Published on August 26, 2025 by CA Sachin Shah

Last year was a transformative year, fuelled by rapid technological advancement amid ingenious investment strategies and dynamic global affairs. A few critical trends emerged, with artificial general intelligence (AGI) becoming the next frontier and environmental, social and governance (ESG) considerations gaining market-wide acceptance, leading to a spike in deal-making and market momentum.

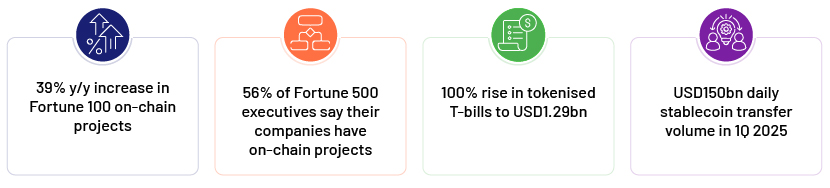

Blockchains transforming global financial markets

Blockchain infrastructure increased sharply in 2024, with transaction fees on blockchains costing just a fraction of the fees charged by traditional mediums of exchange. PayPal supports cross-border transfers for stablecoin users across 160+ countries – with no transaction fees, verses a 4.45-6.39% charge, on average, in the USD860bn global remittance market. Spot Bitcoin ETF assets under management are now more than USD63bn. On 23 May 2024, the SEC approved exchange application to list and trade spot ether ETF, further scaling access to cryptocurrency. The significant increase in the volume of transactions in the top five blockchains is a clear signal of institutional and retail acceptance that, along with a favourable regulatory outlook, has boosted equity-market activity. High interest in tokenisation of real-world assets (RWAs) results in a reduction in settlement time and costs. Security token offerings (STOs) are gaining traction, with the latest USD500m STOs of FintechX a clear indication of decentralised finance.

AGI and Quantum Computing – the new frontier

With soaring investor interest in AI, companies leveraging and offering AI-based solutions or AI solutions are driving valuation and capital intake from primary markets across developed markets. Companies that are part of the AI value chain are significantly oversubscribed. From the overflowing order books of generator manufacturers to the shortage of graphics processing units (GPUs), there is excitement being created for investment in the value chain.

2024 was a great year for Quantum Computing stock:

-

Quantum Computing (QUBT) stock gained almost 2,000% in 2024 – from less than USD1 to USD18 in just a few months. QUBT is expected to have grown revenue by 167% in 1Q 2025, by 40% for the full year and by 200% in 2026, according to analyst reports.

-

D-Wave Quantum Systems’ share rose 1,000%, with a gain of 750% in the past two quarters. IonQ has surged 250% for the year.

-

Rigetti Computing stock was up 1,900% in the past year.

All these premier quantum computing companies have “Buy” ratings. Analysts and financial institutions expect the momentum to continue, with IonQ reporting USD372m and Quantum Computing reporting USD202m in revenue in 2025.

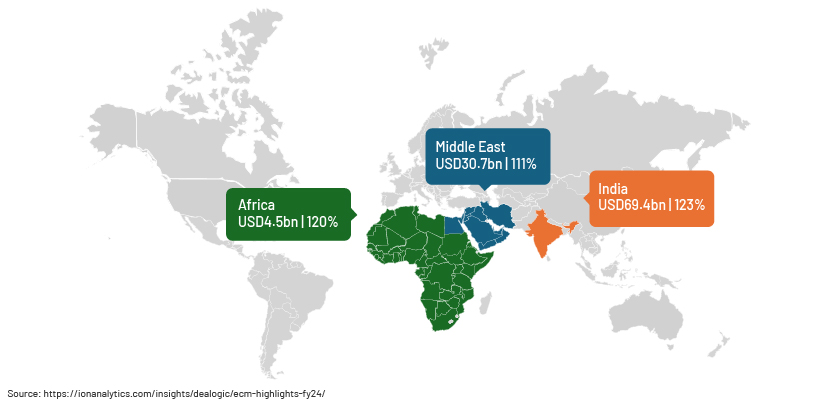

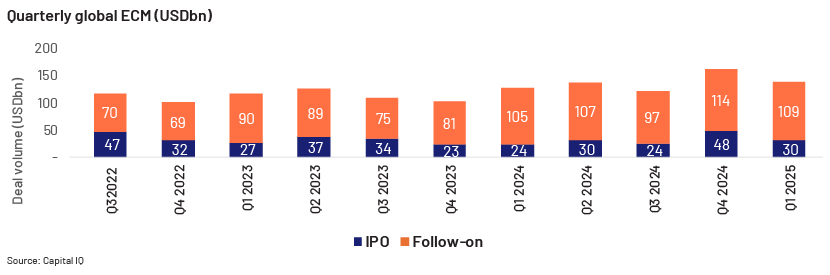

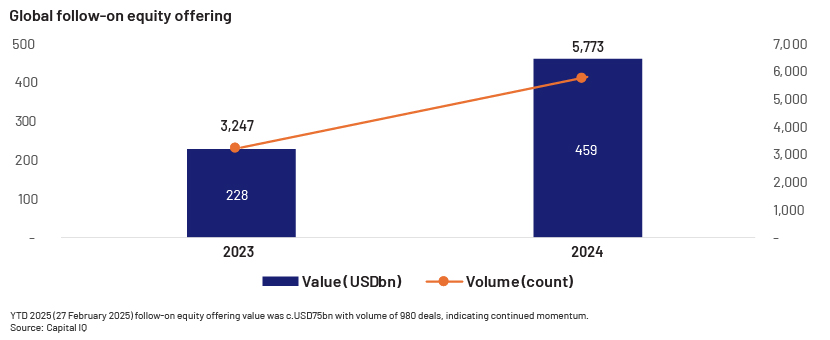

Emerging markets to drive later gains

APAC and MENA are the new ECM hot spots for institutional investors, with VC-backed companies looking to raise capital for the next stage of growth and providing early investors with lucrative returns and institutional investors opportunities to park money in long-term speculations. There are a number of notable IPO listings scheduled in emerging sectors. Institutional investors with sovereign wealth funds, PE and pension funds have increased allocation to ECM markets across APAC and MENA.

ECM activity in APAC and MENA

ESG going mainstream

ESG considerations are increasingly in focus, taking centre stage at action summits and directly increasing capital allocation to companies with ESG goals in their mission statements. ESG strategies have gone from niche to core investment strategies, with a number of investors floating ESG strategy vehicles with a global footprint. Investors are leveraging green bonds and subsidised capital, injecting these into companies with high ESG standards in ECMs and debt capital markets (DCMs). ESG startups are in the later stages of VC and will be going for IPOs for growth capital and exit. Impact investors and the regulatory push are driving the ESG ECM market.

There are incentives for companies to meet growing ESG mandates to attract investment strategies and processes with ESG/sustainability frameworks. There is enough dry powder in ESG funds to invest in ECMs.

Focus on small and medium-size enterprises (SMEs)

With the wealth gap widening, companies focused on serving SMEs and offering SME-centric solutions are attracting interest from a number of investors, including from ESG-specific and non-ESG-specific investors. With the significant growth potential in serving the underserved and unorganised segments of business, investors are looking to democratise access to tech-based solutions and products. It is crucial that SMEs adopt emerging technology. SMEs providing SaaS are achieving USD100m in ARR and obtaining later-stage funding at USD1,000mn valuations. These startups are focusing on reaching USD500m in ARR and getting ready for USD5bn in valuations, providing the later-stage investor an exit via IPO. The number of such SaaS players is increasing and could be a driver of ECM activity.

Industrial Revolution 4.0 and Web3 to play out

Rapid technological advancements in manufacturing have called for Industrial Revolution 4.0, observed with technology sectors such as robotics, drones and machinery driving the next phase of manufacturing process development. IoT, connectivity, analytics and human-machine systems are taking over manufacturing products and exploiting resources with the least amount of inefficiency. Web3-based solutions have effected a visible change in every sector, from logistics and supply chains, industrials, real estate and hospitality to consumers. ECMs have been the main source of funds for mature companies’ capex required for Industrial Revolution 4.0 and for include technology into existing value chains.

Trade war

Lastly, the imposition of tariffs on imports and counter-tariffs has led to a number of companies conducting cost-benefit analyses prior to setting up shop in the markets in which they wish to sell products. This has resulted in a need to dip into their war chests or look for follow-on equity, likely increasing the number of follow-on equity transactions in capital markets to meet the additional capex requirements.

Conclusion

ECMs in 2025 are defined by AI, blockchain, ESG and emerging markets. Capital for growth, climatech and refashioning traditional practices are at the core, and investors need to be flexible enough to capitalise on activity in ECMs while navigating geopolitical shifts.

How Acuity Knowledge Partners can help

Our ECM offerings:

-

Market monitoring and updates

-

Investor profiles and databases

-

IPO comps/analysis

-

Shareholding analysis

-

Newsletters

-

Case studies

-

Benchmarking

-

Pitchbooks

-

Roadshow presentations

Sources

-

https://finchtrade.com/blog/blockchain-payments-vs-traditional-methods-a-comprehensive-comparison

-

https://www.coinbase.com/blog/the-state-of-crypto-the-fortune-500-moving-onchain

-

https://ionanalytics.com/insights/dealogic/ecm-highlights-fy24/

-

https://imaginovation.net/blog/how-sme-can-leverage-emerging-technologies/

-

Database: S&P Capital IQ, Dealogic

What's your view?

About the Author

A qualified Chartered Accountant with 9+ years of experience in finance functions. Has expertise in investment and private portfolio management, M&A and private equity fundraising. Has evaluated investment opportunities in the fintech, industrial, consumer, real estate, hospitality, supply chain and logistics sectors. Has a proven track record in corporate finance and financial management.

Prior to Acuity Knowledge Partners, worked at JP Morgan Chase & Co., Aurum Equity Partners and HN Shah & Associates.

Like the way we think?

Next time we post something new, we'll send it to your inbox