Published on May 8, 2025 by Srikanth Yenigalla

AI in Private banking: Hyper-personalization and democratization of advisory services

The financial services industry adopted AI in private banking and other AI technologies with a focus on scalability and cost-efficiency. Private banking requires a different approach due to its emphasis on tailored services and personal relationships. Generative and Agentic AI holds a promise to transform AI private banking by enabling hyper-personalization of services for ultra-high-net-worth individuals and democratization of advisory services for the mass-affluent. The successful integration of AI in private banking relies on AI readiness, stakeholder commitment, and a well-defined strategy. The future of private banking will be characterized by a hybrid model that seamlessly combines digital solutions with personal interactions.

AI in Private Banking: Industry Trends and Applications

The financial services industry has been at the forefront of adopting technology and AI to enhance customer experiences, re-imagine processes and design innovative revenue streams. Algorithmic trading, predictive and risk analytics, fraud detection, credit scoring and chatbots for CRM were some of the popular use cases. Commercial, retail, and investment banks adopted technology with a primary focus on scalability and cost-efficiency, including applications of AI and private banking solutions.

JP Morgan stands out as a leader in technology adoption through its digital initiatives like the Kinexys blockchain platform, LLM Suite for its employees to assist in writing, idea generation and document summarization, LOXM for optimized trade execution, IndexGPT for customized investment strategies, CASEY for client service, SPECTRUM for portfolio management, Connect Coach for advisors, Sales Assist for marketing, COIN for legal document analysis etc.

The Unique Dynamics of AI in Private Banking

Private Banking presents unique challenges and opportunities that require a different approach, which can be addressed effectively through AI in private banking. Private banking stands out due to its focus on tailored services and the personal relationships developed between bankers and their clients. This exclusive service model aims to offer a superior level of confidentiality, sophistication, and customization, addressing the intricate financial needs of affluent individuals and families. Traditional private banking model relies heavily on human expertise, which limits scalability and can lead to inconsistencies in service quality. Additionally, due to the high personal-contact service model, private bankers were not able to cater to the mass-affluent client base, that occupy the middle of the spectrum between wealthy baby boomers and their millennial heirs.

Reimagining Private Banking with Generative and Agentic AI

Recent developments in Generative and Agentic AI offer efficient solutions for AI private banking, addressing the unique requirements of private banking clients. Generative AI, a branch of artificial intelligence capable of producing new content and insights, is rapidly becoming a transformative force. Unlike traditional AI, which analyzes existing data, GenAI and Agentic AI can incorporate aspects of behavioral finance to generate personalized investment strategies and tailored financial plans. This capability aligns perfectly with the two key opportunities for technology adoption in Private Banking – Hyper -Personalization for the Ultra / High Net-Worth Individuals (U/HNWI) and Democratization of advisory services for the mass-affluent reflecting the growing impact of ai and machine learning in banking.

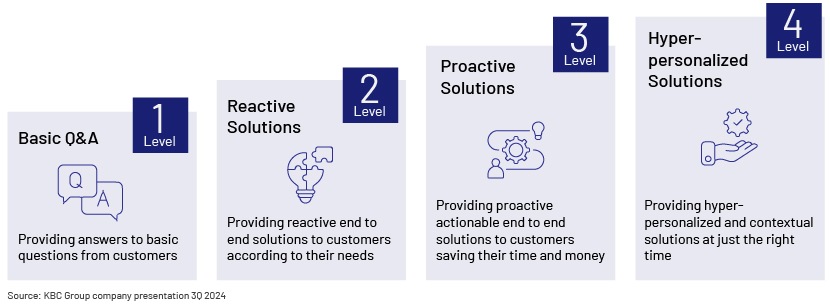

Hyper-Personalization takes the personalization to a whole new level by providing a truly unique, engaging and highly customized user experience. Hyper-personalization tailors customer experiences using real-time data analytics. Advancements in Generative and Agentic AI – large context windows, multimodality and enhanced reasoning capabilities - have accelerated the evolution of virtual assistants that can provide hyper-personalized experience. Kate, a personal virtual assistant deployed by KBC Group (a Belgian universal multi-channel bank-insurer focusing on private clients and SMEs) exemplifies this progression.

Kate: From basic chat-bot to hyper-personal digital assistant

Illustrative client experience scenario: Kate notices a customer with car insurance paid for their 18-year-old son’s driving lessons. She suggests updating the policy to include the son. With KBC Mobile, signing the contract is quick and easy, and the update is visible online in real time.

DBS Private Bank, for instance, has developed over 100 AI and machine learning algorithms to analyze 15,000 customer data points. This generates seven types of nudges, such as personalized product recommendations and milestone celebrations. Over 3.5mn retail and wealth customers in Singapore engage with 30mn hyper-personalized insights monthly. Wealth clients can act on proprietary research through the digibank wealth app. DBS also offers remittance FX alerts to notify customers of favorable foreign currency rates for past transactions.

Democratization of advisory services becomes possible through AI and private banking tools, reducing costs and making these services more affordable and accessible to a broader audience. Private banks and wealth management firms are equipping financial advisors with tools that can free them from routine tasks and focus on providing best-in-class client service and expand their client base. For example, Morgan Stanley’s AI @ Morgan Stanley Assistant gives financial advisors access to proprietary research – akin to having a research analyst, economist and strategist available 24/7. Morgan Stanley's AI @ Morgan Stanley Debrief summarizes client meetings, drafts emails for Advisors to review and send, and logs notes into Salesforce.

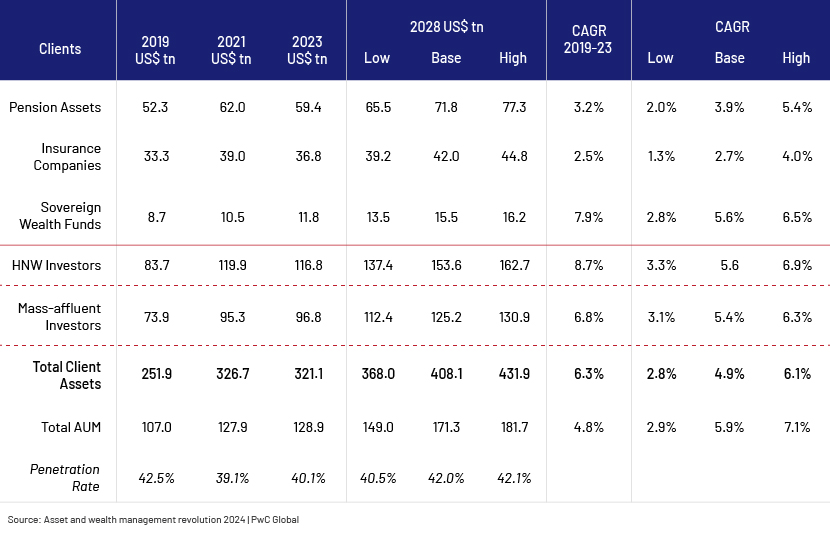

Conversely, banks have been providing clients with algorithm-driven robo-advisors for several years. Nevertheless, these services were initially restricted in scope and primarily dealt with simple financial products such as ETFs. GenAI technology allows for the creation of advanced digital agents that extend beyond automated advice algorithms and can handle complex asset classes and portfolios. These agents can manage various routine tasks such as client on-boarding, portfolio design and rebalancing, answering queries, running simulations, handling transfers, and utility bill payments. The development of digital agents capable of detecting conversational tone and intervening when excessive investment behavior is identified is imminent. The availability of digital tools also enhances financial literacy and promotes self-service. Consequently, financial advisors may have more time to offer their services through a hybrid model to a broader clientele, including the mass affluent and middle class. PWC estimates client assets under the market segment of mass-affluent investors to surpass US$125tr by 2028.

Furthermore, Younger investors, accustomed to high-tech engagement, seek brands that offer similar experience in exploring and managing their investments. PWC estimates that these investors will be beneficiaries of US$68tr of intergenerational wealth transfer over the next decade.

Addressing AI Integration Challenges in Private Banking

While the potential is immense, it is not without challenges such as data quality and structure, disparate legacy systems that do not communicate with each other, data privacy and security, explainability of AI assisted decisions and fiduciary responsibilities. A thorough evaluation of AI readiness, buy-in from all the key stake holders and a clear roadmap for AI adoption is required.

| Challenges | Actions |

|---|---|

| Data Quality and Infrastructure |

|

| Upskilling and Culture |

|

| Strategy and Governance |

|

| Risks and Security |

|

Hybrid Models: The future of Private Banking with Generative and Agentic AI

The path forward involves striking a right balance between client-centric service model, efficiency and profitability. Technologies have evolved from merely supporting back-office operations to becoming integral in enhancing customer interactions. Human interaction will remain the corner stone of Private Banking, resulting in hybrid model with an optimal balance of digital and personal interactions. Continued innovative advancements in Generative AI leading to lower training and inference costs should accelerate the transition from promise and potential to productivity and profit (aka ROI).

How Acuity Knowledge Partners can help

We are a trusted global offshoring partner for the financial services sector, providing bespoke research, analytics, and technology solutions for over two decades. With 6,000+ full-time employees, we assist more than 600 clients worldwide. We support the digital transformation of financial services by combining technology with domain expertise to enhance customer experience, improve risk management, and speed up decision making. With our financial services technology consulting, we collaborate with tech decision-makers to transform business models that enable them to reduce tech debt, execute highly bespoke automations, generate unique insights and deliver enterprise-level applications.

Tags:

What's your view?

About the Author

Srikanth has been with Acuity Knowledge Partners for over 18 years and has 20 years of experience in equity research and capital market data operations. He currently manages the offshore team of a global Investment Bank, responsible for client relationship, training and development, delivery, project execution and process automation. As a technology evangelist, Srikanth is also responsible for tracking technological developments in the domain and advocating for the adoption of innovative solutions. Prior to joining Acuity, he was a Senior Market Analyst at Reuters. Srikanth is a Cost and Management Accountant (CMA) and holds an MBA (Finance and Systems) from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox