“The developments in July warrant cautious optimism about the global economic landscape. Markets are holding near their highs, supported by solid earnings and growing hopes of rate cuts. Yet, beneath the surface, uncertainty stemming from geopolitical tensions and uneven regional growth lingers. The delicate balancing act central banks are performing remains centre stage as inflation eases globally, but not uniformly. While the US economy is still resilient, signs of cooling are emerging. President Trump’s recent interaction with Federal Reserve (Fed) Chair Jerome Powell has incited significant conjecture about whether the frostiness of this relationship will determine the course of monetary policy change. The president’s recent change in stance towards China also brought its own wave of volatility across asset classes.

“The developments in July warrant cautious optimism about the global economic landscape. Markets are holding near their highs, supported by solid earnings and growing hopes of rate cuts. Yet, beneath the surface, uncertainty stemming from geopolitical tensions and uneven regional growth lingers. The delicate balancing act central banks are performing remains centre stage as inflation eases globally, but not uniformly. While the US economy is still resilient, signs of cooling are emerging. President Trump’s recent interaction with Federal Reserve (Fed) Chair Jerome Powell has incited significant conjecture about whether the frostiness of this relationship will determine the course of monetary policy change. The president’s recent change in stance towards China also brought its own wave of volatility across asset classes.

In this environment, we should remain focused on quality – of earnings, of policy signals and of macro fundamentals. Volatility may return quickly if expectations shift, so staying diversified and data-driven is key.”

– Narendra Babu, Senior Director, Financial Marketing Services

Market Pulse

Top-performing asset class:

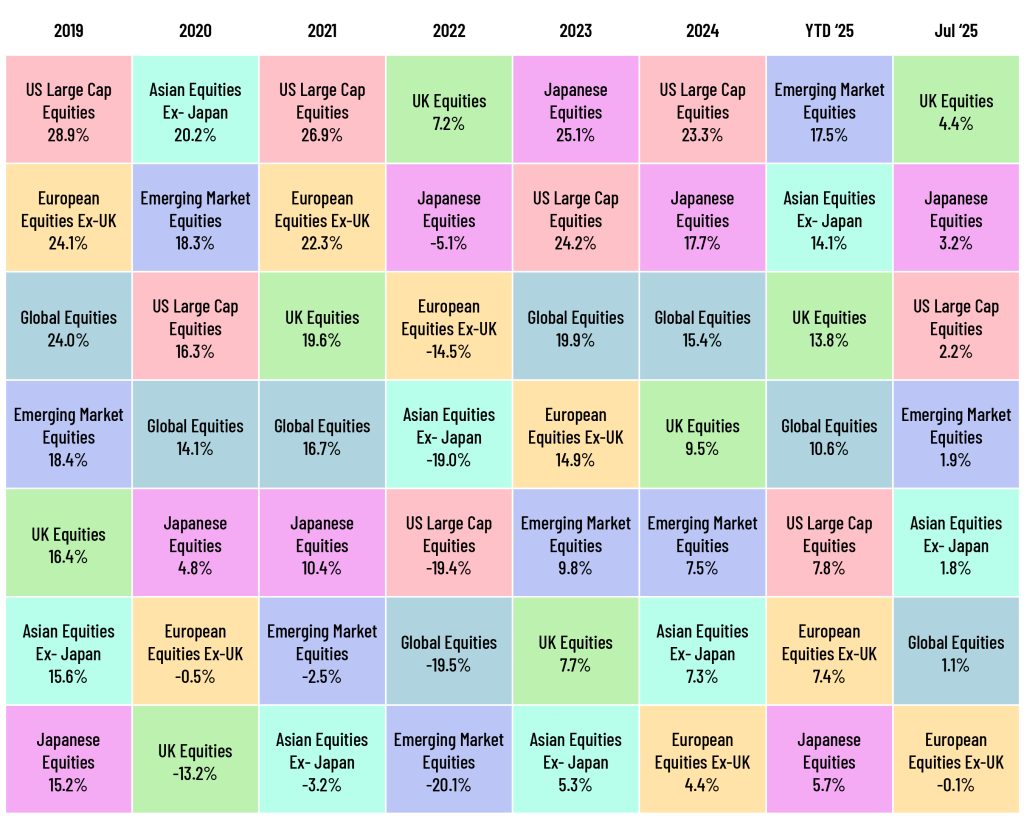

US Large Cap Equities (2.2%): US Large Cap Equities saw a strong performance, driven by robust 2Q earnings from major corporations, investor optimism around new pro-growth legislation, easing trade tensions with China and a stable interest rate environment maintained by the Fed, all of which boosted market confidence and fuelled record highs in the S&P 500.

Worst-performing asset class:

Global bonds (-1.5%): Global bonds underperformed due to rising long-term yields triggered by US fiscal concerns, including a credit rating downgrade and expansive tax policies, which reduced investor appetite and led to weaker demand from foreign buyers.

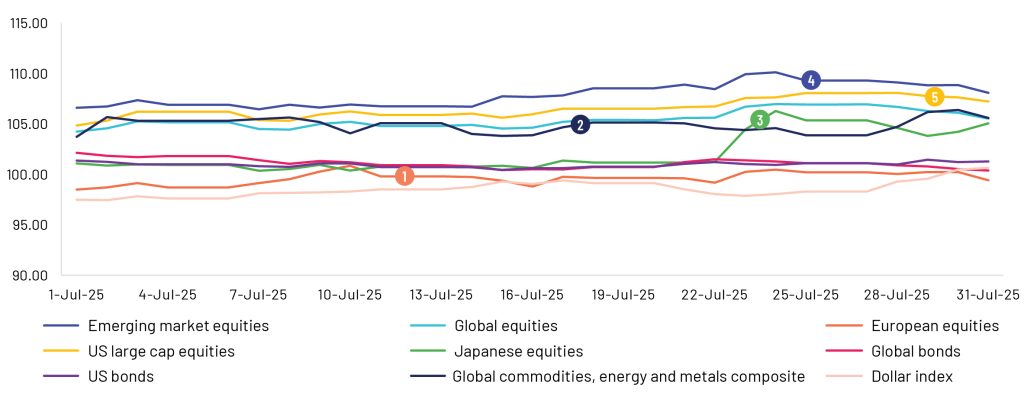

1. 12 July – European equities: The announcement of a new trade deal between the EU and the US led to a significant rally in European markets.

2. 18 July – Global commodities, energy and metals composite: Oil and natural gas declined significantly m/m, with gold facing a slight downside. Industrial metals strengthened, with hedge funds increasing bullish exposure.

3. 24 July – Japanese equities: A significant sell-off by hedge funds reduced longs and increased short positions, dragging the index down. However, the trade deal between Japan and the US boosted sentiment, pushing the index up significantly following the announcement.

4. 25 July – Emerging-market equities: The index continued prior gains from June but decelerated as the USD regained strength and trade/tariff uncertainty returned.

5. 29 July – US large-cap equities: US equities continued near record highs in mid- to late July. The index closed at fresh all-time highs, driven by strong earnings.

Equities

Global equity markets rose in July, buoyed by strong corporate earnings and optimism that tariff impacts would be limited, enhancing risk appetite. In the US, stocks reached record highs, driven by robust big tech earnings, AI-related optimism and positive trade developments. However, gains were limited by reduced expectations of a September rate cut following the Fed chair’s hawkish remarks. The Fed maintained rates at 4.25-4.50%, stressing data dependence amid persistent inflation and market uncertainty. European equities declined as initial optimism over the US-EU trade deal waned due to concerns over US-favoured terms, weak bank earnings and concerns of upcoming tariffs affecting corporate profits. UK equities hit record highs, boosted by strong earnings, UK-US trade optimism and expectations of a Bank of England (BoE) rate cut in August amid a cooling labour market and persistent inflation. Asian markets rallied, supported by strong earnings and easing trade tensions. Japan surged on the US-Japan trade deal and strong US tech earnings, with the TOPIX index reaching a record high. China soared on stimulus measures, easing US tensions and gains in rare earth and tech stocks, reaching its highest level since 2022. Taiwan rose on tech and drone stock gains, with the Taiwan Semiconductor Manufacturing Company (TSMC) hitting a record high on strong June revenue and a positive robotics outlook. South Korea advanced to near-four-year highs, driven by strong chip and auto stocks, upbeat exports and shareholder-friendly reforms. In contrast, Indian equities declined, weighed down by weak IT and bank earnings, persistent foreign outflows and renewed US trade tensions.

Fixed income

In July, the global fixed income market experienced notable developments in policy actions and trade agreements. The US negotiated with the EU, the UK, South Korea and Japan, reducing initial tariffs. The Fed kept borrowing rates at 4.25-4.50% at its July FOMC meeting amid high inflation and an uncertain economic growth outlook. The European Central Bank (ECB) also maintained its rates as it assessed the tariff impact on growth and inflation. In Asia, the People’s Bank of China (PBoC) kept rates unchanged amid sluggish growth affected by tariffs. Global fixed income indices mostly showed negative performance across Treasuries and investment grades. In emerging-market (EM) credit markets, spreads narrowed by 11 basis points (bps) for corporates and by 13bps for sovereigns, with total returns at +0.3% and +0.1%, respectively. EM local-market total returns appreciated by 0.2%, with foreign exchange marginally positive. GBP high yield (HY) provided the highest returns, followed by EUR high yield, benefiting from easing trade tensions, while US HY struggled due to a weakening USD. The US 2-year Treasury yield increased by 22bps and the 10-year Treasury yield rose by 13bps as inflation reached its highest level since February. The 10-2 Treasury yield spread stood at 0.43%, down from 0.52% in June, as manufacturing, GDP and labour data showed declines. With the 90-day tariff cooldown period ending, the Trump administration initiated country-by-country tariff negotiations to address global trade turmoil as markets prepare for further uncertainty.

Foreign exchange

The USD ended July with its first monthly gain of the year, bolstered by Fed Chair Powell’s hawkish commentary, favourable economic data and the US-EU trade agreement (a 15% import tariff on EU goods) ahead of the Fed FOMC meeting. Consequently, the EUR/USD currency pair retreated in July from its June highs. Weaker-than-expected data pushed the GBP to new lows against the EUR. The USD/MXN pair edged lower after President Trump announced a 90-day postponement of the proposed 30% tariff increase. The JPY weakened earlier in the month due to USD gains, reaching 150. Later in the month, USD/JPY rebounded to around 147, driven by a mid-month election, improved Japan-US trade sentiment and the Bank of Japan’s (BoJ’s) upwardly revised inflation forecasts. Asian currencies (IDR, KRW, MYR, etc.) broadly weakened on a stronger USD, renewed trade tensions and capital outflows. The INR was volatile, with overall depreciation triggered by persistent US-India trade uncertainty and sustained FII outflows. The CNY rose to a nine-month high by the end of July as the PBoC lowered the daily fixing rate and tariff tensions eased.

Commodities

The commodity complex had mixed performances in July, with industrial metals and grain prices declining. Gold remained steady around USD3,300/oz as President Trump scheduled multiple negotiations after extending new tariffs. The strength of the USD and Treasury yields limited gains for gold. Silver prices surged to multi-decade highs as market participants favoured cheaper alternatives to gold amid tight physical supply conditions. LME copper prices fell by 2.6% m/min July after the White House detailed copper tariffs effective 1 August, applying only to semi-furnished copper products, excluding refined and concentrate imports. ICE Brent oil prices rose after President Trump gave Russia 10 days to reach a truce with Ukraine or face additional sanctions, allowing OPEC+ to consider unwinding supply cuts despite potential deficits. US natural gas was the biggest loser, with front-month Henry Hub futures dropping 10% m/m in July due to rising storage levels. As of 25 July, total gas stockpiles were 3.123 Tcf, down 3.8% y/y but 6.7% above the five-year average. In agri-commodities, grains performed weakly, with corn and wheat at the CBOT falling over 7% m/m and 2.7% m/m, respectively, due to expectations of better supplies, favourable weather and higher inventories in major producing nations.

Outlook

The global economy is showing modest improvement, with growth slightly upgraded due to stronger-than-expected activity in key regions. The International Monetary Fund’s (IMF’s) recent update highlights positive momentum from early stockpiling ahead of trade barriers, fiscal support in major economies and a weaker USD. However, global growth remains slower than the long-term average and faces continued risks. Key concerns include escalating trade tensions, particularly among major powers, rising public debt, policy uncertainty and geopolitical instability. Inflation continues to ease globally, but disinflation remains uneven across regions, keeping central banks cautious. The US is experiencing subdued growth due to lingering effects of prior monetary tightening, USD strength, diminished fiscal tailwinds and higher tariffs. China’s growth is holding up due to public investment and lighter-than-expected effects from recent tariffs. India remains the fastest-growing major economy, and emerging markets broadly continue to expand at a healthy pace. Overall, the outlook is cautiously optimistic but fragile. Global cooperation, clear trade policies and disciplined economic governance will be essential to sustain momentum and avoid setbacks in the coming months.

Central-bank quotes

“Recent indicators suggest that growth of economic activity has moderated. GDP rose at a 1.2 percent pace in the first half of the year, down from 2.5 percent last year. Although the increase in the second quarter was stronger at 3 percent, focusing on the first half of the year helps smooth through the volatility in the quarterly figures related to the unusual swings in net exports. The moderation in growth largely reflects a slowdown in consumer spending. In contrast, business investment in equipment and intangibles picked up from last year’s pace. Activity in the housing sector remains weak. In the labor market, conditions have remained solid. Payroll job gains averaged 150 thousand per month over the past three months. The unemployment rate, at 4.1 percent, remains low and has stayed in a narrow range over the past year. Wage growth has continued to moderate while still outpacing inflation. Overall, a wide set of indicators suggests that conditions in the labor market are broadly in balance and consistent with maximum employment.”

– Jerome Powell, Chairman, Federal Reserve (30 July 2025)

“Monetary policy has been working as expected and we’ve made good progress on bringing inflation down over the past 18 months. But quarterly trimmed mean inflation has only been in our 2 to 3 per cent target range for one quarter at 2.9 per cent in March. Very pleasingly unemployment remains low at 4.1 per cent. And we’ve already cut the cash rate by 50 basis points since February this year, the effects of which are still to flow through to the economy. The data and policy outcomes around the world since the May meeting have been close to what we expected in our latest baseline forecasts published in May, but economic conditions remain uncertain. We’re waiting to confirm whether inflation is still on track to sustainably reach 2.5 per cent.”

– Michele Bullock, Governor of the RBA (8 July 2025)

Market Indices

*ndices are arranged in descending order based on their performance (% gains) during the period. Each colour refers to a specific index, and it remains constant for the table.

In case you missed it

1. Discover the ethical compass every investment writer must follow to build trust and credibility in financial storytelling – July 2025

https://www.acuitykp.com/blog/ethical-responsibilities-of-an-investment-writer/

2. Highlighting how AI and generative technologies are transforming fund research and commentary by enhancing speed, accuracy and insight generation – May 2025

Revolutionising fund research and investment commentary with AI

3. Learn how outsourced client portfolio managers can support fund managers through reporting, marketing and client engagement – May 2025

Role of an Outsourced Client Portfolio Manager: 5 Ways to Succeed | Acuity Knowledge Partners

4. A comprehensive outlook on the evolving ETF landscape, highlighting trends such as active ETFs, crypto products and market consolidation – March 2025

ETF Market Lens – 2025 Guide to the Evolving ETF Landscape

5. Explore how asset managers are leveraging global talent and AI-driven technologies to enhance operational efficiency and stay competitive – February 2025

The future is now: How asset managers can optimize costs in an increasingly disruptive environment

What’s ahead

| Date | Country | Event |

|---|---|---|

| 15 August | Japan | GDP growth rate q/q |

| 20 August | US | FOMC minutes |

| 24 August | Germany | EIfo Business Climate |

| 28 August | Germany | GfK Consumer Confidence |

| 31 August | China | NBS Manufacturing PMI |

| 2 September | US | ISM Manufacturing PMI |

| 4 September | Canada | Balance of trade |

| 11 September | Eurozone | ECB interest rate decision |

| 12 September | US | GDP m/m |