Introduction

Introduction

The onset of the COVID-19 pandemic saw central banks taking supportive actions to mitigate the business impact of the resultant lockdowns. Set in the backdrop of investors’ hunt for yield amid recovering growth and rising inflation, our survey tried to assess the manner in which fixed income asset managers navigated the challenging times.

The fixed income and credit research survey further analysed the importance of credit research for fixed income asset managers, the level of satisfaction and preferences of fixed income research teams amid the changing landscape. The survey offered insights on the key challenges faced by fixed income research teams as well as the possible solutions that can help improve operational flexibility.

Respondent profiling

Acuity surveyed stakeholders in the global fixed income and credit space in 2021, including CxOs, heads of research, portfolio managers and senior credit analysts in the buy- and sell-side fixed income space.

Since the survey focused on decision makers, it was imperative to have respondents holding senior positions; more than 65% of the respondents had more than a decade of experience.

The respondents were spread across the investment spectrum, with a 60%:40% split between institutional and retail asset managers.

Survey insights

The survey first starts at a high-level view on the interest rate trajectory and then drills down into various sub-segments of the fixed income asset class.

Respondents provided their views on investment grade, high yield, emerging markets, CLO and leverage loan sub-segments.

The survey then assimilates the respondents’ approach to research and the challenges of the current research. To address the challenges, the survey also gives a peak into how an outsourced research partner can add value.

Conclusion / Key takeaways:

1) As the easing cycle ends, respondents had a neutral view on fixed income markets and indicated that certain sub-segments, such as distressed debt and collateralised debt obligations, will offer pockets of opportunity from repricing.

2) High inflation and anemic growth sentiment remain the key near-term headwinds for asset managers.

3) During the turbulent times, 90% of the respondents believed that superior research is the key to generating alpha.

4) 75% of the respondents were either unhappy or only moderately satisfied with sell side research and rating agencies due to various limitations.

5) 50% of the respondents considered offshoring of research as a potential solution to enhance team performance but had reservations on data privacy.

Acuity’s Value proposition

We help clients overcome the challenges caused by increased pressure on the research function. We provide internalised research solutions that offer flexibility and enable clients to maintain their core competency through in-house research. We are SOC-II compliant and maintain high data security standards.

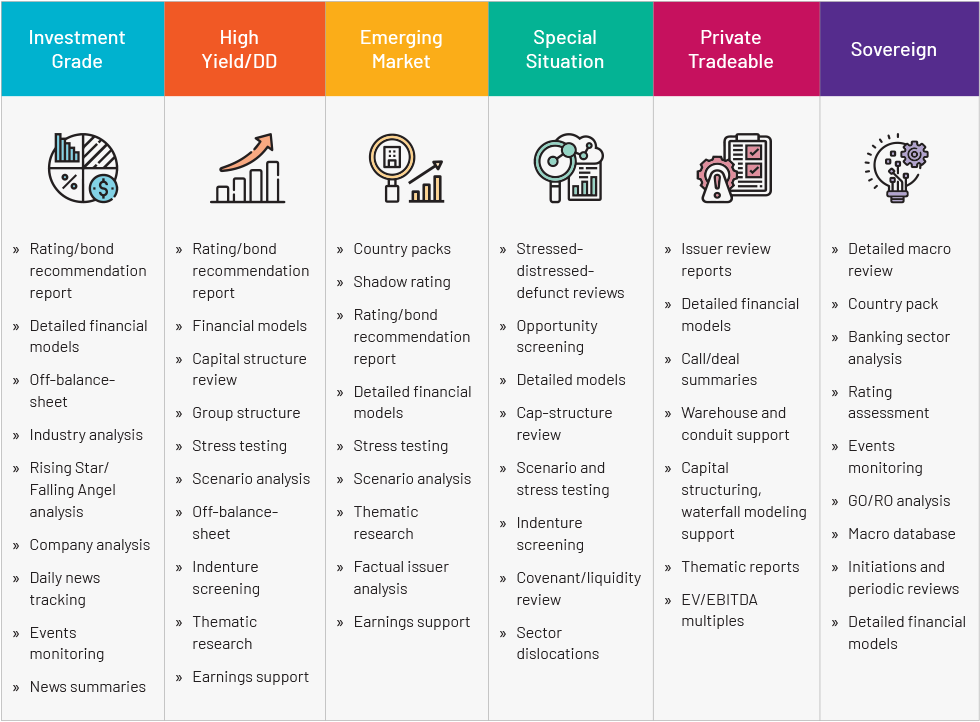

Our credit research solutions have helped financial institutions implement their strategies and grow revenue, increase productivity, reduce risk, enhance returns and make better decisions.