“As we step into July, global equity markets are holding near 52-week highs, supported by resilient earnings and growing anticipation of rate cuts in the second half of the year. Despite persistent geopolitical risks—particularly in the Middle East—investor sentiment remains constructive, with a renewed focus on earnings quality and macro fundamentals. The global economy is navigating a complex transition. Inflation has moderated across most developed markets, giving central banks room to consider policy easing. The U.S. economy remains relatively strong, though early signs of slowing are emerging. Meanwhile, the Eurozone faces industrial stagnation and weak demand, and Japan’s recovery is losing momentum. Emerging markets are mixed. While commodity exporters benefit from price stability, others face capital outflows and currency pressures. Trade tensions between the U.S. and China continue to cloud the global trade outlook.

“As we step into July, global equity markets are holding near 52-week highs, supported by resilient earnings and growing anticipation of rate cuts in the second half of the year. Despite persistent geopolitical risks—particularly in the Middle East—investor sentiment remains constructive, with a renewed focus on earnings quality and macro fundamentals. The global economy is navigating a complex transition. Inflation has moderated across most developed markets, giving central banks room to consider policy easing. The U.S. economy remains relatively strong, though early signs of slowing are emerging. Meanwhile, the Eurozone faces industrial stagnation and weak demand, and Japan’s recovery is losing momentum. Emerging markets are mixed. While commodity exporters benefit from price stability, others face capital outflows and currency pressures. Trade tensions between the U.S. and China continue to cloud the global trade outlook.

Central banks are treading carefully, balancing growth support with inflation control. Markets are highly sensitive to data and policy signals, and volatility may rise if expectations shift. While recession risks have eased, we recommend maintaining diversified exposure and closely monitoring macroeconomic developments and geopolitical shifts.”

– Narendra Babu, Senior Director, Financial Marketing Services

Market Pulse

Top Performing Asset Class:

US large-cap equities (5.0%): US large-cap equities were supported by strong quarterly earnings of major tech firms and steady consumer spending. Market confidence was further boosted by signs of moderating inflation and expectations of a soft landing.

Worst Performing Asset Class:

Global REITs (-0.2%): Global REITs renewed concerns over rising interest rates and pressure on commercial property valuations. Investor sentiment weakened further due to sluggish leasing activity and muted real estate demand in key markets.

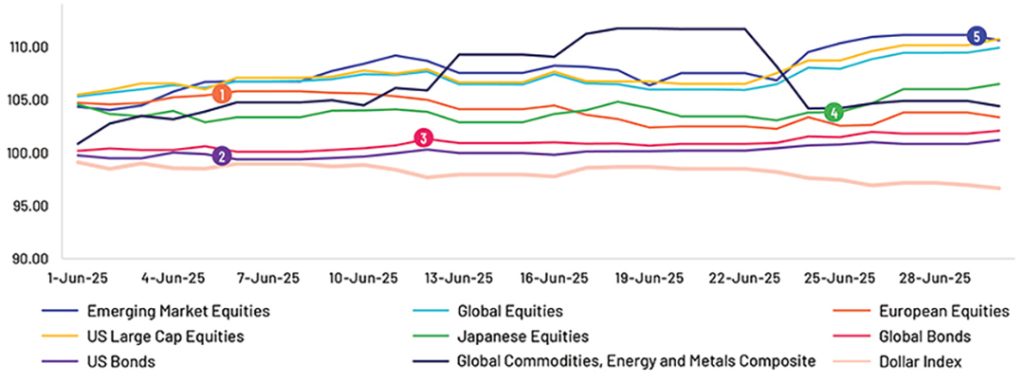

1. 5 June: European equities surged following the ECB’s interest rate cuts, pushing the STOXX 600 higher for the third consecutive day

2. 5 June: US bonds – US Treasuries rallied significantly: 10-year yields dropped as bond investors reacted to a dovish central bank and weaker data

3. 12 June: Global bond yields dropped sharply in response to dovish central-bank signals – namely ECB policy easing and soft US macro data – resulting in a sharp rally in government bonds

4. 25 June: Japanese equities rose amid improved geopolitical sentiment

5. 30 June: Emerging-market equities have turned positive year to date, driven by strong contributions from India over the past three months

Equities

Global equities rallied in June, driven by AI-led tech momentum, easing US-Iran tensions, falling oil prices, trade optimism and growing expectations of global interest rate cuts. US equities surged, powered by tech/AI strength, trade de-escalation, easing geopolitical risks and a dovish US Federal Reserve (Fed) stance that reinforced investor confidence. In contrast, European equities fell amid broad geopolitical tensions, including fears of an escalation in the Middle East after US and Israeli strikes on Iran, investor caution over US-China trade talks ahead of tariff deadlines and uncertainty around central-bank meetings. UK equities rose initially, with the midcap index reaching multi-month highs, supported by earnings optimism, softer consumer spending data easing rate concerns, accommodative monetary policy and relief from US metal tariffs. However, they were later pressured by mixed UK economic data, tensions in the Middle East and trade concerns in North America. Broader Asian markets rallied on easing geopolitical tensions, an improved US-China trade outlook, Wall Street-driven optimism, expectations of rate cuts and a softer USD. Japan’s Nikkei 225 surpassed the 40,000 mark for the first time in five months, buoyed by stronger earnings and improved investor sentiment. Chinese equities rose on early optimism over US-China trade talks, renewed policy support and easing geopolitical risks following the Israel-Iran ceasefire, despite mid-month pressure from limited progress on negotiations. Indian equities grew on easing geopolitical and trade tensions along with robust foreign inflows. The Reserve Bank of India delivered a bold 50bps rate cut and a CRR reduction and provided added liquidity tools to support growth. South Korean markets rose, supported by strong exports, improved investor access, expanded liquidity and heightened confidence in President Lee Jae-myung’s pro-reform, AI-focused economic agenda. The Bank of Korea cut rates to 2.50%, cautioned against overheating and boosted liquidity operations.

Fixed income

In June, geopolitical tensions in the Middle East and trade disputes stemming from tariffs continued to disrupt global markets. The World Bank revised its GDP growth projections downward across regions, indicating an economic slowdown. The Fed maintained its key borrowing rate at 4.25-4.50% at its June FOMC meeting amid high inflation and slower economic growth expectations. Similarly, the Bank of England (BoE) kept rates unchanged at 4.25%, adopting a cautious stance due to heightened tensions in the Middle East. The European Central Bank (ECB) lowered interest rates by 25bps to 2% as inflation settled below its 2% target.

In Asia, China kept its key rates unchanged for June, while India reduced rates by 50bps to 5.50% to stimulate growth and support borrowers as inflation remained below target. Global fixed income indices showed positive performance across treasuries, investment grades and high yields. In emerging-market (EM) credit markets, spreads narrowed by 4bps for corporates and by 8bps for sovereigns. Eurozone credit markets performed well, with rising sovereign yields, with EUR investment-grade spreads narrowing and high-yield spreads stabilising.

The 2-year US Treasury yield decreased by 17bps and the 10-year Treasury yield fell by 16bps as investors sought safe-haven assets during geopolitical crises. The US 10- to 2-year yield spread closed at 0.52%, significantly below the long-term average. As the conflict in the Middle East subsided by the end of the month, high-yield corporate bonds in the US showed a moderate reaction. However, EM bonds, particularly in oil-importing countries, faced increased risk premiums due to potential inflationary pressures and currency volatility.

Foreign exchange

June proved to be a challenging month for the USD, which continued its decline against major currencies. The Fed’s cautious stance, hinting at a possible rate cut by the end of July, combined with rising concerns over US debt (linked to the “One, Big, Beautiful Bill”) and escalating tensions between Israel and Iran, drove investors towards safe-haven currencies such as the Swiss franc (CHF). As a result, the USD/CHF pair fell 2.91% in June, reaching a decade low. Meanwhile, the USD/JPY remained broadly stable amid tariff-related headlines and market speculation of a delayed rate hike by the Bank of Japan. In a notable comeback, the EUR/USD surged past the key resistance level of USD1.16, its highest in four years. This rally was fuelled by a combination of USD weakness, uncertainty surrounding US trade policy, Eurozone inflation aligning with the ECB’s 2% target and support from fiscal stimulus measures. The GBP/USD pair also extended its strong upward momentum in June, driven largely by the continued weakening of the greenback.

Elsewhere, emerging markets in Asia presented a mixed picture. While the South Korean won (KRW) and the Vietnamese dong (VND) benefited from strong export demand, countries such as Indonesia saw currency depreciation, and the Indian rupee (INR) experienced a mild slowdown. Overall, the region remains highly sensitive to geopolitical developments and shifts in Fed policy. In Latin America, the Mexican peso (MXN) held steady as USD weakness offset the impact of a 50bps rate cut by Banxico.

Commodities

The commodity complex continued to perform well in June as lingering geopolitical concerns drove precious metals and energy prices higher, while base metals rose due to declining stockpiles. Gold prices surpassed USD3,300/oz last month amid rising tensions between Iran and Israel, fuelling safe-haven demand. Meanwhile, silver prices jumped to multi-year highs, following estimates of a fifth consecutive year of supply deficit. Turning to industrial metals, LME copper prices rose by 4% m/m in June, primarily due to supply disruptions at major mines and decreasing inventories in both LME and SHFE warehouses. President Trump’s investigation of whether to impose import tariffs on copper has seen year-to-date (YTD) LME on-warrant holdings decline by around 75% by the end of June. As for aluminium, LME 3-month (3M) prices rose by almost 6.3% m/m last month due to rising immediate demand and tightening LME inventories.

Meanwhile, ICE Brent oil prices ended positively last month, primarily due to the conflict between Israel and Iran and slowing drilling activity in the US. Baker Hughes data shows that the US oil rig count fell for a ninth consecutive week, the longest period of declines since mid-2020. US natural gas ended with marginal gains, primarily on mixed weather forecasts and larger-than-expected storage injections. Gas stockpiles totalled 2.9 Tcf as of 20 June, down 6.3% y/y but 6.6% above the five-year average.

In agriculture, sugar prices fell by almost 9% m/m in June, primarily on hopes of increased global production supported by favourable weather conditions in top producers Brazil and India. Meanwhile, money managers increased their net bearish speculation on raw sugar by 12,066 lots for a fifth consecutive week to 85,592 lots as of 24 June, the most bearish since December 2019.

Outlook

Global growth remains subdued as trade tensions and policy uncertainty continue to weigh on investment and confidence. The Organization for Economic Co-operation and Development attributes the slowdown to rising tariffs and fragmented global trade, which dampen spending and complicate supply chains. Advanced economies are experiencing modest momentum: US and Eurozone activity is moderate, with industry and services balancing out despite ongoing tariff-related pressure. Inflation is gradually cooling but remains above long-term averages. Central banks, especially in Europe and emerging markets, are cautiously easing, while the Fed maintains a more measured approach. Emerging markets, particularly in Asia, show more resilience; India is noted for its stable inflation and domestic strength. Risks remain tilted to the downside, including renewed tariff actions and geopolitical shocks. Despite some supply-chain stabilisation and selective rate cuts, global momentum remains fragile.

Central-bank comments

“Incoming data suggest that the economy remains solid. Following growth of 2.5 percent last year, GDP was reported to have edged down in the first quarter, reflecting swings in net exports that were driven by businesses bringing in imports ahead of potential tariffs. This unusual swing has complicated GDP measurement. Private domestic final purchases, or PDFP as we call them –which excludes net exports, inventory investment, and government spending – grew at a solid 2.5 percent rate. Within PDFP, growth of consumer spending moderated, while investment in equipment and intangibles rebounded from weakness in the fourth quarter. Surveys of households and businesses, however, report a decline in sentiment over recent months and elevated uncertainty about the economic outlook, largely reflecting trade policy concerns. It remains to be seen how these developments might affect future spending and investment.”

– Jerome Powell, Chairman, US Federal Reserve (24 June 2025)

“In the present geopolitical environment, it is even more urgent for fiscal and structural policies to make the euro area economy more productive, competitive and resilient. The European Commission’s Competitiveness Compass provides a concrete roadmap for action, and its proposals, including simplification, should be swiftly adopted. This includes completing the savings and investment union, following a clear and ambitious timetable. It is also important to rapidly establish the legislative framework to prepare the ground for the potential introduction of a digital euro. Governments should ensure sustainable public finances in line with the EU’s economic governance framework, while prioritizing essential growth-enhancing structural reforms and strategic investment.”

– Luis De Guindos, Vice President, European Central Bank (5 June 2025)

Market Indices

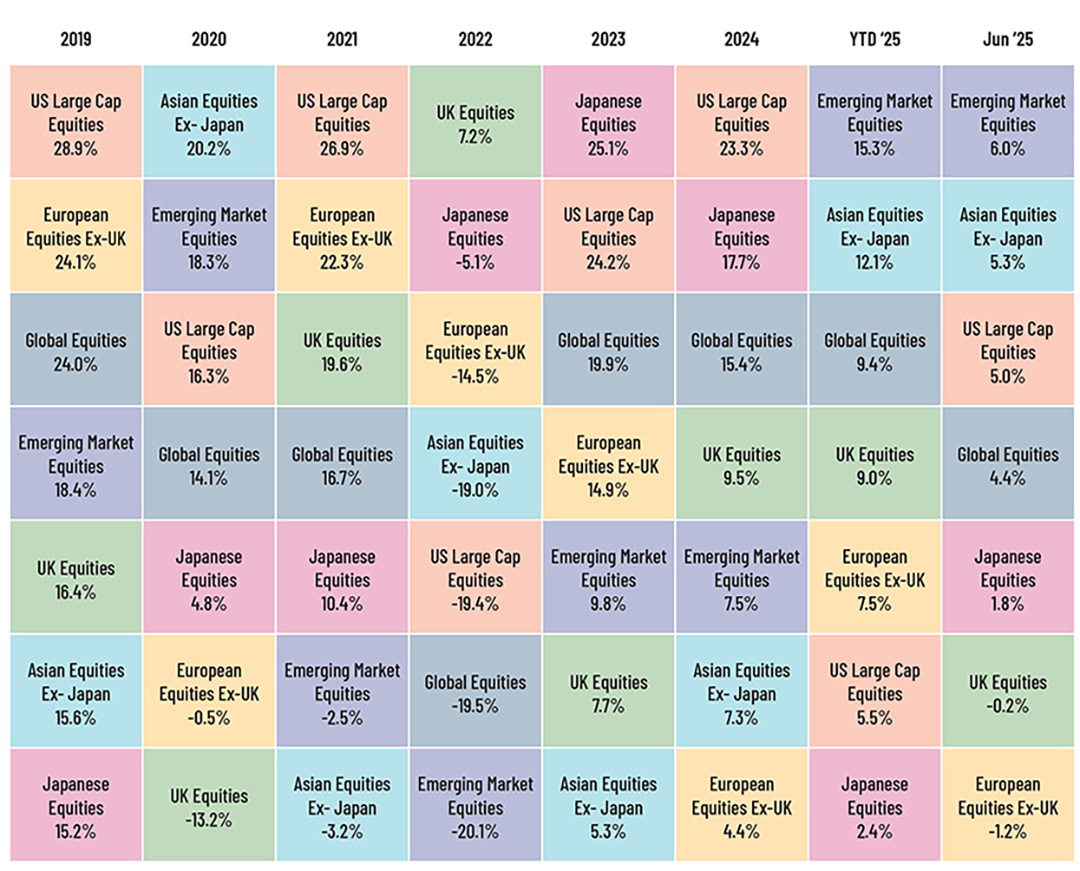

*Indices are arranged in descending order based on their performance (% gains) during the period. Each colour refers to a specific index, and it remains constant for the table.

In case you missed it

1. Discover how AI is transforming fund research and investment commentary by leveraging Generative AI and natural language processing to provide innovative insights and enhance financial decision-making – May 2025

Revolutionising fund research and investment commentary with AI

2. Learn the key strategies for successful outsourced client portfolio management with these five essential elements – May 2025

5 elements for success as an outsourced client portfolio manager

3. Navigating the future: Strategic takeaways from leading asset managers – May 2025

Key trends and recommendations in asset managers’ latest thought-leadership content

4. Check out the road ahead for the ETF market in 2025 – March 2025

ETF Market Lens – 2025 guide to the evolving ETF landscape

5. See how asset managers are leveraging the global talent pool and tech augmentation – February 2025

The future is now: How asset managers can optimise costs in an increasingly disruptive environment

What’s ahead

| Date | Country | Event |

|---|---|---|

| July 17 | UK | Unemployment rate |

| July 22 | Australia | RBA meeting minutes |

| July 23 | US | Existing home sales |

| July 25 | Germany | IFO Business Climate |

| July 31 | China | NBS Manufacturing PMI |

| August 1 | Eurozone | Inflation rate y/y flash |

| August 5 | Canada | Balance of trade |

| August 7 | UK | BoE interest rate decision |

| August 9 | China | Inflation rate y/y |