Introduction

Stay agile – Opportunities ahead

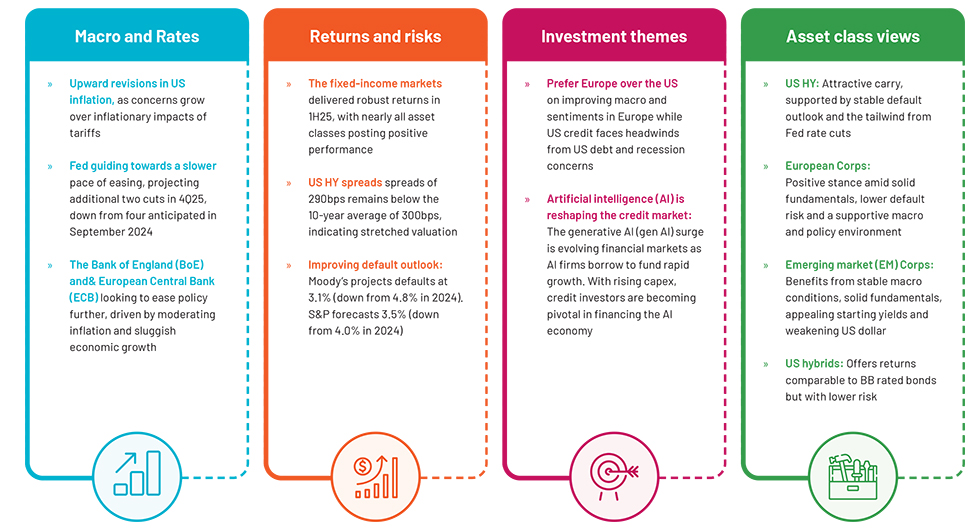

With the unpause rate cuts and the US economy remaining resilient amid policy shifts and geopolitical uncertainty, fixed income stands out in 2025. Diverging central bank paths create risks and opportunities, but elevated yields and strong credit fundamentals make the asset class compelling.

Inflation – Firms, then decelerates

With tariffs coming faster and ending at a higher rate, inflation is expected to remain firm until end-25, before slowing down

» US inflation: Tariff-related increases in goods prices has kept headline (2.3%) and core (2.7%) PCE firm and tracking to finish 2025 at 3.0%. Thereafter, weak demand, coupled with a likely ensures the tariff-induced shock on inflation is transitory. Headline and core PCE inflation are projected to slip to 2.3% in 2026.

» EU inflation: Energy prices are expected to rise slightly in 2025, while core inflation would decrease slowly and is anticipated to fall below 2% by 2026. Meanwhile, a resilient labour market and an accommodative monetary policy will prevent inflation falling back to 2015-19 lows (1% core)

» Japan inflation: Expected to remain stronger in near term, driven by sticky food inflation and rising rents, but expected to decline gradually below 2% in 2026

Interest Rate (US) – A slower pace of rate cut than anticipated

>>Slower economic growth than anticipated but expected to avoid recession : The trade shock hit major economies, including the US, pushing growth below potential. The International Monetary Fund estimates US growth will slow to 1.8% in April 2025 from 2.7% in Jan25. Consensus expects even slower growth at 1% for 2025 and 2026. Besides tariffs, immigration restrictions weigh on US growth, and there is unlikely to be significant support from fiscal policy or deregulation.

>>50bps cut in 2025, but deeper cut in 2026: Market participants expect the Fed to cut rates by additional 50bps in 4Q25 because inflation remains a bigger concern than weak growth, with the easing cycle likely to begin in March 2026. In 2026, the Fed may cut rates more aggressively than markets currently expect, aiming for a federal funds rate target range of 2.50-2.75% by the end of 2026.

AI: a game changer – If designed for friction

Automation, productivity gains and scale – Quilter Investor Trend Survey 2025

» 94% of asset managers will expand use of AI in next 12 months

» 59% of asset managers to significantly increase use of AI, while 35% of asset managers said they would slightly expand use of technology

» Biggest use case ranges from creating bespoke client solutions, automating operations and enhancing research process

Challenges

» Best research is non-consensus recommendation that turns out to be right – Byron Wein

» Output by AI not there yet, does not follow in-house investment philosophy or even find the market-beating idea

95% of gen AI pilots fail – MIT Study

» 95% fail as they “lean on generic tools, slick enough for demos, brittle in workflows. They’re stuck in high-adoption, low-transformation mode”

» 5% who succeed – design for friction. They embed gen AI into high-value workflows, integrating deeply and shipping tools with memory and learning loops. That’s where ROI lives

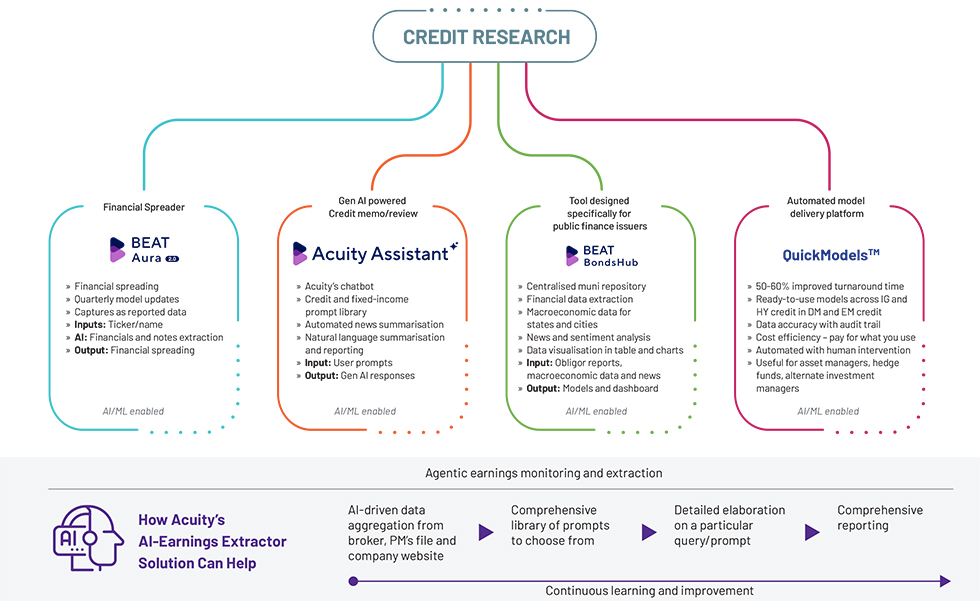

Technology to support Credit Research team