Published on September 1, 2023 by Neha Harish Sharma and Disha Agrawal

The year 2022 ended the longest positive economic cycle (which started in 2010) since WWII. We saw unexpected turbulence in venture capital trends and investing activity in 1Q23 owing to a number of factors such as the war in Ukraine, global supply-chain issues, rising interest rates and inflation, and a looming recession. Venture capital investors and the startups they backed had to manage the resulting fallout. Investors halted new financing as they turned their focus to supporting existing portfolios.

Trends in venture capital showed a steep plunge in activity in 2022. Global venture capital investments amounted to USD22bn in November 2022 vs USD70bn in November 2021, almost a 70% y/y decline, according to Crunchbase. Similar declines were experienced when the internet bubble burst in 2000-02; investment volumes in the sector took 16 years to return to normal levels. The year 2023 will likely be a year of tightening belts for most startups, as fundraising is expected to be far more challenging, with venture capitalists becoming more cautious and opportunistic investors disappearing.

After an exceptional period, a slowdown[2]

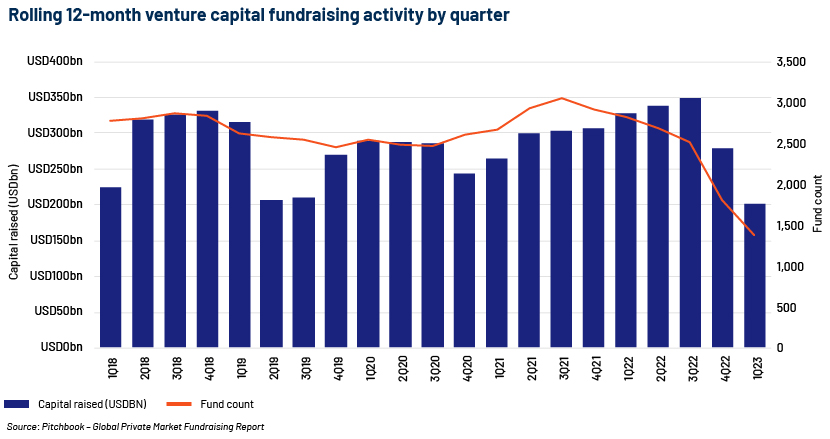

Venture capital investment continues to face significant headwinds due to the accelerated slowdown in venture capital fundraising trends; 1Q23 saw an even steeper downturn in the volume of venture capital financing worldwide, across stages. Capital raised settled at USD29.5bn in 1Q23, representing a 72.0% drop from 1Q22.

Trailing 12-month capital raised was nearly as low as levels in 2018, while the respective fund count plummeted to what we saw in late 2014. Venture capital fundraising activities suffered a knock-on effect from an extremely slow exit environment, diminished distributions and the denominator effect of the valuation pullback. Limited partners are, thus, cautious in capital deployment, favouring known general partners with long-term and consistent track records.

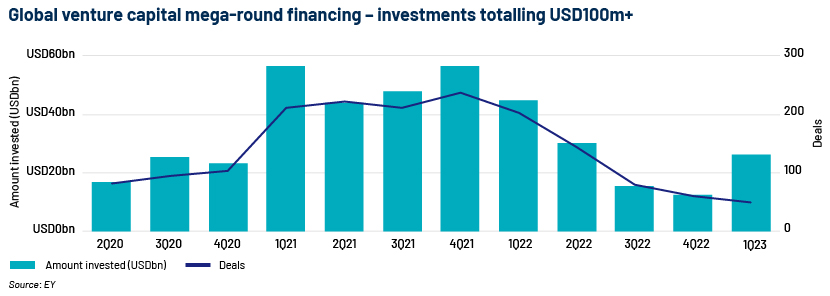

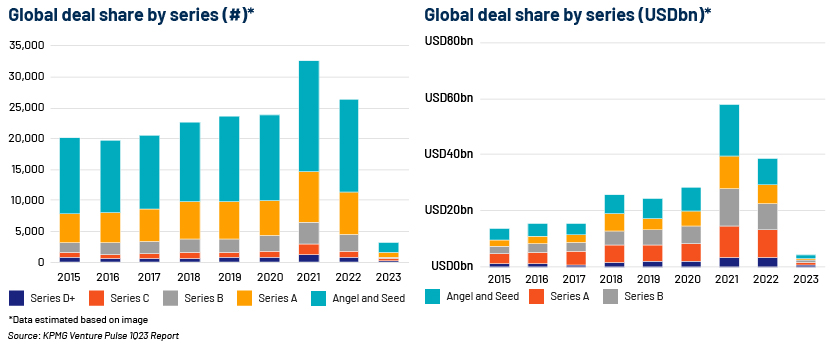

Large megadeals disappearing, reducing investment volume and value

Venture capital investment in mega-rounds has been declining globally since 2022; this declined further in 1Q23, with deal count down by 73% y/y as venture capital investors continued to shy away from large, Late-Stage deals. By this time last year, the market had already recorded 208 mega deals. In 1Q23, only one area attracted a USD1bn+ mega-round. Despite the overall drop in venture capital investment, large deals continue to be concluded, especially among companies with large addressable markets and disruptive innovation.

Deal activity showed far more resilience, with investment and deal activity remaining quite robust for pre-Seed and Series A deals.[3]

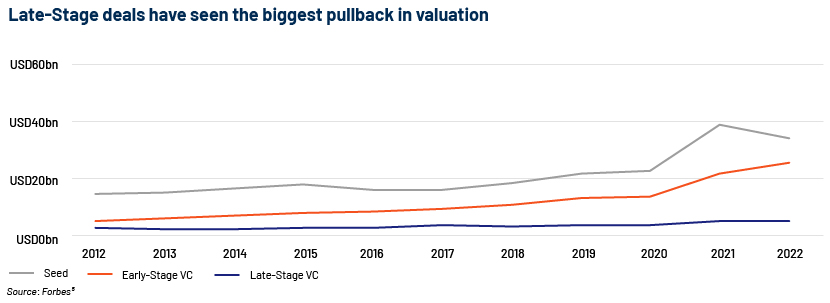

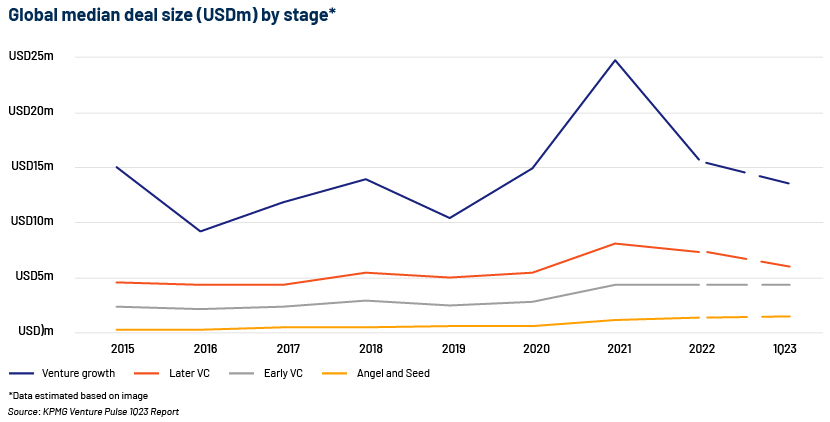

Investors step back from Late-Stage deals

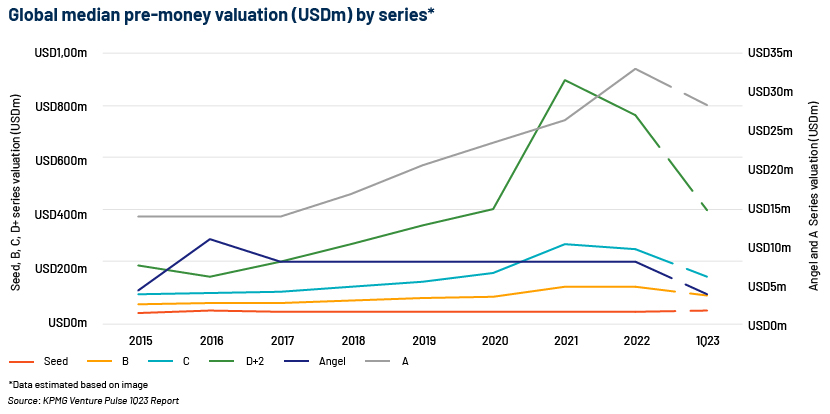

After a record-breaking 2021, venture capital investments and Late-Stage tech valuations decreased in most of 2022, with valuations dropping 10% y/y. The exponential increase in valuations in recent years has disappeared, and companies and investors are bracing for down-rounds and, potentially, re-pricing of prior rounds. This is because investors are now less willing to pay the revenue multiples they have been paying in recent years for high-growth, Late-Stage companies. However, 2022 saw large up-rounds. Companies focused on revenue growth and profitability were rewarded in the fundraising market.

Early investment holds strong as investors retreat from riskier stages

Despite pricing pressure in the Later Stages, Seed and Early-Stage valuations were resilient and rose slightly in 2022. Valuations in the Early Stages were supported by increased competition, with sizeable Seed-focused funds raised in recent years by firms such as Sequoia, Andreessen Horowitz, Index and Khosla.

Median pre-valuation for Seed-Stage deals reached USD9.1m in 1Q23 compared to a median USD7.0m in 2022. The trend likely indicates investors are flocking to higher-quality companies. The sudden emergence of Early-Stage companies in the generative AI space is also giving even pessimistic investors something to be bullish about[7].

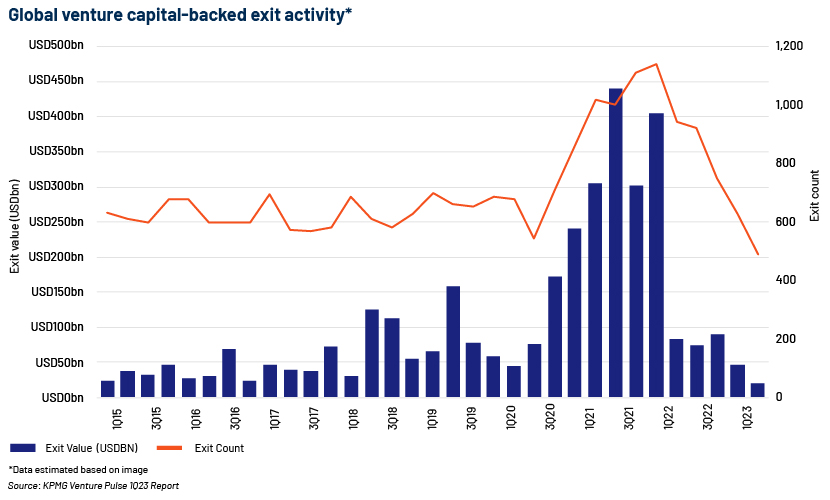

Almost no exit activity; market dominated by sluggish M&A

Remarkably, 2022 saw a 90% drop in exit activity compared to 2021, including buyouts, public listings and acquisitions. M&A remained the most prolific route while the IPO window remained firmly shut in 1Q23. Investor sentiment, particularly in the Americas and Europe, suggests the IPO window would not open until late in the year or, quite possibly, until 2024. Given their unique positions globally, China and Hong Kong could be the exceptions[8].

Shifting investment focus towards tech

Themes/types of investments expected to gain momentum in 2023 include the following:

-

Focus on sustainability and solutions to reduce carbon footprint.

-

Research from PwC shows that climate tech funding in 2022 accounted for more than 25% of all venture capital spending and investments; this share is expected to increase.

-

2023 is expected to be the year for mainstream AI adoption. The development of large language models (such as ChatGPT3/4) and recent advancements in generative AI in speech-to-text, text-to-images and images-to-video are expected to significantly influence the development of many SaaS companies and marketplaces. Hence, venture capital funds would be increasingly interested in deep tech solutions based on AI and machine learning.

-

The largest venture capital deals in every region in 1Q23 were by alternative-energy companies. US-based alternative-energy infrastructure company Generate raised USD880.6m; China-based electric-vehicle company Zeekr raised USD750m; and Germany-based alternative-energy leasing company Enpal raised USD228m.

Summary

Later-Stage companies had a rough run in 1Q23, with venture capital in short supply. The slow-moving exit market continues to tie up limited partners’ capital, making investors cautious in an unforgiving tech market. venture capital portfolio management may become even more selective about how they deploy capital, and Seed and Series A rounds may become more challenging, as they are likely to prioritise existing portfolio companies.

How Acuity Knowledge Partners can help

We have partnered with global venture capital portfolio monitoring firms for two decades, helping them navigate challenges amid down-trends and up-trends in the markets and weather economic cycles. Venture Capital Outsourcing

Sources

-

[1] https://www.vestbee.com/blog/articles/vc-trends-shaping-cee-startup-ecosystem-in-2023

-

2 Pitchbook – Global Private Market Fundraising Report: https://pitchbook.com/news/reports/q1-2023-global-private-market-fundraising-report

-

[3] https://pitchbook.com/news/reports/q1-2023-global-private-market-fundraising-report

-

[4] https://www.ey.com/en_us/growth/venture-capital/q1-2023-venture-capital-investment-trends

-

[5] https://www.forbes.com/sites/truebridge/2023/03/30/state-of-vc-in-2023-the-resilience-of-venture-capital/?sh=1df51a068b76

-

[6] https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/04/venture-pulse-q1-23-report.pdf

-

[7] https://pitchbook.com/news/articles/venture-capital-monitor-charts-Q1-2023

-

[8] https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/04/venture-pulse-q1-23-report.pdf

Tags:

What's your view?

About the Authors

Neha holds a Bachelor’s Degree in Finance from Narsee Monjee Institute of Management Studies, Bangalore. Prior to joining Acuity, she worked at TresVista Financial Services for ~3 years as a Senior Financial Analyst. She describes herself as confident, focused, and practical. In her spare time, she enjoys dancing.

Disha is a senior associate within the Private Equity team at Acuity Knowledge Partners and has 4+ years of experience in business and strategic research working on a range of qualitative as well as quantitative research & analysis assignments for global investment banking and PE clients. She holds an MBA in Finance from LBSIM, Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox