Published on September 1, 2025 by Deepak Motwani

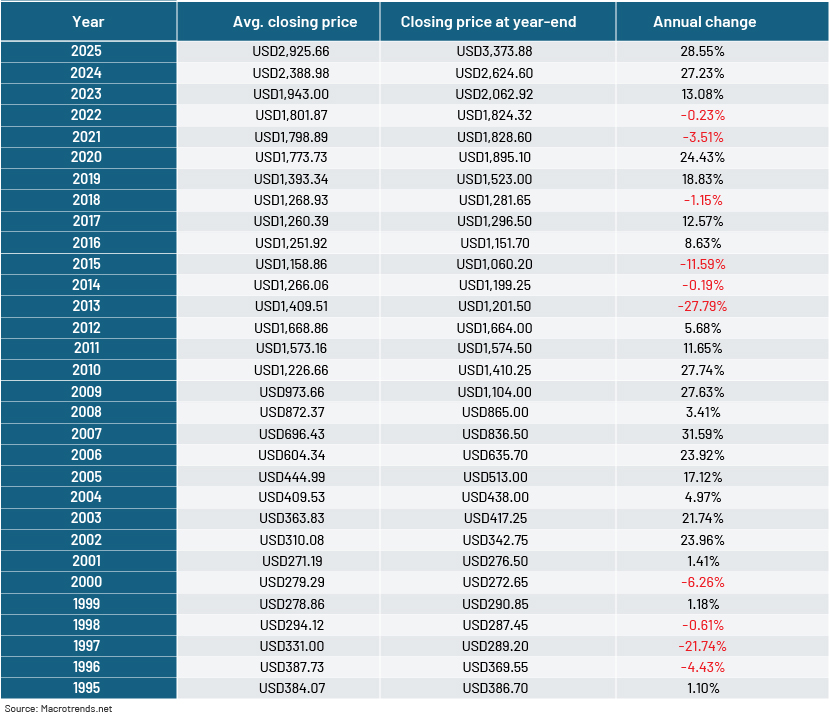

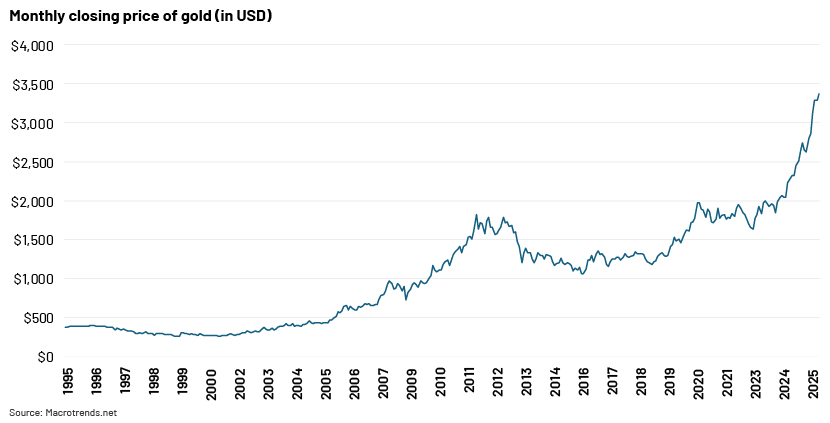

The global price of gold increased from USD1,393.34 an ounce (average closing price) in 2019 to USD3,373.88 in mid-April 2025, an increase of 2.42x or 242.1%. This was due to a combination of factors, including the ongoing economic uncertainty, unprecedented geopolitical events and ever-increasing demand from central banks.

Gold is often seen as one of the safest assets, especially during periods of economic uncertainty. Factors such as inflation, currency volatility, growing debt and weakening economies have further stimulated gold’s upward momentum, capturing the attention of investors, economists and consumers globally.

Historical context of the gold price

It is important to consider historical trends when trying to understand the recent growth in gold prices, especially how prices have stabilised amid economic downturns, volatile inflation or geopolitical tensions.

Factors driving the recent price increase

The gold price increased significantly in mid-April 2025, a year-to-date rise of nearly 28.6%, according to a Reuters report. It peaked at a high of USD3,500.05 per ounce during the trading session on 22 April 2025, before pulling back to under USD3,400.00 within the same day.

The key factors that led to this bullish trend are as follows:

Geopolitical tensions: The primary reason for the increase in price includes ongoing conflicts such as the US-China trade war, involving aggressive tariffs announced by the US and retaliatory measures by China, which have intensified concerns of a global economic slowdown. This led to strong demand for gold as investors sought to safeguard their interests amid rising volatility. Although the tariffs have been temporarily reduced for 90 days – from 145% to 30% by the US and from 125% to 10% by China – uncertainty prevails.

Furthermore, the Russia-Ukraine conflict has been escalating for several years, and the missile strikes and drone attacks on Isreal and Iran, including participation of the US, and other skirmishes in Eastern Europe and the Middle East that have obstructed trade flow especially in the Strait of Hormuz, have added to global uncertainty. Consequently, demand for gold remains high.

Weakening USD: The USD has declined around 9% against major currencies such as the Japanese yen (JPY), Swiss franc (CHF) and EUR since the start of 2025. The JPY has strengthened over 10% against the USD while the CHF and the EUR have appreciated about 11% since the beginning of 2025, according to LSEG data. As gold is priced in USD, a weak USD makes gold cheaper for holders of other currencies, boosting global demand.

Central-bank accumulation: Central banks around the world have significantly increased their gold purchases over the past few years. For the third consecutive year, gold purchases have surpassed 1,000 tonnes, with a record 1,180 tonnes purchased in 2024, following 1,082 tonnes in 2022 and 1,037 tonnes in 2023. This trend is expected to continue as nations diversify their reserves away from the USD amid rising geopolitical tensions, including deteriorating diplomatic relations and economic policy-related uncertainty. The following is a list of the countries that have net added the most gold reserves in the past 10 years.

Economic conditions and interest rates: The US Federal Reserve’s decision to cut rates has created a favourable environment for gold investment. Lower interest rates typically reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive. Expectations of additional rate cuts in the near future could further support gold prices.

Trump’s tariff impact: The tariffs announced by President Trump on 2 April 2025 have led to significant economic uncertainty across the globe. Although a 90-day pause has been implemented for most countries (including China), concerns remain over policy instability, the potential for a prolonged trade war and slower global growth, all factors that typically drive demand for gold.

Investor sentiment: Rising investor sentiment towards gold cannot be overlooked. Increasing concerns surrounding inflation and sustainability of government debt have further stimulated a rise in gold prices. In early 2025, this trend was reflected in record inflow to gold exchange-traded funds (ETFs).

Conclusion

Amid the current uncertainty – from global tensions and central-bank decisions to how investor sentiment affects public markets – gold remains stable and is likely to be in the spotlight for years to come. While the recent spike in price is due the uncertainty, its reputation as a safe investment remains strong. The challenges that the global economies are bound to face will certainly influence the gold price, making it a key asset especially in the long run.

How Acuity Knowledge Partners can help

We provide financial services, specialising in fixed investment and other alternative asset class valuation. We publish comprehensive credit opinion reports, meticulously analysing the financials of portfolio companies. We focus on assessing cashflow sufficiency, coverage ratios and liquidity positioning of issuers.

With over two decades of experience, we support global clients operating in the private-markets space. As pure extensions of their onshore teams, we offer end-to-end support across the investment cycle. In private markets, we support private equity firms, with the requisite skills to support teams on alternative asset analysis and big data using automation and our in-house-developed platform FolioSure.

Sources:

-

Gold Price Reaches Historic High of $3,500 per Ounce Amid Economic Uncertainty | The Munich Eye

-

Gold takes a breather after hitting $3,500 on higher stocks, stronger dollar | Reuters

-

Gold prices forecast to climb to record high | Goldman Sachs

-

30 Year Gold Price History in US Dollars per Ounce | GoldPrice.org

-

Ranked: The Countries That Added the Most Gold Reserves (2013-2023) | Visual Capitalist

-

A Historical Gold Prices Chart, Events and Results | TopForeignStocks.com

-

U.S. dollar weakening could force central banks to devalue currencies | CNBC

-

Trump drove up the price of Gold. Could he now crash it? - Gold Pulse News | The Financial Express

-

Gold prices surge after Trump hikes tariffs on China to 125% | Hindustan Times

-

Iran vs Israel: How flights, oil & gold prices have been impacted | Firstpost

What's your view?

About the Author

With over 7 years of experience in the Private Market space, Deepak has worked on various sector-agnostic projects. His expertise lies in financial analysis, capital structure assessment, credit analysis, and preparing detailed credit reports and investment memos. He has also successfully managed projects involving relative valuation, DCF modeling, conducting company and industry research, and preparing investor presentations.

Like the way we think?

Next time we post something new, we'll send it to your inbox