Published on August 4, 2023 by Aman Aryan

Three-Dimensional Risk Assessment - Introduction

The three-dimensional risk assessment framework is a model that considers the three dimensions of risk:

-

The probability that a given event will occur

-

The severity of the consequences

-

The impact on the different players along the value chain

The framework helps companies identify risks and prioritise them based on their likelihood and severity, so they can allocate resources effectively to mitigate them and improve performance.

Importance

Business executives spend most of their time weighing the risks and rewards of the choices available to them. Critical questions include the following: Will hiring more salespeople increase revenue enough to cover the additional expenses? Can we introduce our new product before competitors change their tactics? Do the extra costs and hassle of compliance and governance outweigh our knowledge of the geopolitical environment in a new market? Risk assessment addresses these adequately and provides necessary guidance for making critical business decisions.

-

Cyber risk: The risks businesses and large social media corporations face from data breaches that could result in a loss of customer confidence are the most notable today.

-

Environmental risk: Companies must deal with natural disasters such as hurricanes and earthquakes that could disrupt their operations.

-

Business risk: Includes external risks from environmental changes or manufacturer competition.

-

Economic risk: This refers to the potential a nation's economic state has to adversely impact business operations. For instance, the increasing cost of doing business could force more than a third of the UK's hospitality sector out of business in the of 2023. Companies are losing money or will run out of money by the end of the year; they also face higher energy costs.

Pros and cons of risk assessment

Pros

-

Opportunity to identify and avoid risk before making an investment

-

Increased profits: Projects that are finished on time and within budget generate greater returns. Less risky projects are far more likely to adhere closely to their initial objectives.

-

Ability to develop and change: Risk management procedures improve as a company responds to hazards over time. Teams will be more productive the more experienced they are in identifying and managing risks.

Cons

-

Inconsistency: Qualitative risk assessment is inconsistent and subject to interpretation. When a risk materialises, it may not be as severe as expecte.

-

Take risks unlikely to materialise: It may be wiser to keep taking the risk and deal with the loss if it materialises.

-

Time- and resource-consuming: Too much time spent analysing and trying to control unlikely scenarios could waste resources that could be put to better use.

Risk assessment methodologies

Traditional risk analysis methodologies use a two-dimensional approach, based on the risk's relative likelihood and severity. These matrices provide a quick overview of the possibility (Y axis) and severity (X axis) of a risk event's likely consequences. The three-dimensional method explained here uses the general X and Y axes and adds a third dimension (Z axis).

Severity refers to the amount of harm done to the company, its employees and its objectives due to risk incidents. This could be on a scale of 1 to 5, where 1 stands for low severity (an incident that would not affect the business) and 5 for critical impact (one that would result in the business's failure).

The likelihood of a hazard risk is also measured on a five-point scale, where 1 stands for a rare possibility and 5 is a likely possibility.

The third parameter should be related to the sector in which the company operates and must be directly related to the severity of the risk and the likelihood of hel using the third.

Risk assessment approach

Acuity Knowledge Partners' Private Equity conducted research to better understand the numerous risks and related factors affecting all sectors in all regions. The study used sectoral analysis to provide vital insights into how each risk is ranked in terms of severity, probability of occurrence and likelihood of help.

Risk assessment of a major holding company in the ICT sector in the Middle East

Objective: To analyse risk in the ICT sector and assess severity and likelihood

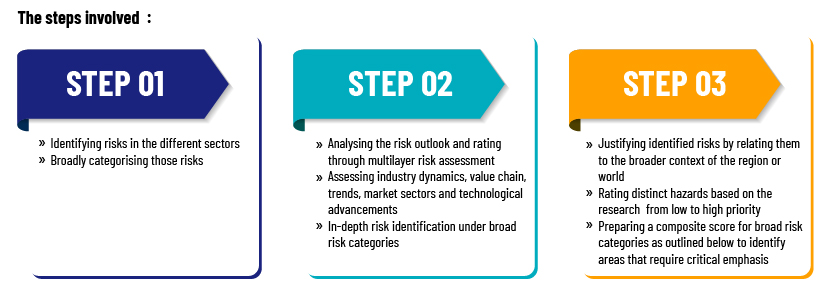

Process:

-

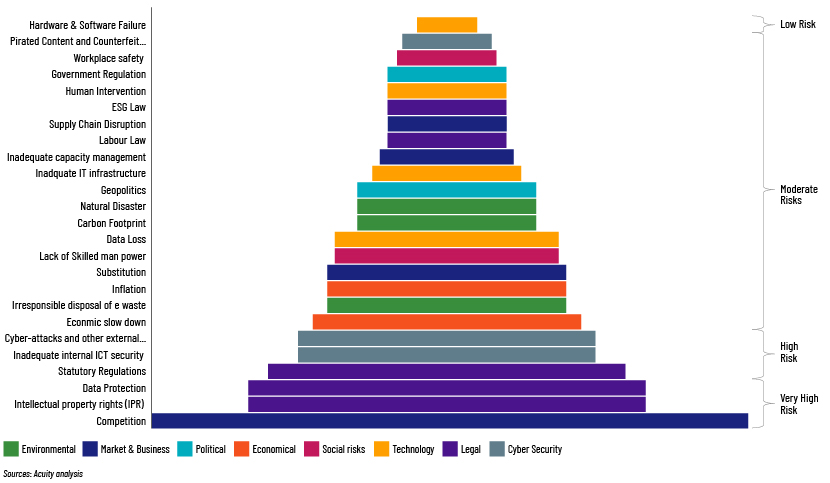

Step 1: Risk identification: Information and communications technology (ICT) companies are highly exposed to a number of risks. The first step is to analyse the sector in terms of competition, government regulation, economic slowdown, hardware and software failure risk across participants in the the value chain (telecom, data and cloud services, IT infrastructure and services, devices, media and communications and business services). The PESTEL framework (which analyses political, economic, social, technological, environmental and legal risks) and important sector-specific risks were used to categorise risks into eight basic groups.

-

Step 2: Scale assessment: The second step is to assess the scale of risks in the context of the UAE, based on broad risk parameters such as likelihood of occurrence and impact on the value chain on a scale of 1-5, with 5 being the highest likelihood of occurrence and 4 being the highest impact on multiple sectors.

-

Step 3: Severity assessment: Market research can help understand and justify each score for each criterion, leading to the third step: rating the severity of each ICT sector risk on a scale of 1-5.

-

Step 4: Composite score and risk ranking: In steps 2 and 3, each parameter (likelihood, impact on value-chain participants and severity) is assigned a rating. The overall score is derived by multiplying the ratings across likelihood, impact on value-chain participants and severity to generate a composite score to rank risk.

The UAE's ICT market is currently categorised by fierce competition, low margins, low entry barriers, and stagnant growth in sub-segments such as PCs and desktops. Due to a decrease in the ordinary sales revenue of ICT products, volume growth in Information and communication technology is reported to be greater than value growth. This growth is fueled by the government’s efforts to bolster the sector and increased investment in infrastructure and services.

Conclusion

Implementing a three-dimensional risk assessment framework to support industry growth is of utmost importance. By considering the probability, severity and impact of risks, companies can effectively identify and prioritise mitigating potential threats. This enables them to allocate resources efficiently, reduce risks and improve overall performance.

The significance of risk assessment in business decision-making cannot be overstated. It provides executives with valuable insights on the potential risks and rewards associated with the different choices. Whether it addresses cyber risks, environmental challenges, business uncertainties or economic fluctuations, a robust risk assessment framework empowers an organisation to proactively manage and mitigate risks.

There are several advantages to conducting a risk assessment. First, it allows for identifying and avoiding risk before making an investment, leading to better decision-making. Second, completing projects on time and within budget increases profitability and generates higher returns. Lastly, risk management procedures improve over time as teams gain experience in identifying and managing risks, leading to greater productivity and adaptability.

However, it is important to acknowledge the potential drawbacks of risk assessment. Qualitative assessments can sometimes be inconsistent and subject to interpretation, leading to varying results. Additionally, allocating resources to analyse and control highly improbable risks can be time-consuming and inefficient.

The methodologies used in the three-dimensional risk assessment framework provide a comprehensive approach to evaluating risks. Incorporating a third dimension specific to the sector results in a deeper analysis and a more accurate assessment of severity and likelihood.

Overall, the framework plays a vital role in supporting industry growth by enabling businesses to navigate uncertainties, make informed decisions and allocate resources effectively. By embracing risk assessment methodologies and integrating them into strategic planning, organisations can position themselves for success in an ever-changing and competitive business landscape.

How Acuity Knowledge Partners can help

We specialise in strategic support and advisory services, assisting businesses in analysing risks and opportunities in the face of supply-chain disruptions and geopolitical events. With expertise across sectors such as energy, metals and mining, manufacturing, electric vehicles and ESG, we offer tailored solutions to help companies diversify and strengthen their supply chains. Our in-depth market research capabilities across the value chain enable informed decision-making, aligning strategies with market dynamics. We focus on supply-chain resilience and sustainability, empowering businesses to navigate challenges and capitalise on new opportunities. We are committed to being a trusted partner, driving growth and success in a rapidly changing business landscape.

References:

-

Third of UK's hospitality businesses at risk (traveldailymedia.com)

-

Acuity Knowledge Partners’ Risk Assessment Project

What's your view?

About the Author

Aman Aryan is a strategic research analyst with close to 2 years of work experience in the energy and chemical domain along with some other industries. At Acuity Knowledge Partners, he supports clients in various strategic research projects. He holds an MBA degree in International Business as finance as a major and B.com in Accountancy.

Like the way we think?

Next time we post something new, we'll send it to your inbox