Introduction

Executive summary

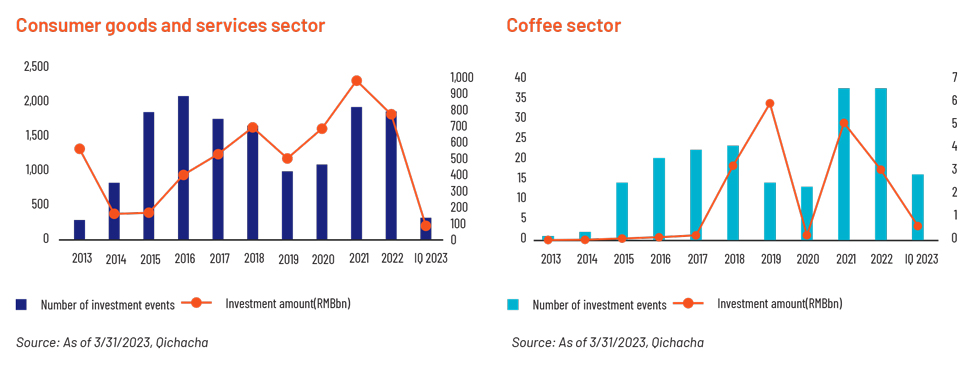

With high growth potential, long-term demand, government support and a rapidly changing market landscape, China’s coffee sector is attracting large investments, making it recover the fastest post-pandemic from among consumer goods and services subsectors. Following the lifting of the Zero-COVID policy in November 2022, the number of investment events in China’s coffee sector was 16 in 1Q23, almost half the number for all of 2022, while China’s coffee sector’s share of the consumer goods and services sector jumped from 2.0% in 2022 to 4.9% in 1Q23. Despite the challenges of increasingly fierce competition and changing consumer needs, there are still many opportunities for growth in China’s coffee sector, particularly among the younger generations and untapped markets in lower-tier cities.

Four reasons for investing in China’s coffee sector

1. Large potential for market growth

Driven by economic development, revenue generated by China’s coffee segment increased significantly from USD4.73bn in 2012 to USD14.22bn in 2021, according to Statista, and is estimated to continue growing to USD20.22bn in 2025. However, China’s coffee market still seems to be lagging behind other mature markets, leaving plenty of room for growth. In terms of total coffee bean consumption, China consumed only 290,000 tons in 2022, far below the US’s (1,600,000), Brazil’s (1,340,000) and Japan’s (430,000) consumption.

2. Long-term and diversified demand

Following the five stages of development of China’s coffee market, coffee is now widely accepted by the public in China, mainly due to its addictive properties and increasingly diverse consumer demand. According to a survey by Deloitte, consumers who started drinking coffee over five years ago prefer to buy several cups of coffee per day, while those who started drinking coffee within the past year would buy only one or two cups per week.

3. Support of local governments and leading companies

As sectors in which foreign investment is encouraged, coffee cultivation and coffee beverage R&D have been supported by local government, particularly in Yunnan province, the main coffee-growing area in China. Coupled with a series of initiatives by local governments to pay subsidies, introduce high-quality coffee varieties and delineate suitable areas for coffee plantation, leading companies such as Starbucks, Nestlé and Seesaw are trying to improve the quality of Yunnan coffee beans by establishing planting bases, introducing international standards and training farmers.

4. Rapidly changing competitive landscape

China’s coffee market concentration is quite low, according to Mordor Intelligence, meaning it is a fragmented sector without too many dominant players. Taking China’s freshly brewed coffee segment as an example, Starbucks’ market share fell to 36% in 2020 from 60% in 2018, while the market share of other companies rose sharply, to 51% in 2020 from 25% in 2018, indicating a rapidly changing competitive landscape.

Outlook: Opportunities and challenges

Chinese coffee consumers mainly belong to the middle-income group aged 20-29. As China’s middle-income group continues to grow, Gen Z (born in 1995-2009) will dominate China’s coffee market over the next 10 years, with high preference for coffee and purchasing power resulting in a growing pool of potential coffee consumers. In addition, the penetration of coffee shops in lower-tier Chinese cities is still quite low, with only 13% in tier 3 and below cities by 2022. Meanwhile, coffee takeaway orders grew the fastest in tier 3 and below cities, indicating the large untapped market in lower-tier Chinese cities.

In addition to seizing opportunities for growth in China’s highly competitive and dynamic coffee market, companies in the sector need to keep innovating and remain adaptable if they are to maintain their edge. On the one hand, the highly competitive market has led to a price war between coffee brands, all of which are under pressure to keep prices low while maintaining quality. On the other hand, changing consumer needs require coffee brands to adapt their products or services and constantly launch new products to attract consumers.

How Acuity Knowledge Partners can help

As an extension of our global client team, Acuity’s Beijing office has been providing research and analysis services for over a decade. With a long-term presence on the ground and a large pool of bilingual research analysts, we help global clients with an interest in China’s coffee sector monitor the local market, producing thematic research reports, building financial models and translating policy documents. Benefiting from our expertise and language skills, our clients have gained an edge in keeping up with the trends in China’s coffee sector.