Introduction

Introduction

Aircraft securitisation: the sustainable force in aviation financing

» Aircraft securitisation has emerged as a prominent asset class within the esoteric asset-backed securities (ABS) market in recent years. Its appeal lies in its strategic role in workingcapital management, support to a systemically important sector and potential to deliver higher yields than those of other ABS segments.

» Issuance volumes increased steadily from 2013 to 2019. The market experienced a sharp decline in 2020 due to the global halt in air travel caused by the pandemic, but activity rebounded in 2021 as travel resumed and demand surged. However, momentum slowed again in 2022-23 amid renewed concerns relating to infection and geopolitical tensions, particularly the Russia-Ukraine conflict.

» Industry outlook: With key bottlenecks in the aviation sector beginning to ease, the aircraft securitisation market is expected to maintain positive momentum through to the mid-2040s, assuming current trends continue and it remains focused on achieving its green goals.

Importance of aircraft ABS

Aircraft lease-backed securities and enhanced equipment trust certificates (EETCs) have become the twin engines driving the resurgence of the aviation ABS market in recent years. These instruments have played a pivotal role in supporting the sector’s recovery and growth. However, the aviation sector’s emergence from the pandemic has not been without turbulence. The rollback of economic support measures introduced during the crisis created financial headwinds. While passenger demand rebounded sharply, airlines faced liquidity challenges as cashflow remained insufficient to service the debt accumulated during the pandemic. This gap was bridged by renewed access to capital markets, where securitisation provided a critical mechanism for refinancing and sustaining operations.

To avoid a systemic collapse in aviation-linked bond markets, the sector focused on the following:

» Reducing cash burn

» Retiring older aircraft

» Deferring new aircraft deliveries

» Executing sale-leaseback transactions

» Using liquidity reserves

A sustainable solution emerged: using securitisation vehicles for financing needs, which enabled capital raising, debt rollover and funding for general corporate purposes. By early 2021, capital markets reengaged, and aviation demand rebounded, breathing new life into securitisation activity. Aircraft values stabilised in late 2021, bringing loan-to-value (LTV) ratios back within acceptable ranges for achieving investment-grade ratings on both senior and junior tranches. Rolling back equity injection, sustaining the sudden spurt in demand and focusing on growth led to a jump in debt-to-equity ratios of airlines with differing revenue buckets.

Aircraft sector – the present

EETCs and aircraft ABS: the twin financial engines US airlines issued over USD35bn in EETCs to finance their fleets from 1994 to 2021. This trend has continued after the pandemic, and EETCs remain a robust and reliable financing tool for major carriers, offering long-term, asset-backed debt solutions. United Airlines, for example, has issued UAL 2023-1 and UAL 2024-1, raising USD1.32bn and USD1.35bn, respectively, as part of a broader strategy to maintain liquidity.20 The aircraft ABS market has seen USD36.4bn in new issuance volume over six years since 2018, proving to be as important as EETCs.30 While the pandemic disrupted issuance momentum, the market rebounded as short-term debt issued during the crisis began refinancing ABS structures. ABS gained favour due to their flexible structuring, liquidity support, robust collateral management and credit enhancements. While EETCs continue to fuel major airlines’ debt strategies, the sector is relying increasingly on a dualtrack financing model, with leasing-based ABS for long-term capital, and asset-backed funding and loanbased securitisations for flexible, short- to medium-term capital.

Current market trends and challenges: filling the gap

With new ABS issuance constrained, banks are renewing warehouse facilities, loan-based securitisations (e.g., Ashland Place 2023-1) are gaining traction and the no-payment-insurance (NPI) guarantee model – similar to export credit support – is being used to secure “A” rated debt.

» KPMG reports that five-year all-in coupons for 2024 leasing deals include BOC Aviation: 5.0%, AirLease: 5.1% and AirCastle: 5.95%.10

» Goldman Sachs notes that while private placements are occurring, they are limited to high-quality assets, with sub-investment-grade issuers facing limited access.

» Mizuho highlights a shift in investor expectations, with bonds previously priced at a 2.5% yield for 65% LTV now requiring a 7.5% yield for the same LTV, reflecting market risk repricing.

» Lease rates are rising, but older aircraft portfolios are the only ones currently offering yields high enough to meet investor demand.

2025 and beyond: navigating the future of aircraft ABS

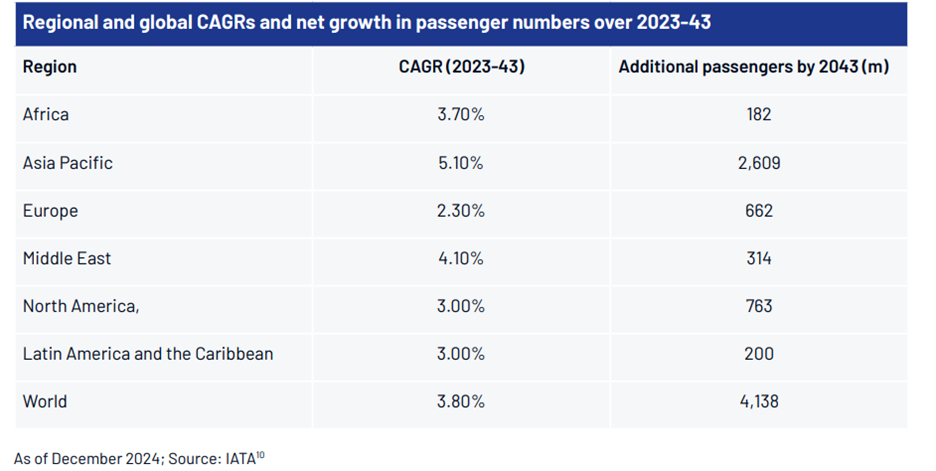

The global aircraft leasing market is projected to grow at a CAGR of 8.5%, reaching USD247.4bn by 2027, according to a study by Houlihan Lokey. USD25-30bn worth of ABS aircraft issuance and USD15-20bn worth of EETC issuance is expected by 2027, based on historical trends and aviation market growth forecasts. This growth aligns with long-term trends in air travel as global passenger traffic is expected to increase at an average annual rate of 3.8% through 2043. Regionally, Asia Pacific, Europe and North America would be the key contributors to this expansion, with Asia Pacific poised to become the largest driver of airline-sector growth by 2043.

Aircraft ABS account for 8-10% of total aviation financing options, and EETCs for 6-8%, according to Boeing’s 2025 Commercial Aircraft Finance Market Outlook; aircraft ABS issuance volumes could, therefore, reach a mammoth USD2.7tn by 2050.

Time is a critical factor in aviation, with speed and efficiency unmatched by other modes of transport. The sector’s success hinges on a number of interconnected modules – timing debt, route optimisation, fleet modernisation, maintenance and innovation. Timed debt plays a pivotal role, enabling airlines to finance upgrades, manage operations and adapt to evolving market conditions. Well-functioning primary and secondary markets, supported by securitisation, provide the flexibility needed to roll over debt and align financing with operational goals.

How Acuity Knowledge Partners can help

We bring deep domain expertise to the securitisation and structured finance markets; this has been proven over the past 10 years, with our SMEs in Investment Operation and Risk Services (IORS) supporting multiple asset classes and jurisdictions via flexible engagement models – from one-time projects to ongoing managed services. Support areas include pre- and post-issuance activities, along with market research, cashflow modelling and monitoring deal performance. This saves bandwidth for bankers, enabling them to focus on revenue-generating activity. We also provide technology-driven support by leveraging advanced tools for accuracy, speed and scalability, with solutions tailored to unique business needs and goals.