Published on May 14, 2025 by Sanyam Jain

Advanced air mobility, or AAM, refers to a new air transport ecosystem that leverages advanced aerospace solutions and innovative airplane designs to enhance current aviation processes. Its primary goal is to enhance the movement of people and goods, especially in underserved areas such as regional, urban and rural settings.

AAM promotes the development of cost-efficient, low-carbon aircraft, with organisations such as NASA advocating for designs that utilise electrification and automation. Most AAM vehicles are all-electric or hybrid-electric, with some exploring hydrogen-powered options. Many are also designed for autonomous operation, ensuring safe navigation without a human pilot.

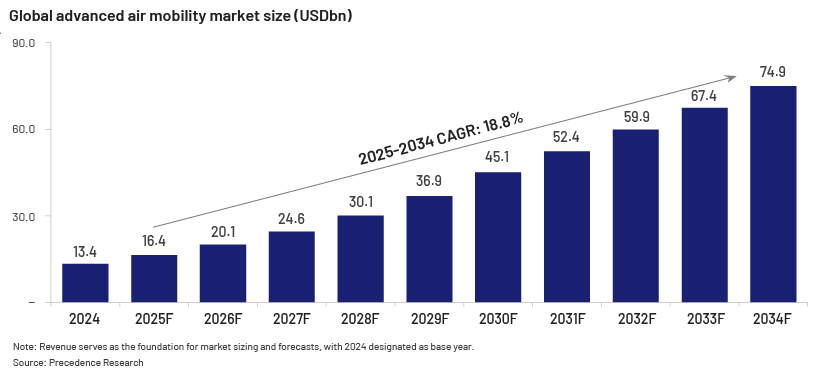

Global AAM market set to skyrocket

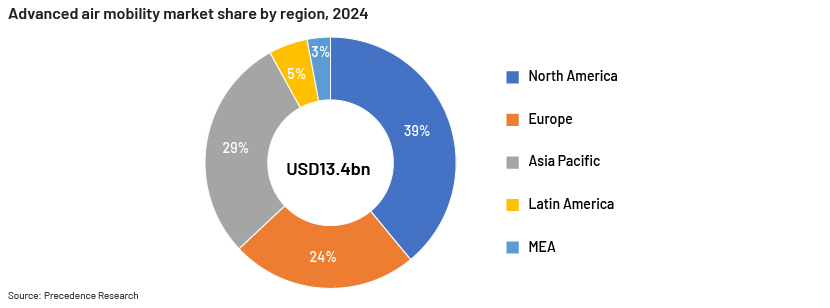

The global AAM market reached USD13.38bn in 2024 and is projected to grow to USD74.93bn by 2034, at a CAGR of 18.8% from 2025 to 2034. The North America market is estimated to have surpassed USD5.22bn in 2024 and is expected to see a CAGR of 18.95% over 2025-2034.

Key drivers of AAM market

Demand for alternative transportation, especially advanced mobility solutions, is increasing. The International Air Transportation Association (IATA) predicts that, by 2037, around 8.4bn people may travel by air globally. Furthermore, according to the United Nations, 68% of the world’s population is expected to move to cities by 2050, leading to congestion and accessibility challenges. This scenario boosts the need for alternatives such as short take-off and landing (STOL), electrical vertical take-off and landing and vertical take-off and landing (VTOL) aircraft, particularly for short-haul flights in crowded cities.

Innovative applications of air mobility solutions

AAM vehicles are highly automated, capable of safely navigating passengers or goods without a human operator on board in most cases. Most vehicles fit into the following categories:

-

Electric vertical take-off and landing (eVTOL): Designed for medical transport and urban trips, airport transfers, demand-driven flying taxis, some eVTOLs have pilots, while others are fully automated.

-

Electric conventional take-off and landing (eCTOL): These aircraft are intended for short-distance travel, light cargo transport and passenger transfers from remote locations or airstrips.

-

Short take-off and landing (STOLs): These aircraft are fixed-wing planes designed to operate on runways significantly shorter than those required by conventional aircraft. They typically use aerodynamic enhancements to increase lift and decrease landing speeds.

-

Small unmanned aircraft systems (sUAS)/Unmanned aerial vehicle (UAVs): These aircraft, usually drones, are used for videography, pharmaceutical delivery and courier services.

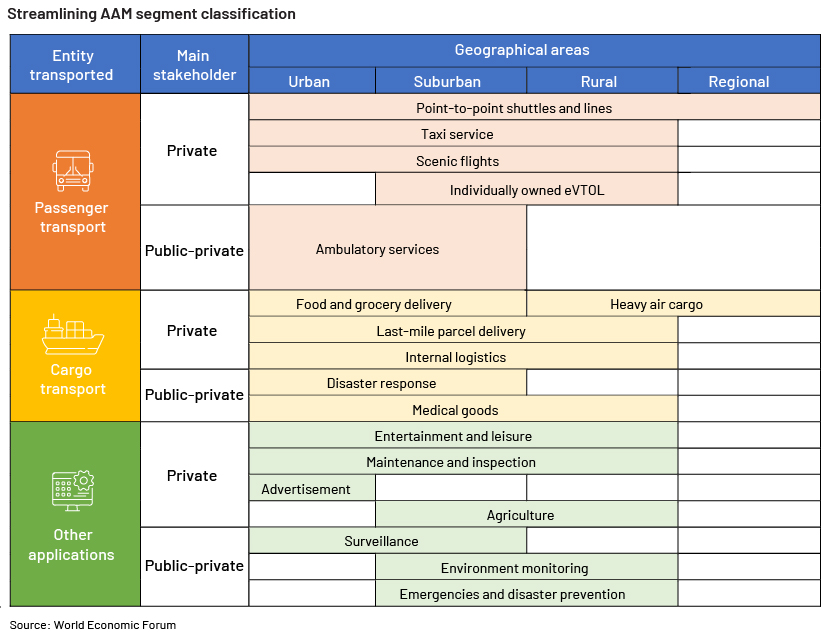

AAM segment classification

Segments can be categorised into the following:

-

By type of transportation: passenger, cargo and other applications. Examples of this include the use of point-to-point shuttle services that can serve urban areas by transporting passengers from train stations to sports events or operate in regional settings to improve connectivity between remote communities and nearby urban centres.

-

By stakeholder: private sector or public-private partnerships

-

By geographical context: urban, suburban, rural or regional

The table below summarises AAM developments and their positions within segments.

Areas that could attract future investment

Given its prospects, the AAM sector has garnered considerable attention from global investors.

-

Vehicle manufacturers: A notable share of investment has been allocated to firms engaged in the development of eVTOL aircraft and other AAM vehicles. These companies compete to create aircraft that are safe, efficient and commercially viable.

-

Infrastructure developers: Investors are increasingly acknowledging the essential role of infrastructure within the AAM ecosystem. Capital is being directed towards the establishment of vertiports, charging stations and other vital infrastructure elements.

-

Technology providers: Firms innovating in advanced technologies, including state-of-the-art batteries, propulsion systems and autonomous flight systems, are also drawing significant investment.

-

Service providers: Firms offering AAM-related solutions, like aerial traffic management, maintenance and operational support, are also emerging as appealing targets for investment.

Key players in advanced air mobility

Key players in AAM include Joby Aviation and Archer from the US, focusing on air taxis with vectored thrust technology. Joby Aviation received USD2,983m in funding, first flying in 2018, while Archer received USD2,052m, first flying in 2023. Volocopter from Germany and Ehang from China are known for their multicopter technology. Other notable companies include SkyDrive from Japan, AutoFlight from China and Heart Aerospace from Sweden, each contributing to the evolving landscape of air mobility with their unique technologies and use cases.

AAM key players

| OEM | Ownership | Funding (USDm) | Use case | Vehicle type | First flight | Country |

| Joby Aviation | Public | 2,983 | Air taxi | Vectored Thrust | 2018 | |

| Archer | Public | 2,052 | Air taxi | Vectored Thrust | 2023 | |

| Beta Technologies | Private | 1,303* | Cargo, regional, air taxi | Conventional / Lift + Cruise | 2020 / 2022 | |

| Volocopter | Private | 761* | Air taxi | Multicopter | 2021 | |

| Eve Air Mobility | Public | 646 | Air taxi | Lift + Cruise | 2025 | |

| Vertical Aerospace | Public | 491 | Air taxi, cargo, EMS | Vectored thrust | 2023 | |

| Ehang | Public | 262 | Tourism, EMS, firefighting, air taxi | Multicopter/Lift + Cruise | 2018 / 2021 | |

| SkyDrive | Private | 258 | Air taxi, tourism, EMS | Multicopter | 2024 | |

| AutoFlight | Private | 200* | Cargo, air taxi | Lift + Cruise | 2022 | |

| Volant Aerotech | Private | 161 | Air taxi, EMS, tourism | Lift + Cruise | 2023 | |

| Heart Aerospace | Private | 150 | Regional | Conventional | 2025 | |

| Electra | Private | 134* | Regional, cargo | Augmented Lift | 2027 | |

| REGENT | Private | 90* | Regional | Augmented Lift | 2025 | |

| Ascendance | Private | 63 | Regional, cargo | Lift + Cruise | 2025 | |

| ZeroG | Private | 57 | Tourism, EMS, SAR, air taxi | Multicopter / Vectored Thrust | 2023 / 2025 | |

| Vertaxi | Private | 55 | Tourism, air taxi, EMS, cargo | Lift + Cruise | 2023 | |

| Aerofugia | Private | 52* | Air taxi, cargo, tourism | Vectored Thrust | 2023 | |

| TCab Tech | Private | 45* | Air taxi, tourism | Vectored Thrust | 2023 | |

| Dufour Aerospace | Private | 11* | EMS, regional | Vectored Thrust | - | |

| Jaunt Air Mobility | Private | 3 | Air taxi, cargo | Lift + Cruise | 2025 | |

| Supernal | Private | Corporate | Air taxi, cargo | Vectored Thrust | 2025 | |

| eAviation (Textron) | Private | Corporate | EMS, air taxi, cargo | Vectored Thrust | 2025 | |

| Robinson Helicopter | Private | Corporate | Cargo, EMS | Helicopter | 2025 | |

| Wisk (Boeing) | Private | Corporate | Air taxi | Vectored Thrust | 2025 | |

| Honda Motor | Public | Corporate | Air taxi | Lift + Cruise | 2024 | |

| Wanfeng Diamond | Public | Corporate | Air taxi, tourism, EMS, cargo | Lift + Cruise | 2023 |

Note: February 2025 Release; The asterisk in the Funding column indicates additional undisclosed funds; EMS: Emergency Medical Services

Source: AAM Reality Index

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has over 14 years of experience in assisting global investment managers, leveraging our specialised expertise in various sectors. In the aviation industry, we provide investment firms with support in generating ideas, analysing the competitive landscape regarding emerging trends and evaluating investment opportunities through thorough research and dedicated sector coverage.

Sources:

-

https://www3.weforum.org/docs/WEF_Advanced_Air_Mobility_2024.pdf

-

Advanced Aerial Mobility Market Size to Hit USD 74.93 Bn by 2034

What's your view?

About the Author

Sanyam Jain is part of the Private Market team at Acuity Knowledge Partners. He has c.3 years of experience in Research and currently supports private equity clients with research assignments including industry research, company analysis, data research, IC memos and financials extraction. He holds a master’s degree in business administration with specializing in Finance and Business Analytics

Like the way we think?

Next time we post something new, we'll send it to your inbox