Published on September 3, 2025 by Natasha Agarwal and Thusitha Kuruppu Arachchige

Introduction

The notion of flying cars has persisted for decades as a vision of future transport, where every day travel extends into the skies. However, the idea has largely lingered in fiction, with every real-world attempt struggling to find commercial success. Meanwhile, our urban reality has become increasingly congested and strained.

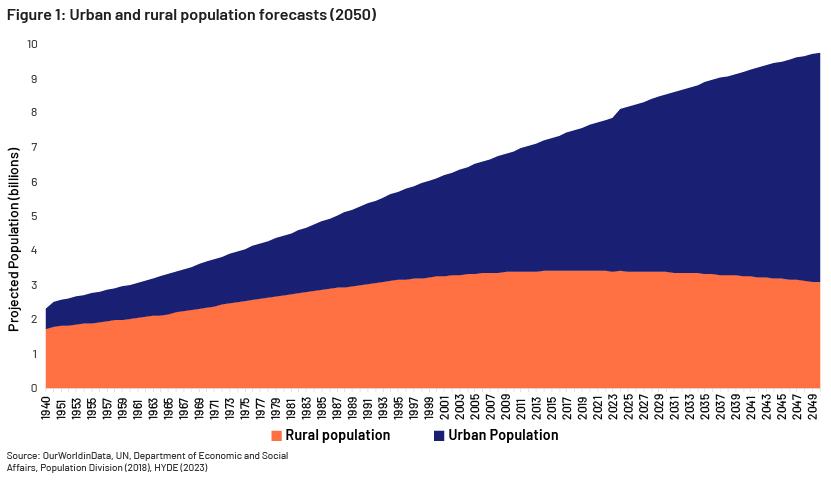

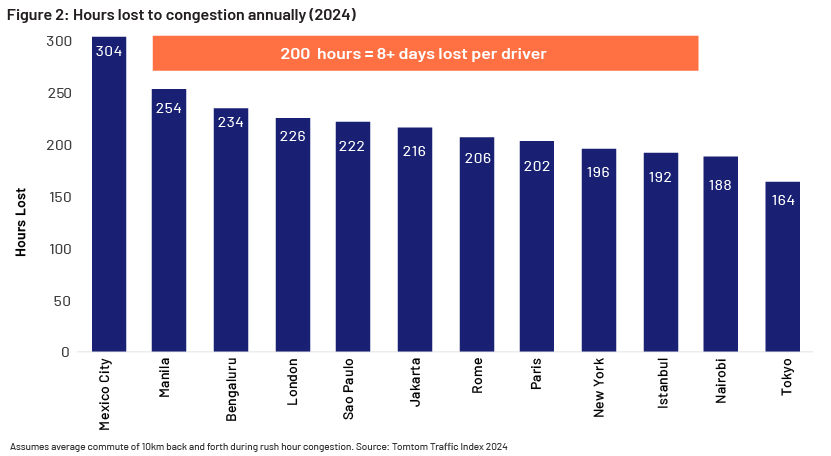

Enter urban air mobility (UAM) and electric vertical take-off and landing (eVTOL) aircraft. This refers to low-altitude movement of people and goods within and around cities, using vehicles that can take off and land vertically. Think of it as a new layer of transport to complement what already exists. As urban populations increase globally and infrastructure struggles to keep pace, the need for faster, more flexible transport is becoming harder to ignore (Figure 1). Everyone hates being stuck in traffic. Take London, for instance, where drivers lose over 200 hours a year to traffic congestion (that is more than eight days of being stuck behind the wheel), costing the city more than GBP5bn annually (Figure 2). The pattern is the same in cities across the globe, and the consequences are mounting: lost time and productivity and rising environmental costs.

How do eVTOLs work?

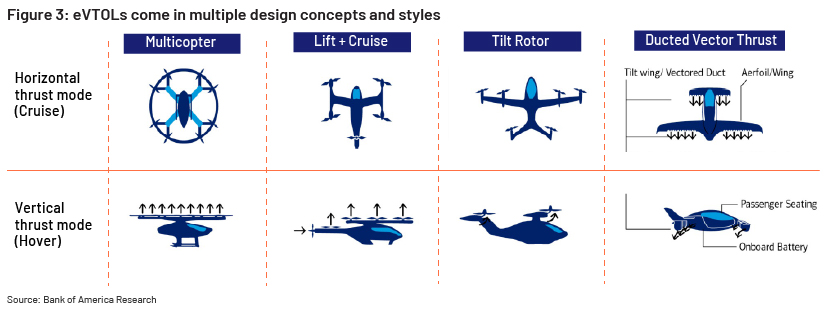

The UAM sector prefers the vehicular term eVTOL aircraft. While the acronym is not quite as catchy as “flying cars”, eVTOLs are already at the centre of a multi-billion-dollar industry. They are designed to take off and land vertically, cruise like a plane and run entirely on electric propulsion. Unlike helicopters, which rely on a single rotor to generate both lift and thrust, eVTOLs use multiple electric motors powered by batteries. These motors are distributed around the aircraft to drive rotors and propellers that provide thrust. This setup gives designers a great deal of flexibility, which is why eVTOLs can look and fly in radically different ways (Figure 3). Furthermore, they are cheaper and quieter than helicopters and, in theory, produce significantly less carbon. With further technological advances, some models could even be capable of autonomous flight.

Applications of Urban Air Mobility

UAM use cases revolve around two primary functions: transporting goods and transporting people (Figure 4). While both face similar regulatory and technological hurdles, goods transport is expected to scale more quickly because safety requirements are lower and size/weight constraints tend to be less severe. Both large and smaller eVTOL aircraft can be used for a range of these services, including last-mile delivery and emergency logistics. Human transport, meanwhile, is seen as the more lucrative and longer-term opportunity. Initial services for human transport will likely focus on short routes such as airport shuttle services, urban point-to-point travel and medical services.

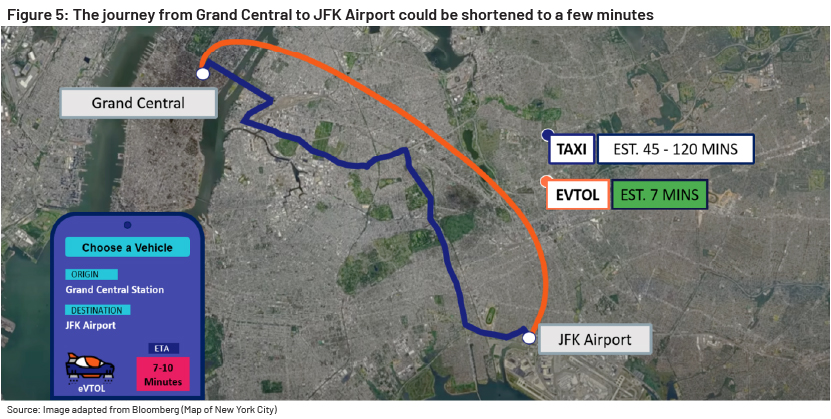

UAM transport will likely operate in a multimodal, ride-share fleet model. For instance, a traveller could book an eVTOL ride from Grand Central Station (New York) to JFK Airport with the same ease as hailing an Uber, completing the trip in a fraction of the time it would take by road (Figure 5). Over time, as vertiport infrastructure expands and trip distances lengthen, costs are expected to fall, making air mobility more accessible and integrated within the broader transport ecosystem.

Market outlook of Urban Air Mobility – high potential comes with uncertainty

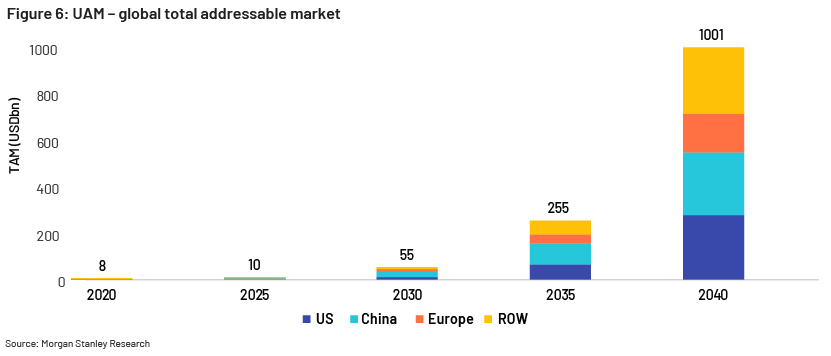

Momentum is building with dedicated startups, aerospace incumbents and carmakers continuing to commit billions to the UAM space. Current projections value the market at around USD1tn by 2040, led primarily by passenger transport (USD475bn by 2040) and supported by cargo, logistics and emergency service use cases (Figure 6). Much of this growth reflects the potential to replace short-haul car trips in congested urban corridors, while unlocking new aerial routes that surface transport cannot practically serve. To date, USD20-25bn has already flowed into the sector, although most of this remains tied to early-stage development.

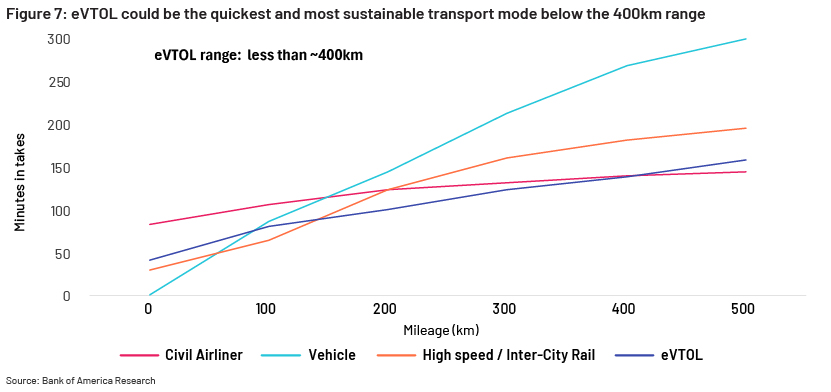

That said, the vision and demand for UAM and eVTOLs are still largely unproven, and it remains to be seen whether their commercial viability and economics will stack up. Progress is still largely limited to test flights, concept approval and small pilot projects. The mid-2020s are expected to mark the beginning of limited operations, with more widespread adoption occurring after 2030. By 2040, over 100,000 eVTOLs could be in operation, potentially serving up to one billion passengers annually. This outlook is supported by studies indicating that eVTOLs could take the least travel time when journey distances lie below 400km, compared with ground vehicles, rail transport and civil airliners (Figure 7).

Key challenges of Urban Air Mobility

Much of the uncertainty around the sector stems from several hurdles related to effective and widespread adoption. These include the following:

eVTOL batteries. Battery performance remains a key fundamental constraint. The effective and seamless operation of eVTOL depends on high-performance eVTOL battery packs that provide both high energy density and high-power output. Current lithium-ion systems have far lower energy density than jet fuel, supporting only short-distance flights. Substantial advancements are needed in battery technology, cooling systems and safety protocols to transform urban transport.

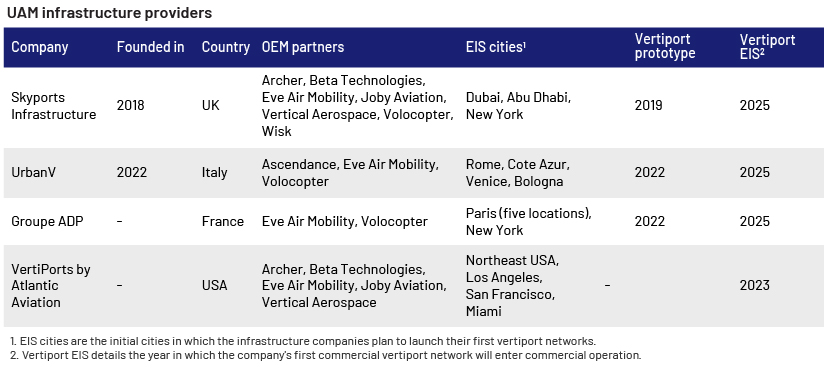

Infrastructure-readiness. Effective deployment of eVTOL and drones requires specialised infrastructure such as vertiports that serve as landing and take-off hubs for air taxis and passenger drones. These vertiports should be easily accessible and equipped with facilities for maintenance and passenger services. Charging stations are also needed to ensure uninterrupted operations. Further integrating UAM vehicles into the airspace will require advanced technologies and upgraded air traffic management systems.

Regulatory frameworks. Robust regulations need to be in place to address the specific requirements and challenges of UAM. To ensure safety and reliability of UAM operations, standards for vehicle certification, maintenance and pilot training must be established. Integrating eVTOL operations into the airspace will require cities to collaborate with aviation authorities to establish dedicated air corridors, flight paths and traffic management systems for safe and efficient UAM operations. Some progress has been made recently, for instance, with cities in China, the US and parts of Europe preparing for pilot routes. In late 2024, the US Federal Aviation Administration (FAA) also introduced a new “powered-lift” category, marking the first civilian aircraft classification since the 1940s, specifically designed to accommodate eVTOL designs more effectively. However, overall regulatory progress remains uneven and fragmented.

Public acceptance. Public trust and support are essential for the successful adoption of UAM. Communication, transparency and outreach initiatives are required to educate people about the safety, reliability and benefits of UAM.

Urban Air Mobility (UAM) ecosystem

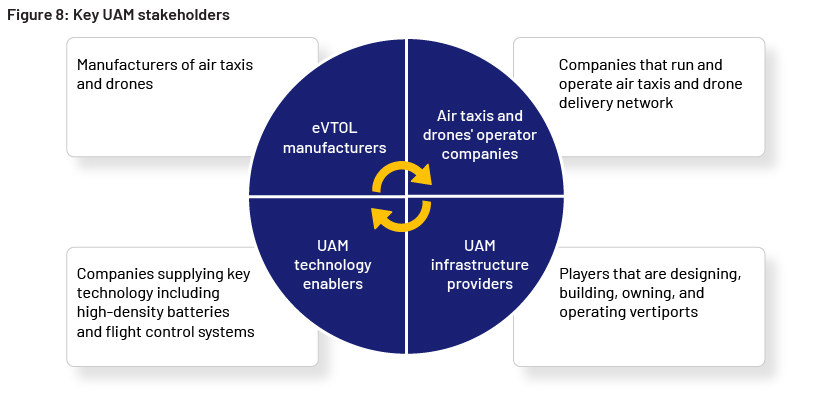

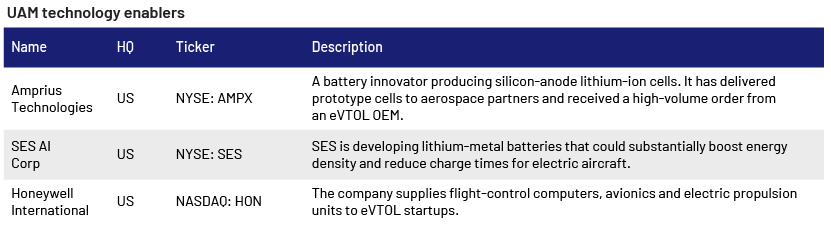

The UAM sector includes a wide range of stakeholders, including eVTOL manufacturers, technology developers, infrastructure developers and providers, delivery solution providers and logistics companies (Figure 8).

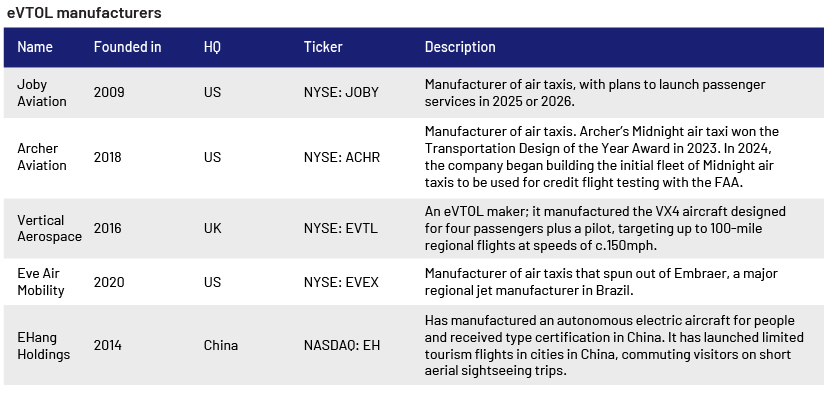

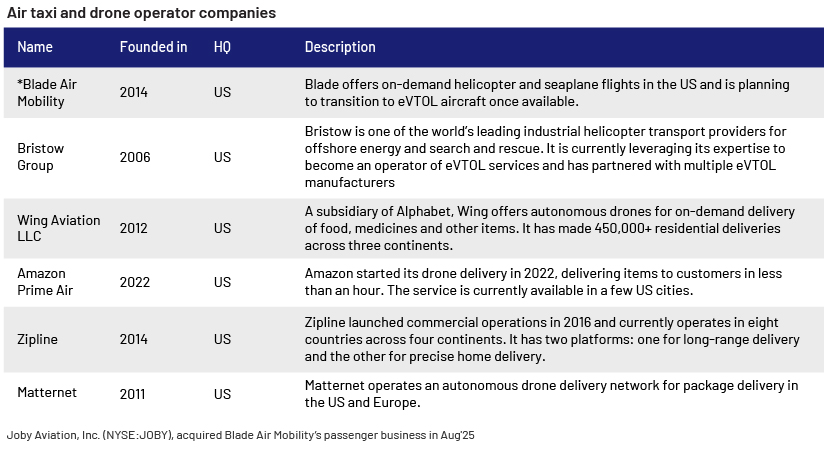

While there are only a handful of publicly listed players in eVTOL manufacturing, there are several private companies making significant strides across the UAM sector.

Urban Air Mobility Investment Trends

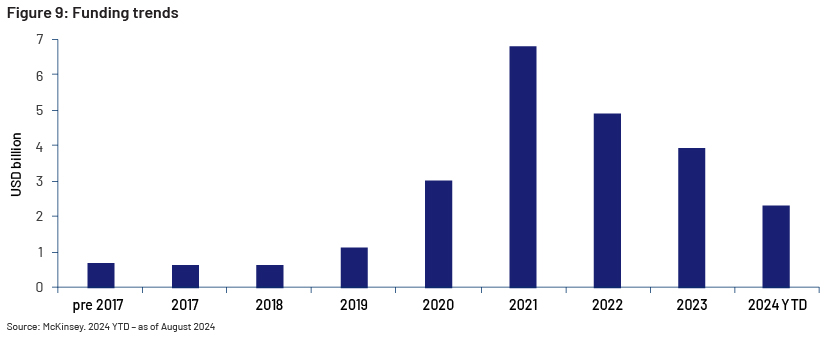

The air mobility sector has raised a cumulative USD22.2bn since 2004, with most of the funding directed towards the UAM sector (Figure 9). The UAM sector is cautious and going through a difficult phase, as disclosed funding has slowed since its peak in 2021, and additional funding is essential, as some of the leading UAM players are close to entering the commercialisation phase.

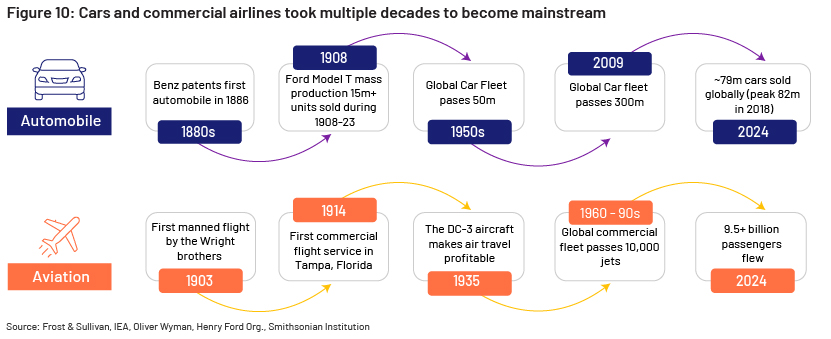

While it is tempting to get carried away by its potential and promise, UAM and eVTOLs remain a long-term opportunity. History reminds us that even automobiles and civil aviation took multiple decades to reach mainstream adoption (Figure 10). In much the same way, the success of UAM hinges on the sector’s ability to overcome these critical challenges before these vehicles can truly take flight on a commercial scale.

How Acuity Knowledge Partners can help

We offer tailored research, analytics and business intelligence solutions across sectors, integrating human expertise with advanced technology to generate timely, high-quality insights that help clients navigate fast-evolving areas such as mobility technology.

Sources:

- Joby Completes Acquisition of Blade’s Passenger Business :: Joby Aviation, Inc. (JOBY)

-

The “low-altitude” economy is taking off (https://institute.bankofamerica.com)

-

eVTOL/Urban Air Mobility – Morgan Stanley & Global UAM Regional Summit (https://www.aam-gurs.com/)

-

Top eVTOL Stocks for 2024: Ranked by Pure-Play Focus (exoswan.com)

-

Global Urban Air Mobility Infrastructure Market Share 2032 (custommarketinsights.com)

-

FAM funding: Capital flows regain momentum despite challenges (mckinsey.com)

-

Clouds or clear skies? Prospects for future air mobility (mckinsey.com)

-

Ehang – Funding, Financials, Valuation & Investors (crunchbase.com)

-

The Challenges and Opportunities of Urban Air Mobility(UAM) (aerogo.live)

-

Urban Air Mobility (UAM): Navigating Promises and Challenges in the Sky | LinkedIn

-

Taking to the Skies: The Evolution of Urban Air Mobility | Netscribes

-

4 key challenges in implementing urban air mobility – Crouzet

-

Global Fleet And MRO Market Forecast 2025-2035 (Oliverwynman.com)

-

Working Model of First Automobile Built by Karl Benz (henryford.org)

What's your view?

About the Authors

Natasha has over 13 years of experience in various research areas – equity research, business research and market research. She is currently supporting a buy-side client with thematic research. Prior to joining Acuity, Natasha worked with CRISIL, PwC and KPMG.

Thusitha Kuruppu Arachchige has over 04 years of experience in Investment research and currently supports a Global Asset Manager across various sectors.He specialises in equity research, industry overviews, and thematic analysis.

Like the way we think?

Next time we post something new, we'll send it to your inbox