Published on December 3, 2020 by Surbhi Choudhary

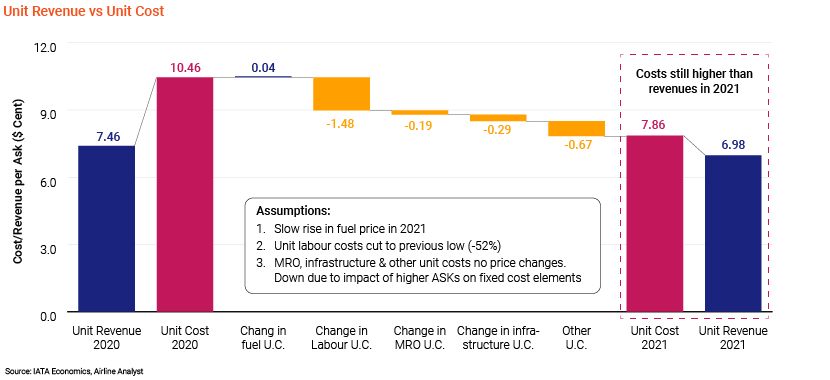

The airline industry is struggling to remain profitable amid the pandemic. It faces significant pressure due to the unprecedented decline in demand for air transport as a result of global travel restrictions, a contraction in global GDP, weak consumer confidence and less international trade. This sharp drop in demand, coupled with discounted ticket prices in efforts to stimulate demand and a large number of refund requests, has led to suppressed revenue. The International Air Transport Association (IATA) expects the industry to record a revenue loss of USD419bn (-50% y/y) and a total net loss of USD84.3bn in FY20.

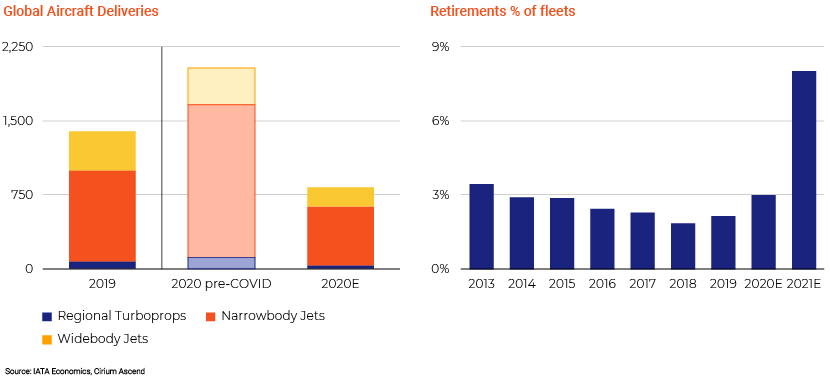

Despite a recovery in cargo demand, airline companies have limited options to reduce their operating costs due to the fixed and semi-fixed costs involved. Consequently, the industry reported cash burn of USD51bn in 2Q20 and is likely to report cash burn of USD77bn in 2H20; this may continue until 2022, although at a lower rate. Hence, the focus now is on postponing delivery of new aircraft and retiring more of the current aircraft.

Inadequate liquidity in the system, aggravated by the prolonged uncertainty surrounding the health crisis, has led to airline companies facing potential risk of default on their existing obligations in the form of non-payment, non-compliance with covenants and cross-default. Although there has been a push for covenant-lite financing in recent months to create a borrower-friendly environment, it is essential that airline companies maintain some relevant covenants such as the loan-to-value (LTV) ratio and the debt-service coverage ratio (DSCR). The LTV ratio may be adversely affected by downgrades of asset value due to the prolonged grounding of aircraft, whereas the DSCR may be negatively impacted by delays in lease or rental revenue of aircraft. Despite the circumstances, lenders have not considered remedial action such as repossessing aircraft or accelerating debt collection and damage claims of defaulted facilities, as these are not favourable options for lenders in the current cash-crunch situation.

To avoid events of default, debt restructuring has become a necessity for the industry. Therefore, lenders and airlines are negotiating, either under the supervision of the courts or consensually. To facilitate negotiation, borrowers may classify lenders into groups/classes depending on their rights, claims or seniority in their capital structure. Banks have adopted the following options:

-

Standstill: Suspending implementation of a creditor’s claims and rights on collateral or security or other property for a particular period of time. This enables the borrower to find a solution to recover.

-

Providing a covenant holiday period to avoid possible breach of necessary covenants.

-

Deferring loan payment for a particular period of time or providing some other form of debt amortisation.

-

Renegotiating the terms of the credit/lease agreement: Banks may agree to amend some terms of existing agreements, such as by extending loan maturities, reducing interest rates or re-establishing covenants or covenant clean-up periods to remedy the default, in return for a strategic benefit

Lenders are also opting for debt refinancing, with either a new loan facility/debt instrument with more sustainable terms and repayment schedules or shares.

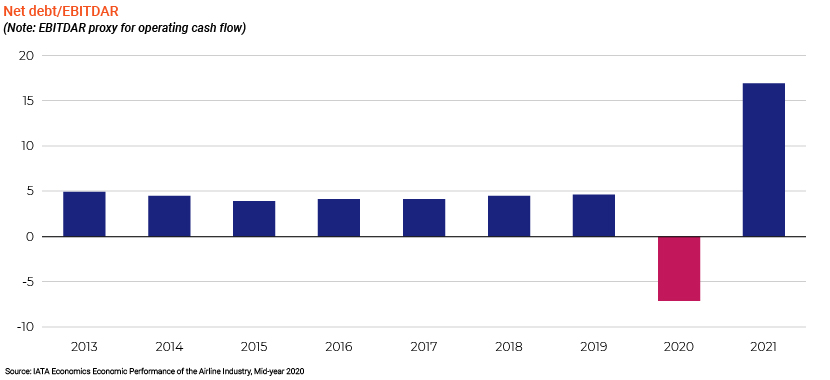

Airlines are also trying to increase their cash balances by taking new facilities from financial institutions and capital markets. The industry’s debt level (including government support) could increase 28% y/y to USD550bn at end-FY20, according to the IATA, increasing its net debt/EBITDAR to 16x in FY21 from 4.6x in FY19.

The expected higher net debt/EBITDAR ratio is a concern for creditors, as it may slow recovery and make the borrower more vulnerable to default. To safeguard themselves against this, creditors are adopting new methods of assessing a prospective borrower, with a focus on real-time data. These include in-depth analysis of cash flow, financial resilience in terms of indebtedness and liquidity, shift in customer demand, organic vs inorganic growth and cost evaluation and practices adopted amid the crisis. Creditors would also determine the default probability of each borrower by translating the recovery time to reach pre-crisis levels and demand shock into a probability-of-default multiplier..

The risk ratings of many airline companies have been downgraded, leading to a higher cost of debt. Banks regularly reassess a borrower’s risk for each loan based on current debt level, operational and financial conditions, terms of agreement, repayment ability, aircraft value (collateral) and potential loss exposure.

The “material adverse effect (MAE)” or “material adverse changes” (MAC) clause in a loan agreement is a heavily negotiated one and is triggered when an incident affects a business’s operations, financial condition or property and leads to inability to service its debt obligations. With the pandemic’s significant impact on the industry, lenders are likely to include pandemic risk in the MAE/MAC clause going forward. Accordingly, lenders may also include clauses for waiving, deferring or renegotiating payment obligations under loan agreement to minimise risk during such market conditions.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) provides the full spectrum of lending solutions to commercial and investment banks and helps them standardise and digitalise their processes. In addition to providing services such as covenant monitoring and validation, credit appraisals and reviews, we support such institutions with the deal origination process and offer other customised solutions such as automation tools and portfolio dashboards. Our debt advisory arm offers debt restructuring solutions through restructuring models and distressed opportunity assessments that would enable banks and credit institutions to manage large portfolios of the currently distressed airline industry.

Source:

IATA

https://www.wfw.com/wp-content/uploads/2020/04/WFW-COVID-19-Aviation-Restructuring-Report.pdf

https://www.whitecase.com/publications/alert/covid-19-and-aviation-finance-industry

What's your view?

About the Author

Surbhi is a Delivery Manager, with more than 4 years of experience in the Commercial Lending division at Acuity Knowledge Partners. She is currently part of the Transport and Logistics sector team undertaking covenant monitoring and validation, financial spreading and commentary, performing risk ratings for a leading European based bank. She has also supported a US based bank within the same vertical. She holds a Post Graduate Diploma in Finance and a Bachelor of Technology (B. Tech.)

Like the way we think?

Next time we post something new, we'll send it to your inbox