Introduction

Introduction

The pace of recovery of China’s property sector has slowed since April 2023 as growth in housing sales and land acquisitions has slackened. The local-government financing vehicle (LGFV) bond market has also been in turmoil amid the unfavourable rumours flooding the market. The sluggish property market has a significant impact on the LGFV sector. We see the chain of risk as follows: homebuilders’ funding pressure and soft contract sales – less land acquisition and a sluggish land market – less fiscal income, especially for lower-tier cities with weaker economic fundamentals – delayed and/or under-payment to LGFVs – tight cashflow at the LGFV level combined with a choking funding channel and concentrated debt maturities leading to credit events – local governments having to decide whether to bail out affiliated platforms with their limited resources.

LGFVs attempted to explore commercially viable models to support their policy function in local infrastructure development, and many of them got involved in the property market; they, thus, suffered a double blow amid the property market downturn. Although we have yet to see defaults on LGFVs’ public issuance, “faith” in LGFVs, referring to investors’ belief that LGFV bonds would never be defaulted on, faces a looming threat, given LGFVs’ current sloughy situation and the central government’s stance that it would not bail out troubled LGFVs unless it triggers a systemic crisis.

Sluggish property market and stressed fiscal revenue

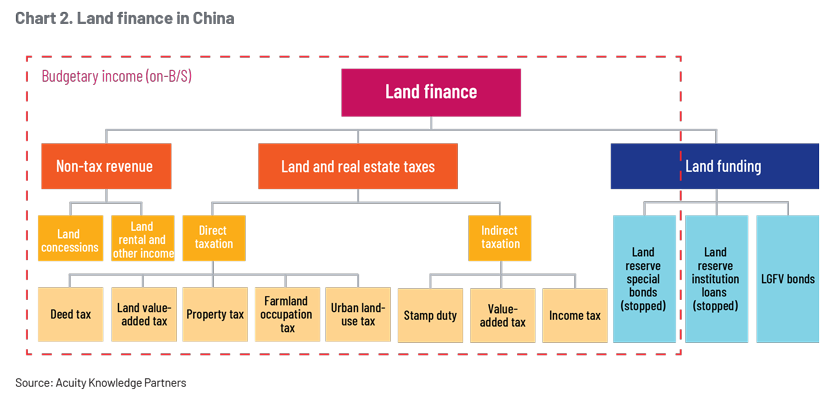

In China, the property sector directly contributed around one-third of national fiscal revenue. “Land finance”, referring to government budgetary income generated from concessions of state-owned land-use rights and taxes related to real estate, and land-related funding, best captures the source of revenue of China’s local and regional governments (LRGs). A booming property market is the premise of land finance, and the current setback in housing and the land market has challenged the sustainability of land finance more than ever. Government fund revenue dipped for the first time in seven years in 2022, mainly due to the continued decline in land transactions as a result of less land acquisition by real estate companies.

LGFVs and land funding

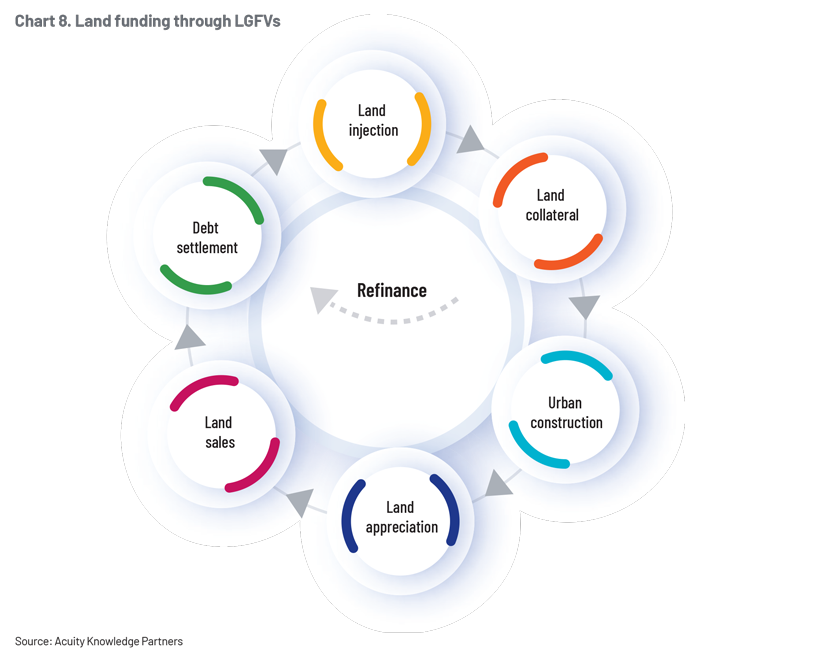

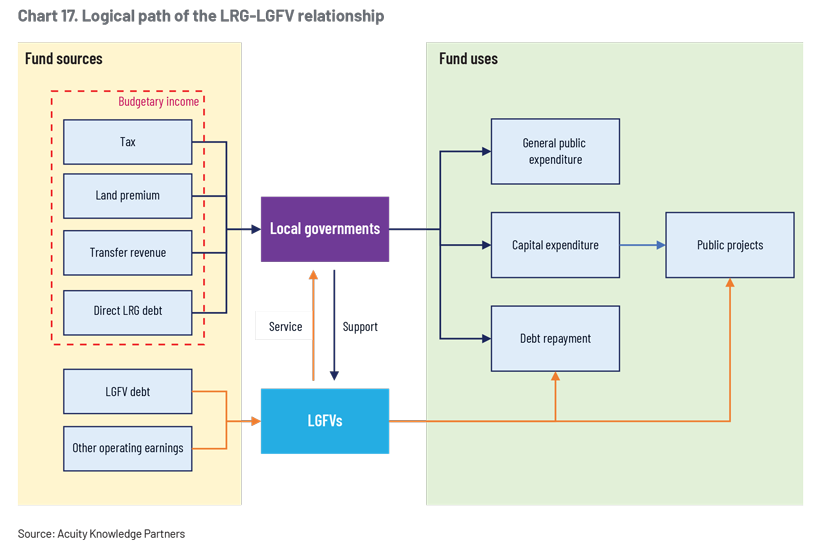

LGFVs emerged alongside China's accelerated urbanisation, as a solution for LRGs to meet infrastructure development needs. Given the shortfall in tax income and funding constraints, LRGs had recourse to land finance and began to set up local financing platforms, i.e., LGFVs, to raise funds and undertake infrastructure projects on their behalf. Many local governments injected substantial amounts of land into LGFVs to enhance the collateral available to them. With implicit credit endorsement from governments (even guarantees in the past) and land as collateral, the platform companies were favoured by financial institutions. Funding was obtained to meet capex on infrastructure, and increased urban construction raised land values. This method of land funding enabled LGFVs to accumulate and roll over debt with limited operating cash inflow.

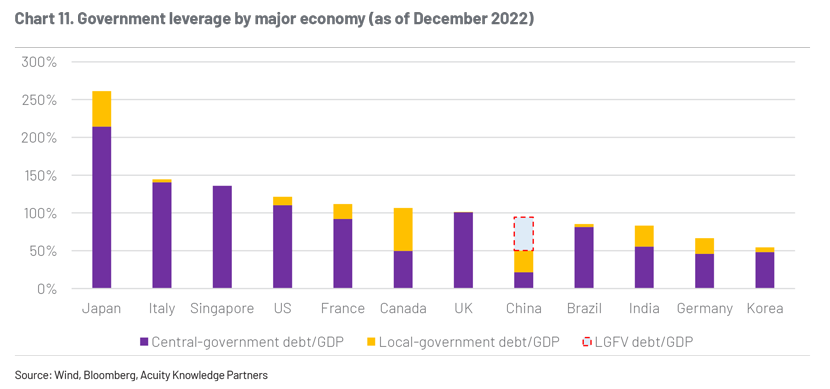

Hidden local-government debt and the rise and fall of LGFVs

LGFV debt grew exponentially, at a CAGR of 20.3% from 2013 to 2022. Given LGFVs’ close ties with local governments in terms of shareholding, daily operations, revenue and reimbursements, and funding resources, LGFV debt has come to embody local-government debt, often referred to as LRGs’ off-balance-sheet or hidden debt. While the central government’s debt is tightly managed, China bears an overwhelming portion of public debt at the local-government level, with over half of local-government leverage being off-balance-sheet debt taken by LGFVs.

High local-government leverage alerted China’s central government. A debt-swap programme was launched in 2015-18, and local governments issued RMB12.2tn worth of LRG bonds and used the proceeds to swap back LGFV debt recognised as “government debt”. Regulation has been limiting local governments’ ability to inject land assets into LGFVs since 2012. LGFVs also face tight regulation and a lengthy approval process when tapping into the debt capital market.

Amid tightened regulatory requirements aimed at containing hidden government debt, the business model for LGFVs’ traditional public projects was under transformation. Some of the LGFVs started a market-oriented transformation to enhance profitability and debt-service ability through three main paths: (1) utility operator, (2) property developer or construction company or (3) investment holding company. That said, the traditional infrastructure development business is still the core mandate of LGFVs, accounting for 60% of revenue.

Faith in LGFVs floundering?

LGFVs will likely remain instrumental in public projects, despite the evolving LRG-LGFV relationship and LGFVs’ changing business model. LRGs still need LGFVs to fulfil policy mandates and are, thus, willing to support subordinate investment platforms. However, LRGs’ ability to provide such support depends on their fiscal strength and the availability of local public resources, including local SOEs, and financial resources from local institutions, especially state-owned banks; this differentiates the credit performance among LGFVs.

While LRGs’ ability to support varies, so does credit performance among entities from the same region. LRGs are likely to allocate their depletable resources to subordinate LGFVs according to the platforms’ importance to local governments; this is decided by the administrative level of owner governments and the number and political implication of public projects undertaken by each LGFV.

LGFVs and LRGs have been tenacious in repaying public debt, and servicing public debt has come at the cost of rising credit risk for non-public products. Troubled platforms would allocate financial resources primarily to public bonds and leave non-standard products at greater risk. As weak LGFVs found it difficult to find funding through the public market, their reliance on non-standard products increased. The time lag between the emergence of non-standard-product credit events and potential market reaction leaves decent room for investors to adjust their portfolios.

Acuity Knowledge Partners’ value proposition

Global organisations and research houses leverage our industry- and country-specific expertise to make sound strategic decisions. We set up dedicated teams of analysts and macro-level associates to support our clients in areas such as macroeconomic research, industry profiling, financial analysis, econometric modelling, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.