Published on May 27, 2025 by Shikha Agarwal and Ramesh Dharanipathy

Unlocking the Omnibus Package – a brief overview

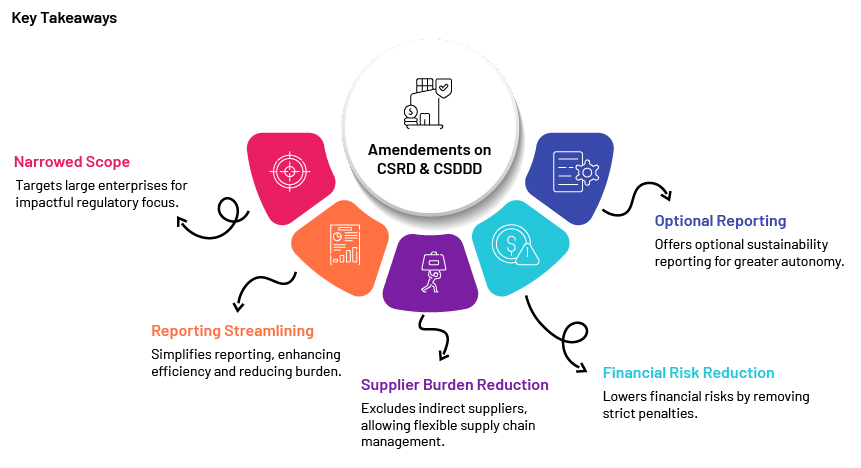

The EU Omnibus Package, a proposal by the European Commission to amend corporate sustainability reporting and due diligence directives, marks a major development in the EU’s regulatory horizon. This initiative aims to provide easier and simpler reporting obligations under the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). These regulations have the potential to improve sustainability transparency and corporate socio-economic responsibility but have been met with the criticism that they are burdensome in terms of administration, especially for small and mid-size enterprises. Specifically, the proposed amendment aims to lower compliance costs, improve the reporting standard relative to frameworks established globally and ensure more flexibility, while not compromising the overall objectives of the European Green Deal.

Source: European Commission, Acuity Knowledge Partners

Summary of pre-Omnibus and post-Omnibus requirements

| Section | Element | Pre-Omnibus requirement | Post-Omnibus requirement |

|---|---|---|---|

| Corporate Sustainability Reporting Directive (CSRD) | Scope of reporting | Applied to all large companies (250+ employees, EUR50m turnover) and listed SMEs. | Now applies only to companies with >1,000 employees and either EUR50m turnover or EUR25m balance sheet. SMEs removed. |

| Sector-specific standards | Required under European Sustainability Reporting Standards (ESRS). | Sector-specific standards eliminated to reduce complexity. | |

| Value-chain reporting | Companies had to disclose sustainability data for both direct and indirect suppliers. | Indirect suppliers excluded unless specific risks exist. Smaller companies (<1,000 employees) protected from excessive data requests. | |

| Reporting complexity | Required detailed qualitative and quantitative sustainability disclosures. | Focus shifted to quantitative KPIs; qualitative disclosures significantly reduced. | |

| Reporting timeline | Staggered deadlines depending on company size, with large firms required to report first. | Reporting delayed by up to two years for certain companies (second and third waves). | |

| Assurance requirements | Limited assurance required, with plans for reasonable assurance. | Future move to reasonable assurance removed; limited assurance remains. | |

| Corporate Sustainability Due Diligence Directive (CSDDD) | Scope of due diligence | Applied to direct and indirect suppliers along the value chain. | Now limited to direct suppliers, unless there is plausible evidence of indirect supplier violations. |

| Monitoring frequency | Annual supplier risk assessments required. | Monitoring frequency reduced from annual to once every five years. | |

| Contract termination | Companies were required to terminate contracts with non-compliant suppliers. | Termination no longer required; companies encouraged to work with suppliers to resolve issues. | |

| Liability and enforcement | Companies could be held civilly liable for due diligence-related failures. | Civil liability provisions removed. | |

| Financial-sector due diligence | Financial institutions had to conduct due diligence on clients and investments. | Due diligence-related requirements removed for financial institutions. | |

| EU Taxonomy | Mandatory reporting | Large companies had to report under EU Taxonomy rules. | New “opt-in” system for companies with <EUR450m turnover. |

| Data points and KPIs | Required reporting on revenue, capex and opex aligned with Taxonomy. | Data points reduced by approx. 705. Opex disclosure made optional. | |

| Penalties and compliance | Financial penalties | Companies faced potential penalties up to 5% of global turnover. | Penalty provisions removed. |

| Regulatory flexibility | Member states could impose additional sustainability requirements beyond the EU framework. | Greater harmonisation across the EU to reduce national-level variations. |

Impact on ESG strategies of asset managers

The Omnibus Package introduces significant regulatory adjustments that will likely reshape the ESG policies and strategies of asset managers across the EU. The new framework reduces the compliance burden, particularly for smaller firms, by ensuring the sustainability reporting requirement is streamlined and the CSDDD is refined. Asset managers would, therefore, have to reassess their due diligence processes, ESG risk assessment methodologies and material versus non-material disclosures. Decreased reporting thresholds may result in a more targeted investment landscape, where asset managers invest in companies aligned with simplified yet robust sustainability criteria.

However, some critics argue that loosening requirements for certain businesses could lead to inconsistencies in ESG data, potentially impacting the comparability of investment portfolios. To navigate these changes, asset managers will likely need to strengthen engagement with portfolio companies, ensuring that sustainability considerations remain a core component of investment decision-making while adapting to the evolving regulatory landscape.

Conclusion

The Omnibus Package marks a pivotal step forward in corporate sustainability reporting and due diligence within the EU, reinforcing the broader framework of EU Sustainability Regulations aimed at promoting responsible business practices. By focusing on enhancing transparency while easing compliance pressures, the package aims to foster a more sustainable and responsible business environment. Asset managers must adeptly balance the flexibility offered by these regulations with the need to maintain the integrity of ESG data, ensuring that sustainable investment practices are prioritised and effectively implemented.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners deploy ESG and sustainability specialists through flexible engagement models to provide a vast array of capabilities to effectively assist clients in a number of critical areas. These specialists are well versed in the intricacies of environmental, social and governance factors and are able to provide tailored insights that align with a client’s strategic objectives. With such comprehensive skillsets, our specialists are invaluable for any organisation seeking to strengthen its ESG and sustainability research and support it in investment decision-making.

Services we offer:

-

Climate risk and opportunity assessment

-

Climate change scenario analysis and stress testing

-

Quantifying financial impacts of climate risks

-

Evaluating the efficacy of decarbonisation plans

-

Evaluating Scope 3 emissions, particularly financed emissions

-

Preparing reports for the Task Force on Climate-Related Financial Disclosures (TCFD)

-

Support with sustainability and climate reporting

-

Conducting green, social and sustainable bond impact assessment

-

Climate risk and vulnerability assessments, including asset impact and impairment modelling

-

Single- and double-materiality assessments

-

ESG and climate maturity assessments

-

SDG mapping and impact assessment of investee companies

-

End-to-end support with SFDR reporting

-

EU Taxonomy assessment of investee companies

References:

What's your view?

About the Authors

Shikha has been with Acuity Knowledge Partners for the last 2 years. She has 6 years of experience in climate change and ESG. At Acuity, Shikha has worked in SFDR and EU taxonomy. Also, she provides specialized ESG issuer research to a large US based asset manager. Along with this, Shikha has also assessed and written PCD documents, formulated anti-corruption and anti-bribery action plans, and collated PAIs for multiple funds of leading asset managers based in Europe and the US. Prior to joining Acuity, she has worked with Tata Power and PwC. Shikha holds an MBA degree from the Xavier Institute of Management.

Ramesh Dharanipathy has been with Acuity Knowledge Partners for 13 years working in the areas of ESG, Sustainability, climate change and investment research. He has acquired extensive experience in various aspects of ESG, sustainability, and climate change, including conducting climate-related risk and opportunity assessments, performing ESG and climate maturity evaluations, and mapping Sustainable Development Goals (SDGs) alongside impact assessments for investee companies. His expertise also encompasses comprehensive support for SFDR reporting, EU Taxonomy assessments, double-maturity evaluations, ESG benchmarking and analysis, and developed ESG – related methodology documents. Additionally, he is involved in assessing the impact of green, social, and sustainable bonds while quantifying the financial implications of climate risks...Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox