Even with clean balance sheets, oil and gas drillers exposed to rate increases

S&P Global | November 20, 2023

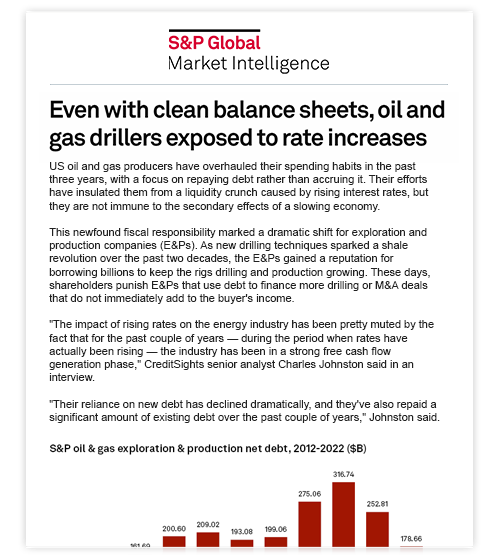

Gaurav Sharma, Assistant Director, Acuity Knowledge Partners recently shared his expert insights on how oil and gas producers are facing headwinds from rising interest rates with S&P Global. According to him, if demand for oil and gas declines, producers could see their profits shrink and their share prices fall.

‘If this environment sustains for a longer period, it will eventually impact oil and gas companies' future cash flows (due to higher interest rate payout and lower income due to low demand and prices)’, he adds.

About S&P Global: S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). We are the world’s foremost provider of credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Latest News

Data Quest

Data Quest

Future thinking Redefining Financial Research: How Acuity is Building a Human-AI Future

Agent Fleet, Agentic AI, AI models

Read More The DrawDown

The DrawDown

Private Markets Gear Up for 2025 Deal Surge with Tech-first Mindset

Read More Bloomberg

Bloomberg

In Hot Credit Market, Fixed-Maturity Funds Are Booming

AT1 Funds, European Bank, Fixed- Maturity Funds

Read More BankDirector

BankDirector

Seek Outside Help to Accelerate Growth and Improve Efficiency in Commercial Banking

Bank Operations, Inflationary Pressures, Interest Rates

Read More CXOtoday

CXOtoday

Shaping the Future of Financial Services: Insights and Leadership Strategies from Acuity Knowledge Partners

Read More Good Returns

Good Returns

How Robust Domestic Economy Propels Indian Equity Markets To New Highs?

Domestic Liquidity, Economic Growth, Equity Markets

Read More