Published on June 5, 2025 by Monika Singh

ESG has become a defining framework in today’s investment strategies. As environmental, social and economic dynamics evolve, ESG integration in private equity is no longer just a compliance requirement; it has transformed into a competitive advantage. Recognising that the principles of sustainability, social responsibility and ethical governance drive long-term value creation, asset managers and investors are prioritising them increasingly.

Integrating ESG factors into private-market investments is becoming more and more relevant, driven by regulatory changes, investor demand and the potential for amplified financial performance. This trend is evident across private debt, venture capital and ESG integration in private equity. ESG integration is accelerating in private markets, according to a recent survey conducted by Acuity Knowledge Partners, with 73% of the respondents allocating more than a quarter of their portfolios to sustainable investments, 92% employing formal ESG risk-identification processes and a projected 70% aligning with UNPRI principles by 2025.

Unlike public markets, private firms, due to the difference in regulatory and structural factors, are not subject to mandatory ESG disclosures, leading to more investor-driven results. Rather than focusing on short-term financial performance, private investments often have longer holding periods, enabling investors to implement ESG-related improvements over time. There is also less external pressure from shareholders and regulators to adopt ESG practices.

Significance of ESG in private markets

ESG has shifted from being an optional scenario to a key driver of investment success. With increasing regulatory scrutiny and stakeholder expectations, ESG integration is achieving prominence in private markets as investors acknowledge its role in value creation, risk management and long-term sustainability. A study by INSEAD’s Global Private Equity Initiative[1] found that 90% of limited partners (LPs) factor ESG considerations into their investment decisions and 77% use it as a criterion in selecting general partners (GPs).

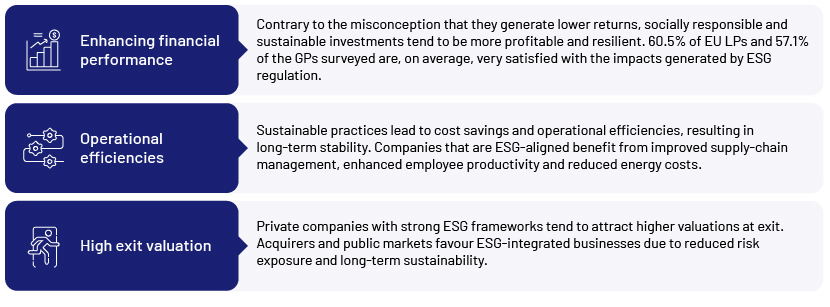

ESG as a value driver in private markets

There is a positive link between private-equity investors that incorporate ESG management frameworks in their portfolio companies and improved long-term performance. Improving a fund’s ESG footprint by 50% could lead to a statistically and economically significant net IRR increase – up to 12.4% over a fund’s lifecycle[2], according to the study.

Key ESG challenges in private markets

Private markets offer a number of opportunities for investors, but they also come with a unique set of challenges. From limited transparency and a lack of standardised reporting to regulatory complexities and inconsistent data, navigating private markets requires an informed and strategic approach. The following are the some of the key obstacles in this field:

-

Lack of standardised reporting: Unlike public companies, private firms are not subject to mandatory ESG disclosures, leading to inconsistent data and reporting.

-

Greenwashing concerns: Some organisations market themselves as ESG-compliant without meaningful integration. Investors need to conduct thorough due diligence to separate genuine impact from superficial claims.[3]

-

Limited transparency: Private firms’ disclosures often contain less information than those of public companies.

-

Inconsistent ESG priorities: Investors’ ESG goals are often not aligned with the strategies of portfolio companies, minimising the overall impact of ESG considerations.

The future of ESG in private markets: emerging trends

ESG integration in private equity is rapidly evolving, and there is significant push for more transparent investment practices. Integration is shifting from being a compliance requirement to a core business strategy, and companies and investors are recognising the long-term benefits of integrating sustainability into their operations and portfolios. The following are some of the ESG-related trends emerging in private markets:

-

Impact investing: The number of funds prioritising measuring environmental and social impact alongside financial returns is increasing.[4]

-

Climate tech and sustainable innovation: Venture capital is fuelling startups focused on renewable energy, carbon capture and circular economy solutions.

-

AI and blockchain in ESG: Technology is enhancing ESG transparency, data collection and accountability to monitor performance of portfolio companies.

-

Active ownership: ESG is not just a risk-mitigation tool but also part of value creation, with GPs taking on an active role in improving ESG performance and incorporating ESG-linked incentives into compensation.[5]

The ever-evolving ESG framework has now become a key factor in private-market investments. As regulatory pressure increases, investor demand for ESG adoption grows and sustainable business practices prove their value, integrating ESG is becoming a competitive advantage. Investors who proactively embrace ESG would be better positioned for long-term success, value creation and resilience to risk.

How Acuity Knowledge Partners can help

We support private-market clients across asset classes, including private equity, private credit/debt, private equity secondaries and buyout firms with investment screening. We conduct positive and negative screening, UN Global Compact framework signatory screening for target screening and screening for LP/GP reporting, regulatory reporting and compliance with the SFDR and EU Taxonomy. We also provide ESG support services across the investment lifecycle, with customised support for pre-deal and post-deal operations.

Sources:

-

https://flow.db.com/more/esg/eight-esg-trends-to-watch-in-2024#!

-

https://store.pwc.in/en/publications/private-equitys-esg-journey-from-compliance-to-value-creation

-

[4] https://www.linkedin.com/pulse/esg-revolution-private-equity-trends-shaping-future-investing-gupta-crxpc

-

[5] https://dv-website-linux.azurewebsites.net/6-trends-shaping-the-future-of-impact-and-esg-investing/

What's your view?

About the Author

Monika has been working at Acuity Knowledge Partners as an Associate for 3.5 years within Private Market (PM). She brings expertise in building ESG products, SFDR reporting, and sustainability-focused analysis across diverse sectors. She has worked extensively with global clients on various sustainability frameworks.

Like the way we think?

Next time we post something new, we'll send it to your inbox