Introduction

Executive summary

High inflation was rampant in 2022, eroding real income, disrupting the financial markets and weighing on the economy. To tame it, the Federal Reserve (Fed) has been hiking interest rates since March 2022, by a cumulative 475bps until April 2023. It also started tapering around the same time. Although inflation was moderated, pushing it back to the 2% target still requires more work. Liquidity shrinking and high interest rates resulted in a banking crisis, prompting the Fed to slow interest rate hikes and even completely revise the direction of monetary policy. The 2023 outlook is gloomy, shadowed by the high interest environment, a still-resilient labour market, volatile energy prices and financial system instability.

What ailed the US economy in 2022?

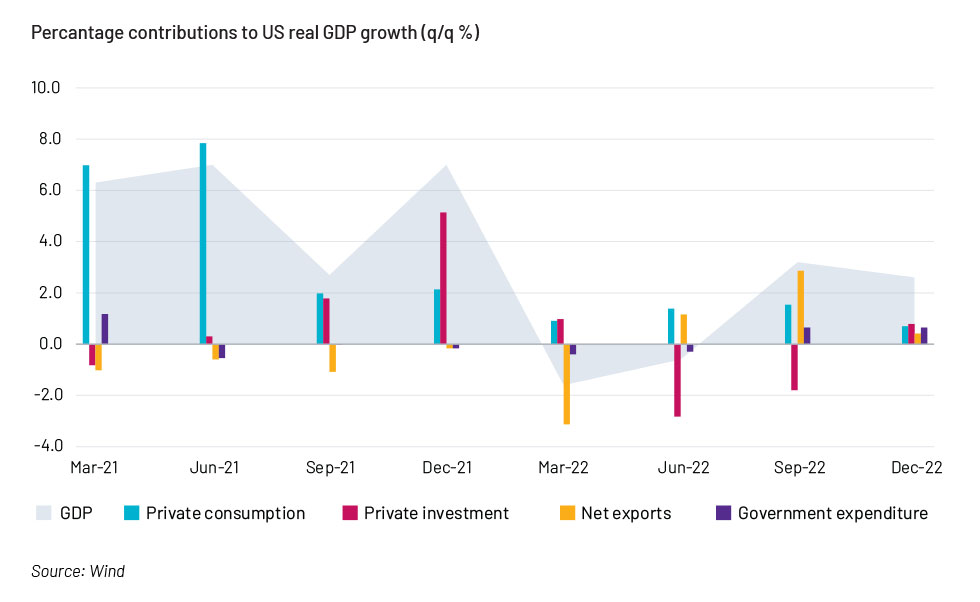

High inflation best characterises the world economy in 2022. CPI in the US was 8.1%, the highest in 40 years. High inflation and consumption have been eroding savings accumulated amid the pandemic, resulting in slower growth in private expenditure and demand for higher wages. Disruption in commodity markets induced by the Russia-Ukraine war also pressured inflation from outside. Aiming to fight surging domestic CPI, the Fed’s aggressive interest rate hikes suppressed consumption and investment. In 2022, US real GDP growth slowed to 2.1% y/y from 5.9% y/y in 2021.

Factors pushing up inflation

US inflation started to soar in April 2021 and peaked in June 2022 under pressure from both the demand and supply side. Loose monetary policy and stimulative fiscal policy amid the pandemic were the main drivers of strong aggregate demand. While supply-chain disruptions played a significant role in increasing the US PPI, the Russia-Ukraine conflict also sent food and oil prices to their peaks, driving up headline inflation. High services CPI bolstered by housing rents and wages was introducing tenacity to this wave of inflation.

The Fed’s fight against high inflation

In March 2022, when US CPI soared to 8.5%, the Fed began a hawkish interest rate hiking cycle to fight inflation. It increased the Fed funds rate by a cumulative 475bps until April 2023, raising the target range for the rate to 4.75-5%, the highest since October 2007. Headline inflation fell while core inflation stood more steadily above central banks’ comfort levels, and its easing trend has been offset by a sharp rise in services inflation. Almost simultaneously with its interest rate hike, the Fed planned to shrink its balance sheet by USD80bn a month, on average, from June 2022, aiming to reduce it from USD8.94tn to USD5.9tn in the following three years, pushing market rates even higher.

Side effects have emerged. Liquidity was strained due to the interest rate hikes and tapering, forcing banks to sell long-term fixed income products to meet short-term withdrawals, resulting in Silicon Valley Bank’s bankruptcy and Credit Suisse’s crisis due to the spill-over of market panic.

A gloomy outlook for 2023

Although US inflation has moderated from its peak amid the Fed’s aggressive tightening monetary policy, the economic outlook for the US is still gloomy in 2023, as predicted by the inverted interest curve. The high interest rate environment and quivering banking system, a still tenacious labour market and lingering external pressure on commodity prices are all adding uncertainty to the US economy.

Acuity Knowledge Partners’ value proposition

Global organisations and research houses leverage our sector- and country-specific expertise to make sound strategic decisions. We set up dedicated teams of analysts and macro-level associates to support our clients in areas such as macroeconomic research, industry profiling, financial analysis, econometric modelling, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.