Introduction

Introduction

The corporate world is taking steps towards a low-carbon economy, environment, and society. The past nine years have been reported as the warmest years since the late 18th century, with the temperature being the highest in 2022. Recent scientific research has shown that the current amount of carbon emission will enhance the earth’s average annual temperature in the next five years beyond the 1.5°C threshold set in the Paris Agreement.

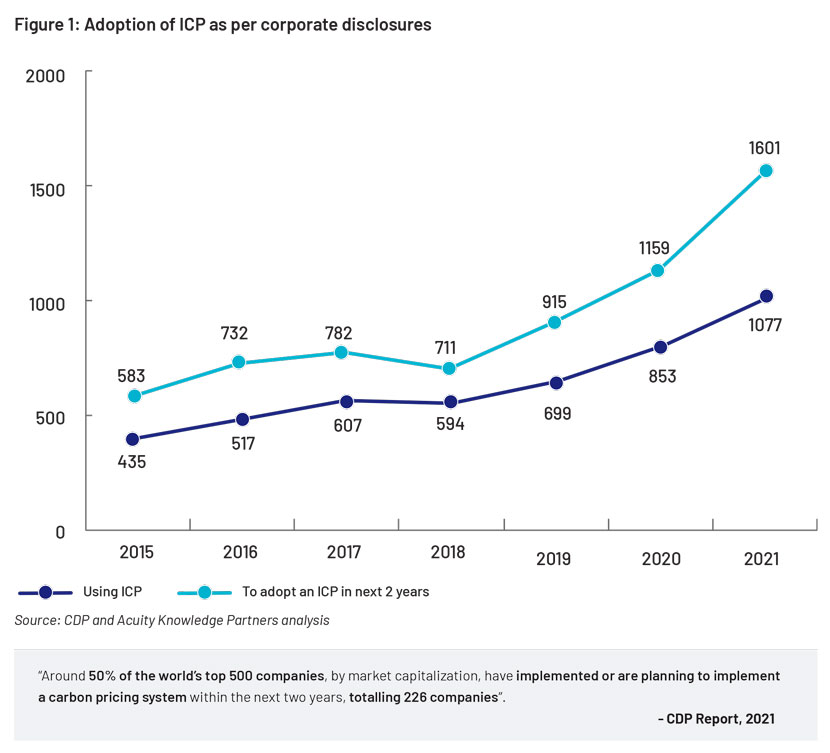

Businesses worldwide realise the need to mitigate their carbon emissions. To make their contribution more impactful, internal carbon pricing (ICP) was introduced. The rationale behind putting a price on carbon emissions was to divert the governments’ and businesses’ investment towards environment friendly production and consumption methods and establish accountability.

Why organisations are adopting ICP?

ICP entails the cost per ton of carbon released in the atmosphere from an organisation’s operations. Businesses have a pressing need to quantify the adverse environmental effects of their investment decisions. The main objective is to make ICP a marketable asset for consideration while making such business decisions.

The concept of ICP was born after the launch of the carbon emission market thanks to the Kyoto Protocol. The emission market is a platform for countries and organisations to trade their emission certificates. Eventually, emission trading became a regulatory obligation in some countries, whereas some geographies and organisations adopted it voluntarily. Soon, carbon taxing emerged, with the government levying taxes on carbon emissions. Keeping the increasing number of external factors in mind, businesses that were exempted from a regulated emission market have actively started imposing prices on their emissions

Download this insight paper to discover:

Key factors for adoption of ICP

Pricing methodologies

How organisations can adopt ICP

Benefits of ICP

Navigating geopolitics

Case Study

How Acuity Knowledge Partners can help

Acuity Knowledge Partners support clients in the formulation and execution of strategy, research and advisory. Our team is qualified to execute customised decarbonisation, climate change, sustainability, ESG, and sustainable business development mandates. We offer consulting services to clients to assist their corporate development, strategy, and finance departments. Our offerings include ICP road map, decarbonisation pathway, net-zero strategies, carbon neutrality approaches, energy transition, low-carbon technology assessments, climate risk and opportunity analysis, company benchmarking, climate financing, and support on ESG disclosures and reporting.

Our team conducts extensive research and analysis to aid strategic consulting businesses in developing end-client solutions. We assist clients in developing transitional organisational models and redesigning operational frameworks that link their business unit plans to their major goals and targets.