Published on May 29, 2025 by Pankaj Gandhi

Introduction

The tariffs recently imposed by US President Donald Trump have disrupted the global trade order. His 10% baseline tariff on all imports has sparked fears of a global trade war, as some countries are looking to reciprocate. The situation has triggered fear of a global recession and a slowdown in consumer and business spending. While the tariffs do not target banks directly, the ripple effect is enough to move the US banking sector. As the banking sector is tied closely to the macroeconomic environment, a decline in spending would adversely impact the sector’s profitability, loan growth and its credit quality.

What is an import tariff?

An import tariff is a tax charged and collected by a government on the goods imported to the country. Tariffs are generally imposed by a government to protect the country’s industries, as tariffs make locally produced goods more competitive. Tariffs impact both consumers and businesses, leading to higher costs of production. Therefore, tariffs are a significant factor in international trade and, thus, can be a reason for conflict between nations.

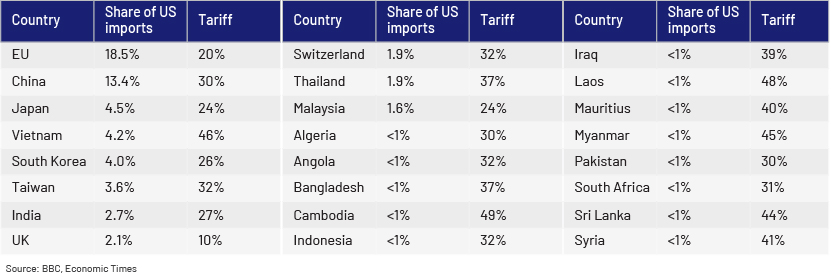

Tariffs list

A minimum 10% tariff has been applied to all imports to the US from 5 April 2025. The countries hardest hit by the tariffs are China, Vietnam, Cambodia, Bangladesh, South Korea, Taiwan, India, Switzerland, Japan, Thailand and Malaysia. The following table lists all the new tariffs on the countries and their share of US imports. The top seven countries accounting for over 50% of US imports are the EU, China, Japan, Vietnam, South Korea, Taiwan and India. A tariff of 145% was imposed on China as a direct response to China’s export controls on critical raw materials and its retaliatory tariffs targeting American exports. Furthermore, President Trump, on 9 April 2025 announced a 90-day pause on reciprocal tariffs for all nations, except for China. However, a baseline tariff of 10% remains in place for all countries.

The US and China later agreed to reduce tariffs, easing some of the pressure on global supply chains. The US has agreed to lower tariffs from 145% to 30%, while China's retaliatory tariffs on US goods will drop to 10% from 125%, through late 2025.

Why is Trump using tariffs?

The objective is to encourage US consumers to buy locally manufactured goods, increase the amount of tax raised and attract significant investment in the country. President Trump wants to reduce the gap between the value of goods the US buys from other countries and those it sells to them.

Impact on US banks

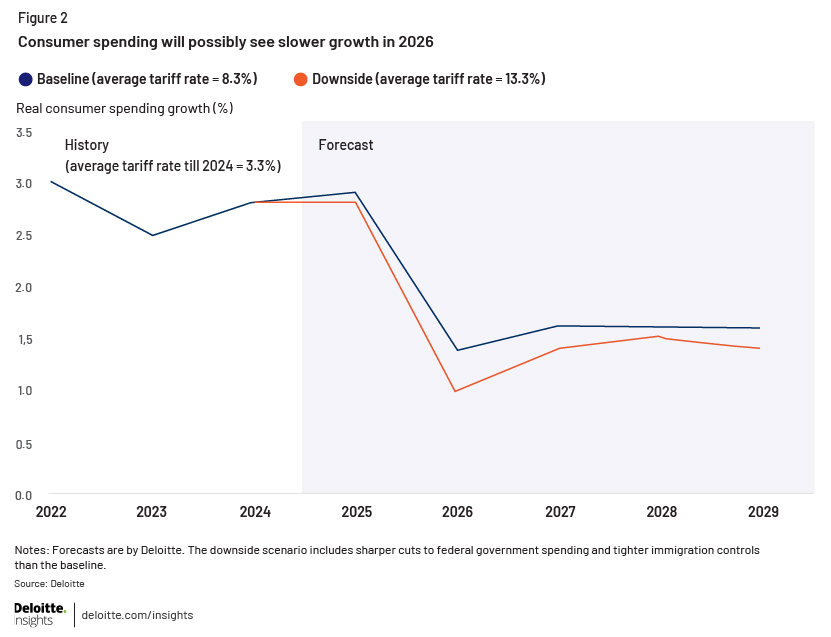

Less consumer spending: Tariffs will raise the cost of imported goods; consumers will, therefore, have less money to spend on other items, leading to suppressed demand in 2025 for items such as automobiles, housing, electronics and furniture that are often purchased on loan. Less consumer spending reduces demand for loans, leading to decreased revenue for banks from interest income. Growth in consumer spending is projected to slow 2025 and 2026, as shown in the graph below.

Reduced business spending: Tariffs will have an adverse impact on the competitiveness of the firms that rely on imported inputs for their production; about 40% of goods imported to the US are inputs for domestic production. A slowdown in spending and production could result in reduced demand for loans from businesses for expansion, investment or working capital. Since interest income from loans accounts for a major portion of revenue for commercial banks, a decline in interest income would affect their overall profitability.

Increase in credit costs: A recession would lead to a significant spike in credit costs for banks, impacting their provisioning and reducing their profitability. During economic uncertainty, individuals and businesses face difficulty in repaying loans, increasing the risk of default on loans. To compensate for this risk, banks increase provisions for credit losses; this ultimately hurts their net profit. In addition, while interest rates may initially fall due to an economic recession, banks may still increase their interest rates to cover for the increased risk and potential losses. This could increase the cost of funds or borrowing for banks even as the interest rate declines, eventually weighing on their profitability.

Pressure on credit quality: Tariffs increase the cost of goods imported by businesses, affecting their profitability and ability to service their debt, and eventually weakening the asset quality of banks. The sectors most exposed to the tariffs are manufacturing, logistics, retail, healthcare, automotive and agriculture, as they rely heavily on the global supply chains. Banks could see an increase in non-performing loans, especially in these sectors, as businesses struggle to repay loans due to increased costs and less demand. The US commercial real estate (CRE) market is sizable and is expected to be the highest-valued CRE market globally, with a 2.2% annual growth rate. CRE sector is also impacted by tariffs, principally through increased construction costs and potential changes in supply chains. While banks are actively creating provisions for credit losses in CRE, the sector is projected to continue facing pressure in 2025.

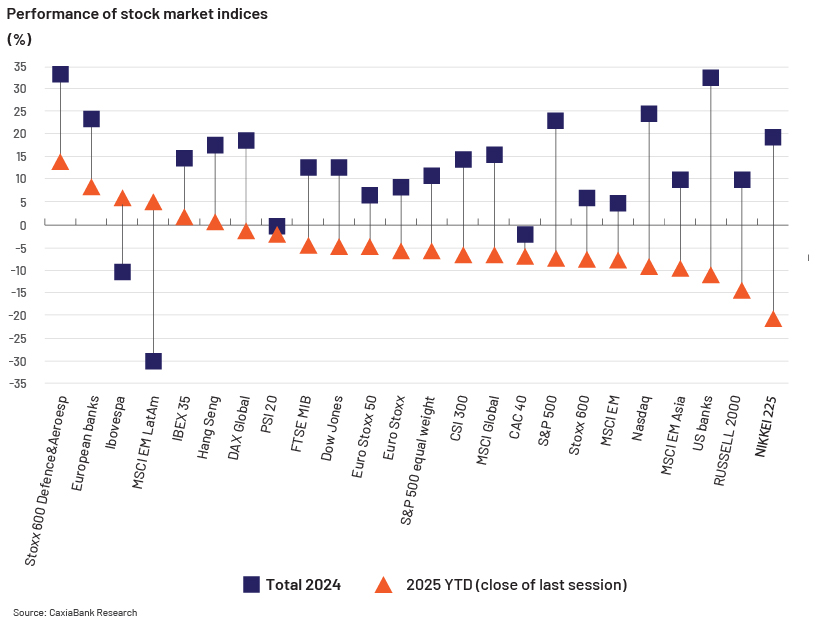

Volatility in capital markets: Unpredictability in financial markets propelled by tariff-related concerns would reduce capital-markets activity, negatively affecting investment-banking revenue. While volatile markets could lead to higher selloff in US equities, boosting banks’ trading revenue, mergers and acquisitions – a major source of income for investment banks – could slow or stop completely.

Following the tariff announcement on 2 April 2025, stock markets across the globe plummeted, experiencing significant losses. The S&P 500 index crashed by more than 10% in the two days after the announcement, erasing over USD5tn in market value. The Dow Jones index also lost over 4,000 points (or 9.5%), losing over USD6.6tn in market value. The following are the major stock indices that saw record lows as of the close of 7 April 2025:

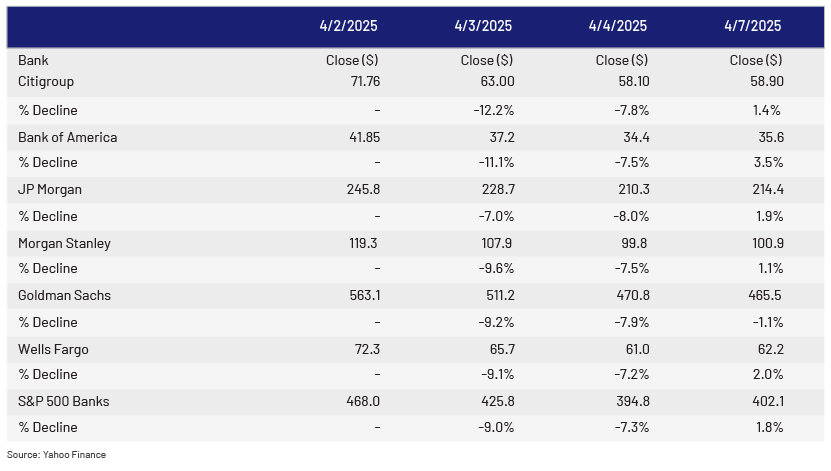

Fall in US banks’ stock prices: Within two days of the announcement of tariffs, billions were wiped out from US banks, creating mayhem in the US banking sector. Share prices dropped to multi-month lows on fear of a recession. The following snapshot shows the movement in share prices of top-tier US banks after the announcement of tariffs on 2 April 2025. The S&P 500 Banks Index fell by more than 7% on 4 April 2025, after having dropped by 9% the previous day.

Outlook

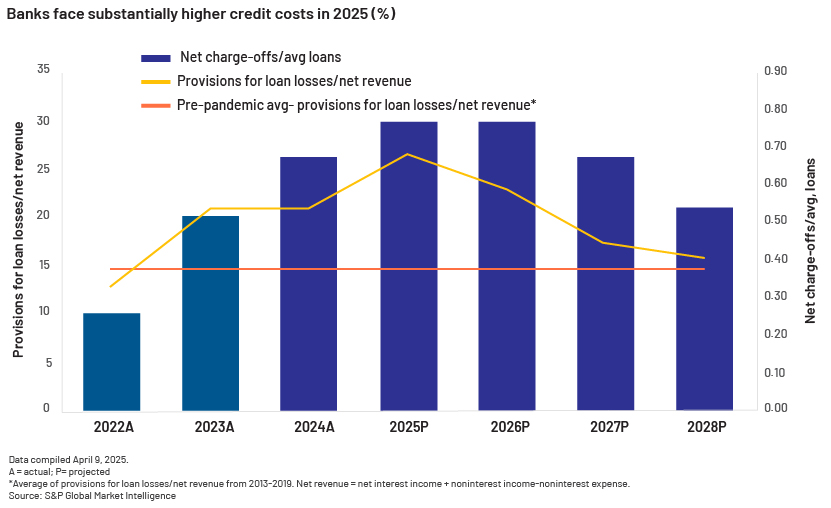

The tariffs would result in a challenging operating environment for US banks, increasing their credit costs and ultimately weighing on their earnings in 2025. The banking sector is expected to witness pressure on net interest margins this year. As shown below, reserves will likely continue to build over the year as the uncertainty remains. Net charge-offs would also remain elevated over the year as businesses struggling with tariffs find it difficult to repay their loans.

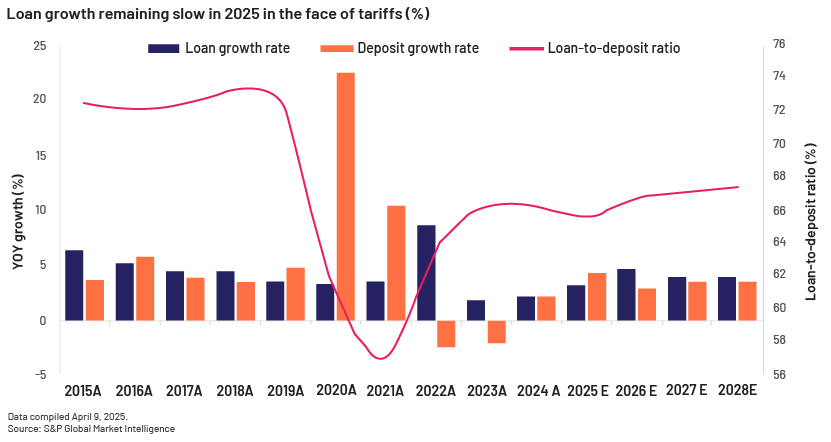

Investment activity is expected to shrink in 2025, as is demand for loans. The following chart shows that loan growth is projected to be weaker than growth in deposits in 2025 as the new tariffs increase operating costs and reduce demand for loans.

Increasing delinquencies due to increased repayment delays would eventually affect the asset quality of banks. We expect provisions for credit losses for US banks to increase to 26.5% of net revenue in 2025, up from 21.1% in 2024 and 20.9% in 2023. On average, banks' provisions for expenses stood at 14.6% of net revenue from 2013 to 2019.

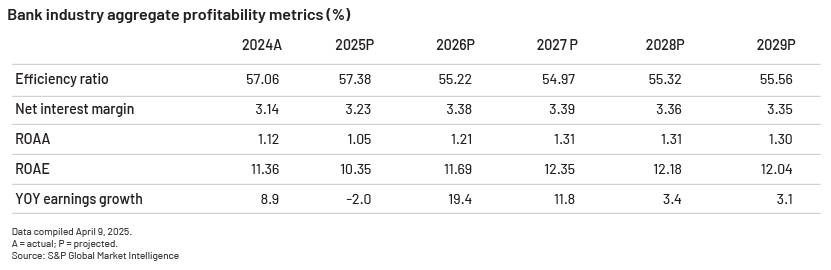

The following are the projected profitability metrics for the US banking sector from 2025 to 2029.

Increasing delinquencies due to increased repayment delays would eventually affect the asset quality of banks. We expect provisions for credit losses for US banks to increase to 26.5% of net revenue in 2025, up from 21.1% in 2024 and 20.9% in 2023. On average, banks' provisions for expenses stood at 14.6% of net revenue from 2013 to 2019.

The following are the projected profitability metrics for the US banking sector from 2025 to 2029.

Risk-mitigation strategies banks can adopt

-

Diversifying loan portfolios by reducing concentration on sectors dependent on global supply chains

-

Credit managers integrating the impact of tariffs into credit assessments can improve risk identification and management

-

Maintaining strong capital buffers to minimise potential losses arising from market volatility

-

Developing tariff scenarios to evaluate their impact on operations and financial performance

-

Diversifying funding sources to maintain liquidity during stress scenarios.

How Acuity Knowledge Partners can help

We provide research, data management, analytics and technology solutions to the global financial services sector, including asset managers, corporate and investment banks, private equity and venture capital firms, hedge funds and consulting firms. We support our clients in a wide range of areas, including M&A, investment research, industry profiling, financial analysis, thematic research, and macroeconomic and FX research. We also help clients build databases and provide regular sector coverage. Each output is customised, based on the client’s requirement. We deploy dedicated teams of experienced analysts at our offshore delivery centres, ensuring our clients benefit in terms of operational efficiency and cost optimisation.

Sources:

-

US bank stocks sink as Trump's tariffs cloud dealmaking, loan demand | Reuters

-

Trump's tariff tactics: How US trade policies could affect global economy – The Economic Times

-

What are tariffs, how do they work and why is Trump using them?

-

Global markets in freefall as Trump digs in on tariff ‘medicine’ | Donald Trump | Al Jazeera

-

Tariffs stand to spoil favorable outlook for US banks | S&P Global

Tags:

What's your view?

About the Author

Credit Analyst with over 11 years of experience spanned across credit underwriting, risk rating, loan due diligence and credit risk recommendations for mid-sized, commercial, large corporates and FIG clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox