Introduction

Introduction

ESG due diligence pays off: investors should be alert to “sustainability washing”

The recent proliferation of self-labelled ESG debt instruments has created an increasingly complex investment landscape for fixed income asset managers to navigate, leaving them vulnerable to "sustainability washing" by unethical credit issuers.

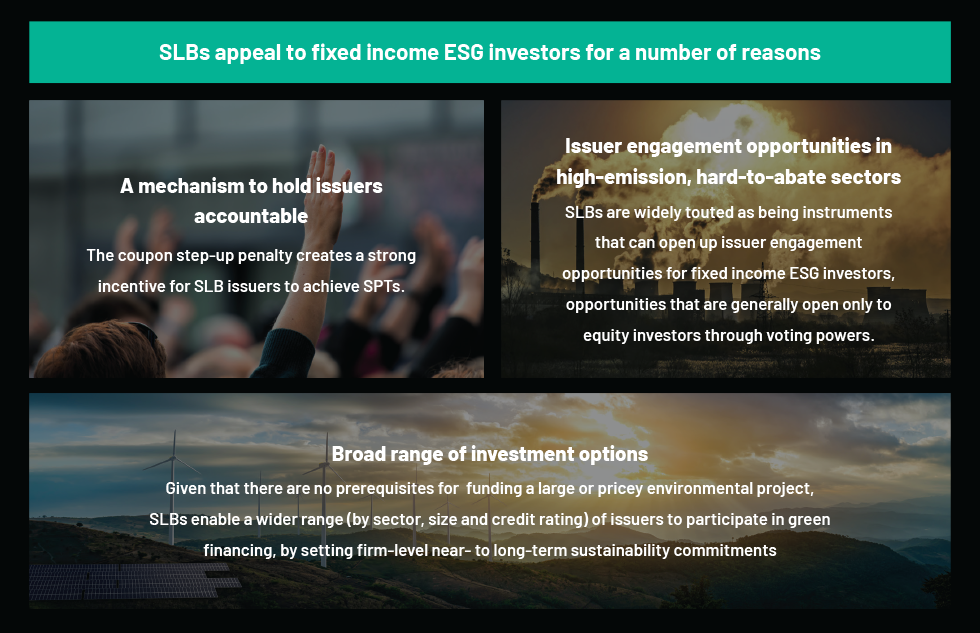

This is especially a concern for the newcomer to the sustainable-debt universe, sustainability-linked bonds (SLBs). This new generation of ESG-labelled bonds has been touted as having the potential to take fixed income ESG investing mainstream, by providing investor engagement opportunities previously limited to equity investors through proxy voting. However, at the same time, this rising star of sustainable debt is extremely vulnerable to “sustainability washing”, given a lack of compulsory market standards or enforceable regulations for issuers, as well as the flexibility afforded to issuers to set their own key performance indicators (KPIs)/sustainability performance targets (SPTs), which are often unambitious or exclude a large share of their carbon footprint. Issuers also set their own coupon step-up penalties, which set in if SPTs are not achieved, creating another avenue to manipulate structural loopholes such as setting low coupon step-ups or step-ups that kick in after the bond’s call date.

SLBs: rising star or problem child of the sustainable-debt universe?

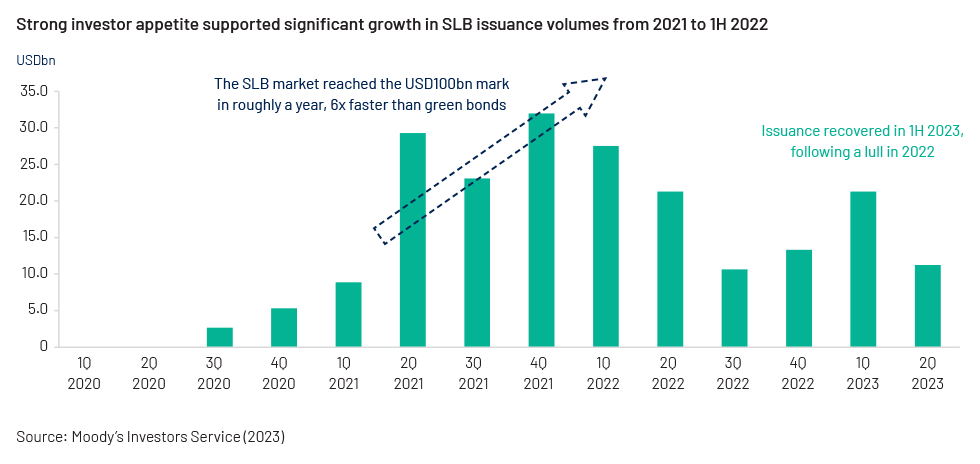

Initial hype: the SLB market reached the USD100bn threshold 6x faster than green bonds amid sky-rocketing popularity

SLBs grew exponentially after the launch of the first SLB by Enel in September 2019, with the market reaching the USD100bn mark in 2021, roughly 6x faster than green bonds. In this initial honeymoon phase, each new issuance was celebrated by ESG investors and heavily oversubscribed, offering an opportunity to issuers (particularly from carbon-intensive sectors) that were previously unable to participate in the sustainable-debt market to signal their energy transition/decarbonisation objectives and commitment to sustainability improvement while raising cheaper financing. The instrument remained popular in 1H 2022, with new issuance up c.28% y/y – the only bright spot in the sustainable-debt universe amid a slump in overall green, social, sustainability and sustainability-linked (GSSS) debt, with new issuance falling by c.14% y/y during the same period. However, SLB issuance volumes declined (-57.5% y/y) in 2H 2022 amid a challenging market landscape for fixed income markets in general, and the decline continued into 1H 2023 (-33.3% y/y), in contrast to a recovery in the rest of the GSSS market, amid investor concerns about sustainability washing.

Issuer engagement: SLBs can revolutionise the role played by debt financing in the transition to net zero

The structure of an SLB is straightforward: it is a performance-based instrument, with a coupon linked to pre-defined SPTs that are calibrated to environmental or social KPIs. If the issuer fails to achieve its SPTs by the stipulated time frame, it incurs a penalty, generally in the form of a coupon step-up. In contrast to use-of-proceeds bonds (green, social and sustainability bonds), where funds raised finance/refinance specific projects, proceeds from SLBs can be used for any purpose. This flexibility has boosted their popularity with issuers, as it renders them suitable for a wide range of sectors (including healthcare, fashion, FMCG, industrials, materials and mining), whereas green bond issuance has thus far been from a limited range of sectors due to the requirement for a large or pricey green-eligible project.

Acuity’s SLB rating product: a three-pillar, nuanced scoring system

Introduction

We concur with investors that debatable practices of certain SLB issuers pose challenges in distinguishing between issuers abusing the instrument for their gain and issuers genuinely committed to improving their carbon footprint or social goals. However, this could be addressed through the use of robust SLB rating structures, such as Acuity’s proprietary scoring product, which can flag subpar SLB issuance with poor sustainability credentials.

Acuity’s experienced credit research team has designed an SLB rating system that looks beyond the ESG self-label and market hype/oversubscription of SLB issuance. Our proprietary scorecard is designed around three pillars in line with the three main areas of investor concern, namely (1) ambitiousness of targets, (2) cost of failure and (3) transparency and integrity in reporting. Each pillar comprises several sub-criteria, 16 in total, weighted by importance, to minimise subjectivity in the rating process. SLBs are assigned an overall rating, using a five-tier rating scale ranging from “outstanding” to “poor”, as well as a rating on individual pillars.

Our rating mechanism has been tested extensively on our in-house SLB database of more than 100 issuances of corporates, sovereigns and municipal issuers, across multiple geographies, credit ratings and tenors. Clients can also opt to access our database as a starting point for SLB selection, as it allows for custom portfolio creation through a dynamic dashboard that filters issuance by region, sector, credit rating, currency denomination, year of maturity, callability and SLB tier rating.

Key features and benefits

Dynamic pillar weights: Pillar weights are dynamic, offering clients the option to select Acuity’s default setting or overweight the pillar that matters most to them.

A coupon step-up trigger alert: This serves as an early warning to clients about issuances that are unlikely to achieve their SPTs by the stipulated time frame. Bondholders concerned about benefiting monetarily from an issuer’s climate failure or social crisis could, therefore, choose to divest such SLBs in advance of the coupon step-up kicking in, or even proactively engage with issuers and pressure them to meet targets. Our product successfully predicted recent trigger events such as Public Power Corporation’s (PPC’s) failure to meet its end-2022 SPT and Chanel missing its interim renewable energy target for 2021.

Insightful analytics and visualisations including (1) a dynamic gauge chart that shows, on average, how much of a particular SPT was achieved at the time the SLB was issued – the lower the achievement, the more ambitious the target, (2) a spider-web chart providing a snapshot of each issuer’s score on each of our 16 criteria, (4) the UN SDGs addressed by the KPI and (5) a bubble chart showing performance against the three scoring pillars.

Provides a standardised approach: Enables comparison of SLBs across credit ratings, sectors and geographies, and factors in complexities such as callability provisions, creating a single snapshot of risks and opportunities.

Eases the burden of high-volume, time-consuming work: Asset managers tasked with evaluating detailed documents, including SLB frameworks, second-party opinion reports and annual progress reports, for hundreds of SLBs get access to Acuity’s readily deployable SLB scoring system and database. Acuity will use its proprietary AI-/ML-based technologies for fast data extraction and web scraping to optimise efficiency. Our scorecard then contextualises and converts the data into useful and processable information.

‘Cost of failure’ pillar: scoring financial penalties for missed sustainability targets

Crunch time for SLB issuers amid looming target observation dates

The SLB market experienced its first coupon step-up trigger event in 2022, when PKN Orlen, a Polish oil refiner, became the first SLB issuer to start paying bondholders a higher coupon on two of its outstanding SLBs. Subsequently, Greek utility company Public Power Corporation (PPC) failed to meet its end-2022 target of a 40% reduction in Scope 1 CO2 emissions, which triggered a coupon step-up of 50bps on its EUR775mn issuance from 2023. Given that around 15 more SLB issuers have target observation dates of end-2023, and most target observation dates fall in 2025, the market could see several more coupon step-up trigger events over the next two to three years.

Many SLBs have coupon step-ups that are too low to sufficiently incentivise issuers to meet targets

The smooth implementation of recent coupon step-up penalties should provide investors a measure of comfort that SLBs work as intended and penalise issuers that fail to meet environmental or social targets. However, we believe the step-ups in many SLB issuances are too small to incentivise issuers to meet their predetermined SPTs. For example, most of the outstanding SLB issuances have been structured with a 25bps coupon step-up penalty, regardless of the issuer’s credit rating, overall coupon or tenure. The selected coupon step-up should, in our view, have financial materiality to an issuer in order to establish credibility with investors and incentivise the issuer to meet its sustainability targets. Nevertheless, we continue to favour coupon step-ups over other forms of penalties, such as donations to charitable organisations or purchasing carbon credits (also called carbon offsets); this is factored into our scoring pillar. We believe that moral ambiguity about coupon step-ups is overdone. While it is not desirable for an ESG investor to “profit” from an issuer’s failure to meet an ESG target, we view coupon step-ups in the same manner as the coupon step-up that results from an issuer receiving a credit downgrade. The financial penalty of incurring a higher cost of debt in the event of failure is an incentive for the issuer to meet its targets.

Our scoring pillar takes a nuanced scoring approach to issuances with coupon step-downs. We recognise that they can promote short-termism by allowing an unethical issuer to set easily achievable targets and then enjoy a lower coupon. However, we believe it is also fair to reward issuers in the form of a lower coupon if they exceed targets, just as they are penalised with a higher coupon if they fail to meet targets. This two-way pricing could also ease the moral ambiguity of ESG investors who do not want to benefit financially from a company’s failure to meet ESG targets. We also prefer issuances that incorporate an SPT redemption premium, which requires an additional premium to be paid upon early redemption in the event that redemption occurs after failing to meet a sustainability target.

‘Transparency and integrity’ pillar: scoring the verifiability of progress towards SPTs

Plans and targets: why we prefer comprehensive plans and absolute targets

We expect issuers to disclose comprehensive plans for achieving their targets with a clearly laid out timeline for future KPI achievement. Some issuers provide only interim targets, to be achieved in a year midway between the SLB’s issue date and its maturity, while the level of achievement expected in each year leading up to the interim/final KPI is not disclosed. Issuers that outline (at least) annual expected SPT achievement levels are rated high – even though missing these annual targets may not lead to a penalty being triggered – as it boosts confidence in the issuer’s sustainability efforts. Furthermore, we expect issuers to report their progress on achieving targets at least annually and to make these disclosures easily accessible via their websites, sustainability reports or universal registration documents.

We also prefer SLBs that carry absolute targets over those that carry relative or intensity targets. An absolute target refers to, for example, an ambition of an issuer to reduce total GHG emissions to 50kt of CO2e by 2025. A relative target refers to, for example, an issuer aiming to reduce total GHG emissions to 50kt of CO2e per 1EURm of revenue by 2025 – this is a ratio of emissions-to-revenue. We believe that relative targets are less ambitious, as the ratio could be subject to manipulation by the issuer to report a reduction in emissions intensity, when in actuality, higher absolute emissions (the numerator) could have been more than offset by even higher revenue (the denominator).

The sustainable financing market becomes more efficient as impact investors are drawn to transparent issuers

The SLB: A seven-year, 2.375% EUR-denominated hospitality-sector bond with an IG credit rating

Benefit to the SLB issuer: Optimisation of its cost of debt, with proceeds used to refinance existing debt that includes a EUR500m 3.625% bond due in September 2023. The SLB saw strong market demand and was 3.5x oversubscribed.

Our ‘transparency and integrity’ impact assessment: Acuity’s scoring framework rated the bond outstanding under this pillar, as (1) the issuer’s SLB framework discloses a clear timeline of annual interim targets, (2) the issuer would report SPT achievement levels at least annually or more frequently when required and (3) KPI achievement levels would be disclosed both on the corporate website and in its universal registration document or in a sustainability report, together with any additional information on material changes to KPIs. The issuer has also set absolute Scope 1 and 2 (SPT 1) and Scope 3 (SPT 2) reduction targets, which we score positively.

Benefit to ESG investors of using our scoring framework: Investors need to monitor the progress of SLB issuances towards achieving their SPTs. Acuity’s scoring framework will help investors identify issuers that would provide relevant, material, up-to-date and accurate information following issuance, and avoid issuers that seek to greenwash at the reporting stage.

However, absolute targets are not immune to manipulation either, as evidenced by the recent divestment of coal plants by an Asian energy company, where the company in question retains the right to use the assets that would appear as financial assets on its balance sheet as opposed to physical assets. The company’s absolute emissions would reduce – but only on paper, not in reality. This gives rise to the question of whether a company is truly ambitious about its sustainability targets if it merely shifts ownership of unsustainable assets rather than shutting these assets down completely. Therefore, our ratings framework factors in issuers’ ESG track records, on a case-by-case basis, and notches ratings based on their history of sustainability practices.

Conclusion

Fixed income ESG investing is evolving rapidly from niche to mainstream, with more investment portfolios being managed with climate mandates, specifically with carbon-reduction targets. While energy companies often get all the bad press from an ESG perspective, there are several other hard-to-abate sectors such as metals and mining, materials (cement, steel, etc.), aviation and utilities that were previously excluded from traditional ESG-focused portfolios. However, with growing focus on stewardship of assets, investors are increasingly recognising the importance of being invested in these sectors in order to work with these issuers to transition to a carbon-neutral economy.