Published on May 15, 2025 by Diksha Khanna and Akriti Rastogi

Operation Support by Corporate firms: A brief overview

In the current fast-paced business world, organizations function like well-oiled machines, with various components working together to achieve their goals. Support functions do not directly produce the core products or services offered by the company, but offers necessary expertise and assistance, allowing the primary functions of the business to work efficiently. Operational support functions are crucial elements within an organization, ensuring a seamless and effective implementation of its primary activities. These functions encompass a wide array of tasks that aid, improve, and streamline operational workflows.

Corporate firms offer essential operational support services such as financial analysis, treasury support, accounts controller support, strategic operations, project and resource management, compliance and risk management among other services. KPMG’s report in 2022 mentioned that 60% of organizations either considered or planned to assess their outsourcing strategies in the next year.

Engaging in a global market presents challenges such as overseeing international supply chains, adhering to varied regulations, and navigating cultural differences. As organizations grow and expand, their operations become more complex, requiring strong support systems to manage various aspects effectively. As regulatory scrutiny and compliance requirements intensify across industries, the need for robust legal and compliance support grows as well. To tackle these complexities and challenges, various corporate firms are adopting outsourcing as a strategic approach, leveraging the specialized knowledge of third-party providers to lower expenses, boost operational efficiency, mitigate risks, and enhance employee satisfaction. By outsourcing non-core functions, companies are focusing more on their core business activities, leading to improved performance and innovation in their primary areas of operation. Companies within financial services sector are increasingly engaging with outsourcing companies and professionals to meet their increasing demand for operations support services. For example, European Central Bank revealed that the proportion of administrative expenses allocated by banks to outsourcing services rose from 6.8% to 7.2% in 2023.

Demand for streamlined operations, adherence to standards to reduce the risk of penalties, improve brand reputation, focus on complying with regulatory requirements and internal controls, with expanding businesses, have resulted in an increasing demand for operation support services by corporate firms.

Compliance has emerged as a fundamental for safeguarding organizational integrity, ensuring adherence to legal mandates, and strengthening stakeholder trust. Compliance functions are experiencing growing demand and becoming risky, however, remains crucial for managing organizational risk and implementing business plans and initiatives effectively. A report by Thomson Reuters mentioned that “64% of compliance professionals have seen an increase in the regulatory burden over the past five years.” Many organizations face high operational costs due to large compliance teams, driven by complex regulations, talent shortages, and shareholder pressure to cut costs.

Within the rapidly changing environment of banking, financial services, and insurance (BFSI), the significance of risk and compliance (R&C) functions has escalated dramatically. Historically, these functions were often overlooked until a regulatory breach occurred. Recently, however, there has been a surge in the volume of R&C-related processes, exerting substantial pressure on the compliance teams within BFSI firms. Therefore, many companies are turning to compliance outsourcing as a strategic solution, allowing organizations to delegate compliance-related responsibilities to external experts, managing compliance demands efficiently while focusing on core business functions and strategies.

Many big companies are increasingly focusing on integrating procurement & finance divisions, to minimize inaccurate financial reporting and duplication of effort, synchronize cash flow management with procurement cycles, improve strategic decision making and achieve overall enhanced efficiency at company level. Accenture reported that integrating procurement, finance, and supply chain functions can result in 15% to 20% savings on direct and indirect expenditures, and a 3% to 5% reduction in the cost of goods sold. Further, Deloitte also reported that by unifying procurement and finance operations can lead to significant improvements in cost savings and operational efficiency. Their approach has shown a 20% to 40% increase in realized savings and a 10% to 30% improvement in operational efficiency. However, the integration of procurement and finance operations is highly complex, hence companies are outsourcing this task to specialized firms.

Furthermore, recent advancements in financial technology, including blockchain, AI, and big data analytics, have significantly transformed treasury operations by improving financial analysis and simplifying payment processing. These innovations have led to an increased demand for advanced services and outsourcing solutions.

Invoicing errors are nearly inevitable while utilising manual paper-based or semi-automated methods. These inaccuracies might lead to vendor frustration and can cause significant issues such as delayed payments, compliance challenges, and increased risk of fraud. Utilizing outsourced invoice processing services can enhance efficiency, offering processing times that are up to four times quicker than traditional manual accounting methods or inconsistent systems.

The demand for outsourcing in project and resource management is indeed on the rise. Many outsourcing firms offer specialized skills and knowledge that may not be available in-house which allows companies to leverage advanced capabilities and improve project outcomes. By outsourcing project and resource management, companies can focus on their core competencies, leading to better overall performance and growth.

Outsourcing operation support allows companies to leverage external skilled expertise and reduce the burden on internal resources. Outsourcing in operational support holds promising outlook, with the synergy of technological developments and macroeconomic conditions expected to profoundly impact the industry in the coming decade.

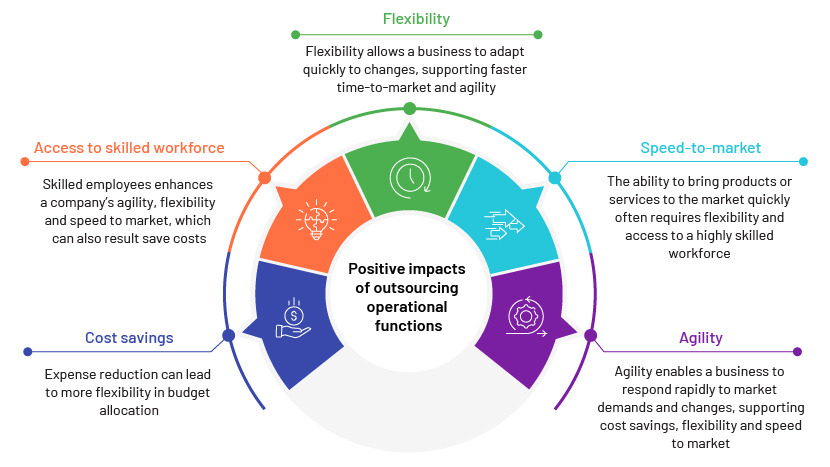

Positive Impacts of Outsourcing Operational Functions

Access to expertise: Outsourcing operation support services provides access to a pool of experts with specialized knowledge in financial strategies, risk management, compliance, and other services, enhancing the quality and effectiveness of operations.

Improved resource allocation: Outsourcing operation support services allows companies to determine which operational support processes to manage internally and which to delegate to external providers, in order to enhance an organization's resource allocation. Companies aim to assign operational tasks to third party firms that are skilled in delivering high-quality results, utilizing cost-effective delivery methods, and allowing internal resources to focus on primary activities that generate revenue.

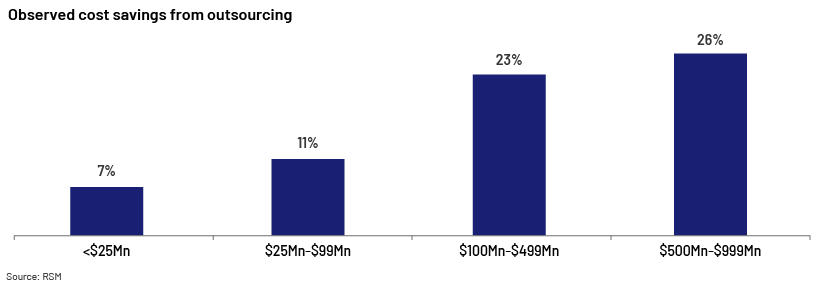

Cost-effectiveness: Outsourcing operation support services reduces costs by eliminating the need for hiring, training, and maintaining an in-house team. It allows companies to leverage the economies of scale achieved by outsourcing firms, which can spread costs across multiple clients.

Strategic Focus: Companies can increase their core strengths by outsourcing operational services, freeing up internal resources to focus on growth and innovation. This approach enhances competitive positioning and ensures specialized tasks are being managed by experts, leading to improved efficiency and service quality.

Access to Cutting-Edge Solutions: By outsourcing operational support services like compliance function, financial support and analysis, companies can utilize advanced technology and tools without incurring the costs of acquisition and maintenance. Specialized strategic consulting firms often uses cutting-edge analytical tools and instruments offering in-depth insights and enhanced capabilities.

Common Issues with Outsourcing Operational Support

Data security & privacy risk: Outsourcing can expose organizations to data security risks, particularly when sensitive information is managed by external providers. To mitigate these risks, it is essential to implement robust data protection measures and select vendors with strong security protocols

Maintaining Quality Standards: Relying on external providers for services can make it difficult to ensure consistent quality and timely delivery. Implementing regular monitoring and setting clear service level agreements can help uphold standards to ensure that outsourced tasks meet the organization's expectations and requirements.

Legal and compliance challenges: Managing legal and regulatory environments can be intricate, especially when outsourcing across borders. Ensuring adherence to all relevant laws and regulations is vital to prevent legal complications. Conducting regular audits and collaboration with legal professionals can support compliance efforts.

Issues with Contractual Alignment: The absence of a consistent strategy and foundational principles between organizations and their clients typically causes misalignment in project expectations and outcomes which can hinder the development of a strong partnership between the companies involved.

Conclusion

Outsourcing operational support allows companies to delegate non-primary tasks to third parties and efficiently allocate their resources for revenue-generating activities. It allows companies to significantly improves efficiency and provides strategic benefits, such as cost savings and access to specialized expertise. However, outsourcing operation support requires diligent management to address potential risks, including data security issues and loss of control over processes. Effective oversight ensures that the quality of service remains high, and that the outsourcing arrangement aligns with the company’s long-term goals.

How Acuity Knowledge Partners can support corporate firms in operation support

Leveraging our deep knowledge and expertise in strategic research and analysis, Acuity Knowledge Partners has supported the execution of numerous tactical projects focused on operation support for global corporate clients. Our operations services teams provide comprehensive support for corporates and consulting firms, enabling them to streamline business processes and enhance efficiency. We specialize in a variety of areas, including strategic operations, project management, finance operations, accounts payable and treasury support.

By utilizing industry-specific knowledge and cutting-edge technologies, we assist businesses in lowering expenses, enhancing adaptability, focusing on their core strengths, and achieving their strategic objectives, all while sustaining a competitive advantage in their markets.

Sources:

-

https://www.linkedin.com/pulse/five-outsourcing-challenges-how-overcome-them-mangtas

-

https://www.outsourceaccelerator.com/articles/operations-outsourcing/

-

https://finmodelslab.com/blogs/blog/benefits-outsourcing-financial-planning-analysis

-

https://medium.com/@joe012745/compliance-outsourcing-benefits-and-risks-6dd0fcdca593

-

https://adaptivesag.com/article/understanding-support-functions-in-an-organization/

-

https://thescalers.com/5-problems-with-outsourcing-and-how-you-can-overcome-them-all/

Tags:

What's your view?

About the Authors

Diksha has over 7 years of experience on a variety of strategy business consulting and advisory services for corporate clients. Her work predominantly focuses on corporate strategy analysis, industry analysis, market assessment, target screening, competitive benchmarking, pitchbooks, company analysis, due diligence studies, amongst others. She has led and handled multiple teams, managing day to day client engagement, requests as well as involved in strategic planning, delivery and presentation of client deliverables including project scoping, planning and execution for smooth delivery of projects.

Akriti has over 6 years of experience in industry research & consulting and has worked on various research projects including industry research, company profiles and competitive intelligence. She is involved in managing projects, including project scoping, identification of research approach methodology, developing strategy frameworks and providing the solutions for client’s business needs. She has worked on multiple ad-hoc consulting projects for global clients specializing in market estimation, growth outlook analysis, risk identification, investment flow analysis and opportunity assessment.

Like the way we think?

Next time we post something new, we'll send it to your inbox