Published on January 5, 2023 by Shilpa Sukumar

2022 was a choppy year for wealth managers as global capital markets faced multiple headwinds. While wealth management asset inflows have remained largely positive, AUM slumped owing to unfavourable market movements. The picture seems no different in 2023. Global growth is expected to be sub-par, with the likelihood of a recession in key European countries and the UK, and a significant slowdown in the US.

As wealth managers navigate these turbulent times, focus would be on preserving clients’ capital and hedging inflation. Digitalisation and personalisation would continue to dominate capex allocations in the wealth management space, as these are likely to offer scalability and client stickiness, and help offset downward pressure on profit margins. On the growth front, deepening presence in emerging markets and targeting younger and mass affluent clients would be key focus areas.

We expect the following themes to play out in 2023 and beyond in the wealth management sector.

1) Creating a basket of resilient investments with a focus on inflation hedge

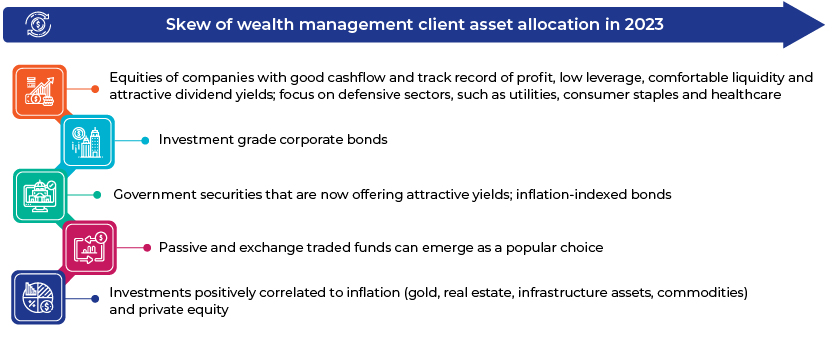

Capital markets are currently highly volatile as the global economy faces an imminent recession. Inflationary pressure, a high-interest-rate environment, uncertainties around the Russia-Ukraine conflict and the energy crisis in Europe would continue to affect capital markets in 2023, although to a lesser extent than in 2022. Market volatility would call for focus on investments in resilient equities and fixed income instruments, which could provide some downside protection. Furthermore, inflation levels are likely to remain structurally high in the near term, despite an anticipated moderation in consumer prices amid easing supply-chain concerns and a softening of prices of a few commodities. Therefore, the prime focus of wealth managers in the near term would be on advising clients on an effective inflation hedge.

The traditional 60-40 stock-bond portfolio mix for financial assets is unlikely to provide the required diversification and returns amid inflationary pressures and swaying markets. Wealth managers are likely to advise their clients to diversify into commodities (mainly energy-related and precious metals) and alternative investments. In terms of emerging-market exposure of global clients, with the MSCI Emerging Markets Index having plummeted c.20% in 2022, valuations are attractive. However, we expect wealth managers to take a conservative stance, as concerns over a global slowdown, a still-strong USD and inflation could weigh on emerging economies’ growth outlook.

2) Alternatives providing diversification benefits and higher returns

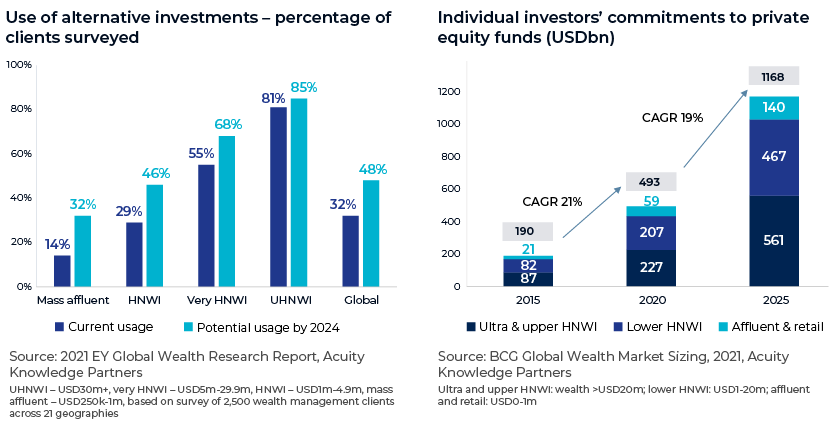

Alternative investments such as commercial real estate, private equity/debt, venture capital and hedge funds are gaining traction among high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), as they offer a good risk premium and diversification benefit. Private markets and unconventional alternatives were largely unexplored by wealth managers owing to their higher minimum investment, restrictions on capital withdrawal and complicated administration. However, some fintech companies and financial institutions have developed investment platforms customised for retail clients (including feeder funds, public non-traded REITs and liquid alternative credit funds) in recent years. Such platforms require lower minimum outlay and offer better liquidity, opening up an array of opportunities for wealth clients.

Overall, alternatives are being viewed as a good inflation hedge, a volatility protector and a medium to generate higher returns vs traditional investments in the tepid market environment. Nonetheless, they come with their own challenges. Hence, allocations in this space could largely flow into relatively flexible (low lock-in periods) and relatively liquid structures in the near term. Of the strategies, private equity could stand out, particularly those focused on real estate, infrastructure and sustainability investments, as these typically have lower correlation to and have exhibited relative outperformance vs public markets. Private debt in these areas is also likely to gain favour among HNWIs and UHNWIs.

-

Mercer’s 2022 Global Wealth Management Investment Survey showed that 58% of the 125 wealth managers surveyed already invest in illiquid assets and 15% are considering investing in the next 12 months. Private equity remains the top choice (58% stating it is their first investment preference among alrernatives), followed by real estate (16%; warehouses, data centres are considered attractive) and private credit (14%).

3) Sustainable investments becoming mainstream

Sustainable net-zero investments by private wealth clients are growing rapidly. Seventy-five percent of wealthy millennials consider environmental, social and governance (ESG) to be a crucial factor in investment decisions, according to a survey by Bain & Company. Offering personalised, research-driven ESG advice to clients is not viewed as a value-add anymore. Against this backdrop, wealth managers are enhancing their ESG capabilities by recruiting ESG specialists or partnering with third-party service providers. Wealth management players would continue to invest in strengthening their ESG advisory in 2023, focusing on offering standardised reporting and scoring, and re-drawing their client portfolios with a holistic view on the circular economy.

-

Bain & Company forecasts that ESG-related assets will constitute c.46% of all AUM by 2030 vs 33% currently

4) Investing in the next leg of digitalisation

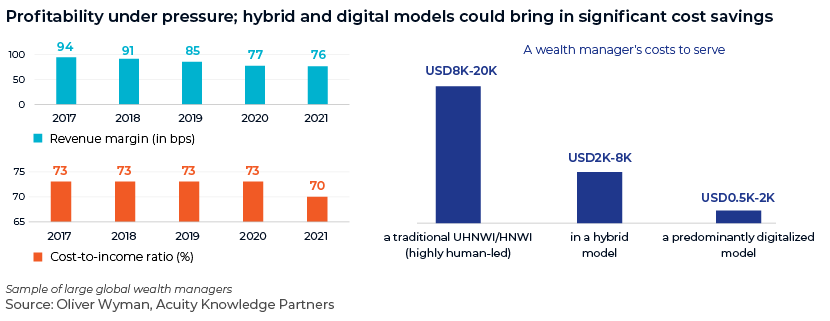

The pandemic accelerated the digital shift in the wealth management sector. Most wealth managers have swiftly implemented online interfaces to interact with their clients and delivered services with a basic level of digital support over the past two years. As the demographic shifts to more tech-savvy, younger affluent clients, and given the heightened competition from robo-advisors and fintech companies, there is growing urgency to turbocharge wealth management players’ tech journeys. Wealth managers’ capex is likely to flow into automation and artificial intelligence in the near term, to provide faster client onboarding, basic curated advice and high-quality tools/ dashboards, complementing the human advisory element. Cybersecurity and compliance are other areas in which we can expect material investment. Tech transformation has become imperative for wealth managers to attain scale and flexibility, and achieve effective mass personalisation. Moreover, a hybrid or digital-led business model could bring in significant cost efficiencies to this sector, which has historically grappled with high cost-to-income ratios. As revenue margins of wealth management players continue to slide, they are likely to re-look at their operating models to augment profitability.

5) Widening emerging-market footprint

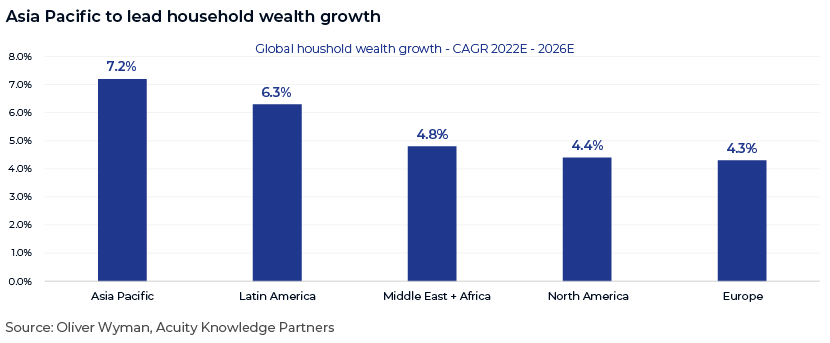

Emerging markets are witnessing a steady increase in household wealth. Asia Pacific, which accounts for 42% of global wealth (according to a McKinsey study), has encouraging prospects. Wealth management growth in Asia is expected to surpass other regions’, according to findings from a survey by Accenture, with AUM doubling and revenue increasing by c.60% over 2021-25. Expanding wealth management footprint in emerging markets, both through organic and inorganic opportunities, is now largely embedded in key global banks’ growth strategies; for example, UBS, Deutsche Bank and Credit Suisse have all committed to making notable investment in Southeast Asia and the Middle East over the next 24 months. Aside from global players, we could also see increased investment by domestic wealth management players in this region.

6) Capturing a wider customer base

Wealth management is no longer limited to HNWIs and UHNWIs. There has been an influx of affluent millennial clients in the private wealth space in recent years, seeking assistance on investments, insurance and tax planning. To start their wealth-planning journeys, younger clients typically prefer self-directed online tools, subsequently soliciting high-quality independent financial advice as their portfolios expand. Thus, wealth managers are likely to integrate digital/mobile applications with their personal advisory offerings, either developing these in-house or buying existing fintech platforms. To provide the instant information sought by tech-savvy clients (in addition to meeting regulatory requirements), they are likely to focus on broadening their bespoke research capabilities by deploying a small in-house research team, supported by a more cost-efficient outsourced team.

-

Intergenerational wealth transfers of USD84tn are expected through 2045 in the US, according to Cerulli Associates. Staying ahead on the curve in capturing the younger client base could be a key business accelerator for wealth management players

Conclusion

Wealth managers are likely to see a slow recovery in AUM in 2023 due to market volatility (with mixed net new money trends across geographies). Fee income would remain under pressure owing to lower AUM levels. Nevertheless, wealth management companies would continue with their digital investments and bolstering product and research capabilities, which would place them on a strong footing to capture opportunities when the market rebounds.

How Acuity Knowledge Partners can help

We work with wealth managers as an extension of their research teams and help build their proprietary research products across equity, credit and funds. Apart from research and advisory, we provide services in sales and marketing, portfolio management, compliance and credit risk analysis.

Our integrated solutions across asset classes and functions help wealth managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Sources:

-

https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-2023.pdf

-

https://www.bcg.com/publications/2022/unlocking-private-equity-in-wealth-management

-

https://www.capgemini.com/insights/research-library/top-trends-in-wealth-management-2022/

-

https://www.accenture.com/us-en/insights/capital-markets/wealth-management-future-asia

-

https://www.mercer.com/our-thinking/wealth/top-considerations-for-financial-intermediaries.html

What's your view?

About the Author

Shilpa Sukumar has around 13 years of experience in investment research. She has been with Acuity Knowledge Partners (Acuity) since 2013 and has worked in both sell-side and buy-side engagements. She currently manages delivery for leading global private banks and wealth managers, supporting clients with their equity research needs, covering multiple sectors and regions. Prior to joining Acuity, she worked with CRISIL Ratings (bank loan ratings) and CRISIL Global Research and Analytics. She has experience in equity and credit research, financial modelling and customer relationship management. Shilpa holds a post graduate diploma in Management from T A Pai Management Institute and a bachelor’s degree in Commerce from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox