Published on March 12, 2024 by Rahul Dhoke

On 28 May 2024, the US, the world’s largest financial market, will transition to the T+1 settlement system for transactions in US equities, unit investment trusts and corporate debt. The move promises to enhance overall transactional efficiency and is in line with global trends. Canada will adopt the T+1 settlement system a day earlier.

The transition to T+1 trade settlement in the US market marks a significant evolution in securities trading, promising to streamline processes and propel efficiency within the financial landscape. With the shift from the traditional T+2 settlement cycle to the shortened T+1 cycle, market participants are poised to experience reduced risk exposure, increased capital efficiency, and heightened liquidity management capabilities. This shift represents a pivotal moment in the modernization of the US financial infrastructure, driven by technological advancements, regulatory imperatives, and industry-wide efforts to optimize operational frameworks. As stakeholders adapt to this accelerated settlement cycle, they are compelled to recalibrate their trading strategies, adopt robust risk management practices, and leverage innovative solutions to navigate the complexities inherent in the transition.

In this blog, we will look in detail at what the transition to T+1 settlements means for the financial markets. We'll discuss the specific securities affected by this change, the benefits of moving to a faster settlement cycle, and the challenges and costs that financial institutions will face. Additionally, we'll examine how this transition fits into global trends toward quicker settlements and what role offshore partners will play in this transition.

What is t+1 settlement?

Simply put, T+1 (or trade date plus one) means that security transactions need to be settled in one business day. For instance, if you purchase a share on Monday, it will be credited to your demat account by Tuesday.

This expedited process contrasts with the previous T+2 system, where settlement occurred two business days post-trade.

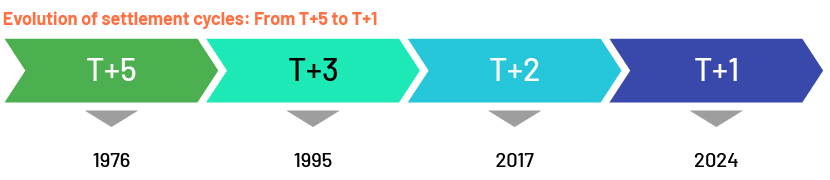

Evolution of settlement cycles

During the days of physical trading, the US Securities and Exchange Commission (SEC) followed the T+5 settlement system. This meant that security transactions could be settled in up to five business days. With technological advancements, the settlement cycle was shortened to T+3 in 2004.

In September 2017, the cycle was reduced further to T+2. In May 2024, it is transitioning to T+1. The (SEC) amended Exchange Act Rule 15c6-1 in February 2023, and according to the amendment, all securities traded through the Depository Trust Company (DTC) will transition to a T+1 cycle.

Although this shift has been progressive, the ramifications of shifting to T+1 are greater.

Which securities are impacted?

This amended rule will impact the following securities:

-

Nearly all equities

-

American depositary receipts (ADRs)

-

Corporate bonds

-

Mutual funds

-

Unit investment trusts

-

Exchange-traded funds (ETFs)

-

Equity options

-

Private-label mortgage-backed securities

-

Exchange-listed limited partnership interests

Benefits of T+1 settlements

Aimed at fostering more efficient markets, this move is expected to deliver significant benefits.

1. Reduction of pre-settlement risk: The major benefit is the reduction of the pre-settlement risk of counterparties failing to meet their obligations on the date of settlement.

2. Reduced margin requirements: Where such credit risks are managed through margins, this reduced risk lowers the margin requirement and related capital. The US Depository Trust & Clearing Corporation (DTCC) expects a 41% decrease in the volatility component of central counterparty (CCP) margin requirements.

3. Increased liquidity: T+1 settlement increases the efficiency of capital utilisation. This would lead to better liquidity management for investors and firms.

4. Improved operational efficiency: Processes from execution to settlement need to be automated and modernised to achieve T+1 settlement. This would improve operational efficiency and also lead to cost savings.

5. Improved investor confidence: As the settlement process becomes more efficient and reduces risks such as pre-settlement risk, T+1 would improve investor confidence in the markets.

Despite these benefits, the challenges and costs associated with the move are significant.

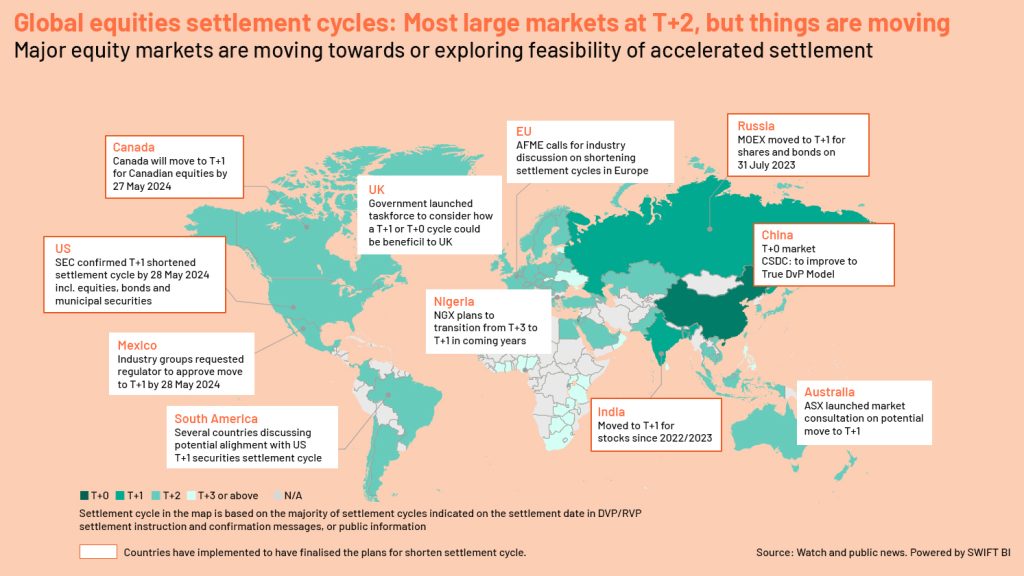

Global trends: Who else is moving towards faster settlement?

Global Equities Settlement Cycles

Source: Swift BI

A number of countries are recognising the benefits of accelerated settlement cycles and are taking steps to implement them.

Coordinating with the US markets, Canada and Mexico will be implementing T+1 a day before the US, on 27 May 2024. In Europe, the UK is exploring the feasibility of moving towards the T+1 settlement cycle. Other European countries are also exploring the move.

In Asia, India implemented the T+1 settlement cycle in 2023 and is moving towards T+0 before the end of the fiscal year ending March 2024. China has also already implemented T+1. Saudi Arabia’s Saudi Stock Exchange (Tadawul) has also implemented T+1 settlement for certain types of transactions.

Challenges for financial firms in the transition to T+1

The transition to T+1 settlement in May 2024 in the US would pose several challenges for financial firms relating to operational, liquidity, compliance, technological and market-related aspects:

1. Operational adjustments

Firms would need to upgrade transaction processing systems for quicker settlement; this would entail increased operational costs during the transition phase.

2. Liquidity management

The faster settlement cycle demands adjustments in liquidity management to ensure availability of funds, potentially complicating cashflow management.

3. Compliance and risk management

Adjustments to compliance frameworks and risk management practices are necessary to align with new regulations and manage reduced time frames for risk identification.

4. Technology and data infrastructure

Data processing and cybersecurity measures need to be enhanced to handle increased data volumes and protect against heightened cyber risks.

5. Market impact

Faster settlement could lead to increased market volatility and changes in investor behaviour, necessitating adjustments in trading strategies.

6. Cross-border transactions

Aligning operations with global markets that have not adopted T+1 poses additional challenges for firms with international operations.

7. Human capital

Investments in training for employees to adapt to new systems and processes are crucial for a smooth transition to the T+1 settlement cycle.

Overall, the shift to T+1 settlement requires comprehensive planning, significant technology investments and agile management to navigate the operational and strategic shifts while ensuring compliance and operational efficiency.

Apart from the challenges, there are issue which can be counted like below.

-

Increased likelihood of settlement failure.

-

Time-zone challenges.

-

Impact on stock lending and borrowing.

Conclusion

The US’s shift towards T+1 settlement is a major step in the direction of more efficient markets and improved investor confidence. This transition, aligning with global trends and driven by technological advancements, promises to enhance market liquidity, reduce risks and streamline financial transactions.

How Acuity Knowledge Partners can help

We provide comprehensive support across the dimensions of the T+1 transition.

1. Global expertise and best practices: With our experience across markets, we introduce best practices and help navigate the challenges associated with a faster settlement cycle.

2, Advanced technological solutions: We provide sophisticated technology solutions that are essential for managing the increased speed and efficiency required for T+1 settlement.

3. Operational support: We support in processing transactions, helping to manage the increased workload and tighter deadlines associated with T+1 settlement.

4. Extended window of operations: We extend operating hours for processing and settling trades, ensuring that all transactions are completed within the required time frame.

5. Risk diversification: By distributing settlement processes across different locations and systems, financial institutions can mitigate the risk of system failures or other disruptions affecting their ability to meet T+1 deadlines.

6. Regulatory compliance: We help navigate the different regulations of different jurisdictions through our experience and expertise in financial marketing services.

With our bespoke research, analytics and technology solutions, we are at the forefront of supporting the financial services sector ranging from asset managers and investment banks to private equity firms – through this significant change.

Our global network of over 6,000 analysts and industry experts, operating from 10 locations worldwide, is dedicated to ensuring that our clients not only meet the challenges but also excel in the evolving regulatory and market landscape.

Our commitment to innovation and excellence positions us as an essential partner in the sector’s transition to T+1, ensuring our clients a seamless adaptation and contributing to the resilience and growth of the global financial markets.

Sources:

-

https://www.fnlondon.com/articles/uk-races-to-keep-up-after-us-pushes-ahead-on-t1-20231005

-

https://www.afme.eu/Portals/0/DispatchFeaturedImages/AFME_Tplus1Settlement_2022_04.pdf

-

https://securities.cib.bnpparibas/t1-settlement-ready/#_ftn2

-

https://iqeq.com/insights/t1-settlements-a-new-era-for-u-s-securities-transactions/

-

https://www.dtcc.com/dtcc-connection/articles/2023/may/30/the-road-to-us-t1-settlement

Tags:

What's your view?

About the Author

Working in the Investment banking sector having 10+ years of work experience in various organizations like BNY Mellon, BNP Paribas, Wipro and in different roles. Has worked on various products like performance portfolio, client management, risk, compliance, attributions, CLO, CDO,CBO,ABS and syndicate loans. Has strong people management skill and enjoys indulging in playing outdoor activities.

Like the way we think?

Next time we post something new, we'll send it to your inbox