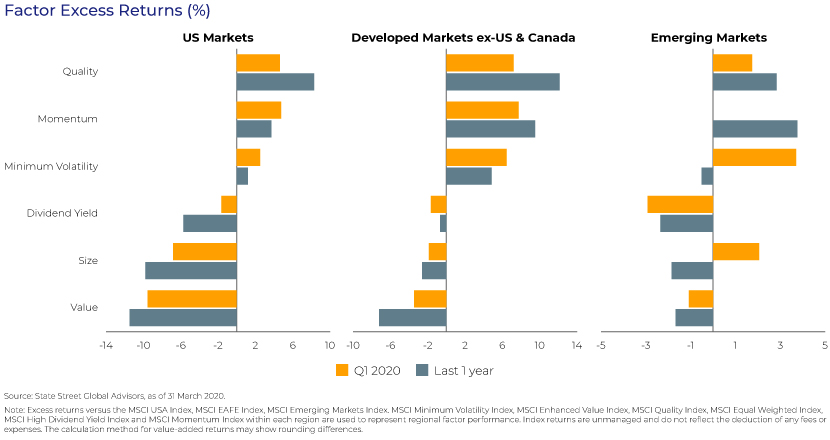

As we see above, this quarter has not been an easy one for investors. Amid this uncertainty, we turn to look at how factors performed. Different factors are believed to perform differently in different economic cycles. Therefore, factors, can enhance diversification and hence, capture premium over the market. With global markets torn apart by the spread of the virus, factor performance was in-line with what was expected from them. Factors reflected strong investor risk aversion. The following charts show that the dominant theme was the outperformance of minimum volatility, momentum and quality indices, whereas value, size and yield underperformed.

Quality remained attractive. Strong balance sheets, stable earnings, low leverage and free cash-flows, allowing operational flexibility in market downturns, were the key drivers of the success. The ability to provide organic growth while withstanding margin compression and possible debt service funding pressure, added positively to returns.

Minimum volatility outperformed amid high volatility. Minimum volatility is a strategy that invests in lower-risk stocks, seeking to deliver returns during market uncertainty and sharp bouts of volatility. The defensive nature of low volatility made the recent high levels of volatility more tolerable, contributing positively.

Momentum’s defensive selection drove returns. Typically, momentum should have faltered with spikes in volatility, as it seeks to select securities with an upward price trend. However, during this bear market, momentum chose defensively (i.e., chose stocks that are not impacted by the various phases of the business cycle). This defensive positioning and its consistent outperformance in the past, contributed to its positive performance.

Value, size and yield lagged in bear markets, in-line with expectations. Value, being cyclical in nature, underperformed when compared to other factors. Additionally, as expected in economic downturns, small size had fewer buffer to survive adverse market conditions, leading to its underperformance, except in emerging markets, where it contributed positively. Yield detracted from returns, across regions.

Overall, amid weak global performance and market sell-off, defensive-oriented factors, such as sturdy balance sheets, repeatable cash-flows and higher profitability, fared well.

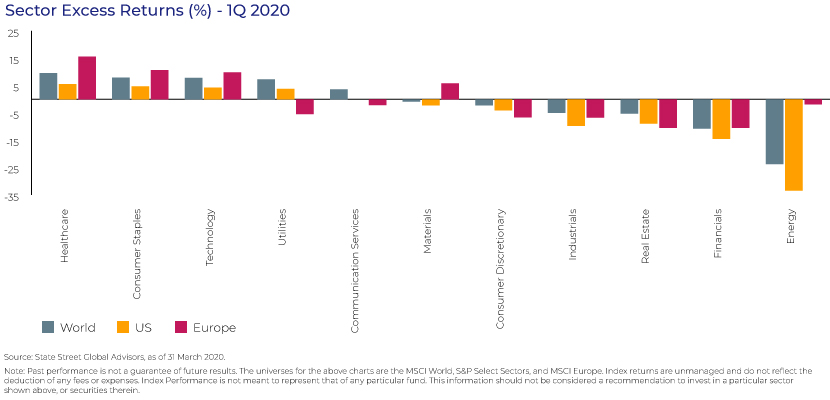

A look across sectors

It is important to look at sector performance, as factors are not the only drivers of returns. Sectors, play an equally important part. For instance, the performance of momentum was largely due to its sector positioning. At a broader level, healthcare, consumer staples and technology sectors performed the best in the first quarter of the year, whereas energy, financials and real estate were on the losing end of the spectrum.

With this crisis likely to unfold completely in the coming months, we expect difficult market conditions to continue. It is, therefore, necessary to cautiously analyse the implications COVID-19 will have on different factors and industries.

The foreseeable future, and looking beyond

As the world continues to embrace the impact of COVID-19 pandemic, the global policy response to fight the virus and its impact on the economy has been sizeable. Central banks have launched broader quantitative easing programmes, implemented near-zero interest rates and provided fiscal support for wage bills and tax holidays, to ease troubles for millions. However, unlike the financial crisis of 2008, which was caused by weakness in the core financial system, this is a public health crisis. Therefore, despite the policy responses, financial markets remain on a bumpy road due to extended lockdowns, upsetting demand and supply chains, and negative investor sentiment.

It is important that as long-term investors, we see beyond the turmoil and be prepared for opportunities once the markets recover. Although factor performance has mostly been in-line with expectations, it is not the sole driver of returns. The current environment requires continued monitoring of different investment strategies to help position our portfolios, so that we stay invested.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. We support asset managers globally, helping them identify opportunities in their portfolios. We partner with our clients in their portfolio research and construction activity; this includes conducting initial research, defining the universe, back-testing, and performance analysis. Our expertise lies in deploying quantitative and qualitative techniques to create multi-factor or factor-titled portfolios for our clients. We work as an extension of a client’s team and provide support across the entire portfolio lifecycle.

To help our clients navigate through both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics, including our latest thinking, thought leadership content and action-oriented guidelines and best practices.

Sources:

https://www.msci.com/www/blog-posts/factors-in-focus-risk-sentiment/01758298275

https://www.devex.com/news/covid-19-a-timeline-of-the-coronavirus-outbreak-96396

https://www.power-technology.com/features/coronavirus-timeline/

https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200416~4d6bd9b9c0.en.html

What's your view?

About the Author

Ankita Jhawar has over 8 years of work experience in portfolio research and operations. At Acuity Knowledge Partners, she supports the investment marketing group of one of the largest global asset managers in client reporting activities. Prior to this, she provided support as a buy-side fixed income product specialist for multi-sector fixed income mandates. She is an alumnus of Goldman Sachs and D. E. Shaw & Co. She is also a CFA Charterholder and holds a Master of Business Administration degree in Finance and a Bachelor of Economics degree.

Like the way we think?

Next time we post something new, we'll send it to your inbox