Introduction

LIBOR Legislation - Executive Summary

Legislators have stepped in to ease the transition away from LIBOR

In the last whitepaper in our LIBOR discontinuation series, we highlighted the importance of LIBOR transition planning, recommended best practices and introduced our proprietary solutions to support LIBOR transition.

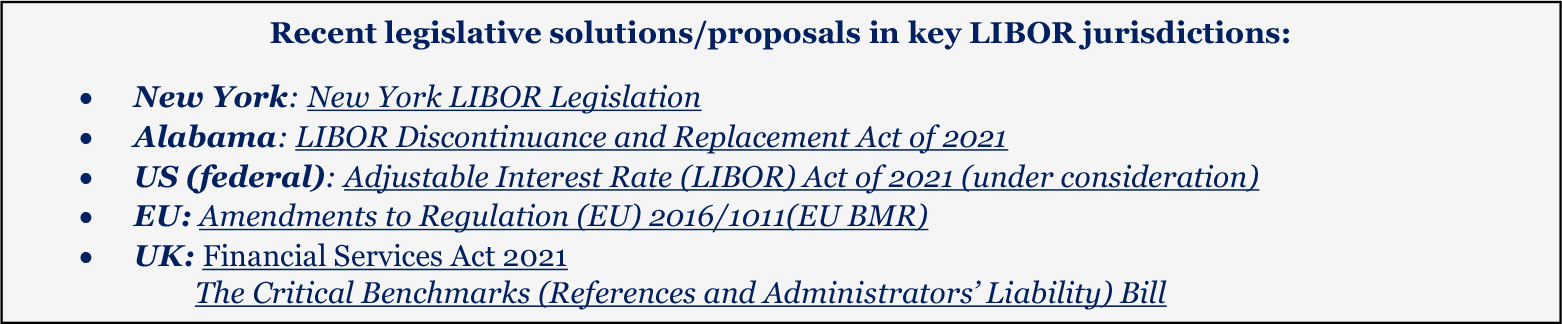

The passage of recent legislation (please refer to our LIBOR legislation map below) in key LIBOR jurisdictions (New York, the UK and the EU) seeks to support an orderly wind down of LIBOR. This whitepaper critically assesses whether these legislative fixes will alleviate legal uncertainties/lawsuit threats and mitigate disruptions to tough legacy contracts maturing in a LIBOR-free era. We also outline potential gaps in current LIBOR laws and attendant risks.

LIBOR Legislation - An Introduction

Key takeaways

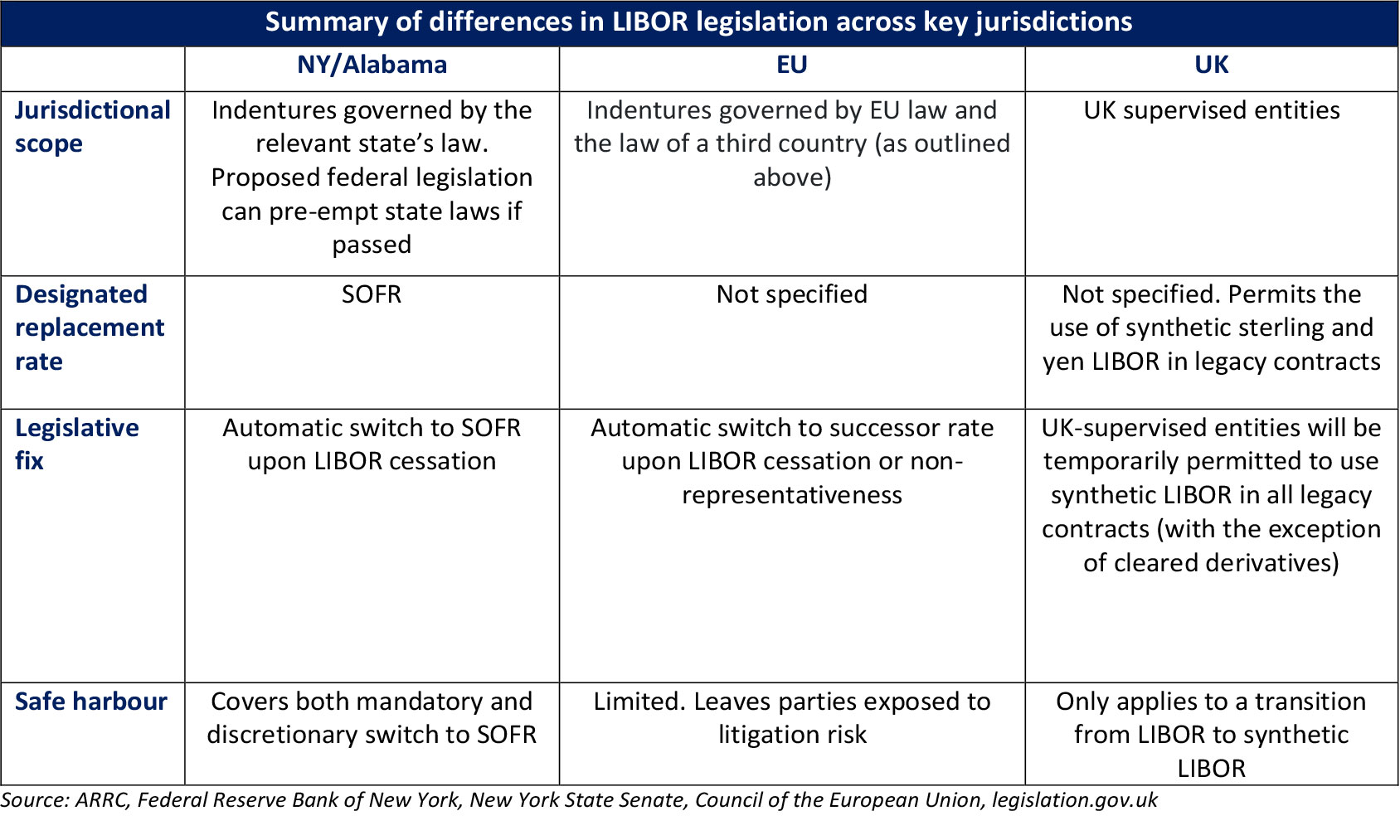

The majority of outstanding LIBOR contracts are governed by New York state (NY) or English law. English law calls for the consent of a minimum of 75% bondholders to amend interest rate provisions set out in an indenture, while consent thresholds of 100% are typical under NY law. Consequently, the renegotiation of contracts is unfeasible.

Around USD1.9tn of current US LIBOR exposure in bonds and securitisations will mature after June 2023. The majority of these legacy contracts have inadequate fallback language.

Recently passed state laws in the US, establish Secured Overnight Financing Rate (SOFR) as a benchmark replacement for LIBOR in legacy contracts with inadequate fallback language, and mandate an automatic conversion to SOFR upon LIBOR discontinuation. They also attempt to provide a safe harbour from litigation and ensure the continuity of contracts.

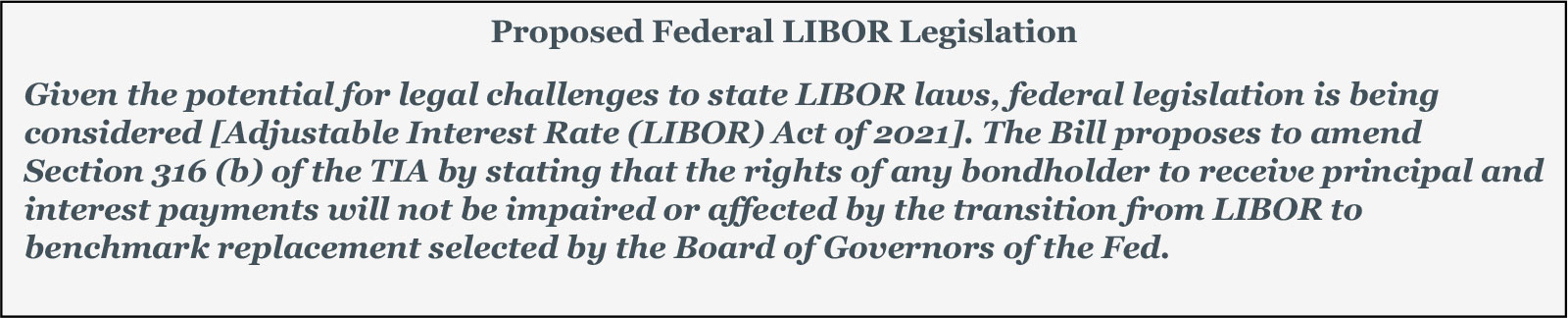

Legal challenges to US state LIBOR laws can still arise unless a proposed federal bill is passed, as federal laws, such as the Trust Indenture Act (TIA), may limit the efficacy of state laws

Divergent LIBOR legislative solutions across regions may overlap in scope or be conflicting. Disadvantaged parties may file legal claims in jurisdictions with more advantageous LIBOR replacement rates or less stringent safe harbour provisions.

Asset managers who have previously carried out inventories of their LIBOR exposure, and drafted LIBOR transition plans, should review their legacy contracts to determine their state/country of legal jurisdiction, as well as applicable laws and their economic consequences.

Leveraging its expertise in the analysis of fallback language, Acuity Knowledge Partners’ (Acuity’s) Fixed Income team has developed a suite of tools to assist clients, including a proprietary quantitative scoring framework that systematically ranks fixed-income issuances on a scale of “well prepared” to “worst prepared”. We analyse indentures to determine likely LIBOR replacement rates based on laws governing the country of jurisdiction and identify potential overlaps or conflicts in laws.

Libor Transition Impact - Key Developments

NY and Alabama LIBOR laws mandate SOFR as the benchmark replacement in tough legacy contracts

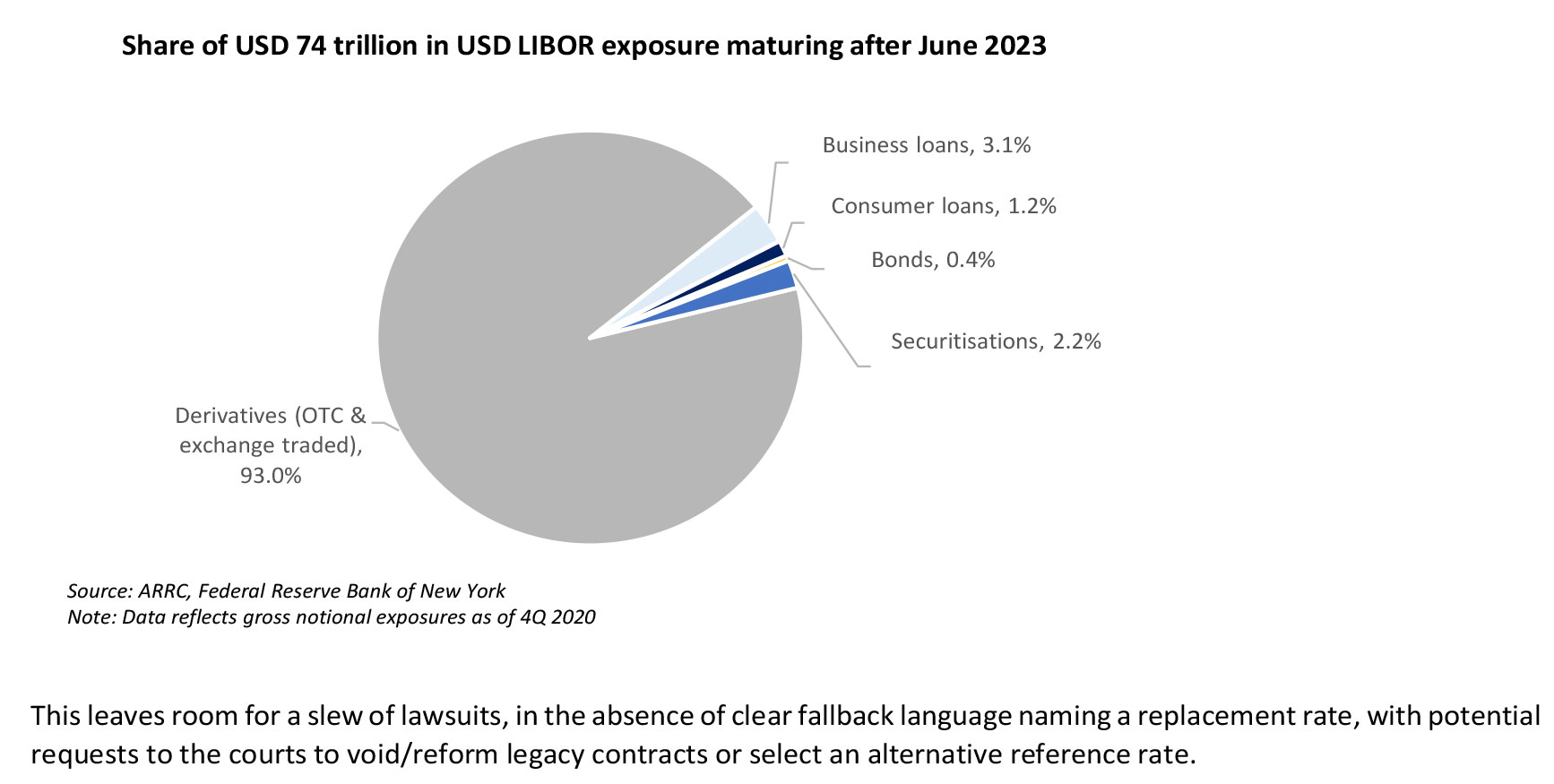

The Alternative Reference Rates Committee (ARRC) estimates that around 67% of current US LIBOR exposure will mature prior to June 2023. This leaves around USD74tn outstanding beyond June 2023. While the majority of this exposure is related to derivatives contracts, which can be handled through the observance of ISDA Protocol, roughly USD1.9tn bonds and securitisation exposure remains, including a sizeable portion with inadequate fallback language to ensure the seamless transition away from LIBOR upon its discontinuation. Typical consent thresholds of 100% make the renegotiation/amendment of these legacy contracts unfeasible.

This leaves room for a slew of lawsuits, in the absence of clear fallback language naming a replacement rate, with potential requests to the courts to void/reform legacy contracts or select an alternative reference rate.

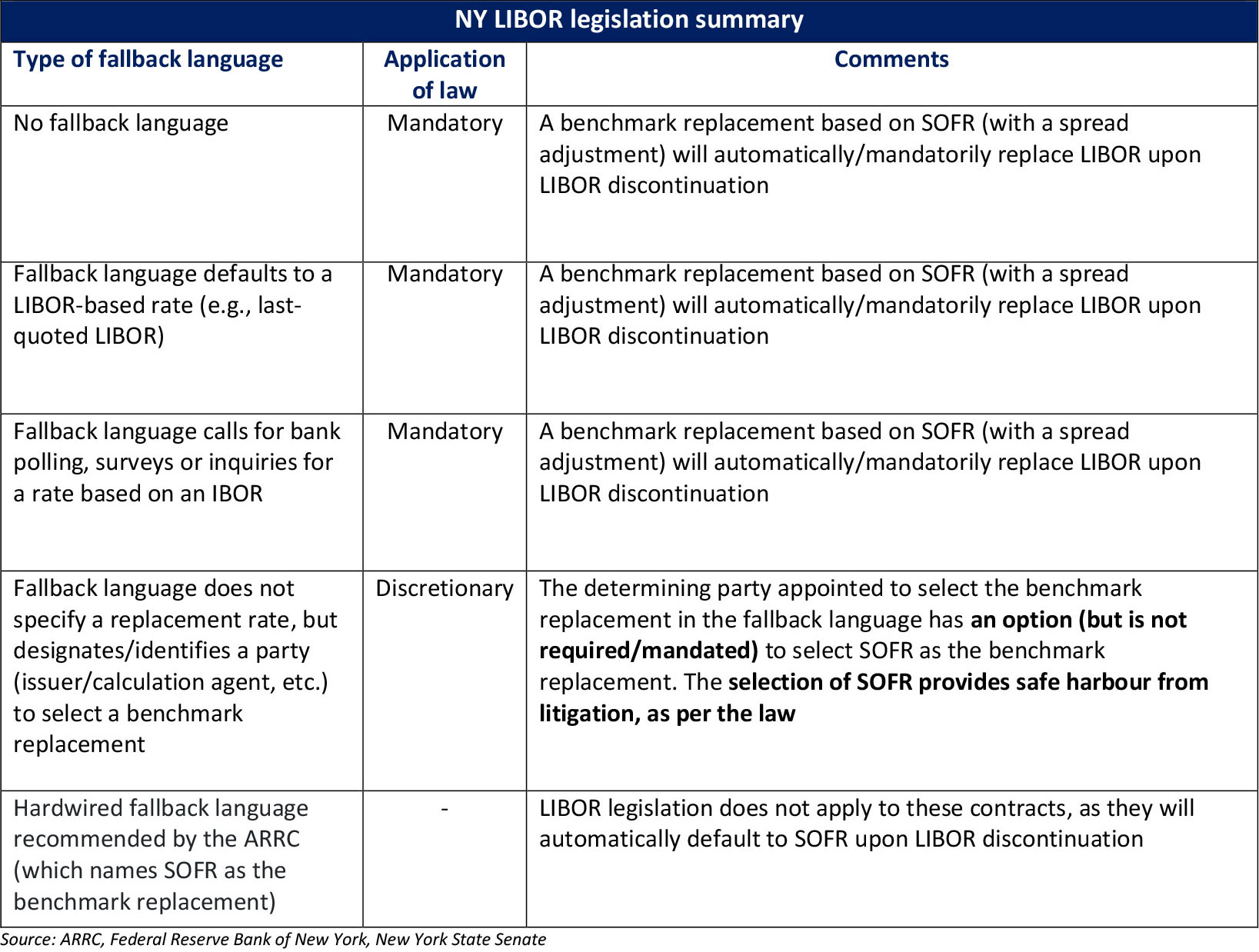

The passage of LIBOR legislation in NY and Alabama in April 2021 was welcomed by asset managers and regulators. Both laws are similar and are not applied to contracts with existing fallback language explicitly naming a non-LIBOR-based benchmark replacement. We summarise the key points of NY’s LIBOR law below.

Importantly, both NY’s and Alabama’s LIBOR laws attempt to 1) ensure the continuity of contracts, stating that neither USD LIBOR discontinuation nor the selection of SOFR as a replacement will affect the continuity of LIBOR referencing contracts and 2) provide a safe harbour from potential litigation to contracts that switch to SOFR.

State laws may be challenged under the TIA; proposed federal legislation amends the TIA

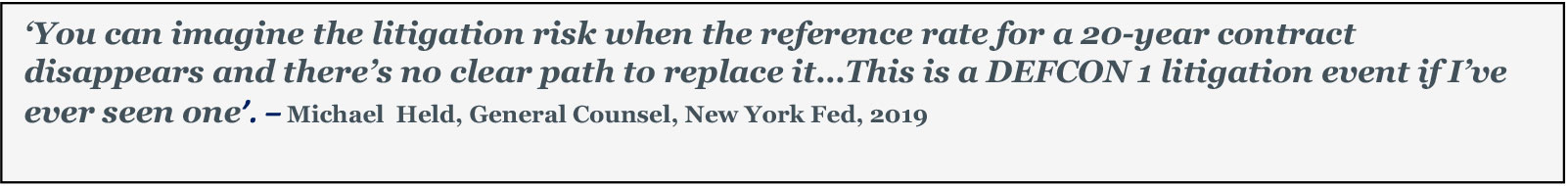

While they are a welcome source of legal clarity, will state LIBOR laws be sufficient to minimise legal challenges? As we previously stated, SOFR is not a like-for-like replacement of LIBOR, so some degree of value transfer is likely to be involved in the change of reference rate, resulting in economic winners and losers. Issuers or bondholders disadvantaged by the switch to SOFR may challenge current state LIBOR laws, under federal laws and the US Constitution:

They may cite perceived conflicts with Section 316 (b) of the TIA of 1939 – a federal law that states that the rights of bondholders should not be affected or impaired without their consent;

They may challenge under the Contract Clause and/or Due Process Clause of the US Constitution, which prohibits states from passing laws that impair contractual obligations or result in unfairness, or

They may cite other federal laws (e.g., antitrust laws).

Benefits

EU: narrower safe harbour provisions could lead to litigation from disadvantaged parties

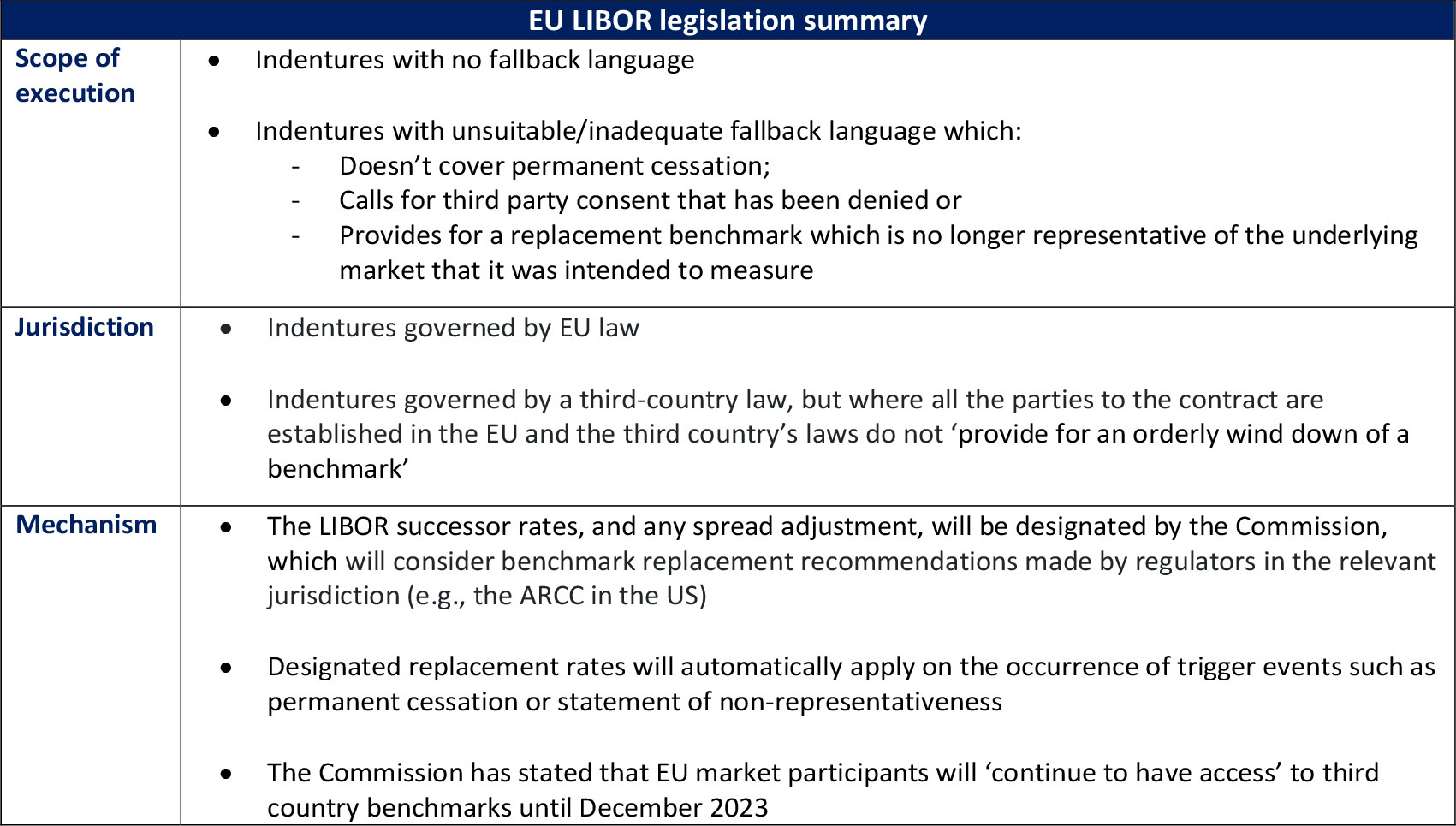

Similar to NY and Alabama state laws in the US, the EU’s legislative solution for legacy LIBOR contracts [Amendments to Regulation (EU) 2016/1011(EU BMR)] will be applied only to contracts with no/inadequate fallback language. In contrast to US laws, which cover only USD-denominated LIBOR, the EU’s legislative fix extends to third-country LIBOR rates whose cessation would disrupt EU financial markets.

The law’s safe harbour provisions are much narrower compared to current US state LIBOR laws and do not provide immunity from claims arising from a shift to an alternative reference rate. Given a likely possibility of economic winners and losers in the switch from LIBOR to alternative reference rates, this implies potential market disruption and legal claims from disadvantaged parties.

Notably, in contrast to US state LIBOR laws, which name SOFR as the benchmark replacement, the legislation does not specifically designate a LIBOR successor rate.

We summarise the key points of the legislative solution in the table below.

LIBOR Legislation - Future outlook

UK: The FCA has authorised the use of synthetic LIBOR for tough legacy contracts

The FS Act is not limited to sterling LIBOR; it applies to all UK supervised entities

The Financial Services Act 2021 (FS Act) applies to all UK supervised entities and amends the UK Benchmarks Regulation (UK BMR) to grant the UK Financial Conduct Authority (FCA) broad powers to 1) prohibit the use of LIBOR in new contracts and 2) exempt tough legacy contracts from this prohibition. Since the FS Act is not limited to sterling LIBOR, the FCA has prohibited the new use of USD LIBOR by UK supervised entities after 2021, despite the publication of most USD tenors until June 2023.

Safe harbour provisions differ from US state laws; do not cover alternative reference rates

The FS Act differs from recent LIBOR legislation in the US and the EU, which mandate an automatic/statutory replacement of LIBOR with a designated benchmark replacement rate in legacy contracts. Instead, under the UK legislation, the FCA can authorise the use of synthetic LIBOR in some legacy contracts. The FCA announced, in September 2021, that it would require the LIBOR benchmark administrator to publish synthetic sterling and Japanese yen LIBOR for one-, three- and six-month tenors throughout 2022 for use in tough legacy contracts. Consequently, LIBOR screen pages referenced in legacy contracts would continue to display a rate (synthetic LIBOR) for use in permitted contracts only.

The UK legislation also differs from NY/Alabama LIBOR laws in terms of safe harbour provisions, as it applies only to the transition from LIBOR to synthetic LIBOR in legacy contracts, where mandated by the FCA. It does not cover a switch from LIBOR to alternative reference rates.

Conclusion

Asset managers should determine state/region of legal jurisdiction for legacy contracts

In the light of the differences in current LIBOR legislative solutions across key jurisdictions, we recommend that asset managers review their legacy LIBOR exposure to identify potential overlaps in scope or conflicts of laws across regions. For example, how would legacy indentures governed by NY law that reference sterling LIBOR be handled by a NY court in the event of a legal dispute? The court could apply the UK’s legislative LIBOR solution and use a synthetic LIBOR. Similarly, how would courts resolve issues relating to legacy indentures governed by EU law for UK-supervised entities? Given the discussed likelihood of financial winners and losers in the transition away from LIBOR, disadvantaged parties may file legal claims in jurisdictions with more advantageous LIBOR replacement rates or less stringent safe harbour provisions

Acuity’s Value Proposition

How Acuity Knowledge Partners can help

Acuity, with its proven record in providing scalable outsourced research solutions to the world’s leading financial services institutions, is best placed to support clients through the LIBOR transition. Our fixed income team has leveraged its expertise in the analysis of fallback language and developed a range of tools and solutions to assist our clients. These include:

-

A proprietary quantitative scoring framework that systematically ranks fixed income issuances on a scale of ‘well prepared’ to ‘worst prepared’. Our comprehensive scoring criteria cover a range of factors including the availability, clarity and comprehensiveness of fallback language (benchmark replacement waterfalls and benchmark replacement adjustments, permanent and pre-cessation triggers, etc.) and designated parties that determine IBOR cessation and alternative benchmark selection. This standardised approach:

Improves comparability across issuers, instrument types, years of issuance and currency-tenor combinations, supporting better decision-making

Serves as a guide to enhance decision-making during the portfolio-rebalancing process of LIBOR

-

Contextualises and converts data into useful and processable information

Assists investors looking to capitalise on arbitrage opportunities from mispriced securities. Bonds with vague or non-existent permanent fallback language – and more favourable terms for the bond issuer - should trade at a discount to their counterparts with clear fallback options

Analysis of indentures to determine likely LIBOR replacement rates based on the laws governing the country of jurisdiction

Identification of potential overlaps or conflicts in LIBOR laws across jurisdictions

Customised e-mails and follow-up on potentially hundreds of contracts and issuers to gain clarity on successor rates, amendment requirements and designated parties.

Our ability to quickly scale up a team and meet large volume requirements or scale down enables flexibility to support varying client operation models.

Author:

Lourdeena Kudaliyanage, CFA

Assistant Director

Lourdeena has over 12 years of experience in investment research. At Acuity, she is part of the Fixed Income and Credit Research team in the Investment Research vertical. During her tenure at Acuity, Lourdeena has supported leading buy- and sell-side firms covering multiple sectors, focusing primarily on frontier and emerging markets, with expertise in thematic and company research. She is a CFA charterholder and holds a BSc (Economics Honours) and MSc in Financial Management from the University of London.

Sources:

libor-legislation-with-technical-amendments (newyorkfed.org)

USD-LIBOR-transition-progress-report-mar-21.pdf (newyorkfed.org)

SOFR and the Transition from LIBOR - FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

Financial Services Act 2021 (legislation.gov.uk)

Further arrangements for the orderly wind-down of LIBOR at end-2021 | FCA