Introduction

Introduction

Structured finance refers to the process of creating bespoke financial products. These products are created for large financial institutions and investment vehicles. They often have complex financing requirements, which cannot be satisfied effectively by using conventional financial products. There are three main processes involved in the creation of structured finance products. These are securitisation, debt tranching and credit enhancement.

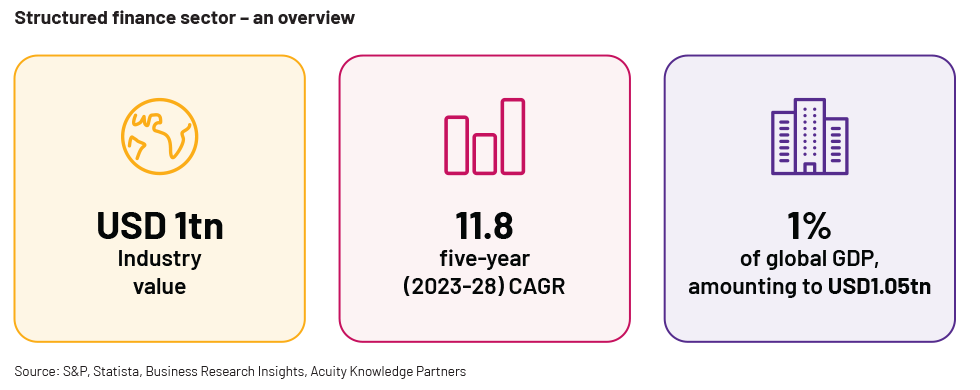

Global structured finance issuance volume declined 11% y/y to USD1tn in 2023 (-3.8% vs S&P’s forecast) owing to the global economic crisis, fuelled by record inflation, the consequent high interest rate regime employed by central banks and geopolitical uncertainty stemming from the Russia-Ukraine crisis, which led to major supply-chain disruptions. The structured finance sector is expected to grow at a CAGR of 11.8% over 2023-28 and was valued at USD1tn at end-2023, equivalent to c.1% of global GDP.

Credit landscape – focus areas in 2024

Outlook by region and asset class

US outlook

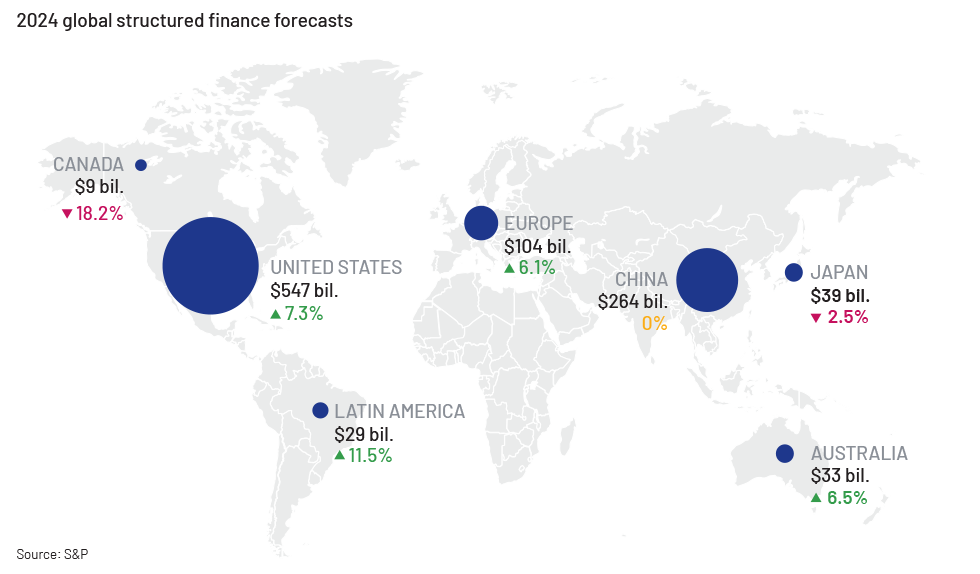

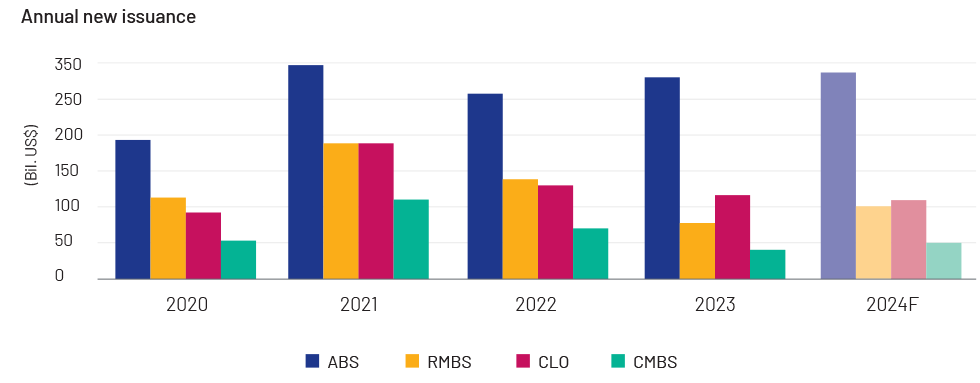

US structured finance issuance declined 14.4% y/y to USD510bn in 2023, with most asset classes recording a deterioration in performance. US auto lease ABS issuance grew by a significant 38% y/y to USD23.8bn in 2023 on the back of 13.1% growth in new- vehicle sales to 15.5m units, driven by the easing of residual supply constraints, improved inventory levels and resumed fleet sales. However, 2024 issuance is expected to grow only marginally, to USD24bn, owing to slower economic growth and weakened consumer purchasing power, which should limit retail auto sales growth.

Europe outlook

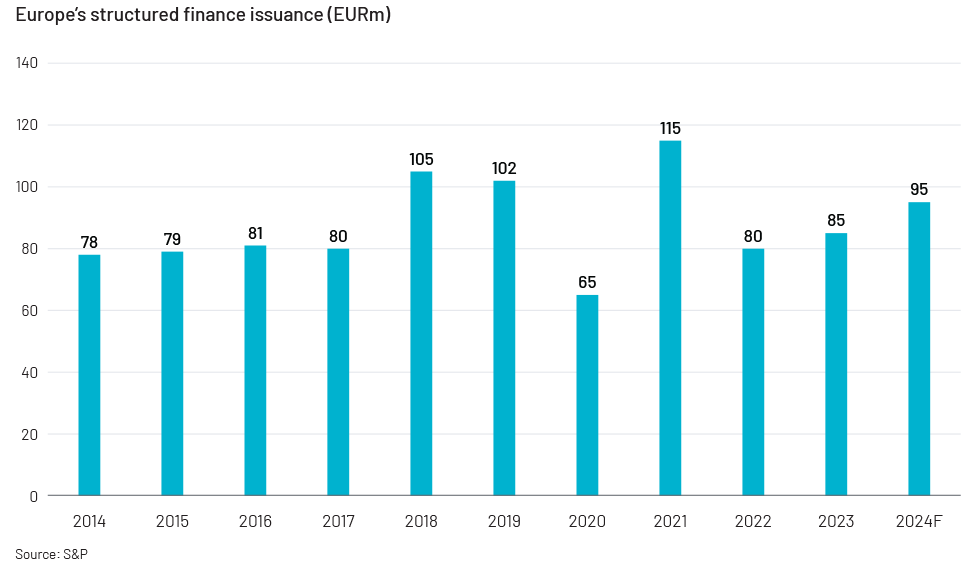

In Europe, structured finance issuance increased by 6.3% y/y to EUR85bn, driven by a strong second-half performance following a tepid first half. S&P expects 2024 issuance to grow a further 11.8% y/y to EUR95bn owing to (1) a larger volume of legacy transactions reaching their call dates and (2) a modest recovery in areas of credit origination such as auto financing that back most ABS issuance.

To get more information of country-specific outlooks, download the complete whitepaper.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of high-value research, analytics and business intelligence to the financial services sector. We conduct (1) credit reviews of relevant SPVs (and originators of non-ring-fenced transactions), (2) detailed periodic analysis of covenant compliance, as specified by the respective credit agreements, (3) financial spreading, (4) cover validations to monitor fluctuations in the asset base of the borrower, (5) borrowing base reviews to ensure client compliance with borrowing conditions, (6) collateral monitoring to analyse the composition of underlying collateral, (7) granular exposure analysis, (8) sub-portfolio reviews and (9) appropriate pricing of structured products via product-tailored risk ratings.