Introduction

Executive Summary

India and China – Asia’s largest oil consumers and members of the BRICS group of leading economies – play a key role in the success or failure of the G7 proposal to cap Russian oil prices. The European Union implemented a master plan, effective from 5 December 2022, to limit purchases of Russian oil by capping the country’s oil price at USD60 per barrel.

This document provides an overview of how Russia managed to survive the G7 oil price cap.

It outlines the events since the war between Russia and Ukraine began in February 2022.

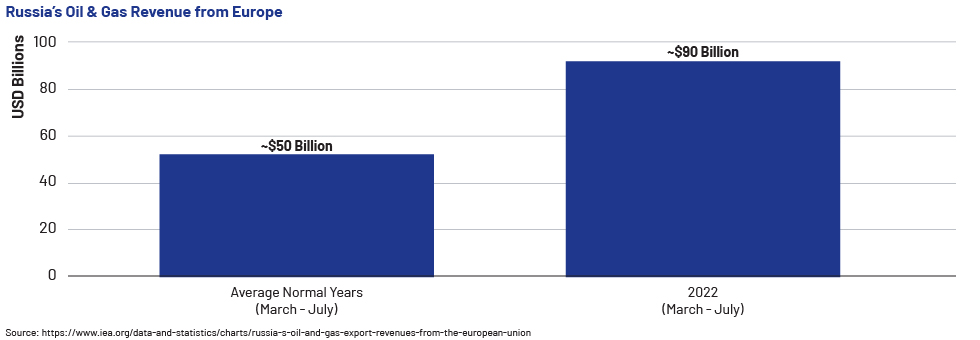

The impact of US sanctions on Russia and subsequent oil supply cuts led to higher oil prices.

Europe and G7 countries formed a buyer's monopoly to counter the price increases.

The document highlights potential gaps in the price cap system that Russia could exploit for oil sales to countries like India and China.

Introduction

The introduction sets the context of the war between Russia and Ukraine and its impact on the global oil market.

It explains the motivations behind the G7 countries' strategy to implement an oil price cap and create a buyer's monopoly.

The significance of Russian oil imports by India and China is discussed, along with the potential effects of the price cap system on these countries.

Key Developments and Challenges

The document explores three significant gaps in the price cap system that Russia can leverage for oil sales to India, China, and other countries.

US sanctions on Russia led to oil supply cuts, resulting in higher oil prices.

Europe and G7 countries formed a buyer's monopoly to counter the price increases and stabilize the market.

Future Outlook

The section examines the potential future scenarios and implications.

It discusses the effects of the price cap system on India, China, and other countries, considering the BRICS alliances.

The document analyzes how Russia's exploitation of gaps in the system could impact the global oil market dynamics.

Conclusion

The conclusion summarizes the key findings of the document.

It emphasizes Russia's resilience in the face of the G7 oil price cap and strategic actions to maintain oil sales.

The implications for India, China, and other countries are discussed, highlighting the need for ongoing monitoring and adaptive strategies in the oil market