Published on June 4, 2025 by Shitij Mathur and Priyanshu Agarwal

In an era marked by global trade realignment, India and the UK have taken a transformative step forward. On 6 May 2025, the two nations concluded a historic UK-India Free Trade Agreement (UK-India FTA), solidifying a new chapter in their economic relationship. The deal is expected to boost job creation, drive exports and accelerate economic expansion in both countries. Notably, this is the UK’s third-largest trade deal post-Brexit, following its agreements with Australia and Japan.

Key highlights of the agreement

1. Fewer barriers to trade in goods

The Free Trade Agreement between India and the UK will eliminate tariffs on 99% of Indian goods, effectively covering nearly all of India’s exports to the UK. In return, 90% of British tariff lines will be significantly reduced.

| The UK will secure phased tariff reductions for key export categories | Indian exporters will gain zero-duty access to the UK market across several sectors |

|

|

2. Boost to services trade

The Free Trade Agreement UK and India enhances cooperation in the services sector – especially digitally delivered and professional services. Indian IT, finance and education service providers gain deeper access to the UK market. Notably, the UK is India’s second-largest destination for IT/ITeS exports, accounting for approximately 14% of total exports in this category.

3. Greater mobility for Indian professionals

The UK India FTA also introduces progressive mobility provisions, easing the entry of Indian professionals to the UK. These include short-term contractors, investors, intra-company transferees and even freelancers such as chefs, yoga instructors and artists. A three-year exemption on social security contributions for short-term Indian employees in the UK makes the deal even more attractive.

While the agreement outlines significant tariff reductions and improvements in market access, the detailed schedule and implementation timeline are yet to be officially released.

Strategic implications

-

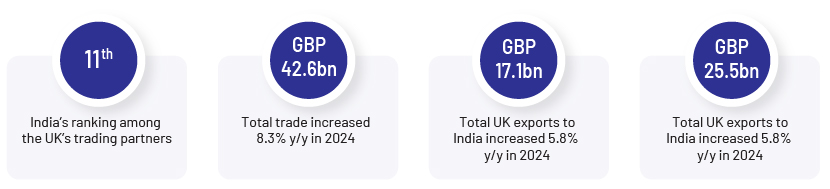

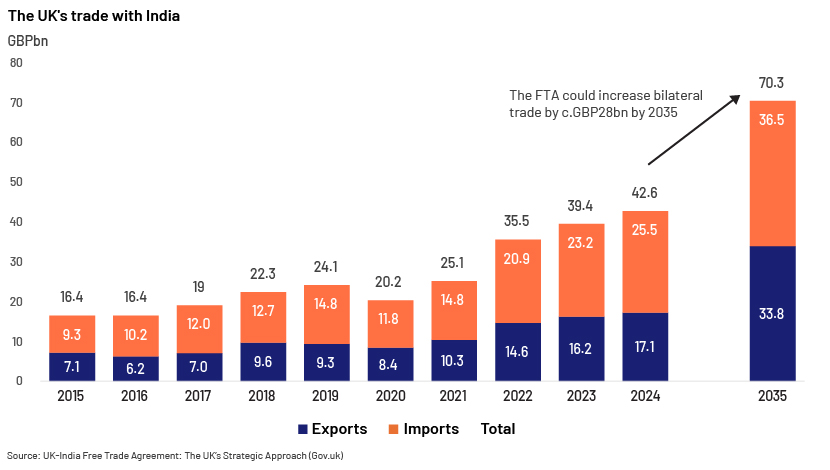

Economic impact: India was the UK’s 11th-largest trading partner in 2024, with bilateral trade of GBP42.6bn (2.4% of UK trade). This could increase by GBP14-27.7bn by 2035, according to the UK’s Department for International Trade, a 40-79% rise, with 32-41% of the gains driven by tariff liberalisation. Furthermore, the FTA could boost the UK’s GDP by GBP3.3-6.2bn (0.12-0.22%) and increase India’s GDP by GBP3.7-GBP8.6bn (0.07-0.16%) by 2035.

-

Export diversification and employment generation: The FTA enables India to diversify its export base and revitalise traditional labour-intensive sectors such as textiles and footwear, aligning with national employment objectives.

-

Market expansion: UK companies will gain access to India’s expanding middle class, with 60m consumers expected to earn over USD12,535 by 2030, enhancing long-term market opportunities.

-

Consumer benefits: Lowering tariffs and non-tariff barriers will directly benefit consumers in both countries by enhancing affordability, improving product quality and expanding choice.

-

Geopolitical dimension: Strengthening bilateral economic ties serves to counterbalance China’s influence and reinforces strategic cooperation in the Indo-Pacific region.

Challenges and considerations

1. Transition and implementation

The FTA’s effectiveness hinges on timely alignment of domestic regulatory frameworks. The agreement will be formally signed after final legal verification and internal approval by both governments.

2. Sectoral sensitivities

Agriculture and dairy remain excluded from liberalisation – India has kept sensitive items such as dairy products, apples and cheese outside tariff concessions, to protect rural livelihoods and smallholder farmers. Around 10% of tariff lines are categorised as sensitive, reflecting a cautious and calibrated trade-liberalisation strategy.

Conclusion

The UK-India FTA sets a benchmark for comprehensive and forward-looking trade agreements, blending liberalisation with strategic sectoral safeguards. By encompassing goods, services and workforce mobility, it addresses both economic and developmental goals. Although its long-term success will depend on effective execution and policy coordination, the agreement holds promise as a model framework for future trade partnerships between emerging and advanced economies.

References:

-

UK-India Free Trade Agreement: The UK’s Strategic Approach (Gov.uk)

-

World Economic Forum – UK-India Free Trade Deal Overview (May 2025)

-

uk india ftaThe Print – Analysis of Sectoral Exemptions in the UK-India FTA

Tags:

What's your view?

About the Authors

Shitij has been working with Acuity Knowledge Partners since 2014 as an Assistant Director. He has in total more than 18 years of experience in Capital markets, Investment / Financial research, Valuations and has worked with various investment banking, private equity and hedge funds teams worked across multiple sectors including DCM, RSG, FSG and Leverage Finance. He has extensive experience in handling end-to-end projects related to Capital markets including macroeconomic research, financial benchmarking, bond pricing, market updates, portfolio analysis and others. Shitij is a Chartered Accountant from the Institute of Chartered Accountants of India and also holds a Masters in Business Administration with specialization in Investments from ICFAI University..Show More

Priyanshu Agarwal is working as an Analyst at Acuity Knowledge Partners with over 4 years of experience in financial research, credit analysis, and investment banking support. He supports the RSG, DCM, and ESG sectors, contributing to macro-economic research, pitch books, credit models, industry profiles, and credit memos for global clients, Priyanshu holds a Masters degree in Finance, Bachelor’s degree in Commerce and pursuing CFA as well.

Like the way we think?

Next time we post something new, we'll send it to your inbox