Introduction

Introduction

Wealth managers constantly navigate an evolving landscape and need to adapt their strategies to remain relevant in the industry. After years of challenges in adapting to the effects of the pandemic and tough macro conditions, 2023 was dominated by market volatility, high inflation and geopolitical issues. Leveraging technology and digitalisation to generate efficiencies and enhance the client experience were the other key themes for wealth managers, in addition to their continued focus on personalisation.

Acuity Knowledge Partners conducted a study of global wealth managers for a fourth consecutive year to understand how bestin-class firms are reorganising themselves given the challenging macro environment and rethinking their client offerings. Around 60 representatives of leading private wealth management firms responded to our survey, including CEOs, CIOs and heads of research and advisory who play an important role in growing assets under management (AuM) and defining business strategy.

Key takeaways from the survey are as follows:

Global wealth was expected to grow at a moderate pace of 5% y/y in 2023, impacted by tough macro conditions and market volatility – navigating periods of uncertainty, providing actionable investment ideas, portfolio diversification and wealth preservation have been the top priorities for wealth managers.

Top trending themes for global wealth managers

Intergenerational wealth transfers in the coming years are likely to offer wealth managers a significant opportunity to grow AuM as those inheriting this wealth seek new managers

With women gaining more control of wealth, wealth managers would need to have products and services that cater to them

Comprehensive solutions – including estate planning, tax planning and retirement solutions – considering the client’s risk appetite are gaining prominence

High inflation and volatility are driving wealth managers to offer a resilient basket of investments that offer a hedge and provide a return

Business expansion plans and the outlook for 2024 and beyond

Expansion into emerging markets, especially Asia, to tap the increasing wealth, and enhancing research offerings through personalisation were the top picks for medium-term strategy to expand business

Growing advisory revenue via bespoke research offerings was a clear top answer in our survey

Growing market share by consolidation and increasing revenue contribution from non-traditional mandates were the drivers of the medium-term revenue outlook

Embracing new technology and digitalisation and expanding to newer markets remained the prime cost drivers

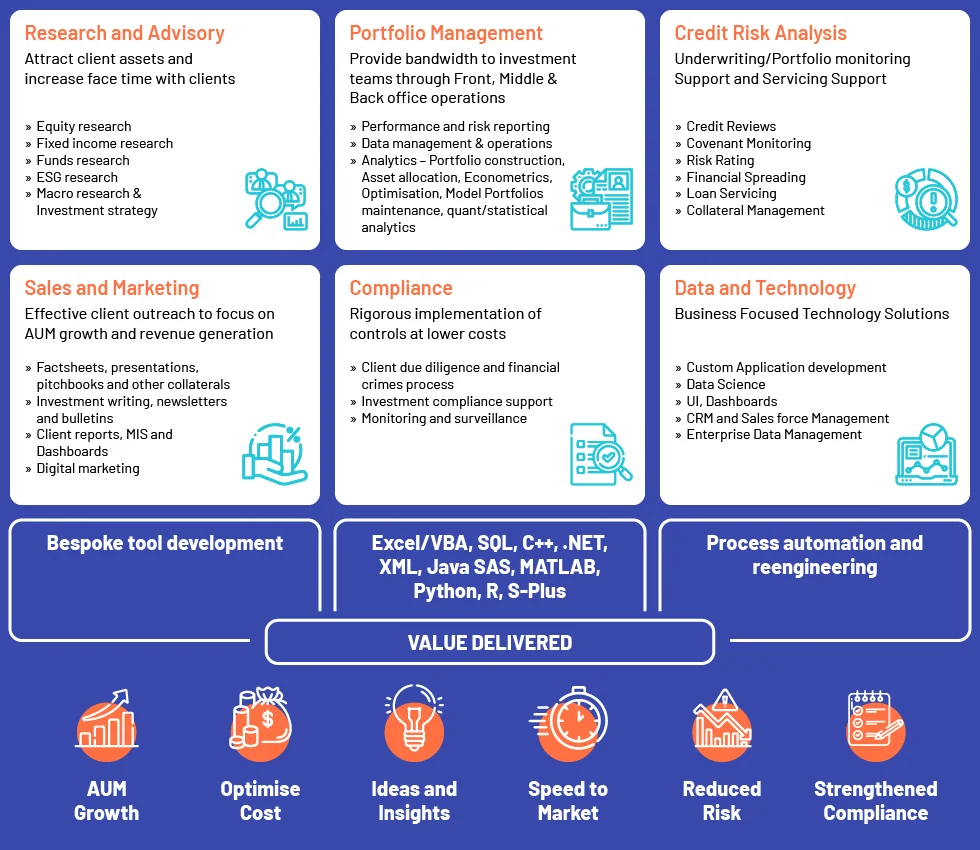

Acuity services for private wealth managers

We are a “one-stop-shop” for the needs of private wealth managers, with deep domain knowledge and experience.

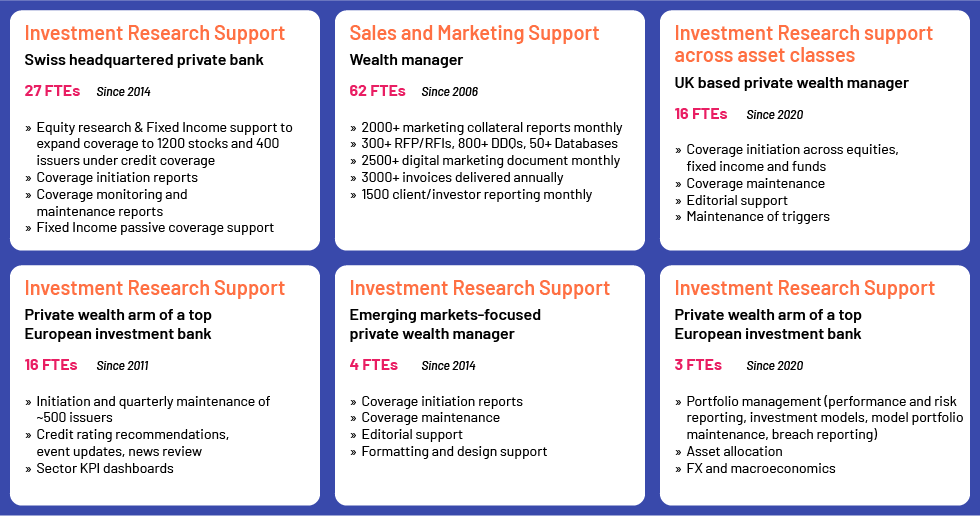

Trusted by global private wealth managers

Generally “Greenfield” teams are added by Acuity to create new research platforms, create differentiation, meet regulatory needs etc.

Conclusion

Wealth managers weather the challenging macroeconomic conditions by constantly adapting to the changing environment. They are required to actively manage client portfolios if they are to meet changing priorities and risk taking abilities.

Leveraging technology to gain preliminary insights and adding specialised advisory would help wealth managers optimise their investment strategies. Amid the increasing need for more high-touch and personalised engagement, wealth managers also are focusing on equipping their advisors with the tools and dashboards required to ensure a value-added client engagement. An optimum combination of traditional practices and modern tools are required to provide an enhanced experience and retain and grow AuM