Investor sentiment remains cautiously optimistic. Despite elevated valuations, equities are buoyed by strong corporate earnings – especially in the US – and a supportive macro backdrop. A 50bps US Federal Reserve (Fed) rate cut is widely expected amid signs of labour-market cooling. Tech, led by AI-driven mega caps, continues to dominate, although concerns over sustainability and monetisation are rising. In this environment, small-cap equities may offer relative value and diversification. Trade policy uncertainty has overtaken inflation as the key risk. The US’s aggressive stance – via broad tariffs and targeted actions against China and India – has triggered retaliation and heightened volatility. These shifts are forcing operational recalibrations across sectors. While near-term outlooks are mildly positive, geopolitical tensions and supply-chain risks persist. Diversification and robust trade frameworks are vital for mitigating these headwinds.

Investor sentiment remains cautiously optimistic. Despite elevated valuations, equities are buoyed by strong corporate earnings – especially in the US – and a supportive macro backdrop. A 50bps US Federal Reserve (Fed) rate cut is widely expected amid signs of labour-market cooling. Tech, led by AI-driven mega caps, continues to dominate, although concerns over sustainability and monetisation are rising. In this environment, small-cap equities may offer relative value and diversification. Trade policy uncertainty has overtaken inflation as the key risk. The US’s aggressive stance – via broad tariffs and targeted actions against China and India – has triggered retaliation and heightened volatility. These shifts are forcing operational recalibrations across sectors. While near-term outlooks are mildly positive, geopolitical tensions and supply-chain risks persist. Diversification and robust trade frameworks are vital for mitigating these headwinds.

– Narendra Babu, Senior Director, Financial Marketing Services

Global Markets

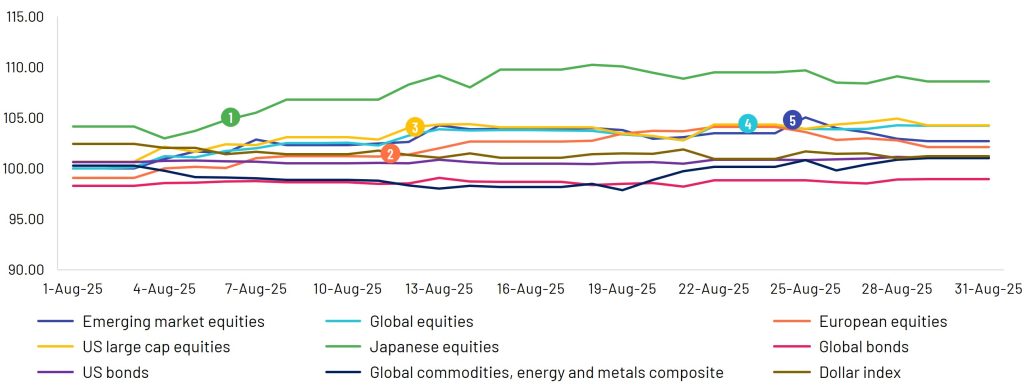

1. 7 Aug – Japanese equities: The TOPIX hit an all-time high, continuing a four-session rally amid optimism from trade developments and tariff relief.

2. 11 Aug – European equities: European indices outperformed on strong corporate earnings.

3. 13 Aug – US large-cap equities: US equities rose, reaching a fresh all-time high, amid tightening rate-cut expectations and easing volatility.

4. 23 Aug – Global commodities: Oil rebounded due to support, gold held high on dovish Fed signals and base metals rose on tight supply and China-related optimism.

5. 25 Aug – Emerging-market equities: A notable shift was seen due to declining confidence in developed markets, especially the US, and a weakening USD, which enhances their attractiveness.

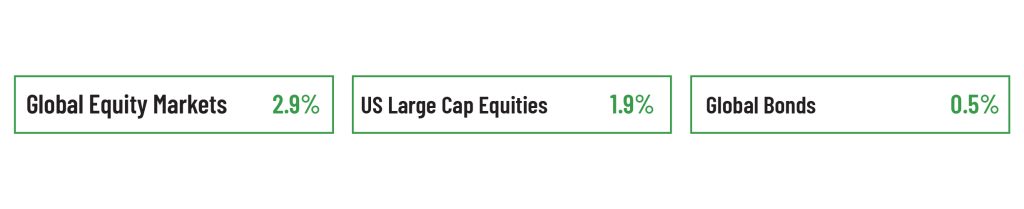

Equities

Global equities rose in August, driven by strong earnings in the artificial intelligence (AI) and tech sectors and increased investor confidence as capital shifted to European and emerging markets. US stocks posted robust gains, fuelled by solid corporate earnings and AI-related optimism. The rally gained momentum after inflation data reinforced expectations of a Fed rate cut in September. However, markets cooled slightly at month-end due to tariff-related and geopolitical concerns. European equities advanced, supported by optimism over the new EU-US trade deal and anticipated US rate cuts. UK equities rose, with the FTSE 100 reaching a record high, driven by strength in consumer stocks and rate-cut expectations. However, the market ended lower due to banking-sector weakness. The Bank of England (BoE) cut rates by 25bps to 4.00%. Asian equities posted modest gains, led by a tech-driven rally and foreign inflows. Chinese equities surged to decade highs, fuelled by domestic tech-sector optimism, easing trade tensions and strong state-backed support. Increased retail investor participation added momentum. Indian stocks declined for the second consecutive month, impacted by steep US tariff hikes on Indian exports, weak June-quarter earnings and heavy foreign investor outflows, despite some optimism from proposed GST reforms. South Korean equities experienced early volatility as new tax reform proposals triggered a sharp sell-off, compounded by weaker-than-expected export growth in key sectors such as automobiles and steel, which were hit hard by US tariffs.

Fixed Income

In August, the global fixed income market witnessed significant geopolitical and trade events. The Trump administration announced new tariffs of 35% on Canadian goods, 30% on South African goods, 20% on Vietnamese goods and 50% on Indian exports, causing market volatility. The Fed kept rates unchanged at 4.25-4.50%, with Chair Jerome Powell hinting at possible rate cuts due to inflation and rising unemployment. President Trump’s attempts to dismiss the Fed governor and influence central-bank policy raised concerns over the Fed’s autonomy and market stability. The BoE cut rates by 25bps to 4.00% to address inflation and a weakening economy, with Governor Andrew Bailey indicating gradual future cuts. The People’s Bank of China (PBoC) kept rates unchanged, while India maintained its rate at 5.50% as inflation eased. Global fixed income indices showed positive performance across Treasuries, investment grades and high yields. Emerging markets delivered positive returns for both sovereigns and corporates, driven by stability, strong fundamentals and robust policy frameworks by managing inflation efficiently and providing more flexibility than developed markets. Strategic balancing of hard- and local-currency exposures offered diversification benefits from US-based fixed income strategies. Emerging-market (EM) high-yield bonds outperformed investment-grade corporate bonds. US 2-year and 10-year bond yields fell to 3.62% and 4.25%, respectively, as unemployment rose and consumer confidence declined. The USD weakened due to concerns about economic growth, inflation and unemployment, with the 10- to 2-year Treasury yield spread increasing to 0.64% from 0.43% in July, as manufacturing, GDP and labour data softened.

Foreign Exchange

In August, the USD weakened due to disappointing job growth, with July payrolls at just 73,000 – a significant downward revision from previous months. Persistent inflation made the Fed cautious, prompting Fed Chair Jerome Powell to signal a dovish shift, citing labour-market weakness. Conversely, the EUR strengthened as German business morale, reflected by the Ifo Business Climate Index, reached a 15-month high and recent activity data showed solid momentum. The strong labour-market performance allowed the European Central Bank to pause rate cuts, boosting the EUR against the weaker USD. The GBP also gained against the USD due to investor concerns over Fed independence, political instability in the US and expectations of interest-rate cuts, which improved market sentiment towards the GBP. The JPY/USD pair, the most volatile, saw the JPY strengthen against the USD, driven by converging interest-rate differentials, an unwinding of carry trades and increased safe-haven demand. The Bank of Japan’s upward revision of its inflation outlook added policy credibility, while global economic uncertainty and tariff-related tensions further supported JPY strength. EM and Asian currencies outperformed the USD in August, bolstered by favourable rate differentials, strong EM fundamentals, attractive valuations and supportive global growth amid shifting US fiscal and trade policies.

Commodities

In August 2025, global commodity markets experienced a downturn. Gold and silver prices reached record highs due to escalating Russia-Ukraine tensions and a weakening USD, which increased safe-haven demand. Anticipation of US interest rate cuts further fuelled the rally. However, US gold futures trimmed gains after White House officials hinted at upcoming tariff policy changes. Industrial demand from the solar and automotive sectors also boosted silver. Copper prices rose slightly, supported by political backing for a major US mining project and initial tariff announcements, but momentum eased due to exemptions and market corrections. Global supply shifts and refining-related challenges added volatility. In the energy sector, crude oil prices fell due to oversupply concerns and geopolitical disruptions. OPEC+ announced a significant output increase for September, while weak US fuel demand added pressure. Sanctions on Russia and Iran, Trump’s tariff threats on India and Ukrainian drone strikes on Russian oil infrastructure disrupted supply chains. However, subdued global growth kept demand weak, limiting price gains. Traders also considered India’s response to US pressure on Russian oil. US natural gas prices dropped, with Henry Hub futures reaching their lowest since November 2024. Cooler weather forecasts reduced demand for air conditioning, while production reached record highs. Although storage accumulations were smaller than expected and LNG exports rose slightly, inventories remained above average, keeping prices under pressure. In agricultural commodities, coffee prices surged due to adverse weather and US tariff threats on key suppliers, tightening an already strained global market. Corn prices rose due to easing harvest concerns, weather-related yield risks in the western corn belt and stronger-than-expected US export sales. Wheat futures declined to near-five-year lows, driven by abundant global supply and upward revisions to Russia’s crop forecast. Poland’s rising surplus, despite poor harvest quality, suggests low-grade shipments entering the market. With stiff competition from Black Sea exporters, traders are increasingly concerned about pricing pressure. Cocoa prices fell amid improved weather in Côte d’Ivoire, weaker industrial and global chocolate demand, and pricing tensions in Ghana.

Outlook

The global economic outlook for September 2025 is marked by modest expectations and cautious sentiment. The IMF recently raised its 2025 global growth forecast to 3.0%, citing easing tariff pressures, frontloaded spending and more accommodative financial conditions. Global investors are anticipating a 25bps rate cut by the Fed in September, driven by weakening labour data, elevated inflation and growing dovish expectations for US policy. However, tariff uncertainty continues to cloud the global economic horizon. Experts at the World Leaders Forum warn that ongoing trade tensions may disrupt supply chains and deter investment, potentially undermining global growth. Sector strategists foresee renewed strength in oilfield services and natural gas, driven by disciplined spending and rising AI-related demand. Offshore services are gaining traction amid limited upstream investment, with opportunities emerging in the US, India, Europe and China. Concerns relating to global growth are tempering markets: Powell’s recent caution about downside risks to employment has heightened concerns of a global slowdown, driving investor interest towards safe havens such as gold. September stands at a crossroads. Monetary easing is nearly priced in, but persistent trade disruptions and geopolitical instability threaten to dampen global momentum. Selected markets might outperform, although broader growth remains fragile.

Central-bank quotes

“Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside – a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance. Monetary policy is not on a preset course. FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach.”

– Jerome Powell, Chairman, Federal Reserve (22 August 2025)

“At this meeting, the Monetary Policy Committee judged that a further 0.25 percentage points reduction in Bank Rate was appropriate. Based on the outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate. The restrictiveness of monetary policy has fallen as Bank Rate has been reduced. The timing and pace of future reductions in the restrictiveness of policy will depend on the extent to which underlying disinflationary pressures continue to ease. Monetary policy is not on a pre-set path, and the Committee will remain responsive to the accumulation of evidence.”

– Andrew Bailey, Governor of the BoE (7 August 2025)

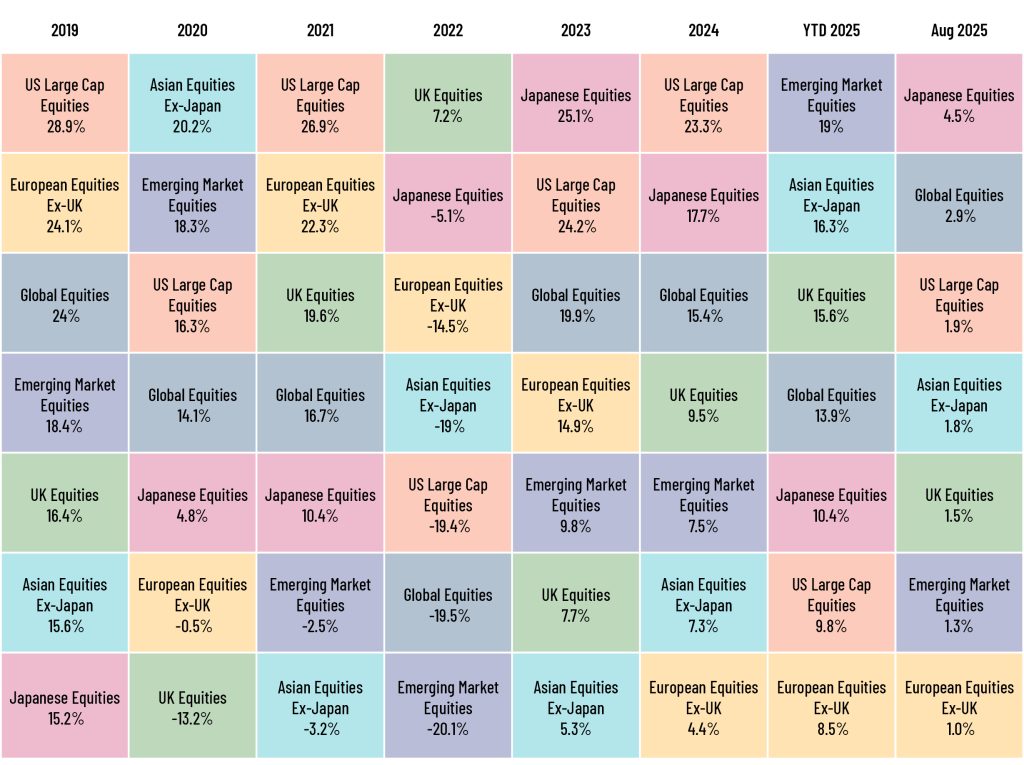

Market Indices

*ndices are arranged in descending order based on their performance (% gains) during the period. Each colour refers to a specific index, and it remains constant for the table.

In case you missed it

1. Discover the ethical compass every investment writer must follow to build trust and credibility in financial storytelling – July 2025 https://www.acuitykp.com/blog/ethical-responsibilities-of-an-investment-writer/

2. Highlighting how AI and generative technologies are transforming fund research and commentary by enhancing speed, accuracy and insight generation – May 2025 Revolutionising fund research and investment commentary with AI

3. Learn how outsourced client portfolio managers can support fund managers through reporting, marketing and client engagement – May 2025Role of an Outsourced Client Portfolio Manager: 5 Ways to Succeed | Acuity Knowledge Partners

4. A comprehensive outlook on the evolving ETF landscape, highlighting trends such as active ETFs, crypto products and market consolidation – March 2025ETF Market Lens – 2025 Guide to the Evolving ETF Landscape

5. Explore how asset managers are leveraging global talent and AI-driven technologies to enhance operational efficiency and stay competitive – February 2025 The future is now: How asset managers can optimize costs in an increasingly disruptive environment

What’s ahead

| Date | Country | Event |

|---|---|---|

| 15 September | China | Retail sales y/y |

| 18 September | UK | BoE interest-rate decision |

| 19 September | Japan | Inflation rate y/y |

| 23 September | Germany | HCOB Manufacturing PMI flash |

| 25 September | US | GDP growth rate q/q final |

| 30 September | Australia | RBA interest-rate decision |

| 1 October | Euro area | Inflation rate y/y flash |

| 3 October | US | Unemployment rate |

| 7 October | Germany | Balance of trade |

| 13 October | China | Exports y/y |